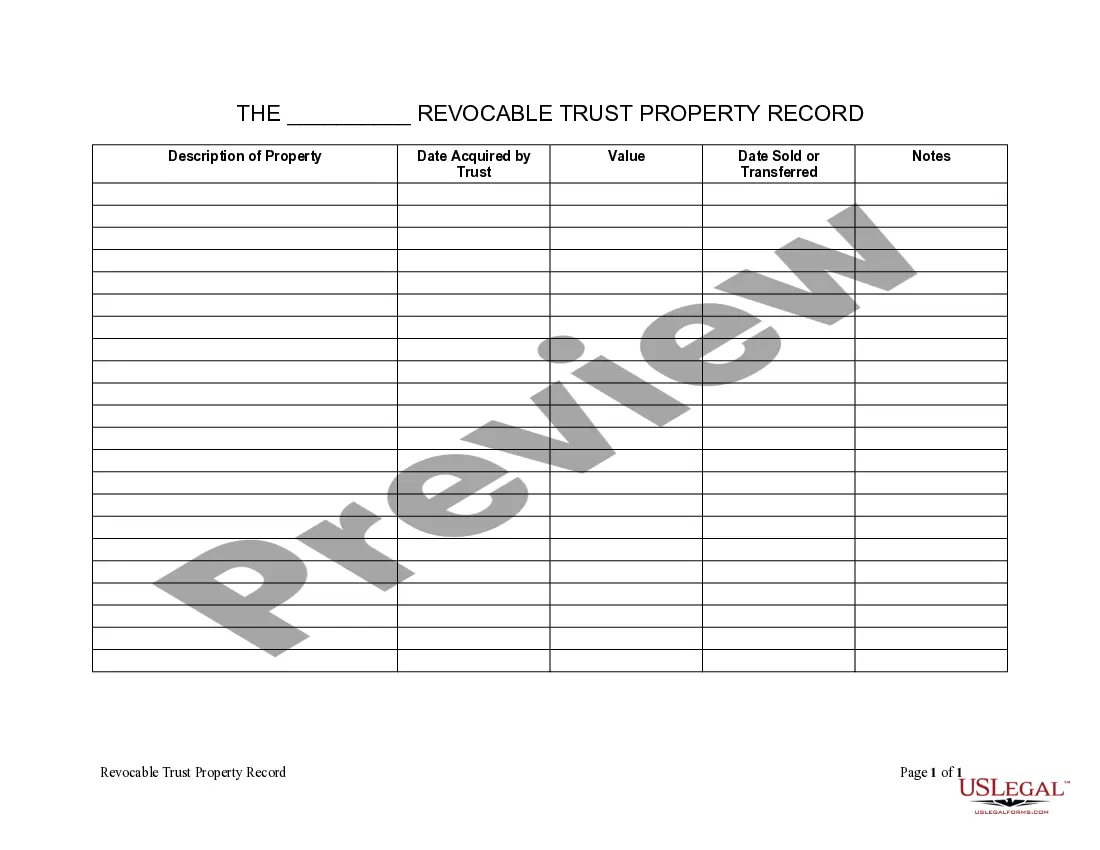

Revocable Living Trust For Property

Description

How to fill out Colorado Living Trust Property Record?

- If you are a returning user, log in to your account and access the required template by clicking the Download button. Verify that your subscription remains active and renew if necessary.

- If you are new to US Legal Forms, start by browsing the form descriptions and preview modes to find the appropriate revocable living trust for your needs, ensuring it aligns with your local jurisdiction's requirements.

- If the selected form doesn't meet your requirements, utilize the Search tab at the top of the page to find the right template. Proceed to the next step once you find a suitable document.

- Purchase the selected document by clicking the Buy Now button. Choose the subscription plan that best fits your needs, and register for an account to unlock the library's resources.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Finally, download your form and save it securely on your device. Access it anytime through the My Forms section of your profile.

In conclusion, using US Legal Forms for your revocable living trust for property simplifies the legal process. Their extensive library and expert assistance help ensure that your documents are both accurate and legally compliant.

Ready to secure your assets? Start your journey with US Legal Forms today!

Form popularity

FAQ

Determining whether your parents should place their assets in a trust, specifically a revocable living trust for property, depends on their estate planning goals. If they want to avoid probate and ensure a smooth transfer of assets, a trust can be an excellent option. However, it is crucial for them to consult with a legal expert to evaluate their specific situation and understand the implications of establishing a trust.

Major disadvantages of revocable living trusts include limited protections against creditors and a lack of tax advantages. A revocable living trust for property does not prevent estate taxes or offer protection from lawsuits. Moreover, if you do not fund your trust adequately, certain assets might still be subject to probate, which can create a lengthy and costly process.

A key disadvantage of a family trust, including a revocable living trust for property, is the potential lack of asset protection. Since the trust is revocable, you can modify or dissolve it at any time, which means it does not safeguard assets from creditors. Furthermore, family trusts can sometimes complicate tax reporting, as income generated by the trust still passes through to your personal tax return.

Assets that usually should not be placed in a revocable living trust for property include certain retirement accounts and health savings accounts. These types of accounts have designated beneficiaries and could lead to unnecessary tax implications. Therefore, it's crucial to evaluate each asset and consult with a legal expert to determine the best course of action.

You should place various types of assets in your revocable living trust for property, including real estate, stocks, and valuable collectibles. This helps you manage these items effectively and ensures a smooth transfer of assets to your beneficiaries. Remember to properly fund the trust by transferring ownership, which often requires specific legal steps.

Generally, you should keep your checking and savings accounts out of a revocable living trust for property if you need full access to them regularly. High-interest accounts or accounts used for everyday expenses are better kept outside the trust for ease of management. Always consider your financial habits and consult with a professional to make the best choice.

Yes, a nursing home can potentially take your house held in a revocable living trust for property to recover costs if you need long-term care. However, if you plan ahead, you can protect your home through other legal strategies. Consulting with an expert can help you navigate these concerns and maintain control over your assets.

You should generally avoid placing certain assets into a revocable living trust for property, such as your retirement accounts, like IRAs and 401(k)s. These funds might have beneficiary designations that take precedence over the trust. Additionally, life insurance policies should not be put into the trust, as they also typically allow for direct beneficiary transfers.

To put your assets in a revocable living trust for property, you should start by identifying each asset you want to include. After documenting the trust, transfer ownership or title of each asset to the trust, which may involve changing deeds or account information. Always ensure the documentation is correct and complete to avoid future disputes. If you need assistance, resources like US Legal Forms can guide you through the steps effectively.

The downside of putting assets in a revocable living trust for property mainly revolves around the initial setup costs and maintenance effort. Establishing a trust may require legal fees, and managing the trust necessitates time and organization. Moreover, individuals may inadvertently neglect to update the trust with changes in assets or beneficiaries. Being aware of these issues helps you navigate the process more smoothly.