Joint Tenancy With Right Of Survivorship

Description

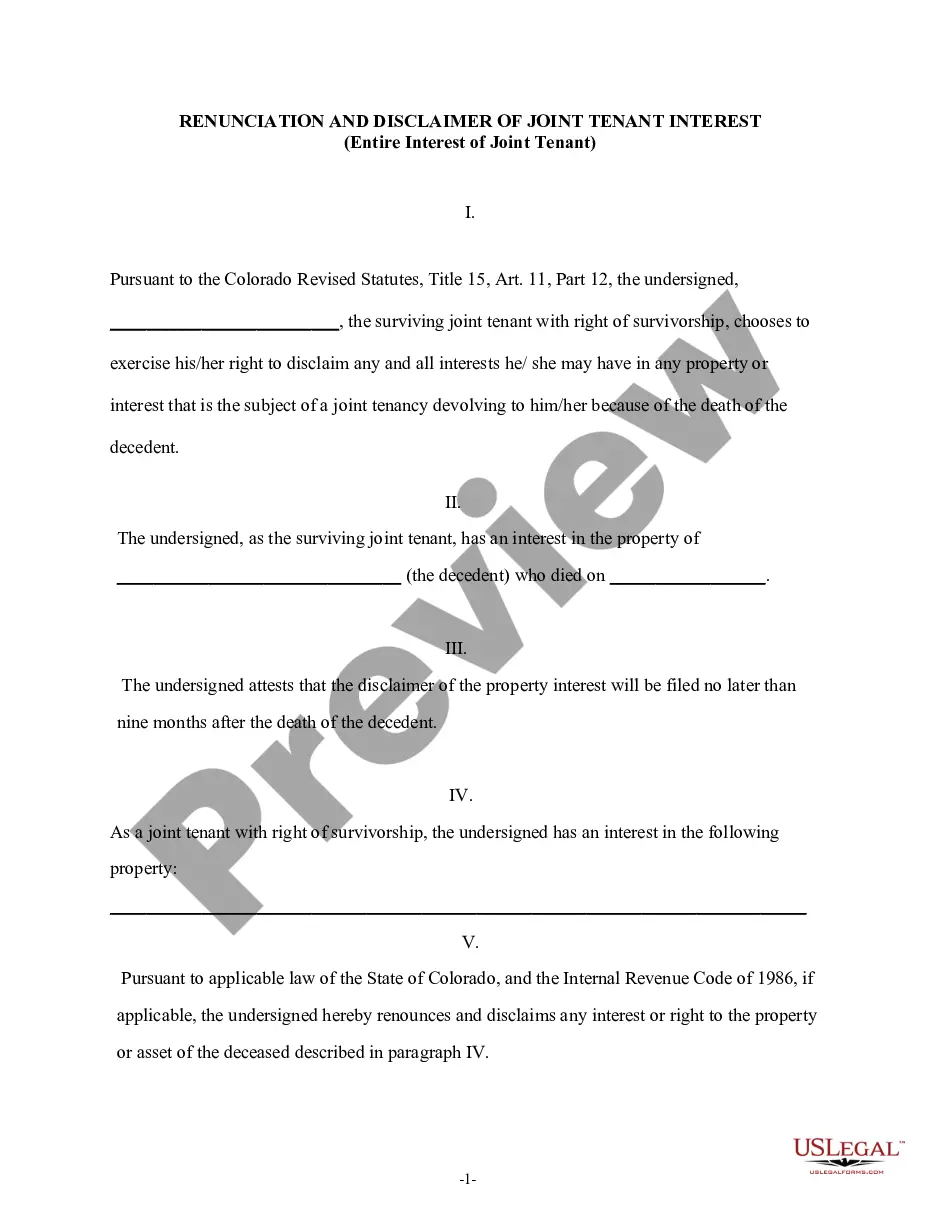

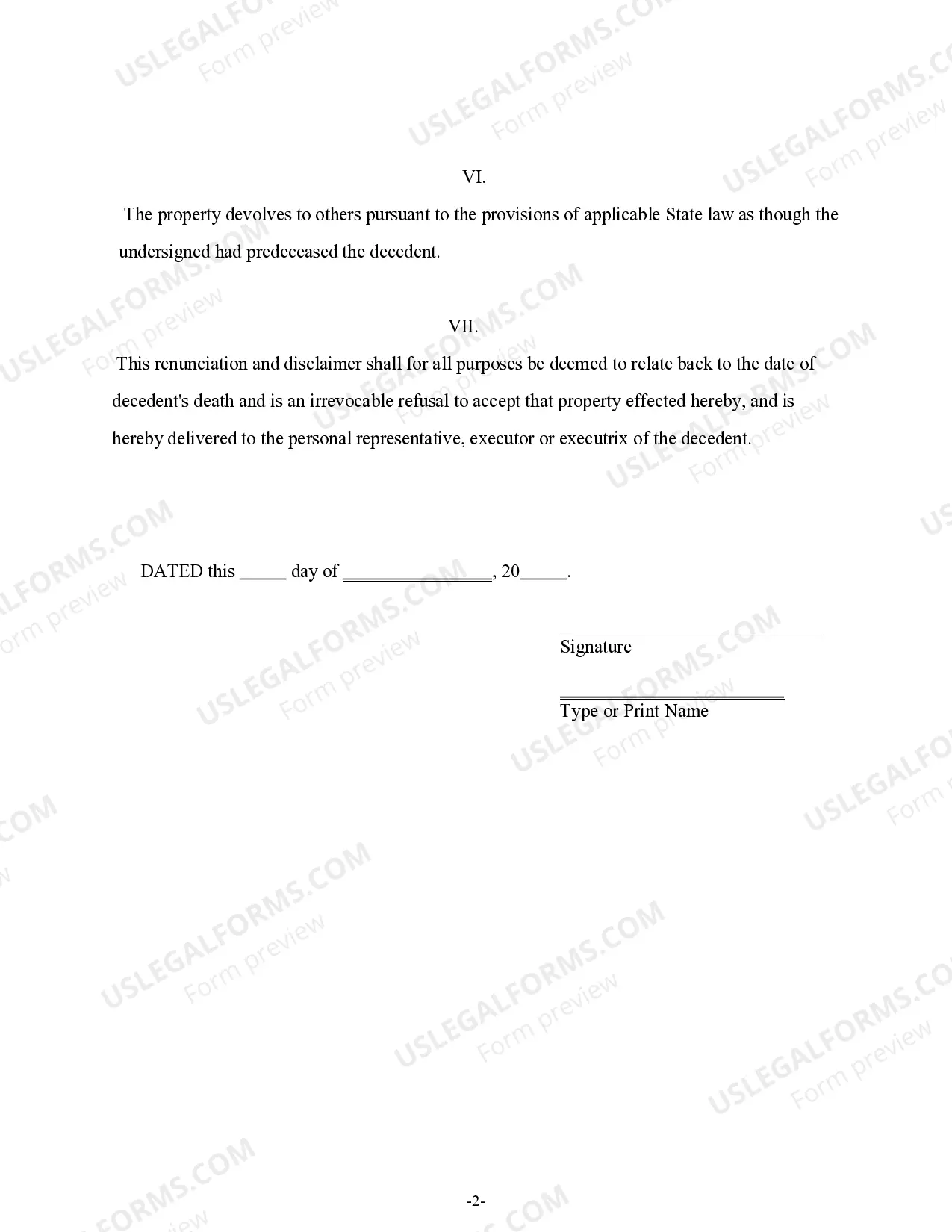

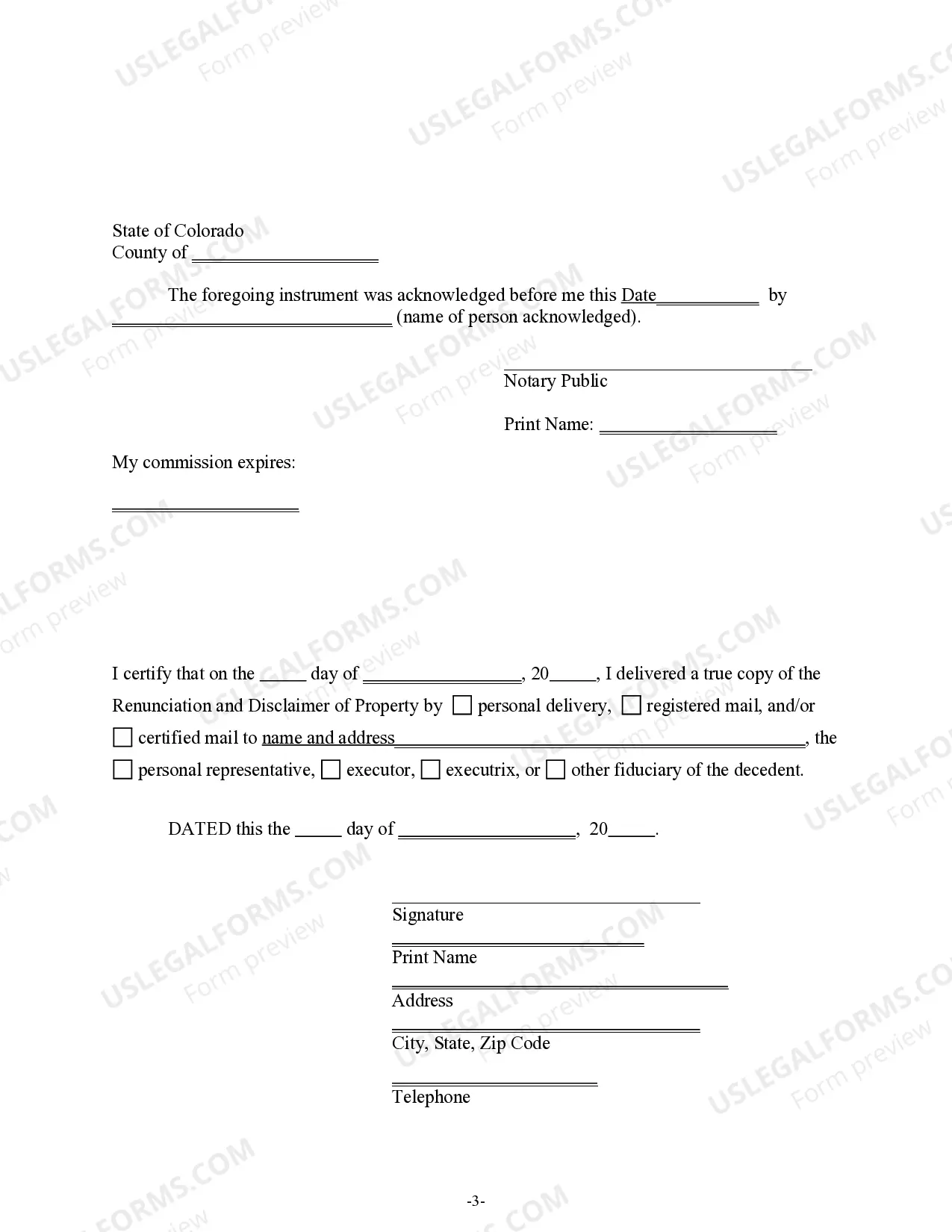

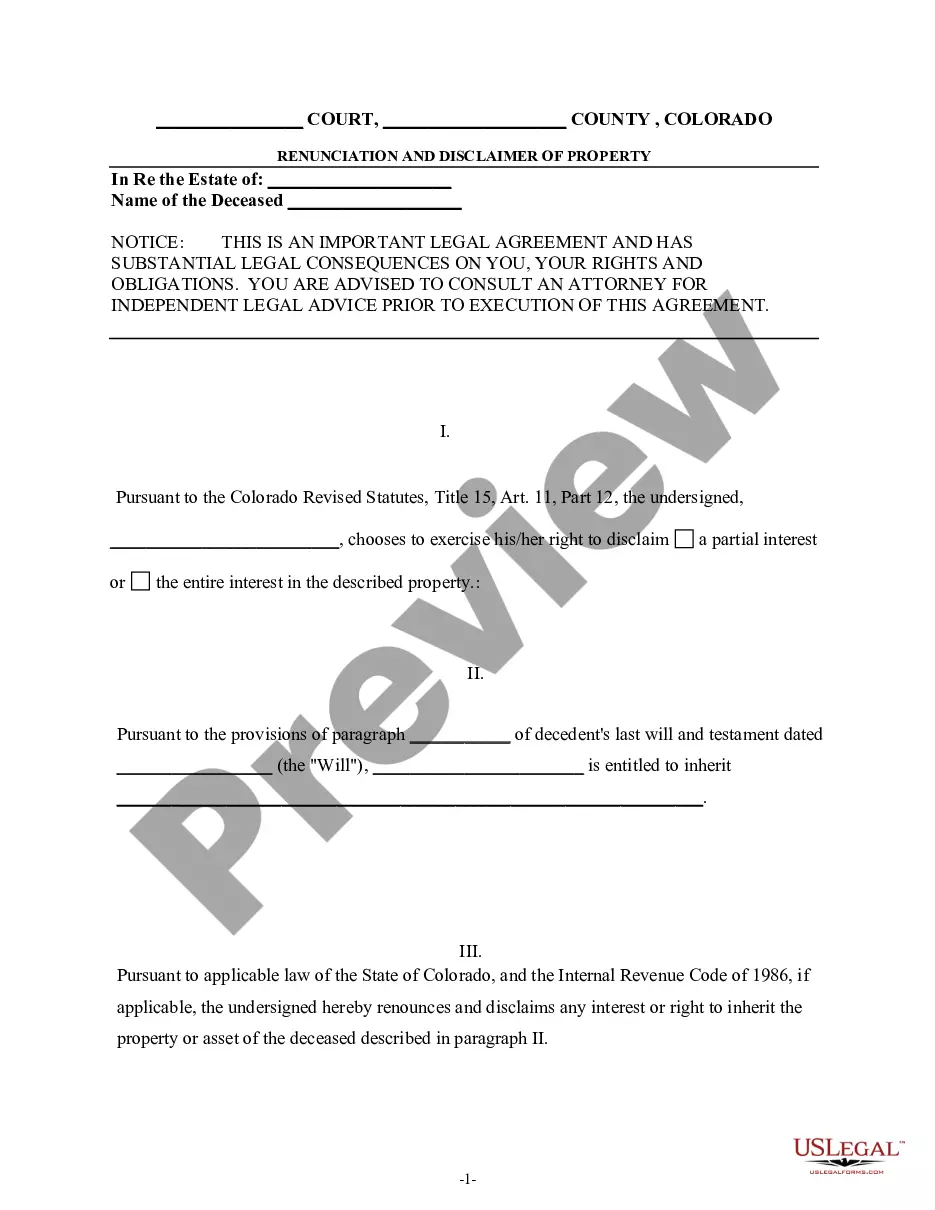

How to fill out Colorado Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

- If you're a returning user, log in to your account and find the required form. Ensure your subscription is active; if it's expired, renew according to your plan.

- Preview the form and read its description carefully to confirm it meets your needs and local requirements.

- If you need a different template, use the Search function at the top of the page to find the appropriate form. Make sure it fits your criteria before proceeding.

- Purchase the document by clicking the Buy Now button and selecting your subscription plan. You’ll need to create an account to access our extensive library of resources.

- Complete your purchase using a credit card or PayPal account to finalize your subscription.

- Download your completed form and save it on your device, making it accessible via the My Forms section of your profile. You can revisit it anytime you need.

In summary, US Legal Forms offers a wide range of legal documents, including those for joint tenancy with right of survivorship, facilitating a seamless process for both individuals and attorneys.

Start simplifying your legal documentation today by accessing our extensive library!

Form popularity

