Lease Transfer Form Nsw

Description

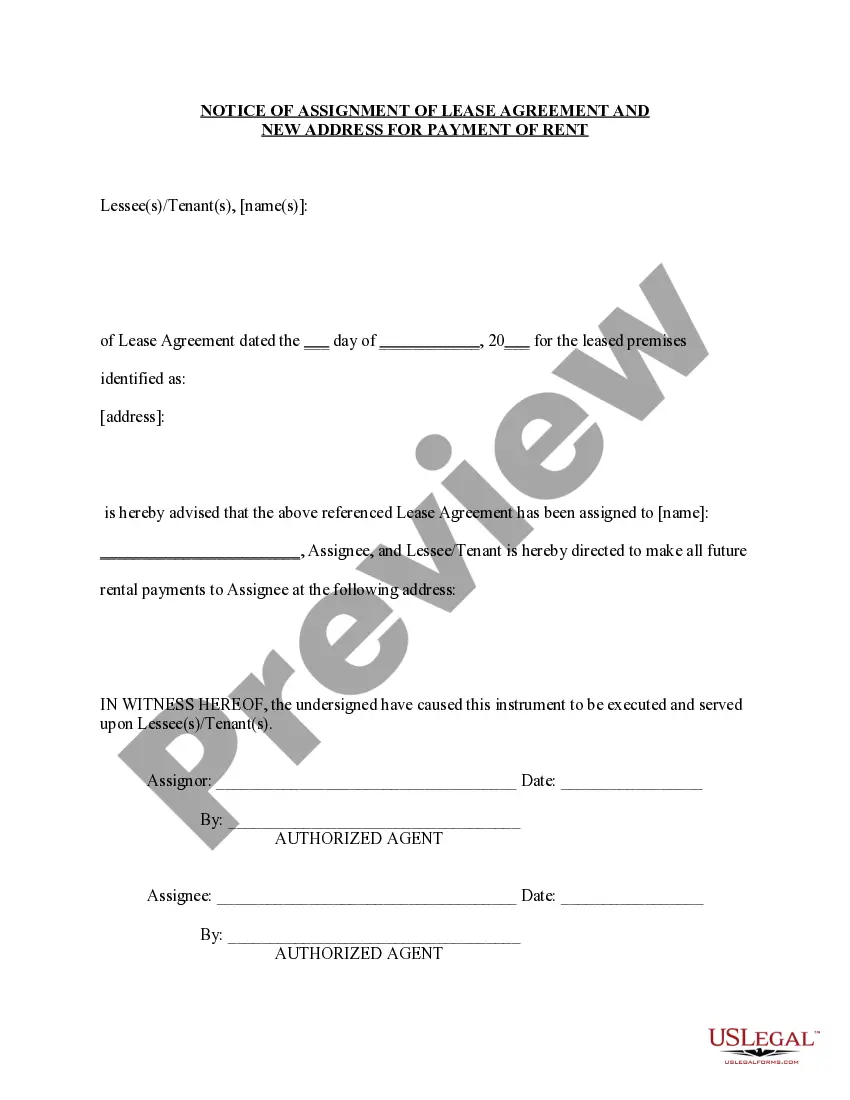

How to fill out California Assignment Of Lease From Lessor With Notice Of Assignment?

Finding a reliable place to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents necessitates accuracy and careful consideration, which is why it’s essential to acquire Lease Transfer Form Nsw exclusively from reputable sources, such as US Legal Forms. Using an incorrect template may consume your time and hinder your situation.

Once you have the document on your device, you can modify it with the editor or print it out and fill it in manually. Remove the hassles associated with your legal documentation. Browse the extensive US Legal Forms collection where you can discover legal templates, assess their applicability to your situation, and download them immediately.

- Utilize the library navigation or search bar to locate your document.

- Review the form's description to verify it meets the requirements of your jurisdiction.

- Preview the form, if available, to confirm it is indeed the template you need.

- Return to the search to find the correct document if the Lease Transfer Form Nsw does not meet your specifications.

- If you are confident about the document’s relevance, proceed to download it.

- If you are a registered user, click Log in to authenticate and access your selected templates in My documents.

- If you have not yet created an account, click Buy now to purchase the template.

- Choose the pricing plan that best fits your requirements.

- Continue to register to complete your order.

- Finalize your order by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading the Lease Transfer Form Nsw.

Form popularity

FAQ

A lease transfer is conducted by filling out a lease transfer form nsw, which serves as the official document to facilitate the transfer of responsibilities. Both the existing tenant and the incoming tenant must complete the form, providing necessary details. Following that, the landlord must review and approve the transfer to ensure all parties are informed and agree. This structured process ensures legality and protects individual interests.

How do you dissolve/terminate a Montana Limited Liability Company? To terminate your domestic LLC in Montana, you must provide the completed Articles of Termination for a Limited Liability Company form to the Secretary of State by mail, fax or in person, along with the filing fee.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Link: mtrevenue.gov.

File These Montana State Tax Forms Prepare and efile these state forms for current tax year in conjunction with your federal and state income tax return. As you proceed through the tax interview on efile.com, the application will select the correct state forms for you. You can also select tax forms individually.

We will begin issuing Individual Income Tax Rebates in July 2023. Individual Income Tax Rebates will be issued in the order that a 2021 tax return was filed. All Individual Income Tax Rebates will be issued by December 31, 2023.

Montana Individual Income Tax Return (Form 2)

The amount of your Montana income tax liability on line 20 of your 2021 Montana tax return, OR. $1,250 for single, married filing separately, or head of household filing statuses; and $2,500 for married filing jointly.

Yes, you can typically e-file the currently due tax year and two prior years, except during an IRS closure. For example, once the IRS has opened e-filing for tax year 2022 returns, you'll still be able to e-file 2021 and 2020 business returns.