Dissolution Limited Form Complete For S Corp

Description

How to fill out California Complaint For Dissolution Of Limited Partnership?

- Log in to your US Legal Forms account if you've used the service before. Check that your subscription is active and download the required template directly to your device.

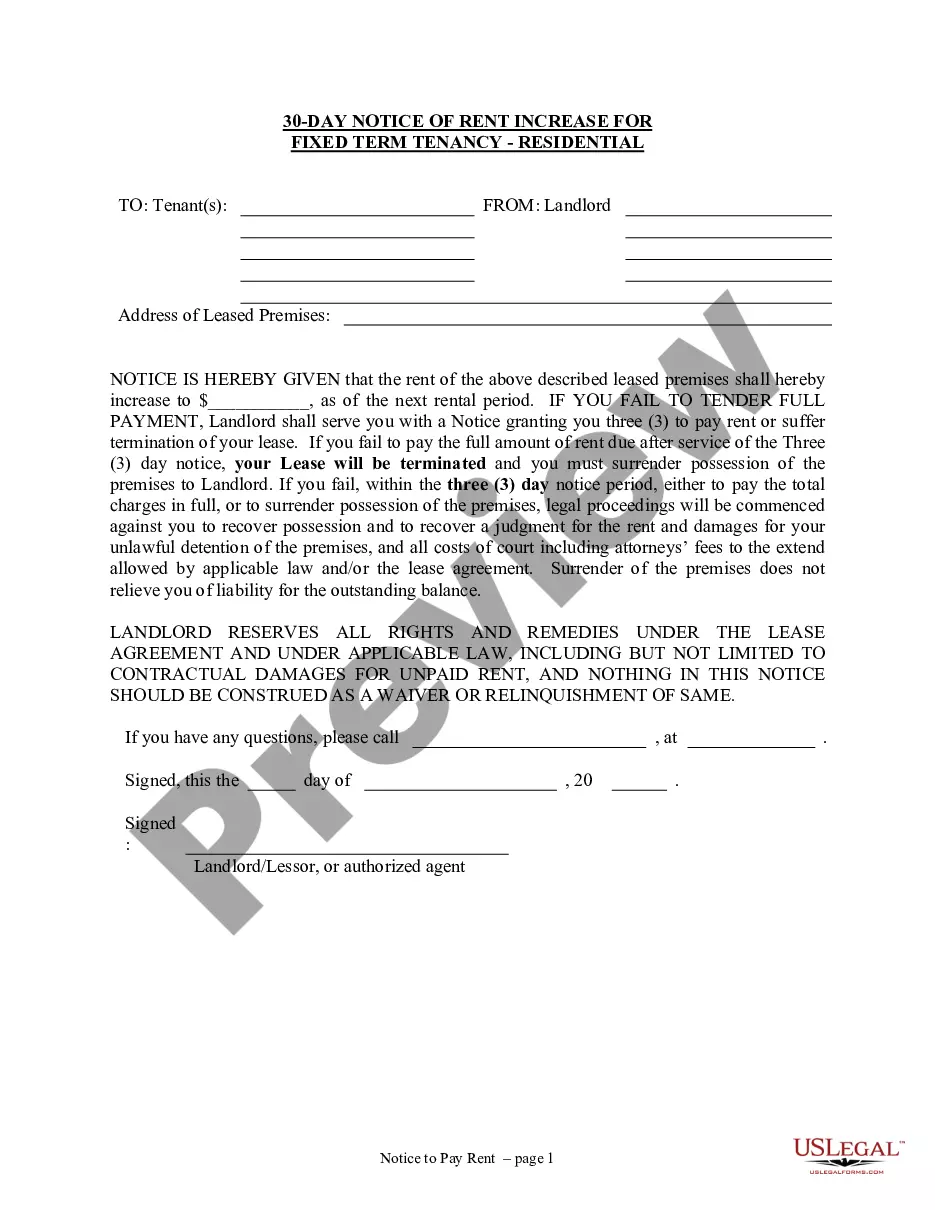

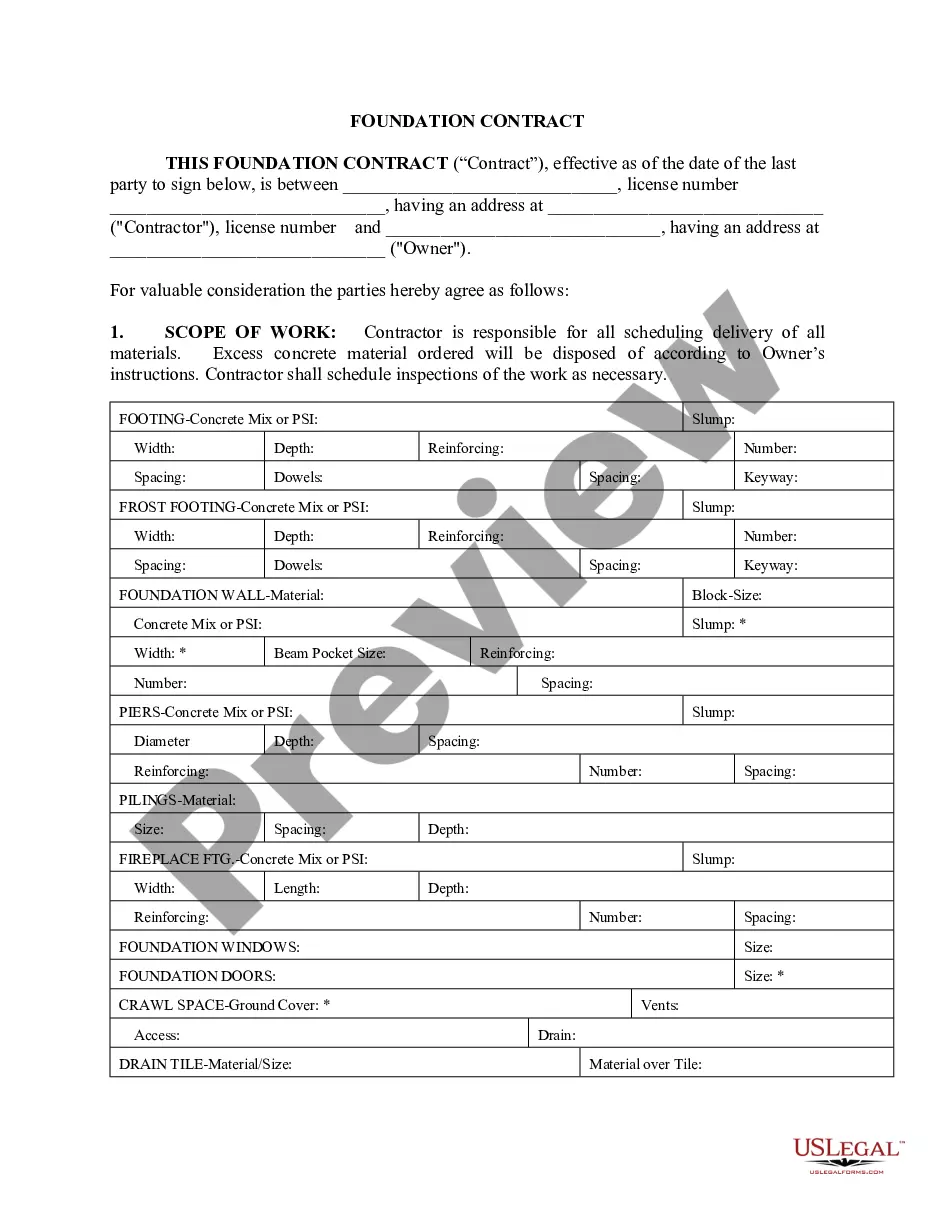

- If you're a first-time user, begin by analyzing the Preview mode of the dissolution form. Verify that it aligns with your needs and meets local jurisdiction standards.

- If adjustments are needed, utilize the Search tab to locate the right form. Once you find a suitable template, proceed to the next step.

- Select a subscription plan that fits your needs and click the Buy Now button. You will need to create an account to access the library.

- Complete your purchase by entering your payment details. You can use either your credit card or PayPal for a secure transaction.

- After purchase, don’t forget to download your completed form. Access the template anytime from the My Forms menu in your account for future reference.

US Legal Forms is dedicated to empowering both individuals and attorneys in executing legal documents swiftly and accurately. With over 85,000 easily fillable legal forms available, it stands out as the leading resource in the industry.

Start your journey towards hassle-free legal documentation today. Visit US Legal Forms to unlock the forms you need!

Form popularity

FAQ

Closing an S corporation can be straightforward if you follow the proper steps. First, you need to file a resolution to dissolve the corporation and comply with state requirements. Using a dissolution limited form complete for S corp can simplify the process. However, consider consulting with a professional to ensure you address all legal and tax implications.

The steps for dissolving an S corporation include holding a board meeting to vote on dissolution, notifying shareholders, and filing the dissolution limited form complete for S corp with the appropriate state authority. After this, the corporation must settle debts, distribute remaining assets, and file final tax returns with the IRS. It's recommended to seek guidance from platforms like uslegalforms to ensure that all legal aspects of the dissolution process are fulfilled correctly.

Dissolving a company is not the same as simply closing its doors. Dissolution is a formal legal process that involves ceasing operations and completing all required filings, including the dissolution limited form complete for S corp. This process ensures that the company is legally terminated and that all debts and obligations are settled. Closing might imply stopping business activities without formal procedures, which can lead to complications down the line.

