California Contractor Form Withholding Independent

Description

How to fill out California Excavation Contractor Package?

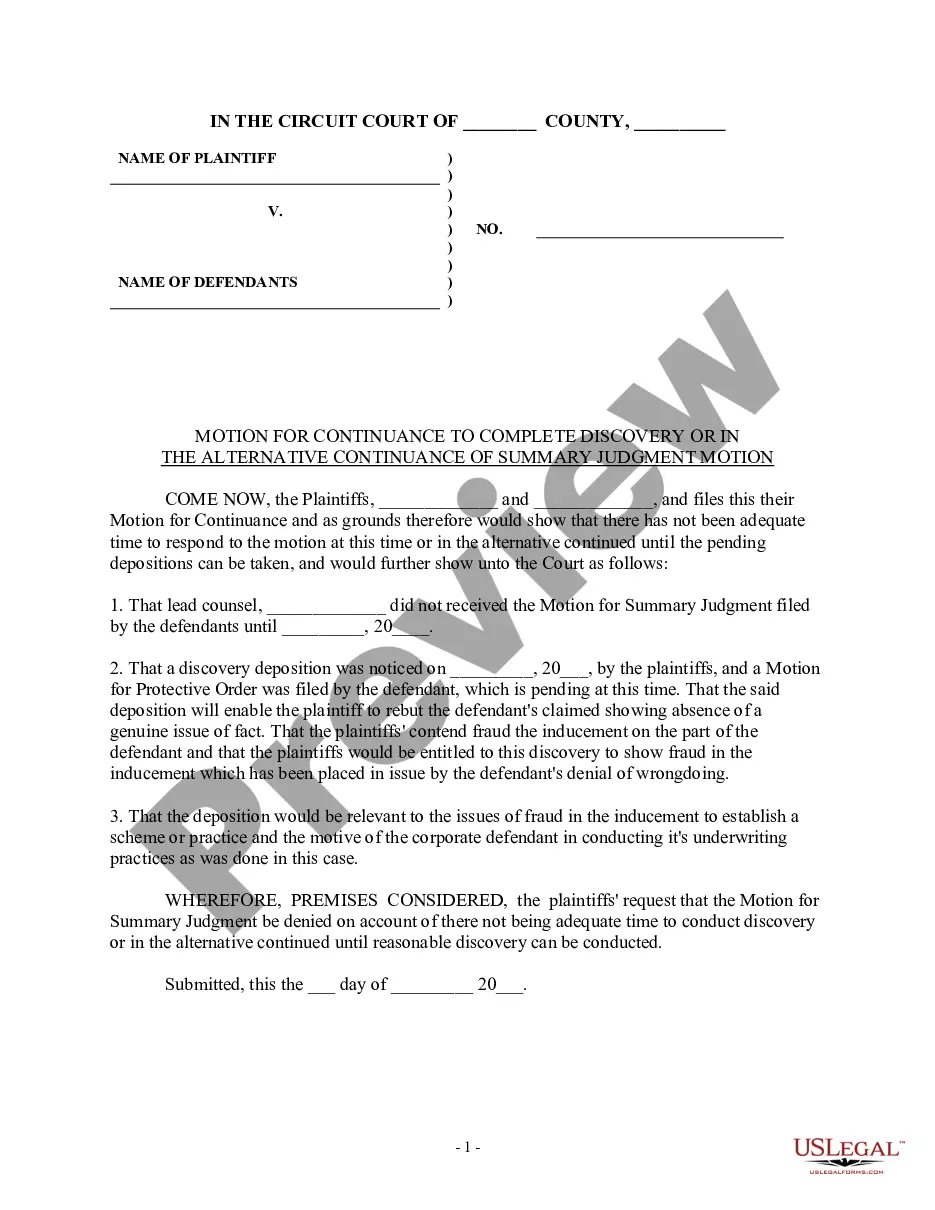

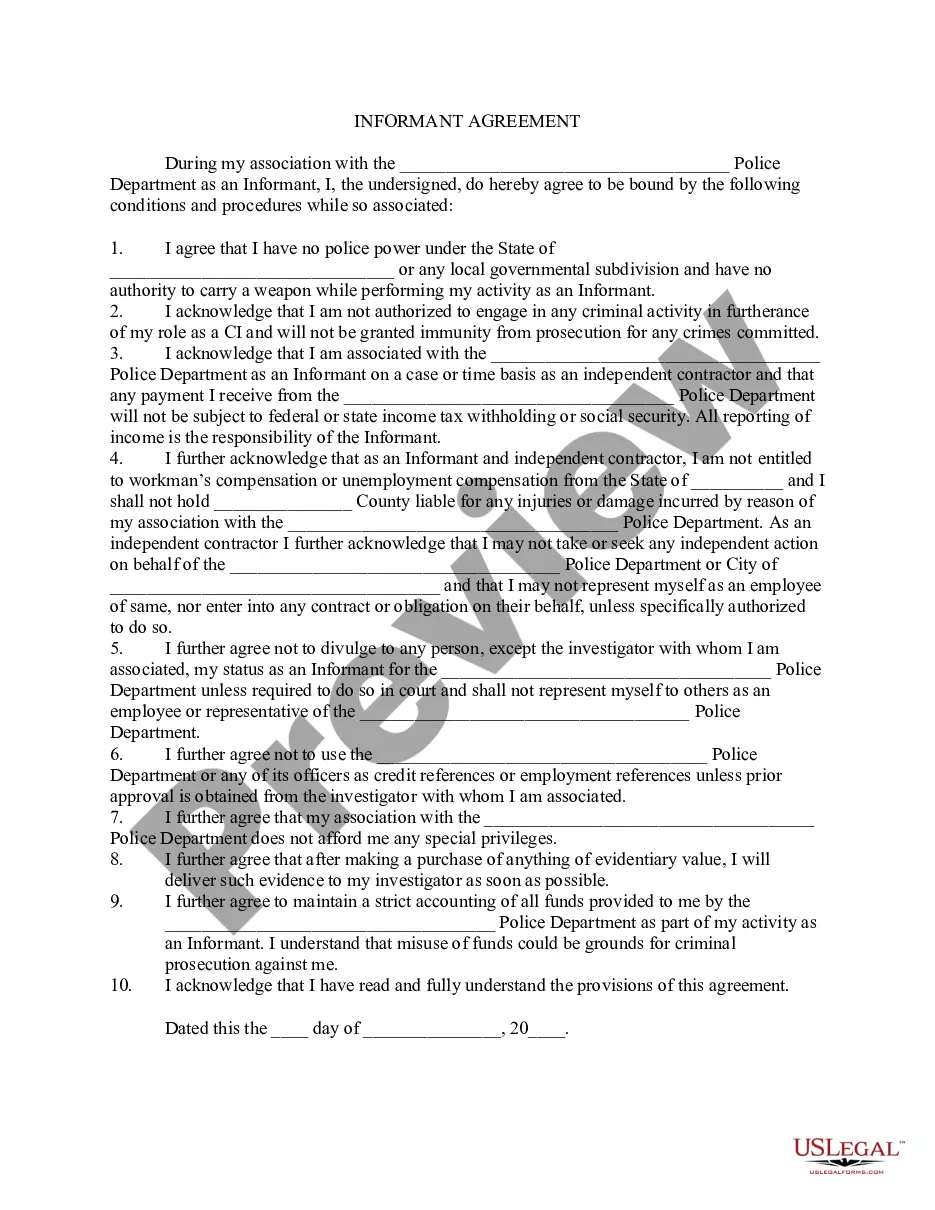

Whether for business purposes or for individual matters, everybody has to manage legal situations sooner or later in their life. Completing legal documents requires careful attention, starting with choosing the correct form template. For instance, when you pick a wrong edition of the California Contractor Form Withholding Independent, it will be declined once you submit it. It is therefore essential to get a trustworthy source of legal documents like US Legal Forms.

If you need to get a California Contractor Form Withholding Independent template, follow these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Look through the form’s information to ensure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, get back to the search function to locate the California Contractor Form Withholding Independent sample you need.

- Download the template if it meets your needs.

- If you already have a US Legal Forms account, just click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Pick your payment method: use a credit card or PayPal account.

- Choose the file format you want and download the California Contractor Form Withholding Independent.

- When it is saved, you can fill out the form with the help of editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never have to spend time seeking for the right sample across the internet. Take advantage of the library’s straightforward navigation to get the proper form for any situation.

