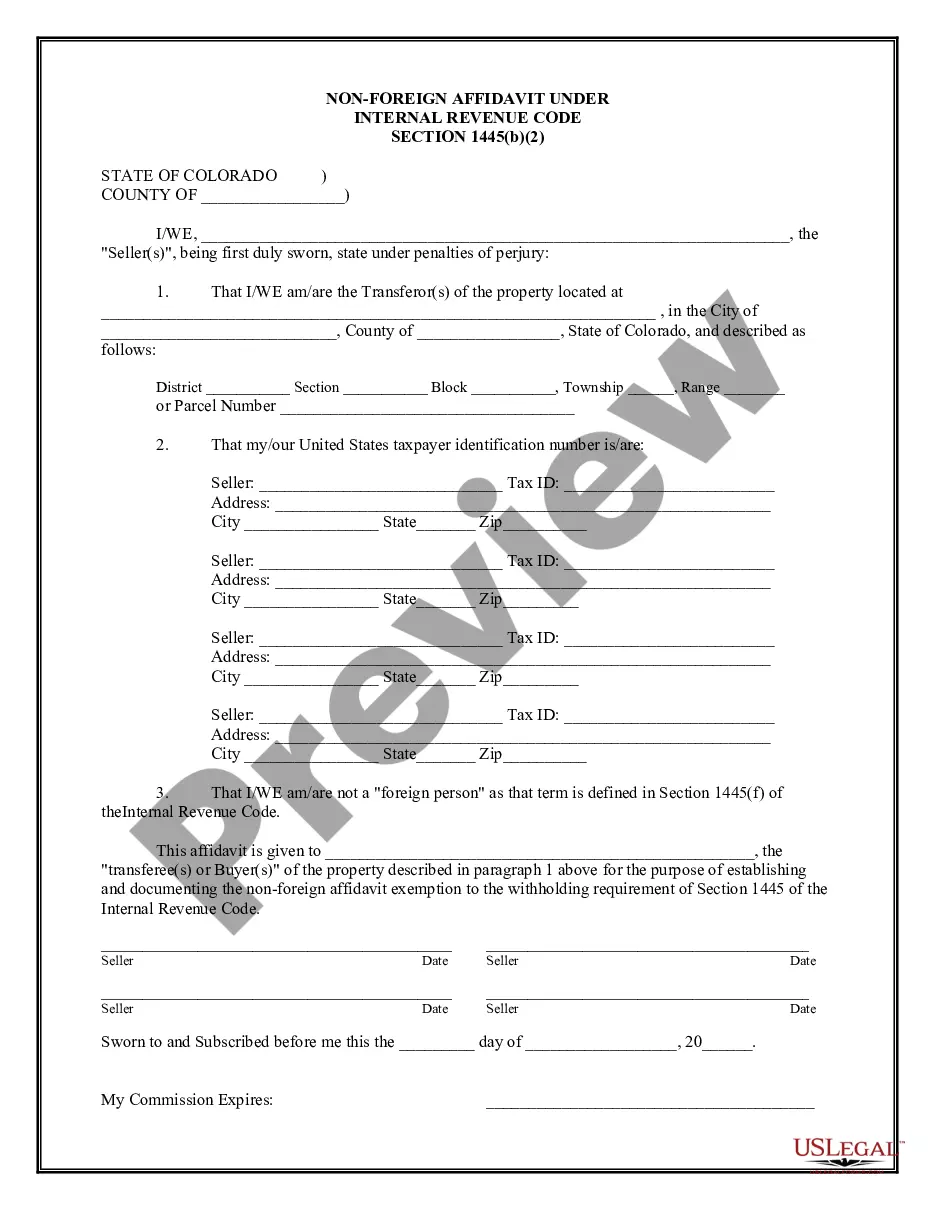

Non Foreign Affidavit Form

Description

How to fill out Colorado Non-Foreign Affidavit Under IRC 1445?

