Ca Death Form Withdrawal

Description

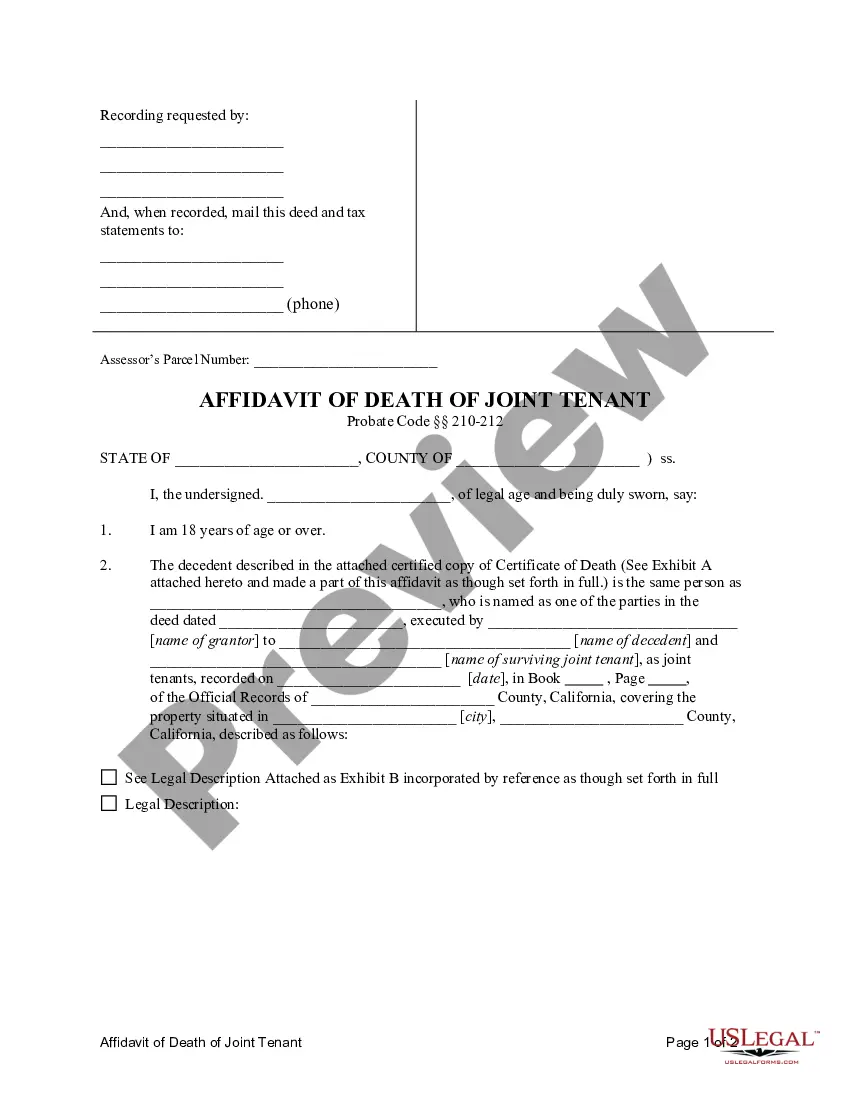

How to fill out California Affidavit Of Death Of Joint Tenant?

Regardless of whether it's for commercial reasons or personal issues, everyone must confront legal matters at some point in their lives.

Filling out legal documentation requires meticulous care, starting with selecting the correct form template.

With a vast US Legal Forms catalog available, you don’t need to waste time searching for the suitable template online. Utilize the library’s straightforward navigation to find the correct template for any situation.

- For example, if you choose an incorrect version of a Ca Death Form Withdrawal, it will be denied upon submission.

- Thus, it's crucial to have a trustworthy source for legal documents like US Legal Forms.

- To obtain a Ca Death Form Withdrawal template, adhere to these straightforward steps.

- Access the template you require using the search bar or catalog navigation.

- Review the form’s details to confirm it suits your case, state, and locality.

- Click on the form’s preview to view it.

