Employers provide the “Fair Credit Reporting Act” portion of this document to the job applicant or employee whenever either a credit report or background or investigative report is requested. Employers provide the California Notice Regarding Investigative Consumer Reports portion of this document to the job applicant or employee only if a background or investigative report is requested.

Noncompliance With The Fair Credit Reporting Act

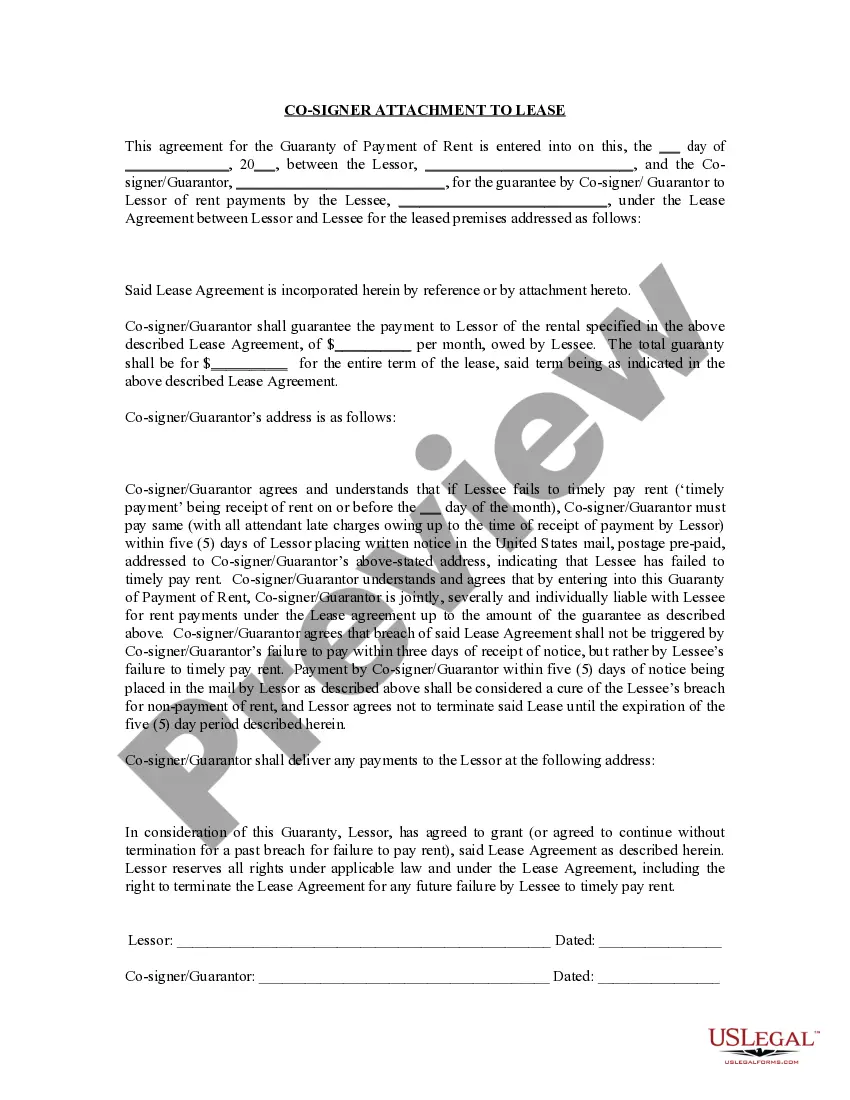

Description

How to fill out Noncompliance With The Fair Credit Reporting Act?

Individuals frequently connect legal documentation with something intricate that only an expert can manage.

In certain respects, this is accurate, as creating Noncompliance With The Fair Credit Reporting Act requires considerable knowledge in subject requirements, including state and local laws.

However, with US Legal Forms, everything has become simpler: pre-made legal templates for any life and business event tailored to state regulations are gathered in a single online repository and are now accessible to everyone.

Create an account or Log In to continue to the payment page. Complete the payment for your subscription through PayPal or with your credit card. Choose the format for your template and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our collection are reusable: once purchased, they remain saved in your profile, accessible whenever required through the My documents tab. Experience all the benefits of utilizing the US Legal Forms platform. Sign up today!

- US Legal Forms offers over 85,000 current documents categorized by state and area of application, making it quick to find Noncompliance With The Fair Credit Reporting Act or any other specific template.

- Returning users with an active subscription must Log In to their account and hit Download to get the form.

- New users to the service must first create an account and subscribe before they can download any documents.

- Follow this step-by-step guide to acquire the Noncompliance With The Fair Credit Reporting Act.

- Review the page content carefully to ensure it meets your needs.

- Examine the form description or view it using the Preview feature.

- If the earlier form does not meet your requirements, find another template using the Search field above.

- Once you locate the appropriate Noncompliance With The Fair Credit Reporting Act, click Buy Now.

- Select a subscription plan that aligns with your needs and budget.

Form popularity

FAQ

The penalties for violating the Fair Credit Reporting Act can be severe. Individuals and companies that breach the FCRA may face actual damages, statutory damages ranging from $100 to $1,000 per violation, and attorney fees. It's essential to stay compliant to avoid these penalties, as violations can lead to significant financial and reputational harm.

Section 609 of the Fair Credit Reporting Act outlines individuals' rights to access their credit information. Under this section, consumers can request a disclosure of all information in their credit reports, which helps ensure transparency. Understanding Section 609 is vital for those looking to address potential noncompliance with the Fair Credit Reporting Act and maintain good credit health.

A willful violation of the Fair Credit Reporting Act occurs when a party knowingly disregards the law. This means not only ignoring clear legal obligations but also failing to take corrective actions after being made aware of a compliance issue. Such violations can lead to severe repercussions, including steep fines and punitive damages.

Noncompliance with the Fair Credit Information Act (FIC) can lead to significant penalties. These may involve fines imposed by regulatory agencies and the possibility of civil lawsuits. It is crucial to understand these consequences to ensure adherence to the law, as the penalties can adversely affect both individuals and businesses.

If you experience noncompliance with the Fair Credit Reporting Act (FCRA), you may be entitled to recover various types of damages. These can include actual damages, which reflect the loss you suffered due to the violation. Additionally, you could receive punitive damages if the violation was willful, as well as attorneys' fees and costs incurred while pursuing your claim.

Damages for violating the FCRA may include statutory damages, actual damages, and sometimes punitive damages. Noncompliance with the fair credit reporting act can result in compensation for consumers affected by the violations. Understanding the potential damages is crucial for organizations to mitigate risks.

Consequences of violating the FCRA can be severe and wide-ranging. Noncompliance with the fair credit reporting act can lead to lawsuits, financial penalties, and reputational damage. Organizations often struggle to recover from the impact of such violations.

An example of a violation of the Fair Credit Billing Act involves a creditor not addressing billing errors reported by consumers. When creditors ignore disputes without conducting proper investigations, they demonstrate noncompliance with the fair credit reporting act. This results in potential legal issues and consumer dissatisfaction.

Violations of the Fair Credit Reporting Act include failing to provide accurate information, neglecting to investigate disputes promptly, and improperly sharing consumer information. These actions contribute to noncompliance with the fair credit reporting act and undermine consumer trust. Organizations must understand these violations to ensure compliance.

Penalties for non-compliance with the FCRA include monetary fines and the possibility of legal ramifications. The exact penalties depend on the nature and severity of the violation. Moreover, repeated offenses can escalate the penalties and lead to more serious consequences.