Form popularity

FAQ

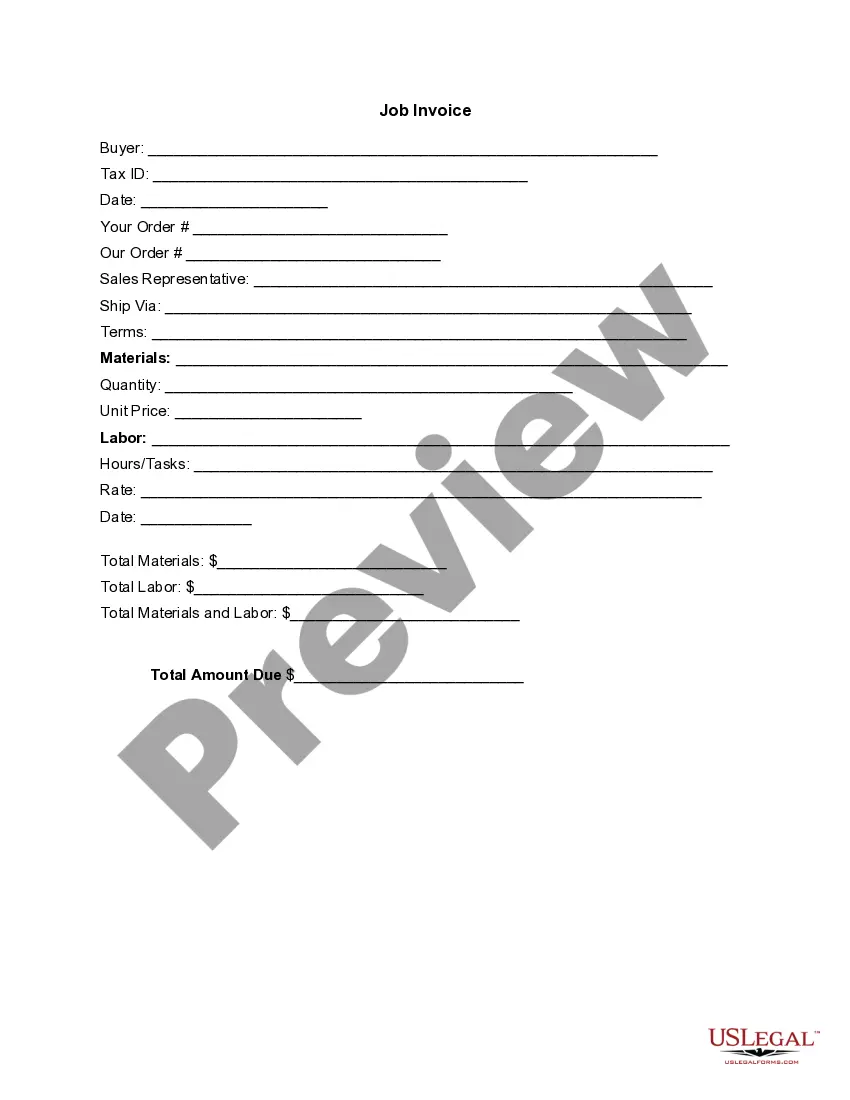

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

Service-provider (independent contractor): First name, middle initial, and last name. Social Security number. Address. Start date of contract (if no contract, date payments equal $600 or more) Amount of contract, including cents (if applicable) Contract expiration date (if applicable)

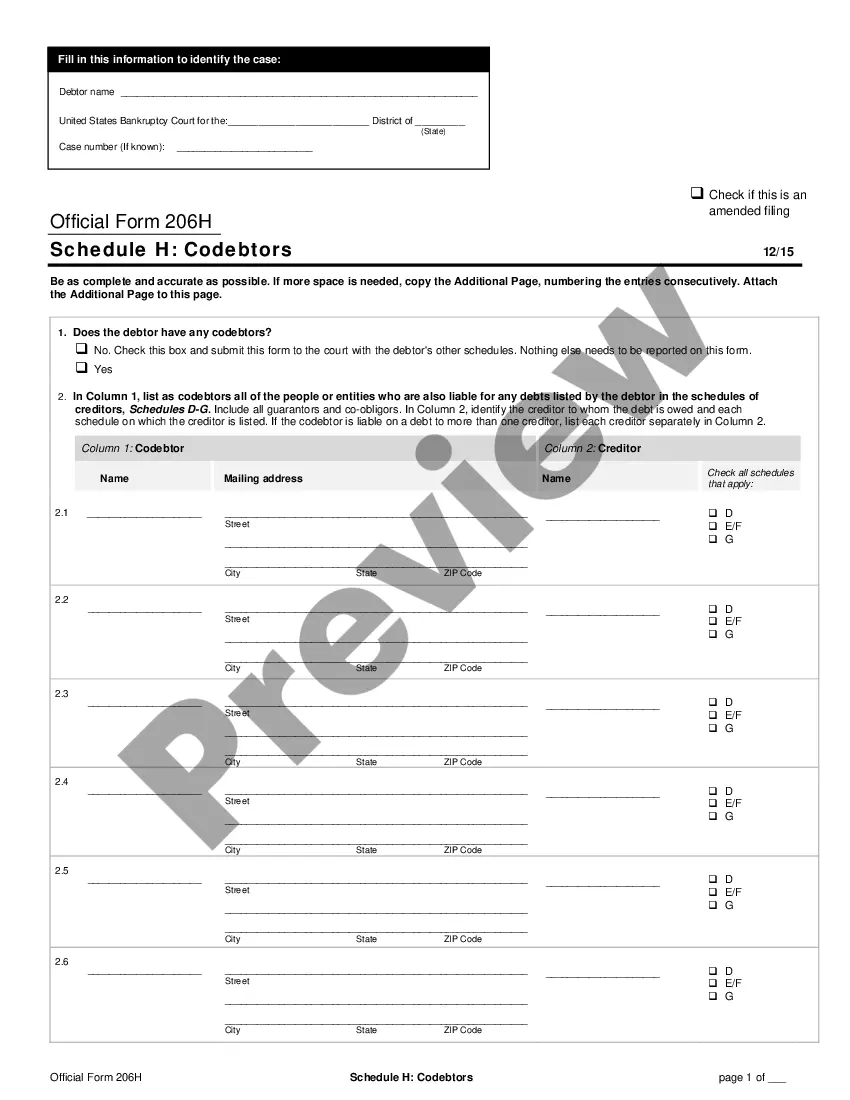

Independent contractors in California are subject to a 15.3% tax, 12.4% for Social Security and 2.9% for Medicare.

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

Independent contractors fill out a Form W-9. Employees fill out Form W-4. Self-employed workers use the Form W-9 to provide their taxpayer identification number (TIN) to companies that they do work for.