Yes, filing Form 966 is necessary when dissolving an S corporation, as it notifies the IRS of the dissolution. This form is part of the process of submitting the dissolution limited form complete for S corp. It is key to ensure that this form is filed within the intended timeframe to avoid penalties. Consulting with a legal expert can help ensure compliance with all requirements.

Notifying the IRS of a corporation's dissolution involves informing them of the business's closure through the final tax return. You must mark the return as a final return and include the dissolution limited form complete for S corp to make them aware of your corporation's shutdown. Additionally, any outstanding tax obligations must be addressed to ensure compliance and avoid future issues. Keeping thorough records during this process is essential.

To complete its dissolution, a corporation must follow specific procedures governed by state laws. This typically includes filing a dissolution limited form complete for S corp with the state Secretary of State. Once filed, it is crucial to notify stakeholders, such as employees and creditors, about the dissolution. Ensuring that all legal requirements are met will help in avoiding potential liabilities.

The process of dissolution of a company involves a series of steps to formally close the business. First, a decision must be made by the board of directors, followed by filing necessary documents with the state. For S corporations, completing the dissolution limited form is essential to legally terminate operations. This ensures that all debts are settled and assets are distributed before the final shutdown.

To dissolve an S Corp in California, you will primarily need to file Form DISS STK, which is the Certificate of Dissolution. This form is essential to complete the dissolution limited form for S Corp in compliance with state laws. Additionally, consider using US Legal Forms, which provides a straightforward process for obtaining and filing the correct forms to ensure a smooth dissolution.

Yes, S Corps must file Form 966 when they dissolve. This form notifies the IRS about the corporation's intent to dissolve and complete the dissolution limited form for S Corp. Filing ensures compliance with federal regulations and finalizes the tax obligations tied to the company. Utilizing tools like US Legal Forms makes it easier to prepare and submit the necessary documents.