Ca Death Form For Credit Report

Description

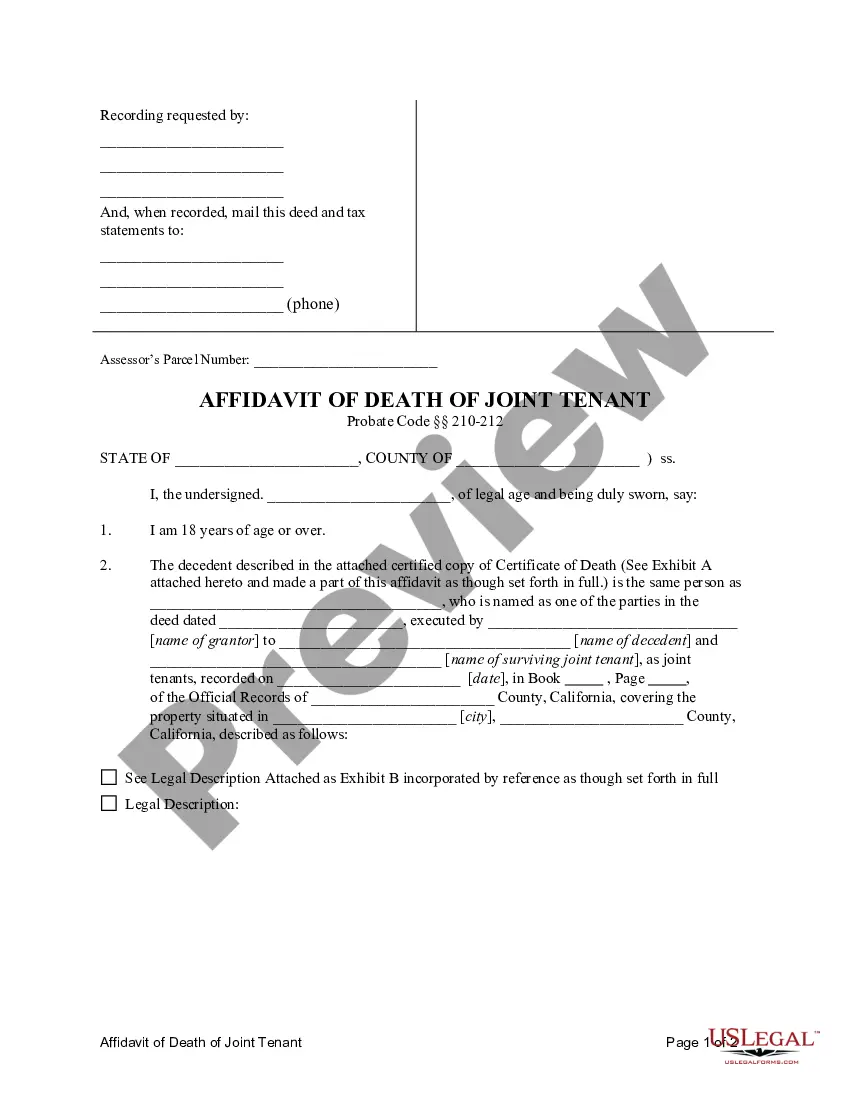

How to fill out California Affidavit Of Death Of Joint Tenant?

Dealing with legal paperwork and protocols can be a lengthy addition to your day.

Ca Death Form For Credit Report and similar forms frequently require you to search for them and understand how to fill them out efficiently.

Therefore, whether you are managing financial, legal, or personal issues, having a thorough and user-friendly online repository of forms readily available will significantly help.

US Legal Forms is the leading online resource for legal templates, featuring over 85,000 state-specific documents and a range of tools that will enable you to finalize your paperwork swiftly.

Is this your first experience with US Legal Forms? Register and create your account in a matter of minutes to gain access to the form library and Ca Death Form For Credit Report. Then, follow the steps outlined below to finalize your document: Ensure you have located the correct form by utilizing the Review function and examining the form details. Click Buy Now when you are ready and choose the subscription plan that meets your requirements. Select Download then fill out, eSign, and print the document. US Legal Forms has 25 years of experience assisting users in managing their legal documents. Find the form you need today and enhance any process effortlessly.

- Explore the collection of pertinent documents available to you with just one click.

- US Legal Forms provides state- and county-specific documents that can be downloaded at any time.

