30 Day Cancellation Notice On Certificate Of Insurance

Description

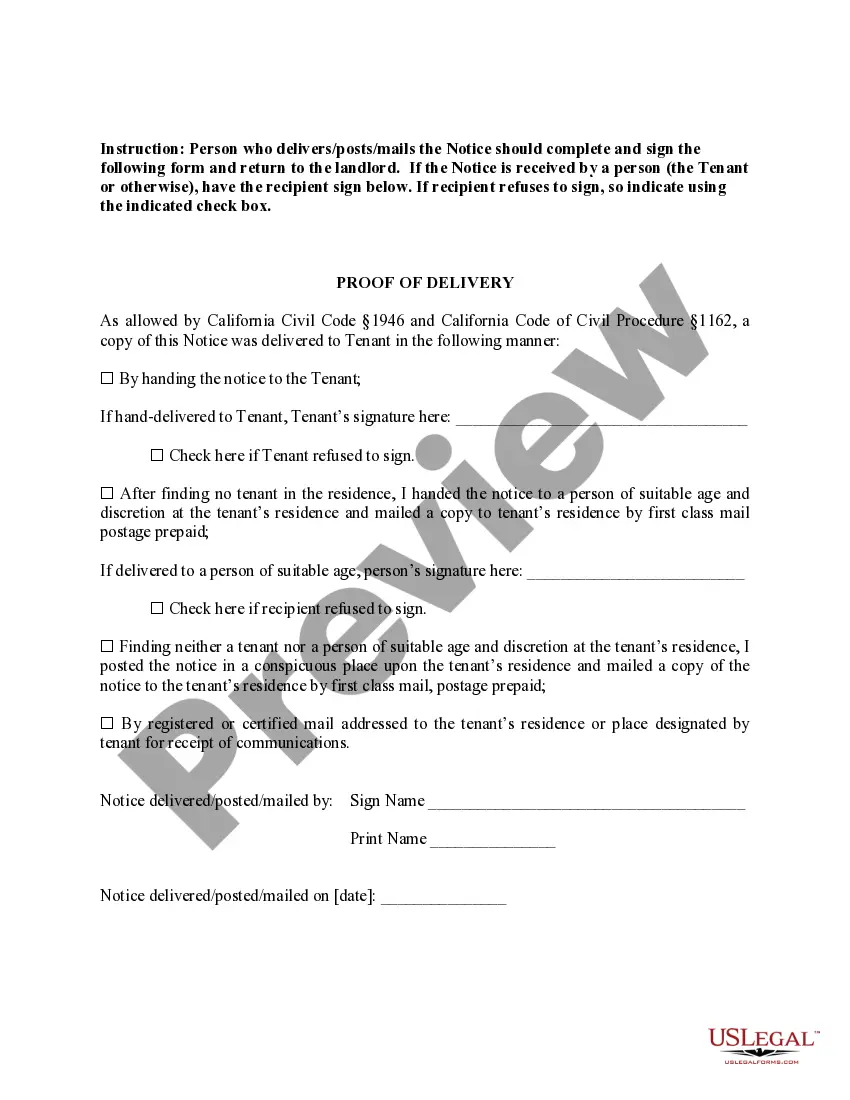

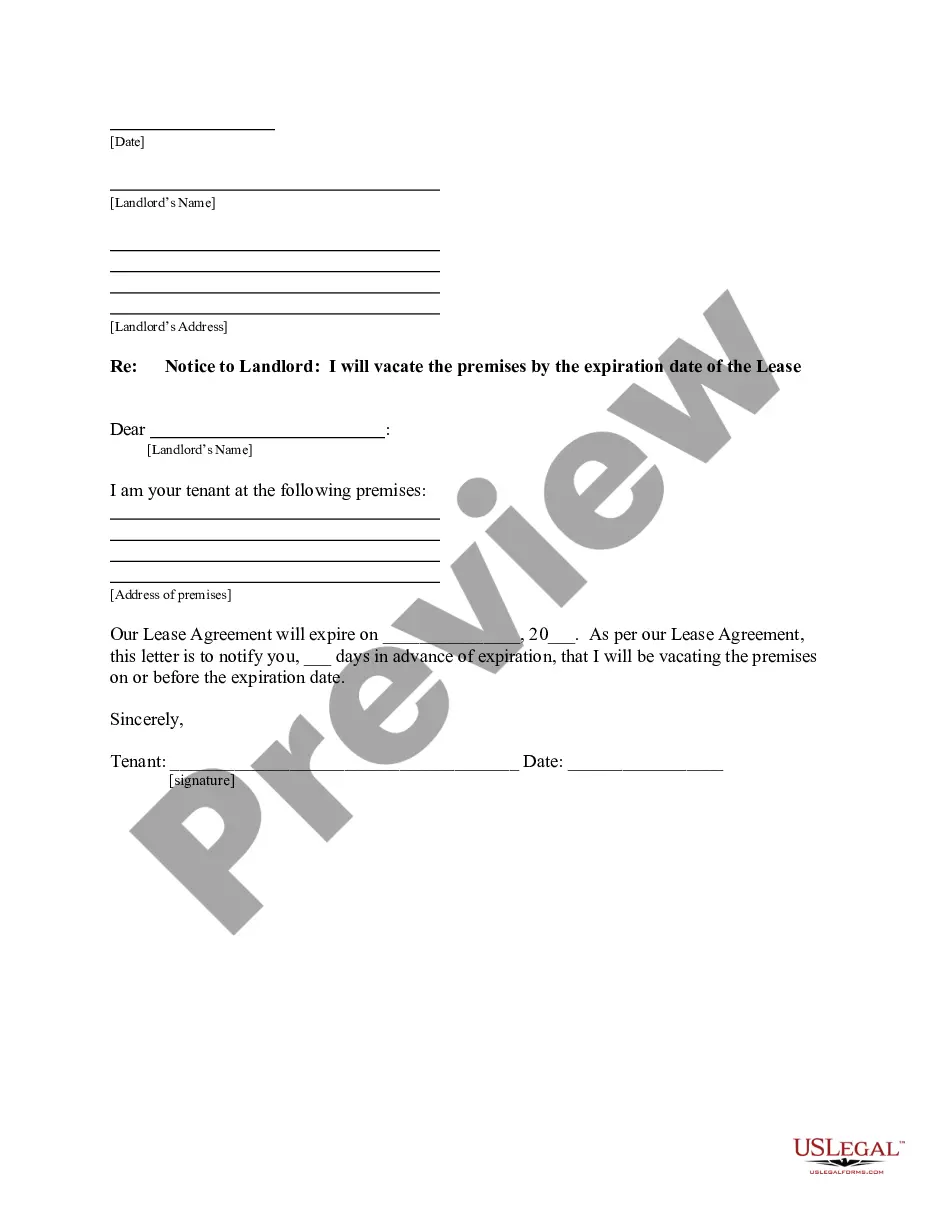

How to fill out California 30 Day Notice Of Termination - Residential Month-to-Month Tenancy - Nonrenewal Of Lease?