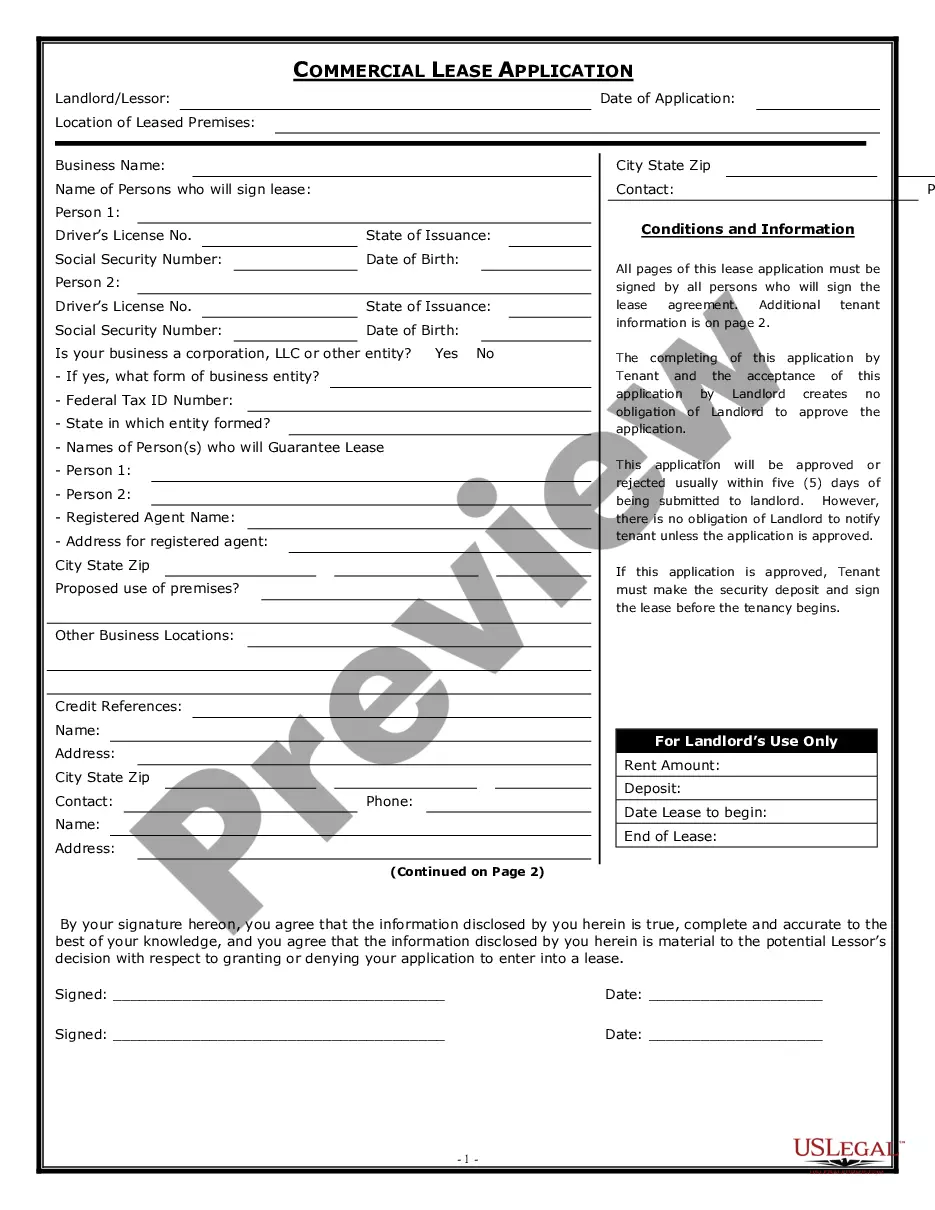

There's no longer a necessity to squander time searching for legal documents to adhere to your local state regulations.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our website features over 85k templates for any business and personal legal matters categorized by state and area of use.

Feel free to utilize the Search bar above to look for another template if the current one doesn't meet your needs. Click Buy Now next to the template title once you discover the right one. Choose the most appropriate pricing plan and create an account or Log In. Make payment for your subscription using a card or via PayPal to proceed. Select the file format for your Non Foreign Affidavit Form and download it to your device. Print out your form to complete it by hand or upload the template if you prefer to do it in an online editor. Completing legal documents under federal and state regulations is quick and straightforward with our platform. Experience US Legal Forms today to organize your documentation!

- All forms are expertly prepared and confirmed for authenticity, so you can be assured of acquiring an up-to-date Non Foreign Affidavit Form.

- If you are acquainted with our platform and already possess an account, ensure your subscription is valid before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any moment needed by accessing the My documents tab in your profile.

- If you've never engaged with our platform before, the process will involve some additional steps to complete.

- Here's how new users can find the Non Foreign Affidavit Form in our catalog.

- Review the page content meticulously to confirm it contains the template you require.

- To achieve this, use the form description and preview options if available.

Form popularity

FAQ

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

There are two different types of FIRPTA Certifications: one for individuals (natural persons) and another for entities (e.g., corporation, partnership, limited liability company, etc.). The FIRPTA Certification must be signed by all transferors (sellers).

The FIRPTA law says that if the seller is a foreign person, the transferee i.e. the buyer, is the Withholding Agent3 that is legally responsible for collecting the tax and forwarding it to the IRS.

FIRPTA stands for Foreign Investment In Real Property Tax Act (26 USC §1445). It is a tax law designed to ensure payment of tax to the Internal Revenue Service (IRS), as may be due, when US property is sold by any foreign person.

foreign person affidavit is made by a seller of a real property stating that s/he is a nonforeign seller as defined by the Internal Revenue Code Section 26 USC 1445. The nonforeign affidavit is required to afford the buyer with guarantee that the seller is not a foreign person.