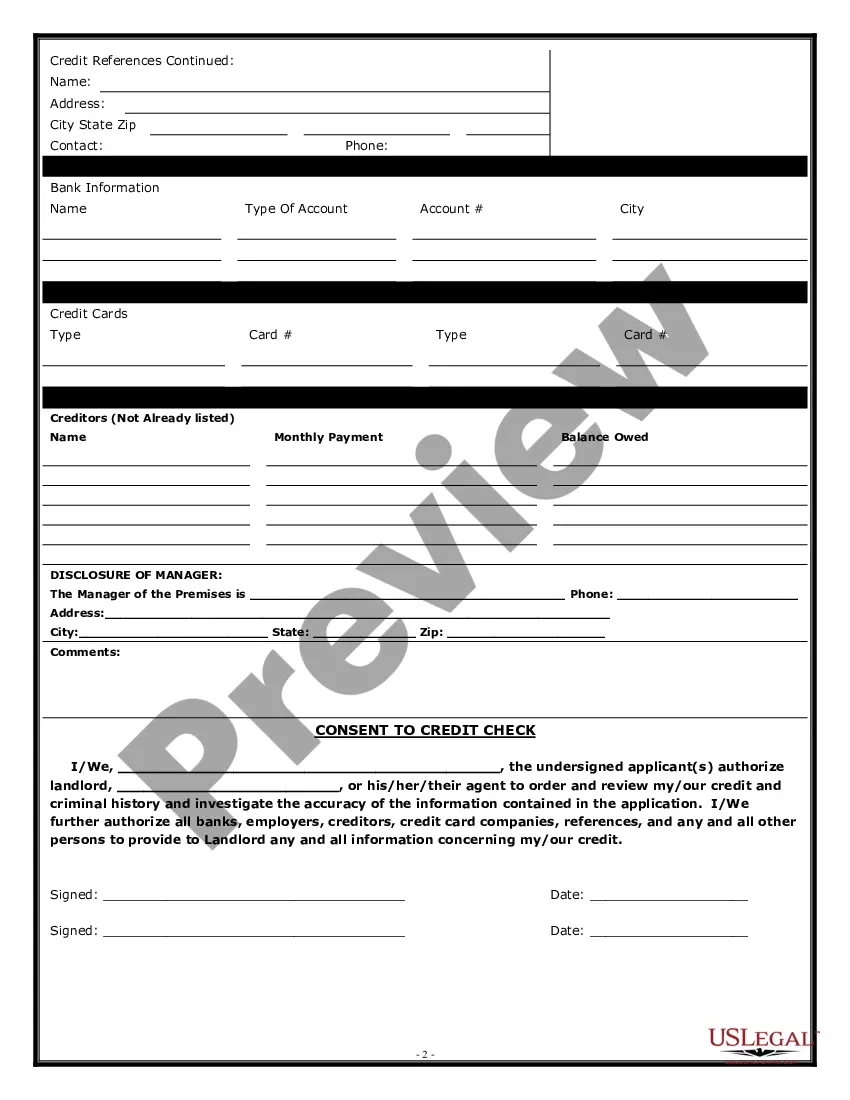

This is a Commercial Lease Application for a Lessor to have the proposed Lessee sign. It contains required disclosures and an authorization for release of information. A commercial lease is a detailed written agreement for the rental by a tenant of commercial property owned by the landlord. Commercial property differs from residential property in that the property's primary or only use is commercial (business oriented), rather than serving as a residence. Commercial leases are often more complex than residential leases, have longer lease terms, and may provide for the rental price to be tied to the tenant business's profitability or other factors, rather than a uniform monthly payment (though this is also quite ordinary in commercial leases).

Formato De Solicitud De Arrendamiento Minerva Withholding Tax

Description

How to fill out Colorado Commercial Rental Lease Application Questionnaire?

