Living Trust Property With A Will

Description

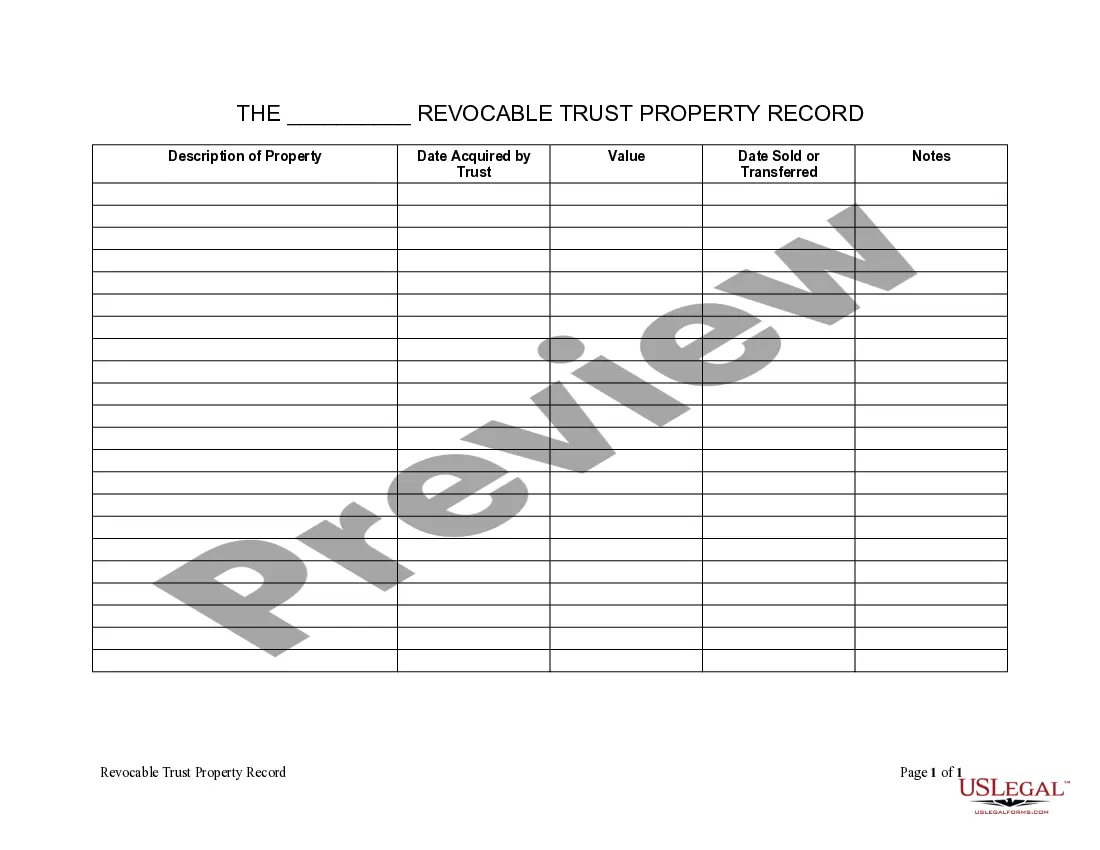

How to fill out Colorado Living Trust Property Record?

- Visit the US Legal Forms website and log into your account. If you are new, create an account to start.

- Browse the extensive online library for the living trust template. Ensure the selected form aligns with local jurisdiction requirements.

- Review the template in Preview mode to confirm it meets your needs completely.

- Select the desired subscription plan by clicking the Buy Now button, and register for an account if necessary.

- Complete your purchase by entering your payment details or using your PayPal account.

- Download the completed form to your device, ensuring you can easily access it later through the My Forms section.

In conclusion, utilizing US Legal Forms not only simplifies the process of creating a living trust but also empowers you with access to a vast collection of legal resources. With over 85,000 forms at your fingertips, you're ensured precision and legality in your documents.

Take the first step toward securing your estate by visiting US Legal Forms today!

Form popularity

FAQ

Placing your house in a trust can complicate the mortgage process, as lenders often need to approve such arrangements. If you have a living trust property with a will, remember that transferring ownership might trigger reassessments for property taxes. Furthermore, there is a chance that you could lose certain tax benefits that come from home ownership. Always consider consulting with a professional to understand how a trust can impact your specific situation.

One downside of a living trust is that it might not offer the same tax benefits as a will. Additionally, living trust property with a will can lead to extra management responsibilities, as you need to fund the trust properly. This process can be complex and may require ongoing oversight. Furthermore, setting up a living trust typically involves legal fees that some individuals might find burdensome.

Writing a living trust will involves outlining your wishes for your assets and beneficiaries clearly. Begin by identifying the assets to be included, then describe how they should be managed after your passing. Tools like uslegalforms can assist you in drafting a living trust property with a will, ensuring all legal details are addressed and your intentions are honored.

Considering whether your parents should place their assets in a trust largely depends on their financial situation and future goals. A living trust property with a will can help manage their estate more smoothly, reducing potential probate delays. It’s wise to consult an experienced professional or use platforms like uslegalforms to guide them through the decision-making process effectively.

A significant downside to placing assets in a trust is losing control over those assets in case of revocable trust scenarios. While you can change or dissolve the trust, doing so can complicate the management of your living trust property with a will. Additionally, certain assets may be subject to probate court review if not incorporated properly, potentially negating some intended benefits of the trust structure.

One significant mistake parents often make when establishing a trust fund is failing to fund it properly. Without the right assets in place, their living trust property with a will may not operate as intended, leading to confusion and possible disputes among beneficiaries. To avoid this, it’s crucial to regularly review and update the trust documentation and ensure all intended assets are transferred into the trust.

Yes, a living trust can override a will for the assets it explicitly covers. This means that if you have property designated within your living trust, it will typically go to your beneficiaries outside of the will's instructions. Understanding how living trust property with a will works is vital for effective estate planning. If you need help navigating these complexities, consider using uSlegalforms to streamline your planning process.

In most cases, a will does not override a properly established living trust. When you create a living trust, it generally governs the distribution of the trust property regardless of the will. However, if the living trust property with a will is not adequately updated or funded, there can be conflicts. Always keep your estate planning documents aligned to avoid confusion among your beneficiaries.

While a living trust offers numerous benefits, it also has a few downsides. One primary downside is the initial setup and ongoing maintenance, which can require time and resources. Unlike a will, which can be simpler to create, a living trust needs careful management to ensure it includes your living trust property with a will. Be sure to consider these factors when deciding on your estate planning approach.

In the realm of estate planning, living trust property with a will often leads to questions about precedence. Generally, a living trust can take precedence over a will for the assets it holds. This means that property placed in the trust will bypass the probate process, allowing for a smoother transfer to beneficiaries. It's crucial to ensure your trust is properly funded to achieve this benefit.