Minutes Organizational Meeting With Manager

Description

How to fill out California Minutes For Organizational Meeting?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some point in their lives.

Completing legal documents requires careful consideration, starting with selecting the appropriate form template.

Once it has been downloaded, you can complete the form using editing software or print it out and fill it in manually. With a comprehensive US Legal Forms catalog available, you no longer need to invest time searching for the correct template online. Utilize the library’s simple navigation to find the right form for any situation.

- For example, if you select an incorrect version of a Minutes Organizational Meeting With Manager, it will be rejected when you submit it.

- Thus, it is imperative to find a trustworthy source for legal documents such as US Legal Forms.

- If you need to obtain a Minutes Organizational Meeting With Manager template, follow these straightforward steps.

- Acquire the template you require by utilizing the search bar or catalog browsing.

- Review the form’s details to verify it aligns with your needs, state, and locality.

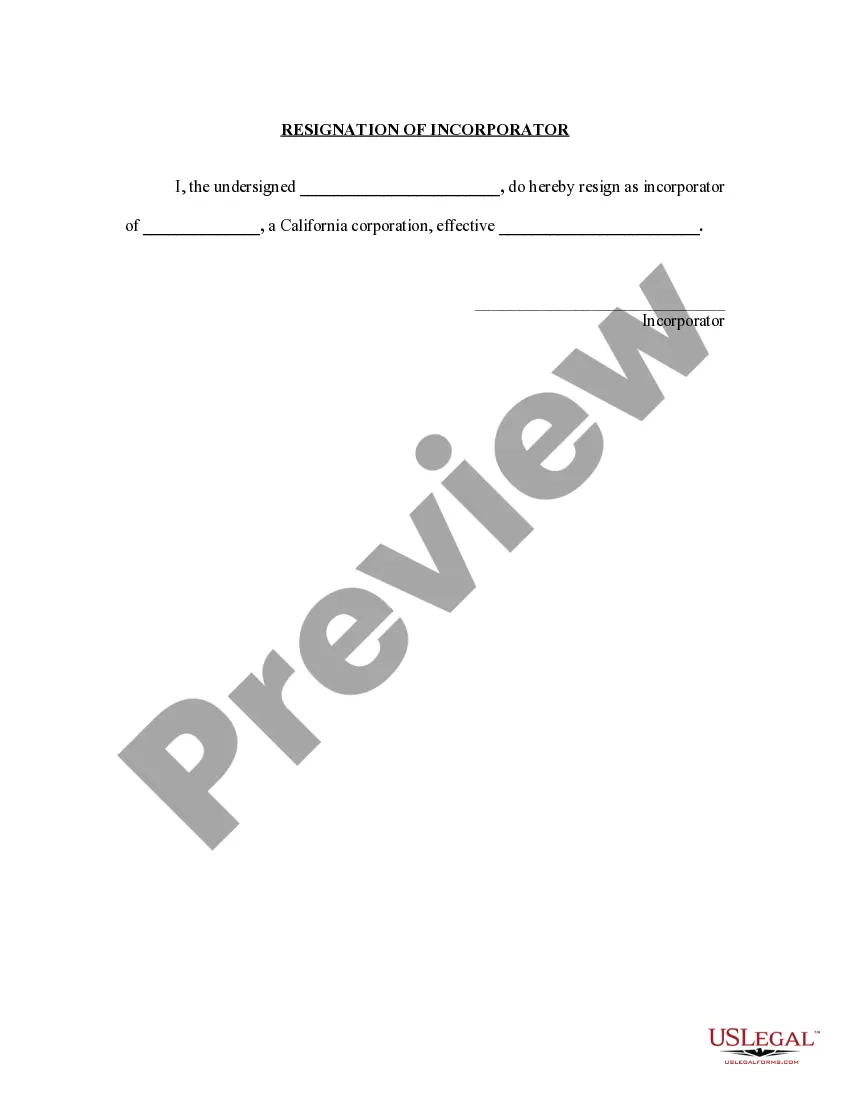

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search functionality to locate the Minutes Organizational Meeting With Manager template you require.

- Obtain the file if it suits your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: you have the option of using a credit card or PayPal account.

- Pick the document format you desire and download the Minutes Organizational Meeting With Manager.

Form popularity

FAQ

How to form a Florida General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

Do general partnerships have to register in Florida? There's no Florida general partnership registration required to start your business. However, you do need to register to pay taxes, get licenses, and use a fictitious business name.

Draft and sign a partnership agreement. Comply with tax and regulatory requirements. Obtain business insurance.

You can search our database by: Entity Name ? lists business entities and registrations by name. Results include the document number and status of each record. Officer/Registered Agent Name ? lists officers, directors, managers, and registered agents by name.

How to form a partnership: 10 steps to success Choose your partners. ... Determine your type of partnership. ... Come up with a name for your partnership. ... Register the partnership. ... Determine tax obligations. ... Apply for an EIN and tax ID numbers. ... Establish a partnership agreement. ... Obtain licenses and permits, if applicable.

Limited Partnership Fees Filing Fees$ 965.00Registered Agent Designation$ 35.00TOTAL$ 1,000.00Restated Certificate$ 52.50Amended and Restated Certificate$ 52.5024 more rows