Irc Internal Revenue Code With Section 121)

Description

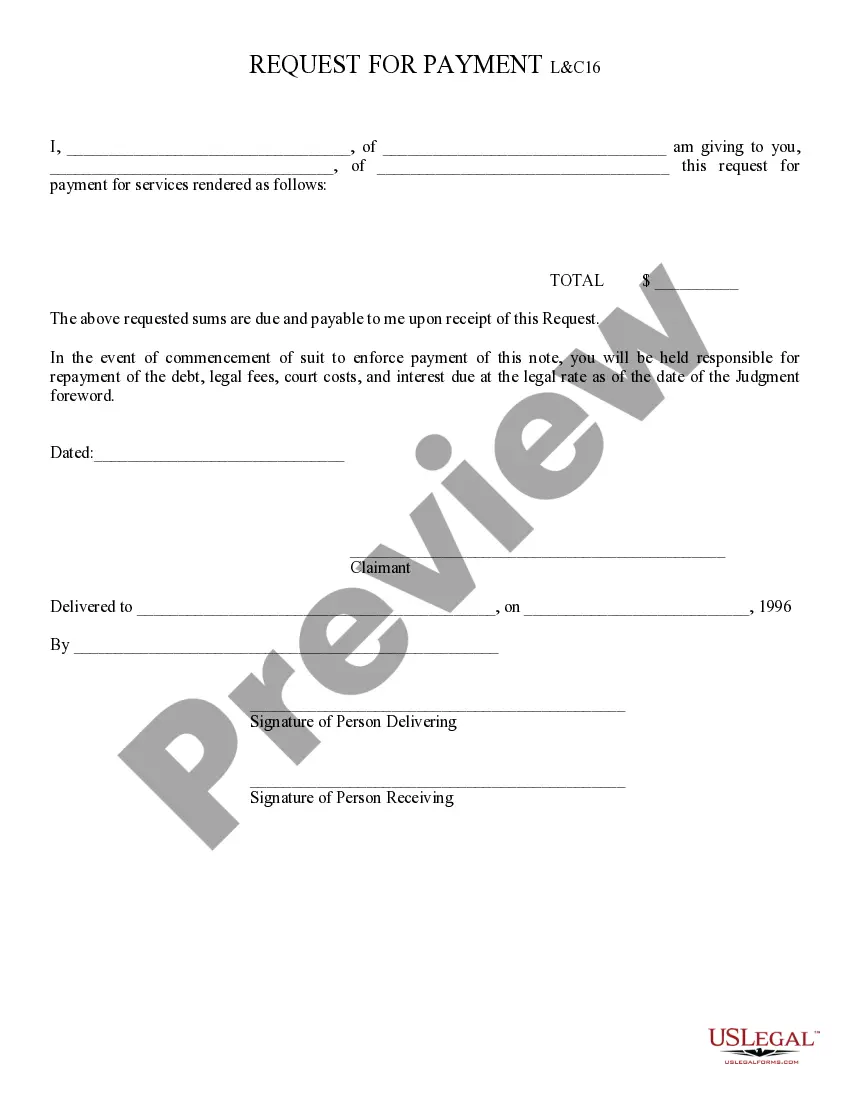

How to fill out California Non-Foreign Affidavit Under IRC 1445?

Whether for business purposes or for personal affairs, everyone has to manage legal situations at some point in their life. Completing legal documents demands careful attention, beginning from selecting the correct form template. For instance, when you choose a wrong version of the Irc Internal Revenue Code With Section 121), it will be declined once you submit it. It is therefore crucial to have a dependable source of legal files like US Legal Forms.

If you need to get a Irc Internal Revenue Code With Section 121) template, stick to these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Look through the form’s description to make sure it suits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, get back to the search function to find the Irc Internal Revenue Code With Section 121) sample you require.

- Get the template if it matches your needs.

- If you already have a US Legal Forms profile, just click Log in to access previously saved templates in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Select the proper pricing option.

- Finish the profile registration form.

- Select your payment method: use a bank card or PayPal account.

- Select the document format you want and download the Irc Internal Revenue Code With Section 121).

- Once it is saved, you can fill out the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time seeking for the appropriate sample across the internet. Take advantage of the library’s straightforward navigation to get the appropriate form for any occasion.

Form popularity

FAQ

One way to avoid paying the capital gains tax is to convert your rental property into a primary residence. With the primary residence exemption, you must have lived in this property as your primary residence for, at minimum, two of the last five years.

One strategy to avoid capital gains tax in Florida is to take advantage of the primary residence exclusion is the ?2 Out of 5 Year Rule.? This rule lets an individual exclude up to $250,000 in capital gains taxes from the sale of a home and up to $500,000 for married couples that file jointly.

Property Tax Exemptions and Additional Benefits Further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military service members, disabled first responders, and properties with specialized uses.

Examples of these circumstances include: A working farm containing the farmer's residence?the working farmland falls under Section 1031 and the farmer's house falls under Section 121. A duplex or similar plex with one unit being owner occupied (Section 121), the balance held as investment with tenants (Section 1031).

The sale of real property in the U.S. does not relieve Canadian residents of their obligation to report the transaction and pay tax on the capital gain in Canada. However, the Canada ? United States tax treaty makes it possible to avoid double taxation.