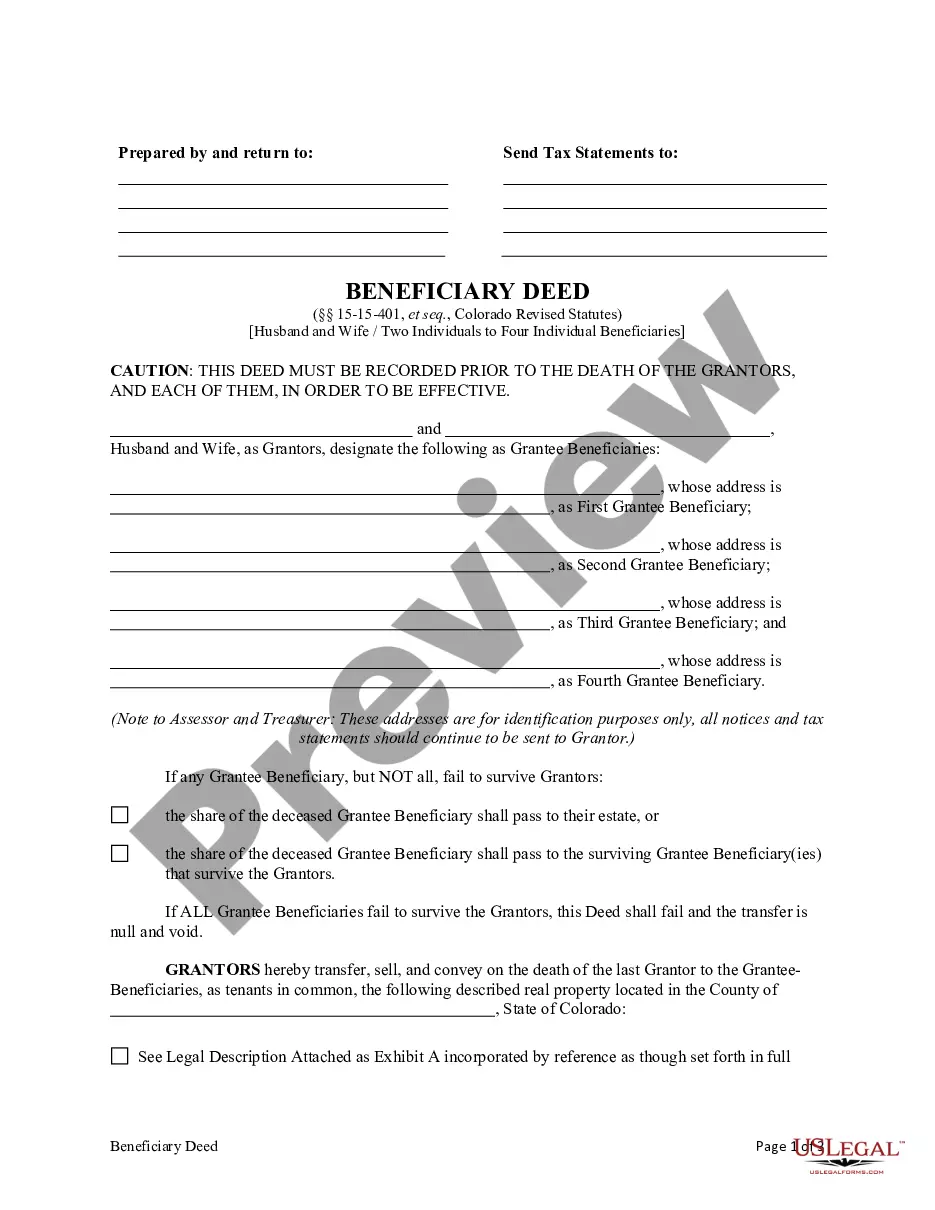

Transfer on Death Deed - Colorado - Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: This deed is used to transfer the ownership or title of a parcel of land, upon the death of the last surviving Grantor, to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Further, it must be recorded prior to death of last Grantor.

Beneficiary Deed Form For Colorado

Description

How to fill out Beneficiary Deed Form For Colorado?