- Streamline your document management processes with a premium service that lets you prepare any form in moments without additional or concealed fees.

- Simply Log In to your account, search for Ca Death Form For Credit Report and obtain it instantly in the My documents section.

- You can also retrieve previously downloaded documents.

Form popularity

FAQ

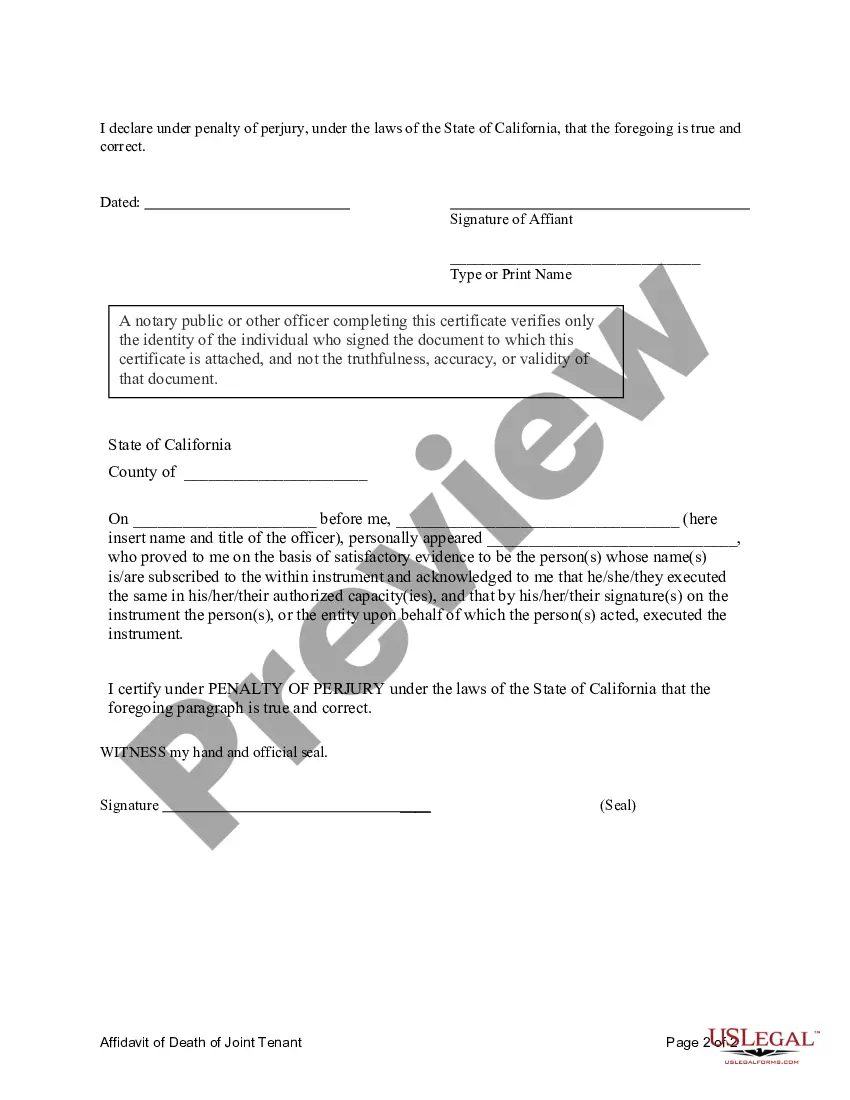

Follow these steps for notifying the credit bureaus of a family member's death: 1. Request copies of the death certificate. You will send these to the credit bureaus (as well as any creditors that the deceased may have, that are still unaware of the death).

Estate executors or court-appointed designees, however, are encouraged to contact at least one of the three nationwide credit bureaus so that the deceased's credit report can be flagged, appropriately.

Generally, a credit report says you are deceased in error because a credit bureau, a credit card company, a bank, or the Social Security Administration made a typo or have a computer glitch. The error gets attached to your social security number on your credit report which does damage to your credit scores.

Write a letter to one of the nationwide credit reporting agencies. Whichever agency you contact ? TransUnion, Equifax or Experian ? will then notify the other two on your behalf. Along with a copy of the death certificate, please also include the following for the deceased: Legal name.

If you are a consumer reading this, it is because you have been told or learned that one or more of your credit reports has a deceased indicator on it. That means you were mistakenly reported dead when it comes to your credit. This is a big deal. These can also have high case values because it violates the law.