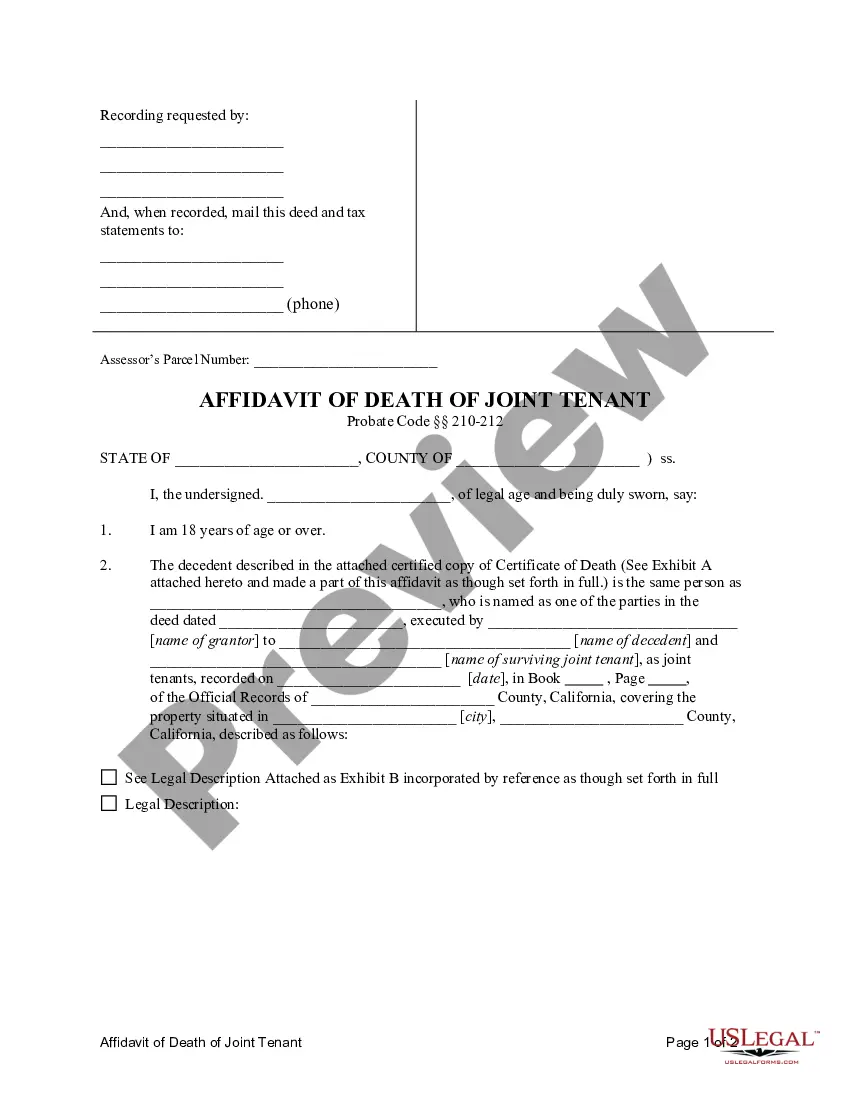

California Affidavit Form Ca For Transfer Without Probate

Description

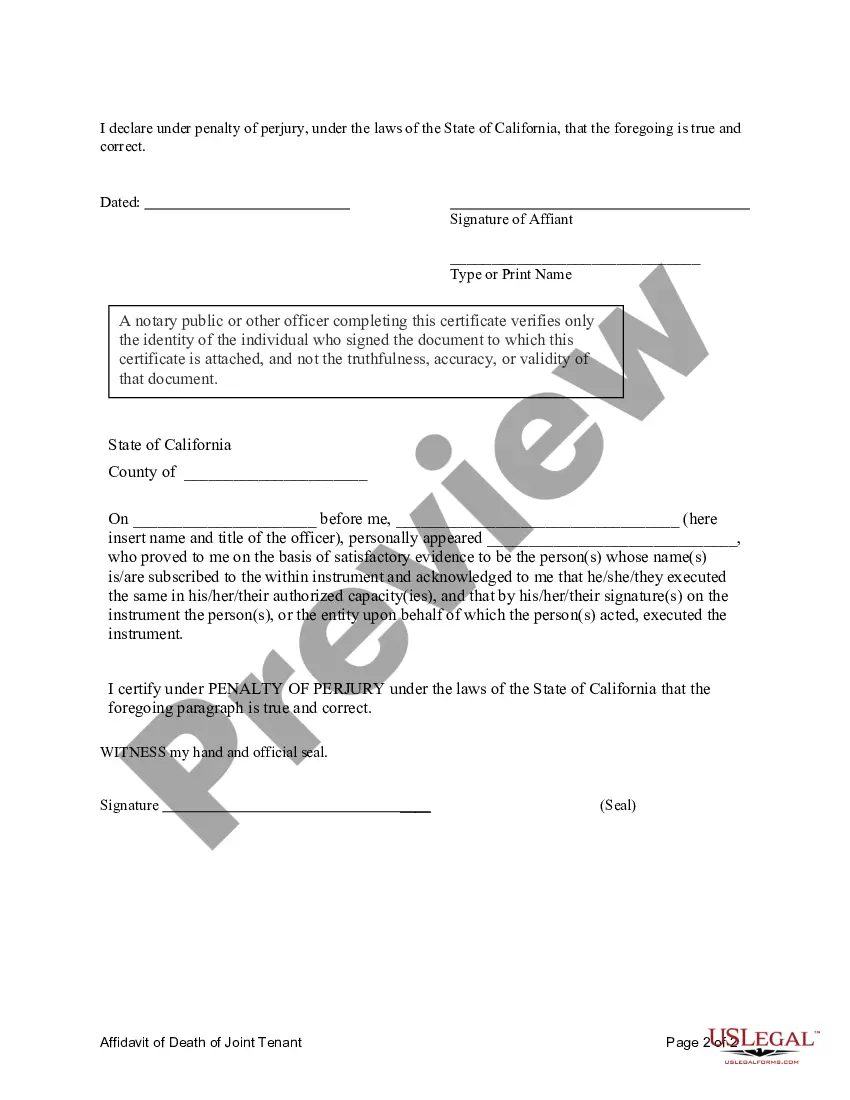

How to fill out California Affidavit Of Death Of Joint Tenant?

Whether for commercial reasons or personal affairs, everyone must confront legal circumstances at some point in their lives. Finalizing legal documents requires meticulous care, starting with selecting the correct form template. For instance, if you choose an incorrect version of a California Affidavit Form Ca For Transfer Without Probate, it will be rejected upon submission. Thus, it is crucial to have a reliable source for legal documents like US Legal Forms.

If you need to obtain a California Affidavit Form Ca For Transfer Without Probate template, follow these straightforward steps: Get the template you require using the search bar or catalog navigation. Review the form’s details to ensure it fits your situation, state, and locality. Click on the form’s preview to examine it. If it is the wrong form, return to the search feature to locate the California Affidavit Form Ca For Transfer Without Probate template you need. Download the template when it meets your specifications. If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents. If you do not have an account yet, you can acquire the form by clicking Buy now. Choose the appropriate pricing option. Complete the account registration form. Select your payment method: you can use a credit card or PayPal account. Choose the file format you desire and download the California Affidavit Form Ca For Transfer Without Probate. Once it is saved, you can fill out the form using editing software or print it and complete it manually.

- With a vast US Legal Forms catalog available, you never have to waste time searching for the right template online.

- Utilize the library’s straightforward navigation to find the suitable form for any scenario.

Form popularity

FAQ

A very common non-probate transfer is the use of affidavits to transfer personal property if the gross value of the decedent's real and personal property in California does not exceed the $150,000 or $166,250 threshold amount and if 40 days have elapsed since the death of the decedent, the successor of the decedent may ...

An Affidavit for Transfer Without Probate California Titled Vehicle or Vessels Only (REG 5) form, completed by the decedent's heir. This includes a court order, Letters Testamentary, Letters of Administration, Letters of Administration with Will Annexed, or Letters of Special Administration.

File at the Probate Court Use the Court Locator and find the probate court where the decedent was a resident. The State filing fee is $435. Request further instructions from the court clerk on the process in the county.

Here are ways of avoiding probate in California: Creating a Living Trust. Setting up a Joint Ownership. Payable-on-Death Designations for Bank Accounts.

If the heir will be the new owner, submit the following to a DMV office: The California Certificate of Title. ... Affidavit for Transfer without Probate (REG 5), completed and signed by the heir. An original or certified copy of the death certificate of all deceased owners.