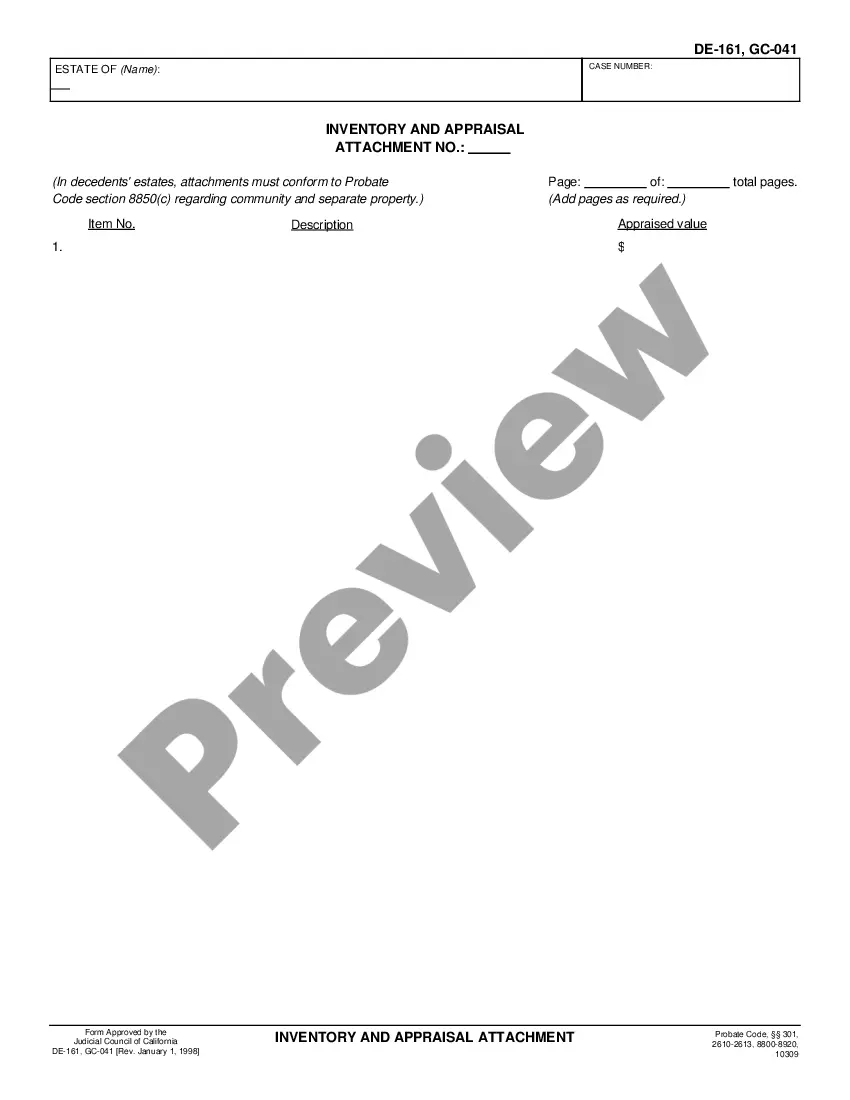

California Probate Inventory And Appraisal

Description

Form popularity

FAQ

You can file probate yourself in California, but you should be prepared for the complexities involved. Managing the California probate inventory and appraisal requires attention to detail and knowledge of legal procedures. Many choose to utilize US Legal Forms to help navigate this process, as it provides helpful tools and resources. This can empower you to handle matters more confidently and efficiently.

Yes, you can file probate online in California, making the process more convenient and accessible. Many courts now allow electronic filing, which can include submitting the California probate inventory and appraisal documents. It's advisable to check your local court's regulations to confirm online options. Using US Legal Forms can help you prepare your documents correctly for online submission.

In California, you typically have four months from the date of death to file probate. This timeline is crucial for completing the California probate inventory and appraisal, as missing it may delay the distribution of the estate. Be sure to act promptly and keep track of the necessary steps involved. Consulting resources like US Legal Forms can ensure you're meeting all necessary deadlines.

Yes, you can manage probate without a lawyer in California, but it can be challenging. The California probate inventory and appraisal process requires you to understand various legal requirements and deadlines. Many people find it beneficial to use resources like US Legal Forms to navigate the necessary documents and procedures effectively. This platform can help simplify your experience by providing the right forms and guidance.

Probate Code 10309 addresses the necessity of filing a petition for an order of final distribution in the probate process. This code ensures that once the inventory and appraisal process is completed, a final accounting and distribution plan is established. This step is essential for wrapping up the California probate inventory and appraisal process and resolving the estate according to the law. Understanding this code helps you navigate the complexities of estate distribution efficiently.

To access probate records in California, you can visit the probate court in the county where the estate is being administered. Many counties also offer online databases where you can search for probate records, including inventory and appraisal documents. These records are public, allowing you to understand how estates manage California probate and appraisals. Consider exploring the tools provided by USLegalForms to streamline your search for these vital documents.

Probate Code 8901 pertains to the duties of personal representatives regarding the inventory of an estate. It ensures that the representative must list all property, including assets not currently in their possession. This requirement is part of the vital California probate inventory and appraisal process, helping to protect the interests of all beneficiaries. Following this code can foster transparent estate proceedings.

Section 4457 of the California probate code deals with the appraisal process and who can perform appraisals for the estate's assets. This section emphasizes selecting qualified appraisers to ensure accurate asset valuation. Accurate appraisals are vital for the California probate inventory and appraisal process, as they influence the distribution of the estate. By understanding this section, you can ensure that your estate's appraisal is handled properly.

The California probate code for inventory and appraisal is primarily governed by sections 8800 through 8900. This section requires the personal representative to prepare a detailed inventory of the deceased’s assets, which must be appraised. Completing this inventory and appraisal is essential for transparent estate management and ensures all beneficiaries receive their fair share based on accurate valuations. Utilizing resources like USLegalForms can simplify this process for you.

Probate Code 15660 in California outlines the inventory and appraisal process for estates during probate. It mandates that the personal representative must provide a complete list of the estate's assets and their estimated values. This process is critical to establishing an accurate understanding of the estate’s worth, which directly impacts how it will be divided among beneficiaries. Understanding this code can empower you to manage California probate inventory and appraisal effectively.