When you need to complete the Beneficiary Deed Form for Colorado in accordance with your local state's statutes and guidelines, there can be several alternatives available.

There's no requirement to verify every form to ensure it meets all the legal standards if you are a subscriber to US Legal Forms.

It is a reliable resource that can assist you in obtaining a reusable and current template on any subject.

Acquiring expertly prepared formal documents becomes effortless with US Legal Forms. Moreover, Premium users can also take advantage of the powerful integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the largest online catalog with a collection of over 85,000 ready-to-use documents for professional and personal legal matters.

- All templates are validated to comply with each state's statutes and guidelines.

- Thus, when you download the Beneficiary Deed Form for Colorado from our site, you can trust that you maintain a legitimate and updated document.

- Accessing the required template from our platform is quite easy.

- If you already possess an account, simply Log In to the system, confirm your subscription is active, and save the selected document.

- Later, you can visit the My documents tab in your profile and keep access to the Beneficiary Deed Form for Colorado anytime.

- If this is your first time using our library, please follow the instructions below.

- Browse through the suggested page and verify it for alignment with your requirements.

Form popularity

FAQ

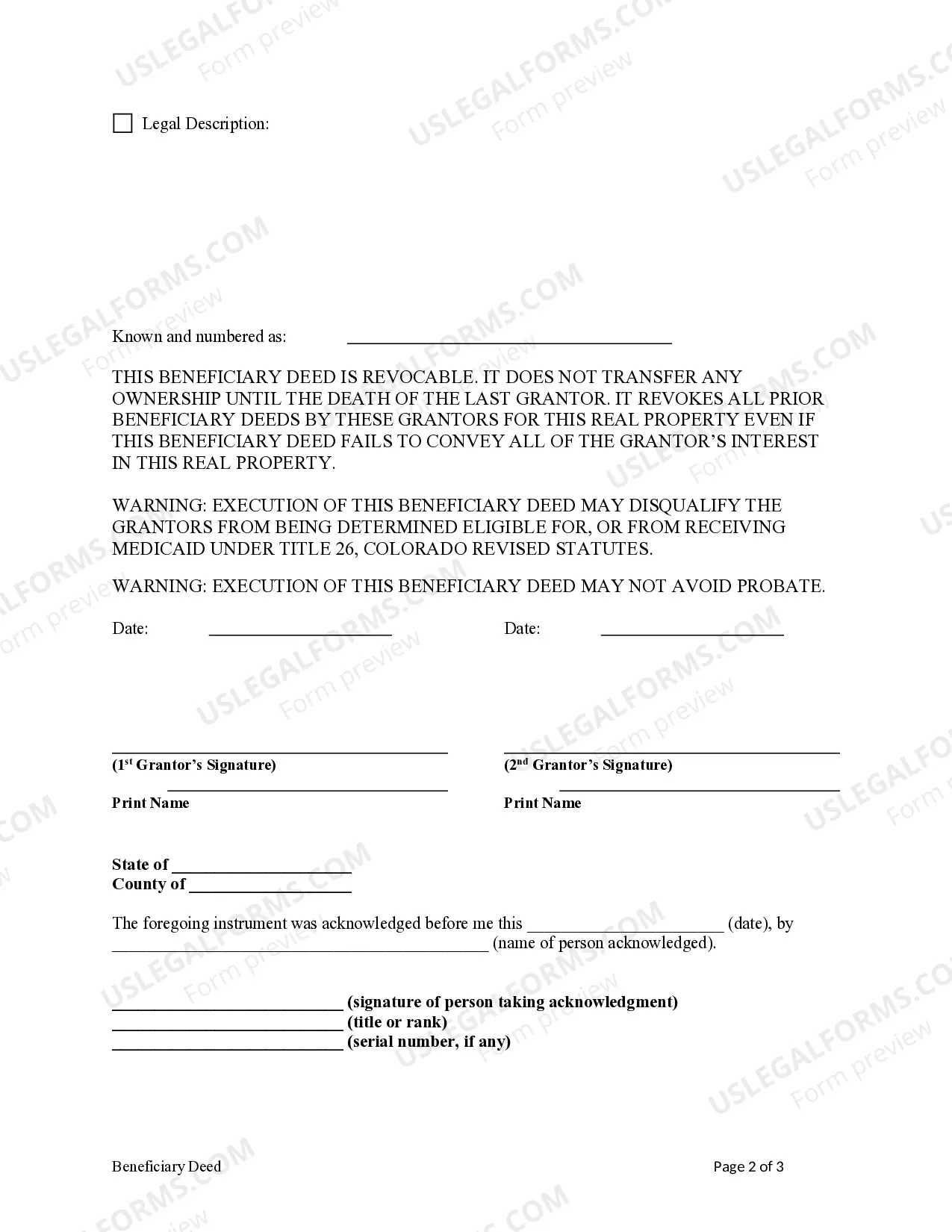

Yes, a Deed of Trust must be notarized in Colorado to be legally binding. Notarization ensures the authenticity of the signatures and the awareness of the parties involved in the transaction. If you are managing property transfer with a beneficiary deed form for Colorado, it's essential to follow proper procedures, including notarization, to safeguard your interests. When in doubt, an attorney or notary can guide you through the process.

You might not need an attorney to complete a beneficiary deed in Colorado, especially if you feel comfortable navigating the process. However, having professional legal assistance can provide valuable insights and help ensure the beneficiary deed form for Colorado is filled out correctly. Consulting with an attorney can also clarify any potential implications, ensuring your wishes are well understood.

While a beneficiary deed offers benefits, it also comes with some potential downsides. One significant disadvantage is that the beneficiary might not have immediate access to the property until the owner's death, which can create uncertainty. Additionally, the property could be subject to the beneficiary's creditors, impacting their inheritance. It's wise to weigh these factors carefully before deciding.

