Colorado Name Change With Dmv

Description

How to fill out Colorado Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Identifying a reliable location to obtain the latest and pertinent legal examples is a significant part of navigating bureaucracy.

Finding the appropriate legal documents requires accuracy and careful consideration, which is why it’s crucial to source Colorado Name Change With Dmv samples solely from credible providers, like US Legal Forms. An incorrect form can squander your time and postpone your situation.

Eliminate the difficulties associated with your legal paperwork. Explore the vast US Legal Forms archive where you can find legal samples, evaluate their relevance to your circumstances, and download them instantly.

- Utilize the library navigation or search bar to find your document.

- Review the form’s description to ensure it meets your state's and area's criteria.

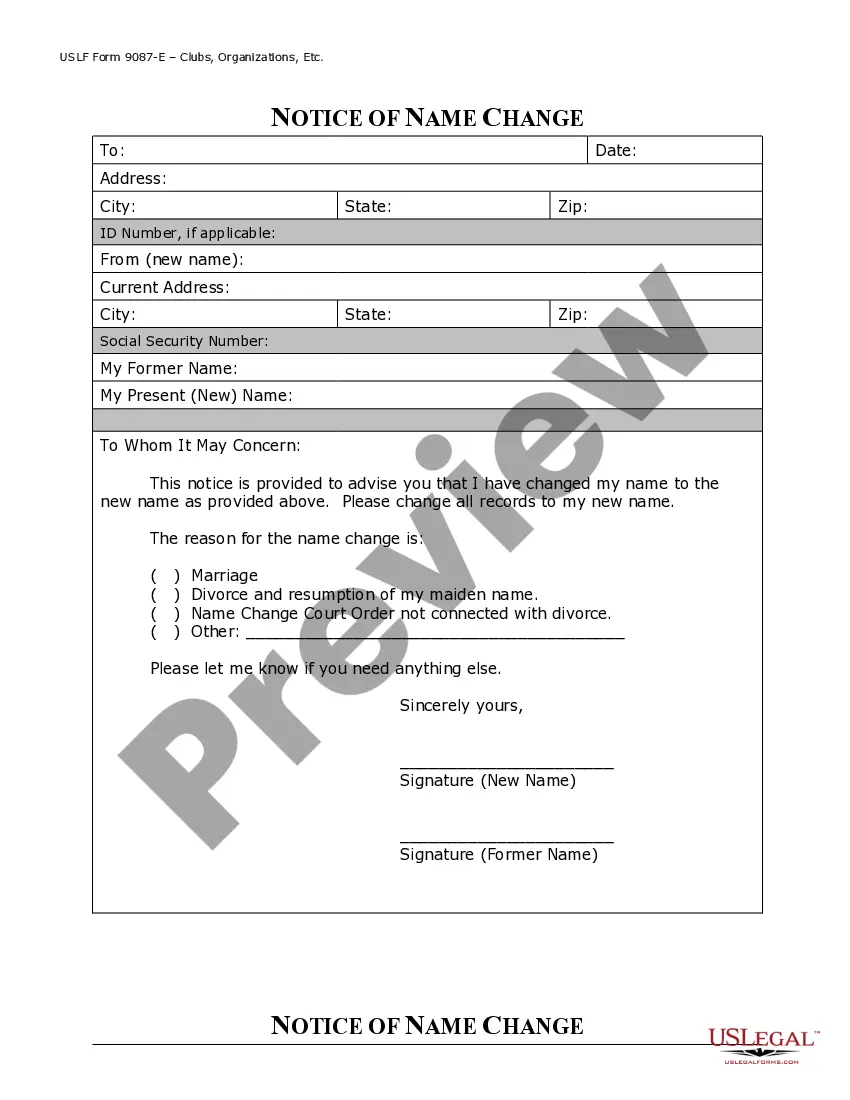

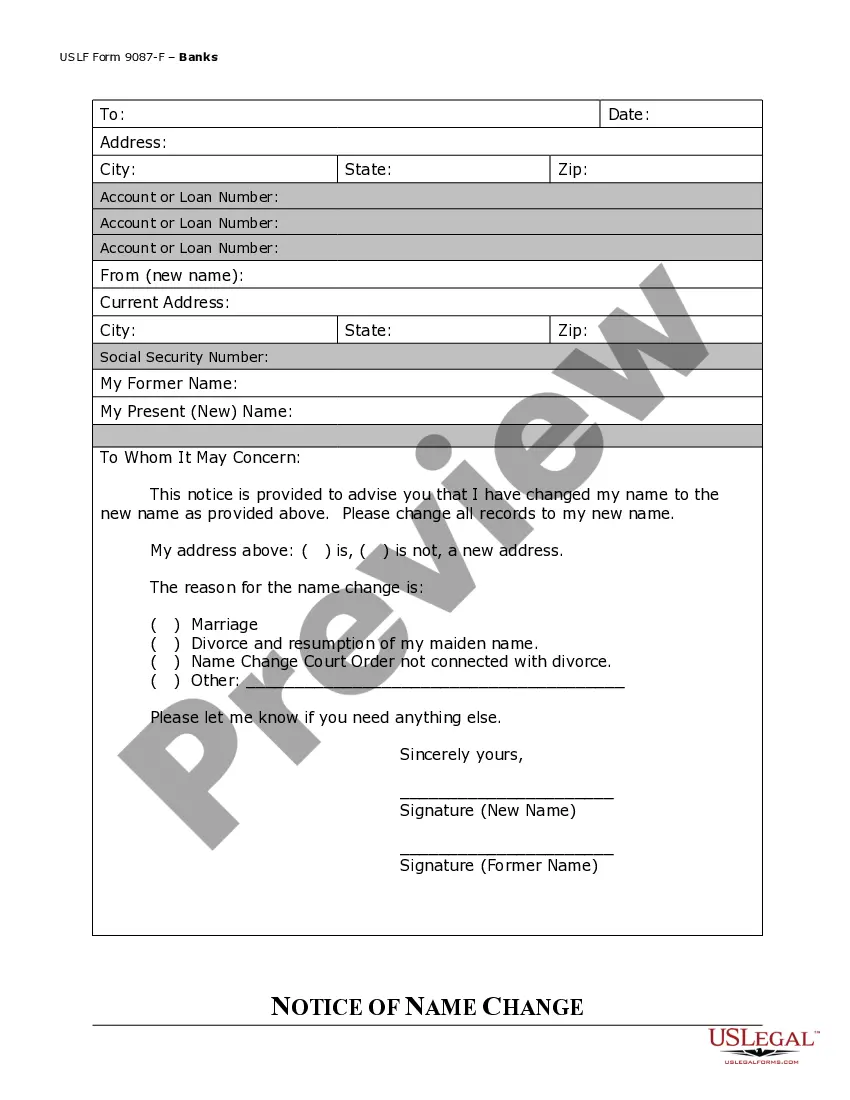

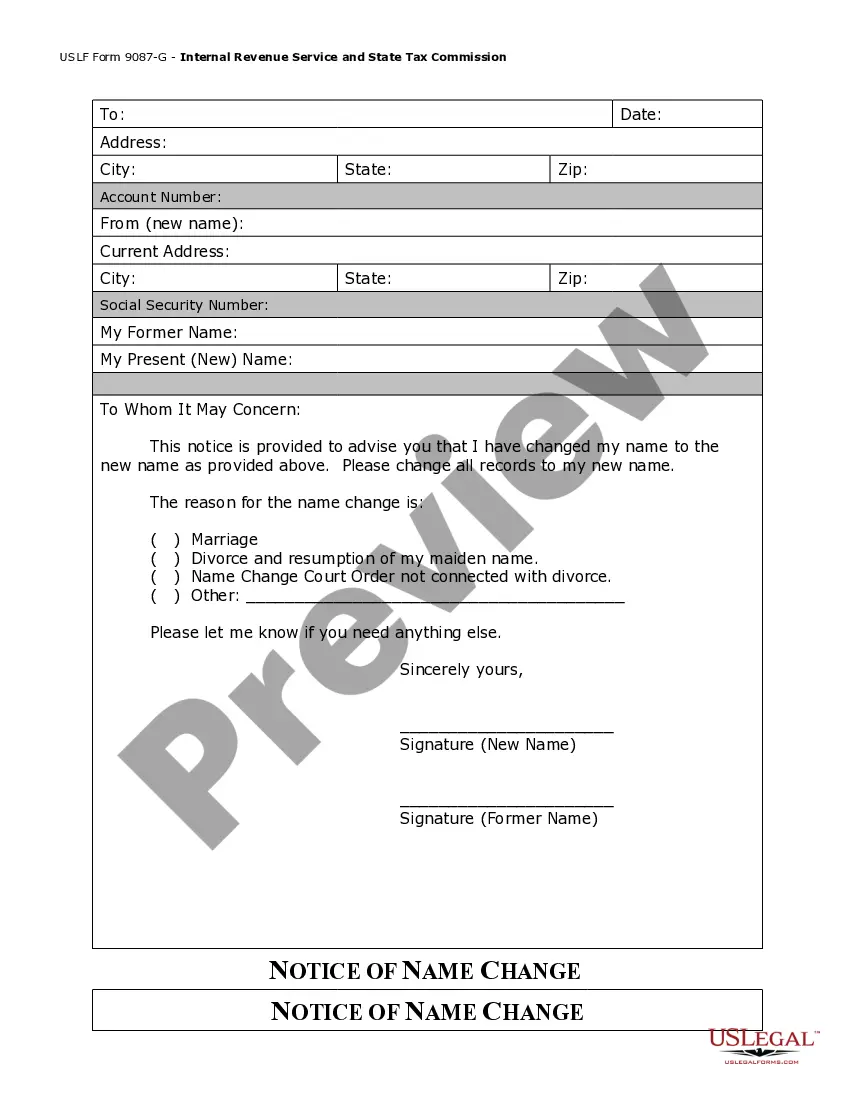

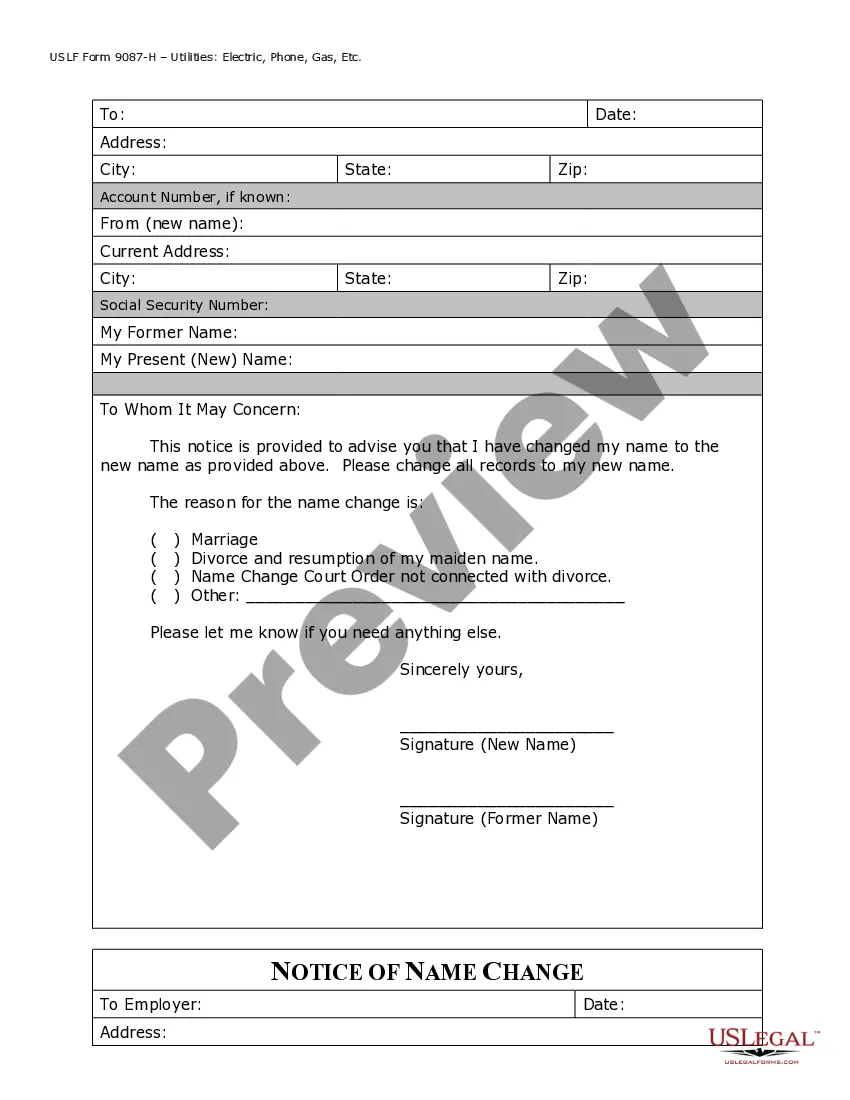

- Access the form preview, if available, to confirm that it matches your requirements.

- Return to the search and seek the suitable template if the Colorado Name Change With Dmv does not align with your needs.

