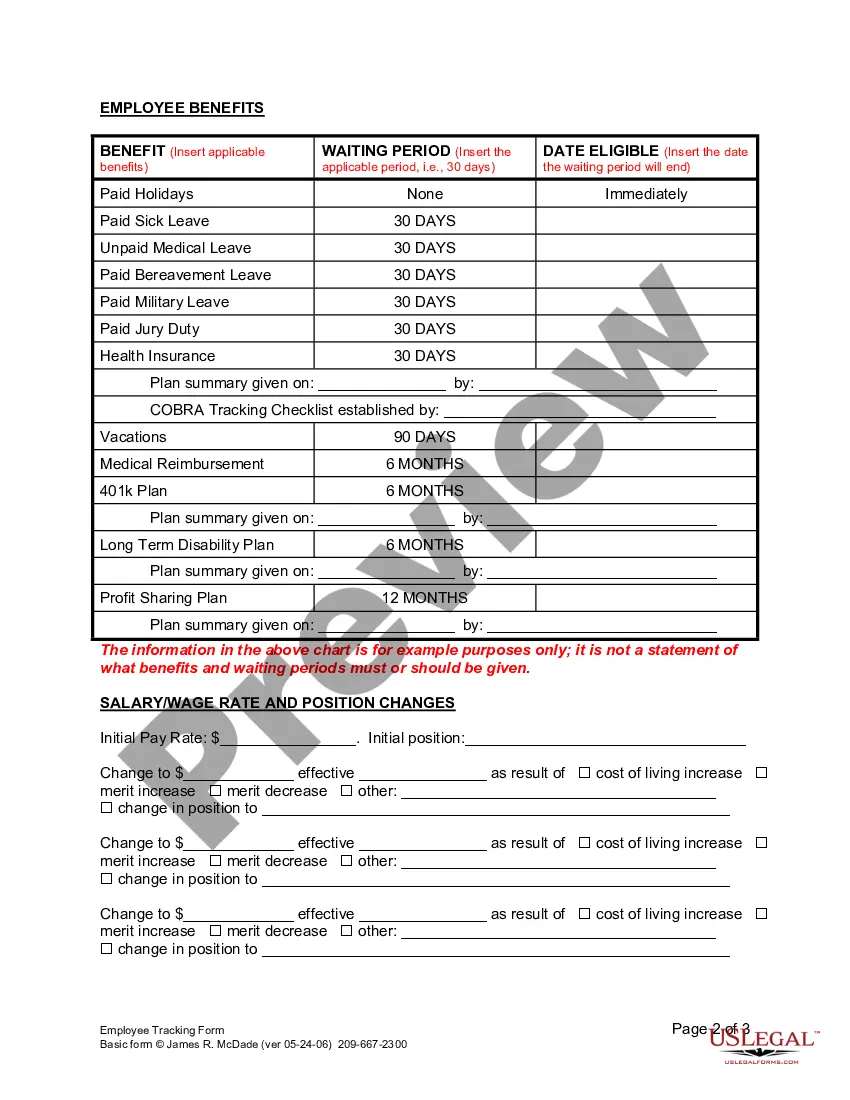

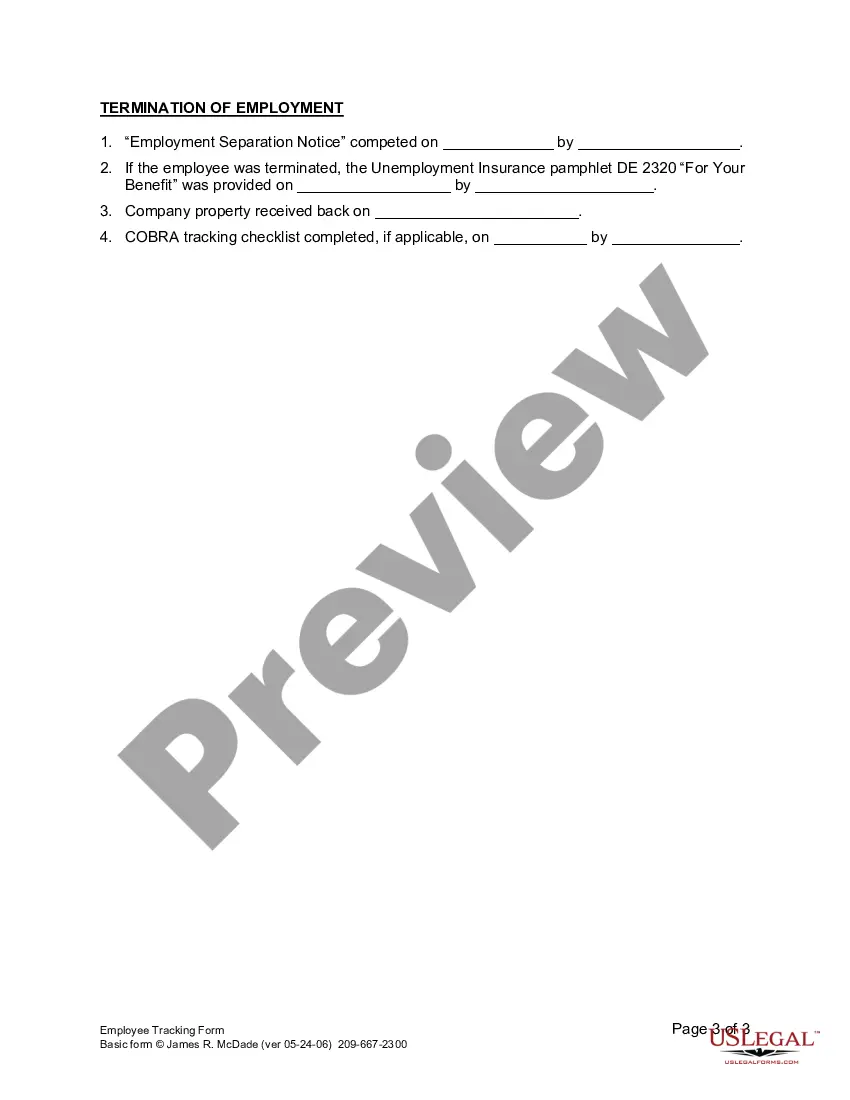

Employers use this form to track the completion of initial orientation and the qualifying for benefits of a new employee.

Employee Tracking Form For Direct Deposit

Description

Form popularity

FAQ

The FMS form 2231 is a financial management service form used for various payment processing purposes. If you’re dealing with federal payments, this form is relevant. However, for direct deposits in employment, using the employee tracking form for direct deposit is more applicable to your needs.

While you can create your own direct deposit form, using a standard template is advisable. The employee tracking form for direct deposit is designed to capture all necessary information clearly. This helps prevent mistakes and ensures your employer has the right details for processing your payments.

An employee direct deposit form is a document that allows your employer to deposit your wages directly into your bank account. It typically requires your personal and banking information. Filling out the employee tracking form for direct deposit ensures you receive payments easily and efficiently.

Yes, you can print a direct deposit form from home if you have access to a computer and printer. Find the employee tracking form for direct deposit online, fill it out digitally, and then print it. This process allows for convenience and quick submission to your employer.

Creating a direct deposit form is straightforward. Start with the employee tracking form for direct deposit, and fill in your personal and banking information. Review it for accuracy, and then submit it to your employer to initiate the process of receiving direct deposits.

Yes, you can track your direct deposit through your bank's online banking platform. Most banks provide notifications or updates when a direct deposit is processed. Additionally, the employee tracking form for direct deposit may offer information on the schedule of payments, helping you stay informed.

You can make your own deposit slips, but ensure they meet your bank's requirements. Utilize the employee tracking form for direct deposit to streamline your deposits without needing traditional slips. You can also find templates online, but cross-check them with your bank to avoid errors.

Yes, you can set up your own direct deposit. Start by obtaining the employee tracking form for direct deposit from your employer. Fill it out with your banking information and submit it to your payroll department for processing. This will allow your wages to be deposited directly into your chosen account.

A direct deposit qualifies as a payment that is electronically deposited into your bank account. Common examples include payroll deposits, tax refunds, and government benefits. Ensuring that your employee tracking form for direct deposit is accurately filled out is vital, as it helps streamline these payments. Verifying this information with your employer can prevent issues related to payment delays.

You can obtain your direct deposit form through your employer’s HR department or employee portal. This form is an essential part of the employee tracking form for direct deposit process. If you're unsure where to find it, ask your supervisor for guidance. They can provide you with the right resources to get started.