Lease Transfer For Apartment

Description

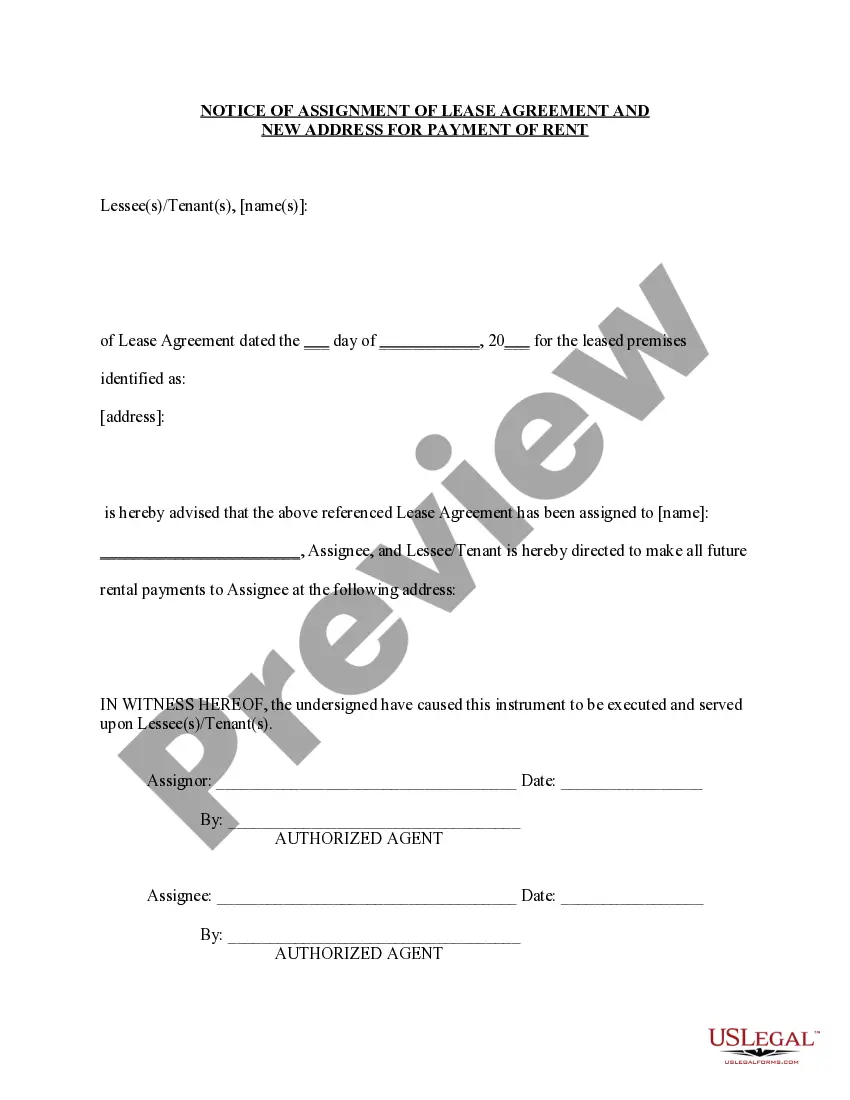

How to fill out California Assignment Of Lease From Lessor With Notice Of Assignment?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some stage in their life.

Completing legal documents demands meticulous care, starting with selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you will never need to waste time searching for the correct template online. Make use of the library’s straightforward navigation to find the right template for any circumstance.

- Obtain the template you need by using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your case, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search feature to locate the Lease Transfer For Apartment document you need.

- Download the template once it satisfies your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Choose the file format you prefer and download the Lease Transfer For Apartment.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

A satisfaction of mortgage is a crucial document for any homeowner. Not only does it prove your ownership, but it allows you to use your home as you see fit. Whether you want to put your home up for sale or refinance it, you'll need that document.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

In addition the following information should be included: The Payee Name. The Owner(s) of the mortgage holder. Total amount of mortgage. Mortgage date of execution. Full and legal description of the property to include tax parcel number. Acknowledgement that all payments have been made in full.

020 sixty days from the date of such request or demand, the mortgagee shall forfeit and pay to the mortgagor damages and a reasonable attorneys' fee, to be recovered in any court having competent jurisdiction, and said court, when convinced that said mortgage has been fully satisfied, shall issue an order in writing, ...

Within 60 days after the date of receipt of the full payment of the mortgage, lien, or judgment, the person required to acknowledge satisfaction of the mortgage, lien or judgment shall send or cause to be sent the recorded satisfaction to the person who has made the full payment.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.