- If you are confident about the document's relevance, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing option that meets your needs.

- Proceed with registration to finalize your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Colorado Name Change With Dmv.

- Once you have the form on your device, you can edit it using the editor or print it out and fill it in manually.

Form popularity

FAQ

Turnaround time: In general, turnaround time for forming an LLC in Alabama is 6-8 weeks. Expedited filings, which require an additional fee, typically take 4-5 weeks. Follow-up filing: Required. A privilege tax return is required to be filed within 2 ½ months after formation.

In order to change your LLC name, you must file a Certificate of Amendment with the Alabama Secretary of State. This officially updates your legal entity (your Limited Liability Company) on the state records.

Steps on How to Start Your LLC in Alabama Reserve Your LLC Name With the Alabama Secretary of State. ... Designate a Registered Agent. ... File a Certificate of Formation. ... Create an Operating Agreement. ... Request an IRS Employer Identification Number (EIN) ... Fulfill Ongoing Obligations.

Immediate Processing: You may acquire copies and certified copies online at .sos.alabama.gov. Click on Business Services (below the picture, Business Entity Record Copies.

It costs $200 to form an LLC in Alabama. This is a fee paid for the Certificate of Formation. You'll file this form with the Alabama Secretary of State. And once approved, your LLC will go into existence.

What Comes After Establishing Your LLC? Get an EIN. EINs are sometimes called federal employer identification numbers (FEINs) or federal tax identification numbers (FTINs). ... File an Annual Report and Pay the Business Privilege Tax (BPT) ... Create an LLC Operating Agreement.

It's the same $200 for the Certificate of Formation and $28 for the LLC Name Reservation, however, there is an extra $8 fee for filing the Certificate of Formation online. If you file by mail, your Alabama LLC will be approved in 1-2 business days (plus mail time). Your LLC approval will be returned via physical mail.

All Alabama LLCs need to pay $50 per year for the Annual Report and Alabama Business Privilege Tax. These state fees are paid to the Department of Revenue. And this is the only state-required annual fee. You have to pay this to keep your LLC in good standing.