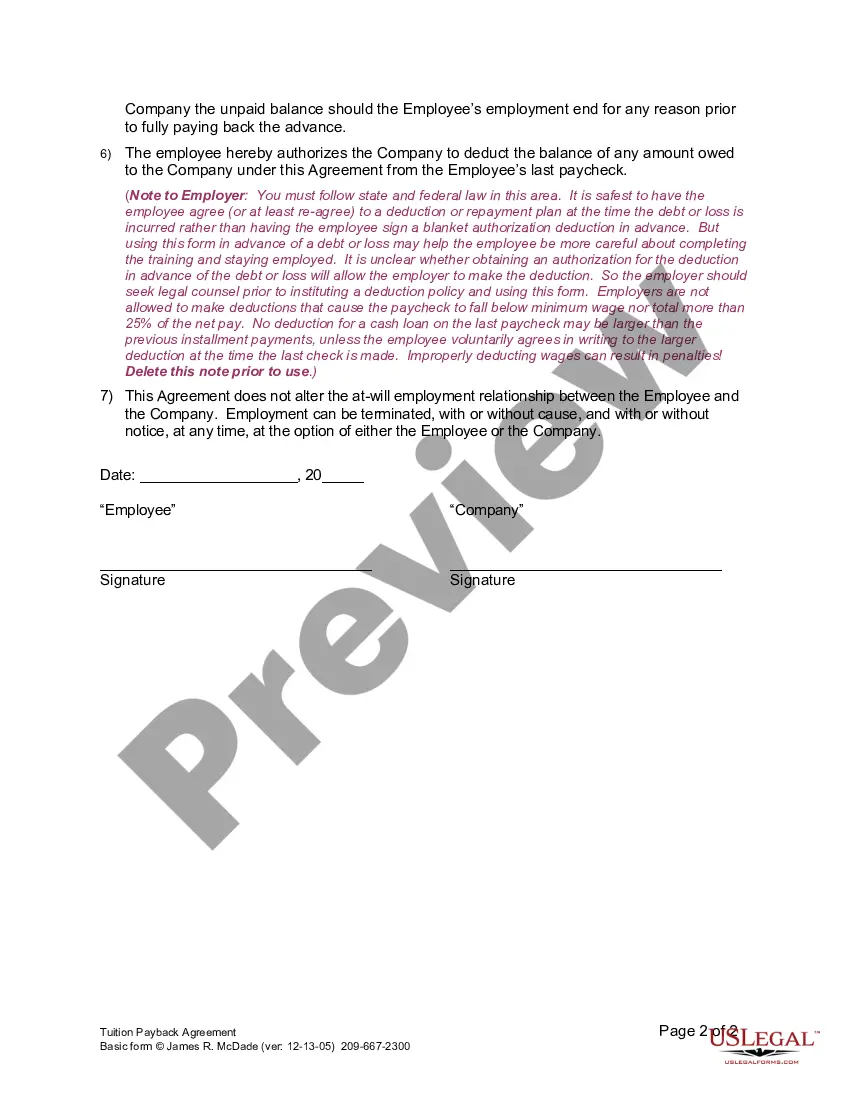

Employers use this form to recover the cost of voluntary training if the employee leaves prior to fulfilling an agreed-upon term of service.

Tuition Reimbursement Payback Agreement Template For House

Description

How to fill out California Tuition Payback Agreement?

Precisely formulated official documents are one of the essential safeguards against issues and legal disputes, but acquiring them without the support of a lawyer may require time.