FAQ

A major disadvantage of joint tenancy ownership lies in its lack of flexibility. While joint tenancy with right of survivorship provides automatic transfer upon death, it does not accommodate individual wishes regarding property distribution. Changes in personal circumstances, such as divorce or the addition of new partners, may complicate joint ownership, leaving you with limited options to adapt your agreements as needed.

Avoiding joint ownership can be wise due to its potential drawbacks. Joint tenancy with right of survivorship can complicate your estate planning, as it may not align with your wishes for asset distribution after death. Additionally, joint ownership can put you at risk of losing your property to the debts or legal issues of your co-owner, making it essential to assess your situation carefully.

Joint tenants with rights of survivorship refers to a legal arrangement where two or more individuals own a property together, with the right to inherit the property if one owner passes away. This means that when one owner dies, their share automatically transfers to the surviving tenant, bypassing probate. This feature can simplify the transfer process, but it is crucial to understand the potential pitfalls involved.

Joint tenancy with right of survivorship is often referred to as a poor man's will because it allows the property to transfer automatically to the surviving owner upon death. This setup can eliminate the need for probate, making the transfer simpler and quicker. However, while it offers convenience, it lacks the customization and protection of a formal will, which can lead to unintended consequences.

Joint ownership, particularly joint tenancy with right of survivorship, can lead to unexpected complications. For example, if one owner faces legal issues or debts, their share may be seized by creditors, affecting the other owner. Moreover, joint tenants may struggle with decision-making if they disagree on property management. It's essential to weigh these factors carefully before choosing this ownership type.

An example of joint tenancy with right of survivorship would be a bank account shared between two siblings. If one sibling passes away, the surviving sibling will retain full ownership of the account without any legal delays. This setup is particularly beneficial for couples or family members who wish to ensure a straightforward transfer of assets. By utilizing platforms like US Legal Forms, you can easily draft an agreement to establish this legal structure.

Yes, the right of survivorship does override a will when it comes to joint tenancy with right of survivorship. This means that if one owner passes away, the surviving owner automatically inherits the entire account, regardless of what the will states. Understanding this concept is critical, as it ensures that your assets transfer seamlessly without going through probate. If you have specific concerns about asset distribution, consult with a legal expert.

To determine if your joint account has the right of survivorship, check the account agreement or documentation provided by your bank. Most financial institutions clearly state the ownership type, including whether it is a joint tenancy with right of survivorship. You can also contact your bank directly for clarification. It’s essential to know this, as it affects how the account is handled after one owner passes away.

The right of survivorship, while beneficial in many ways, comes with disadvantages that you should be aware of. One major drawback is that when one joint tenant passes away, the property automatically transfers to the surviving tenant, usually bypassing the deceased's heirs. This can lead to unexpected issues regarding inheritance and may not align with your overall estate planning goals. To address these concerns, exploring options through USLegalForms can provide clarity and solutions.

When dealing with joint tenancy with right of survivorship, there are specific tax implications to keep in mind. Generally, the income from the property can be taxed to all joint tenants based on their ownership share. Furthermore, the property may be subject to estate taxes upon the death of one tenant. It's beneficial to consult with a tax professional to fully understand these implications, and resources like USLegalForms can provide the necessary guidance.