To file a beneficiary deed in Colorado, start by obtaining the beneficiary deed form for Colorado from a reputable source, like USLegalForms. Complete the form by including pertinent information such as the legal description of the property and the designated beneficiary. Once filled out, take it to your local county clerk and recorder to file it. Remember, proper filing protects your intentions and simplifies the property transfer in the future.

To transfer ownership of a property in Colorado, you typically need to complete a deed. A beneficial option is the beneficiary deed form for Colorado, which allows you to designate a beneficiary who will receive the property upon your passing. This ensures that the transition happens smoothly and avoids probate. After completing the form, you must file it with the county clerk and recorder.

The requirements for a beneficiary deed form for Colorado include having the current property owner's name, a legal description of the property, and the designated beneficiary's name. The deed must be signed by the property owner and recorded in the county where the property is located. It's also essential for the owner to have the capacity to sign and not be under any undue influence. For a comprehensive guide on filling out this form, USLegalForms offers detailed resources.

To obtain the deed to your house in Colorado, you typically need to contact your county clerk's office. They maintain property records and can provide you with a copy of your original deed. If you're unsure about your property's status, you can also search their online database. Additionally, using a beneficiary deed form for Colorado can simplify future transfers of property, ensuring that your wishes are smoothly executed.

Yes, Colorado recognizes the transfer on death decree, often referred to as a beneficiary deed form for Colorado. This allows property owners to designate a beneficiary who will receive the property upon their death without going through probate. It's a straightforward way to ensure your assets are quickly transferred to your loved ones. For assistance in creating this deed, consider using resources from platforms like USLegalForms.

Yes, a beneficiary deed form for Colorado can be contested under certain circumstances. If someone believes the form was signed under duress, lack of capacity, or if the signer did not intend for the deed to take effect, they may challenge it in court. It's important to have clear documentation and witnesses to strengthen the legitimacy of the deed. Consulting with a legal professional can help in navigating these potential disputes.

To obtain a beneficiary deed form for Colorado, you can start by visiting a legal document service like USLegalForms. This platform provides easy access to templates and guidance on filling them out correctly. You can also contact a local attorney who specializes in real estate to ensure that all legal requirements are met. Make sure that the completed form is recorded with the county clerk where the property is located.