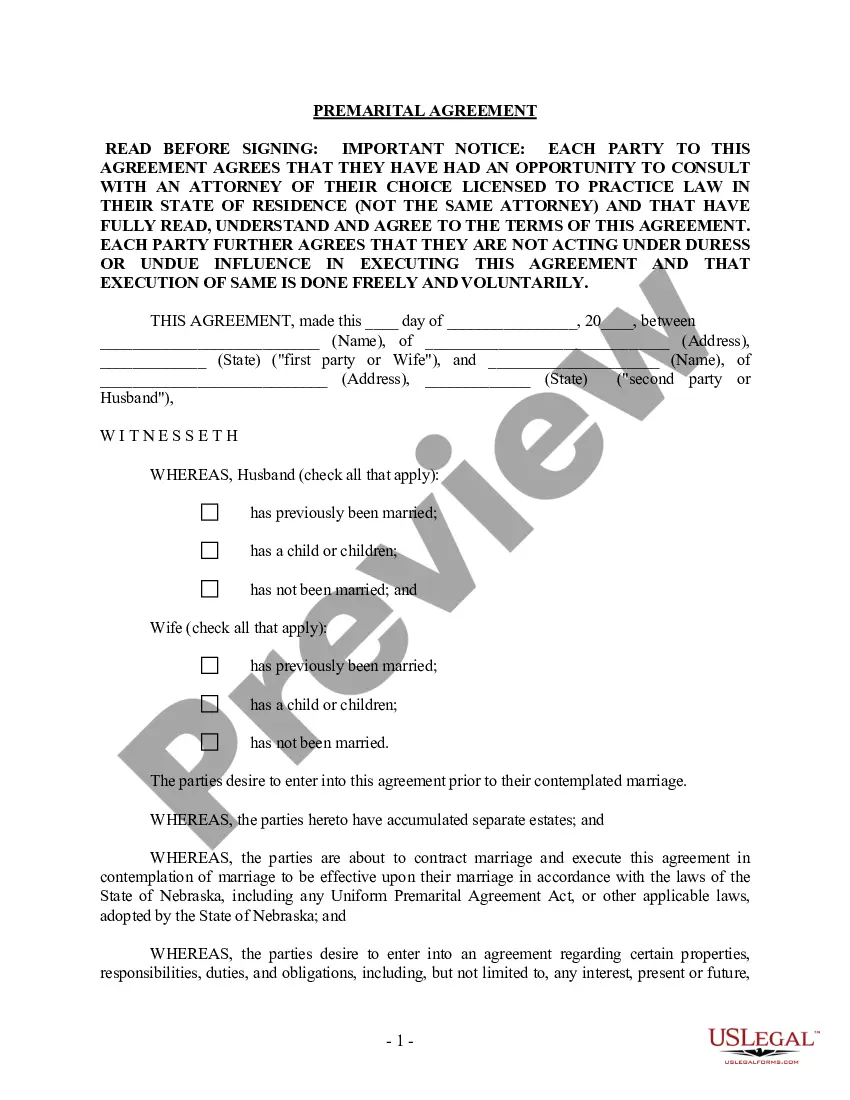

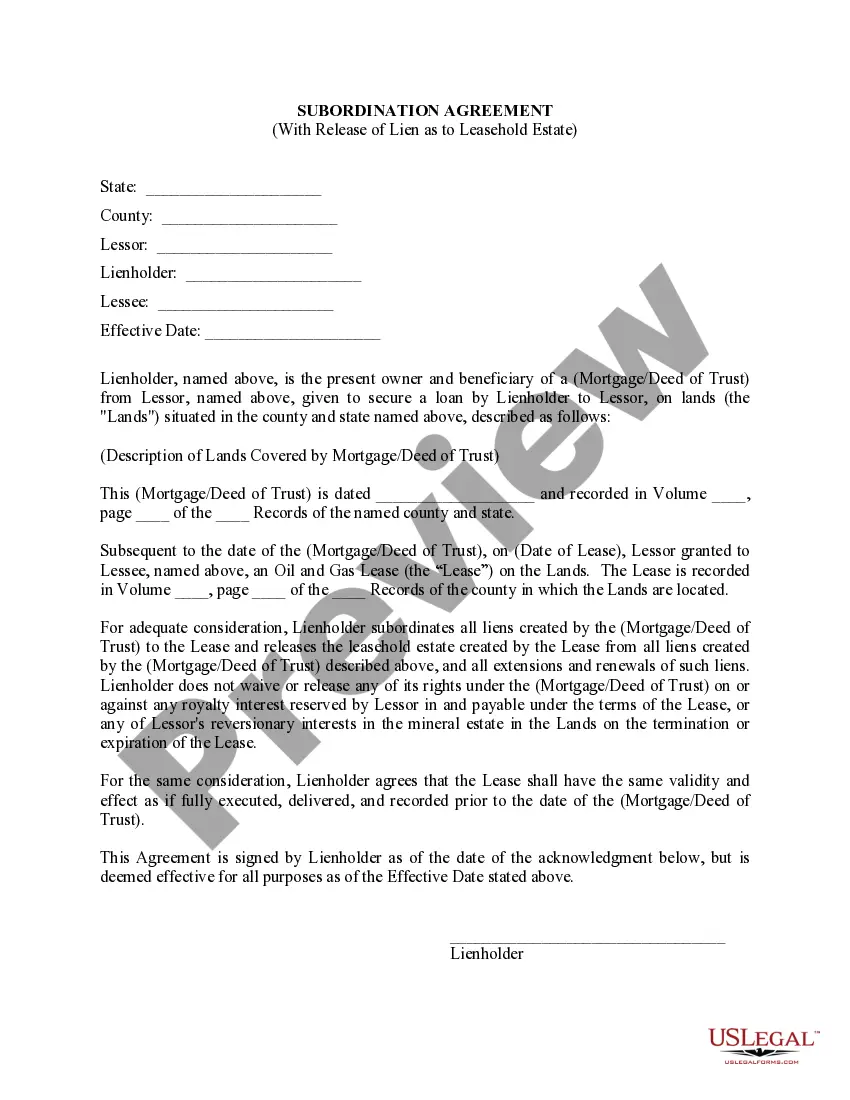

Whether you need to swiftly locate an updated Tuition Reimbursement Payback Agreement Template For House or any other templates for employment, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected document. Furthermore, you can access the Tuition Reimbursement Payback Agreement Template For House at any time, as all documents previously obtained on the platform are accessible under the My documents tab of your profile. Save time and resources on preparing formal documents. Explore US Legal Forms today!

- Ensure the form is appropriate for your situation and location by reviewing the description and preview.

- Search for another document (if necessary) using the Search bar at the top of the page.

- Click Buy Now once you find the right template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (by credit card or PayPal).

- Choose either PDF or DOCX file format for your Tuition Reimbursement Payback Agreement Template For House.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Employers require tuition reimbursement payback agreements to avoid training employees who use their education to get a new job working elsewhere. Companies legally protect themselves by making employees pay back reimbursements if the employee leaves the company within a specific time frame of completing the education.

Section 127 program. Section 127 of the Internal Revenue Code provides an exclusion of up to $5,250 per calendar year from an employee's gross income for amounts received by the employee, provided that certain requirements are met. To qualify under §127, a program must: Have a written plan document.

Begin the request by giving your name, employer and position within the company. List each course for which you would like to receive reimbursement. Provide course dates, the academic institution that offered the course, your grade for the course and the cost of the course plus any necessary books or supplies.

Tuition Reimbursement Helps Offer Tax BreaksAs long as your company has a written policy meeting federal income tax guidelines, employers can deduct up to $5,250 in reimbursements (per employee) from their own taxes each year.

Outline the reasons why you need tuition assistance in the opening body of your letter. Be specific about why you need additional help paying for your college tuition. For example, explain that you care for a sick or disabled family member or that you've recently lost your job and don't have income.