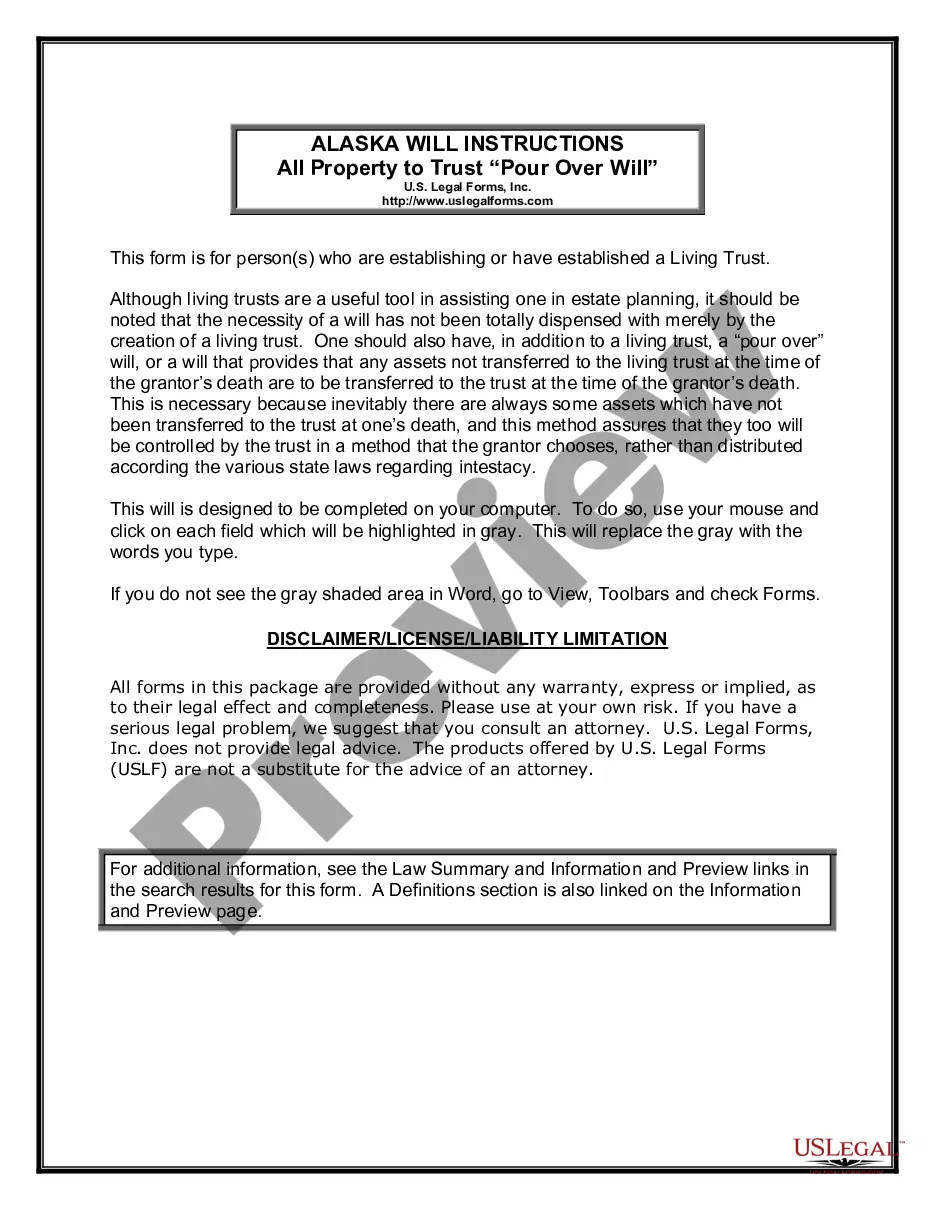

Legal managing might be overwhelming, even for skilled experts. When you are looking for a Formato De Solicitud De Arrendamiento Minerva Withholding Tax and don’t have the time to devote searching for the right and up-to-date version, the processes might be nerve-racking. A strong online form catalogue might be a gamechanger for everyone who wants to handle these situations successfully. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any demands you may have, from personal to organization paperwork, in one spot.

- Use advanced resources to complete and control your Formato De Solicitud De Arrendamiento Minerva Withholding Tax

- Gain access to a resource base of articles, tutorials and handbooks and resources connected to your situation and needs

Save effort and time searching for the paperwork you will need, and utilize US Legal Forms’ advanced search and Preview feature to discover Formato De Solicitud De Arrendamiento Minerva Withholding Tax and download it. For those who have a subscription, log in in your US Legal Forms profile, search for the form, and download it. Take a look at My Forms tab to find out the paperwork you previously saved and to control your folders as you see fit.

If it is the first time with US Legal Forms, register an account and have limitless usage of all advantages of the library. Listed below are the steps for taking after downloading the form you need:

- Validate it is the right form by previewing it and reading its information.

- Ensure that the sample is accepted in your state or county.

- Choose Buy Now when you are ready.

- Choose a monthly subscription plan.

- Pick the format you need, and Download, complete, eSign, print out and send your document.

Benefit from the US Legal Forms online catalogue, supported with 25 years of expertise and reliability. Enhance your daily document management into a easy and easy-to-use process today.

Form popularity

FAQ

Levied in thousands of cities, counties, school districts, and other localities, local income taxes are often used to either lower other taxes (like property taxes) or raise more revenue for local services.

Cities that administer their own taxes on their own form: City of Akron. City of Canton. City of Carlisle. City of Cincinnati. City of Columbus. City of Dayton. City of Middletown. City of St. Marys.

Ohio has a graduated individual income tax, with rates ranging from 2.765 percent to 3.990 percent. There are also jurisdictions that collect local income taxes. Ohio does not have a corporate income tax but does levy a gross receipts tax.

The Village of Minerva Park has a 2% Income Tax, which supports our community infrastructure as well as our police department.

Income Taxes In Ohio, townships do not levy an income tax on residents. If you live and work in a township, you will pay no income tax (assuming your business is not within a Joint Economic Development District). The township's residential taxpayer funding comes generally through property taxes.