- If it’s not the correct form, return to the search feature to locate the Ca Death Form Withdrawal template you need.

- Download the template once it aligns with your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the file format you prefer and download the Ca Death Form Withdrawal.

- After it’s downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

If the beneficiaries decide to keep the property, the transfer can be done using a ?Grant Deed.? The new deed must also be notarized and recorded with the county. In many of our trust administrations, one beneficiary chooses to ?buy out? the other beneficiaries and maintain the property.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

When the trust owner dies, the trustee can transfer property out of the trust by using a quitclaim or grant deed transferring ownership of the property to the beneficiary.

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

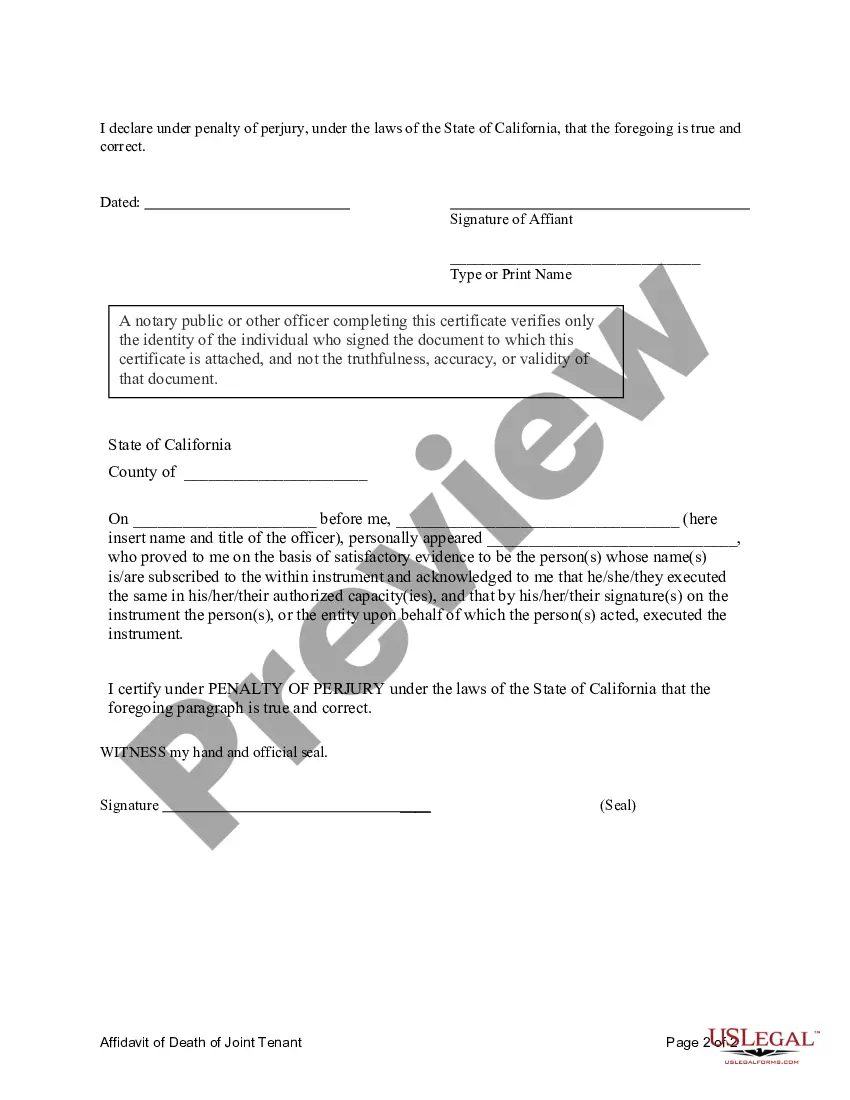

California Transfer on Death Deeds You must (1) sign the deed, (2) have two adults who are not beneficiaries witness your signing of the deed, (3) have your signature notarized, and (4) record (file) the deed with the county clerk's office within 60 days of having it notarized. ... The beneficiary's rights.