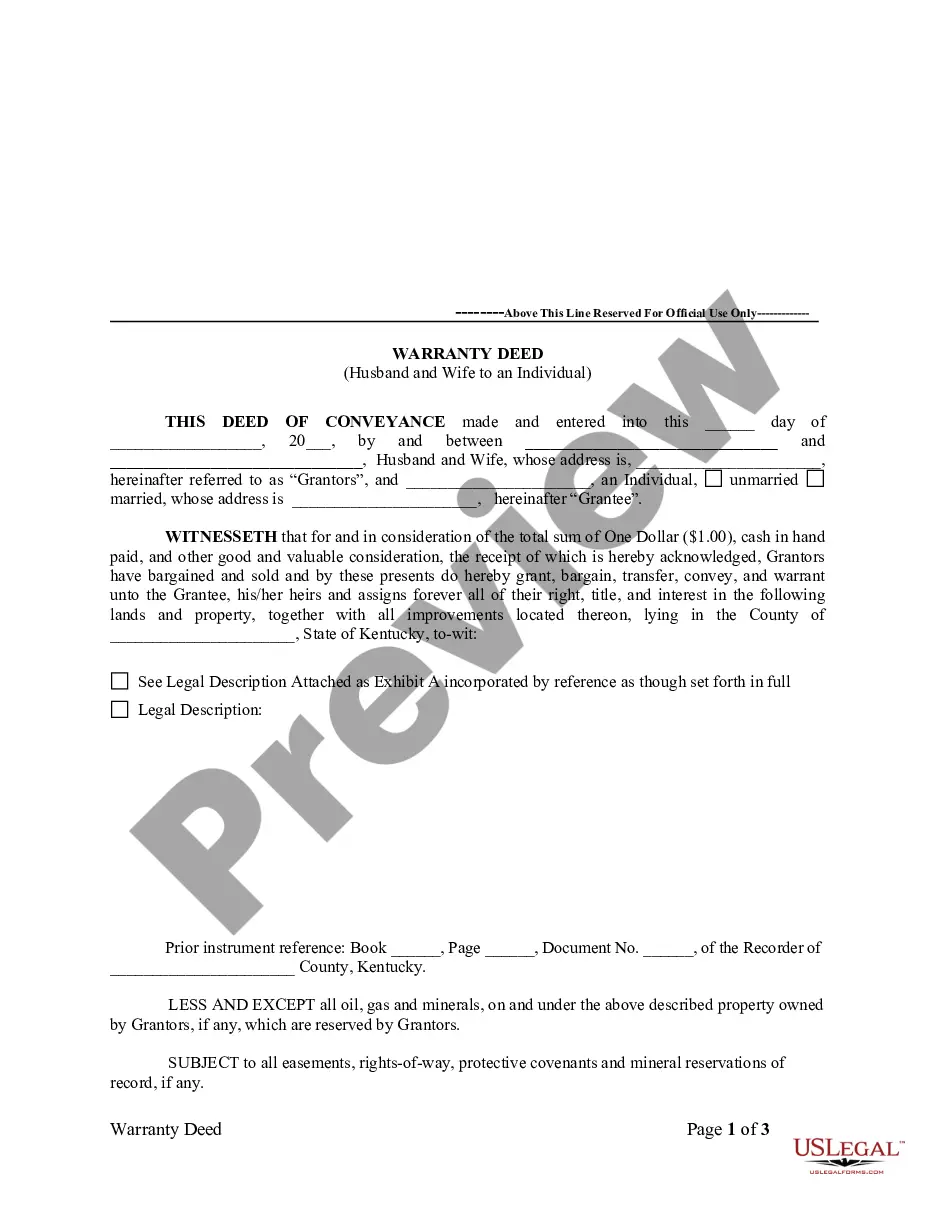

The 30 Day Cancellation Notice On Certificate Of Insurance you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this 30 Day Cancellation Notice On Certificate Of Insurance will take you just a few simple steps:

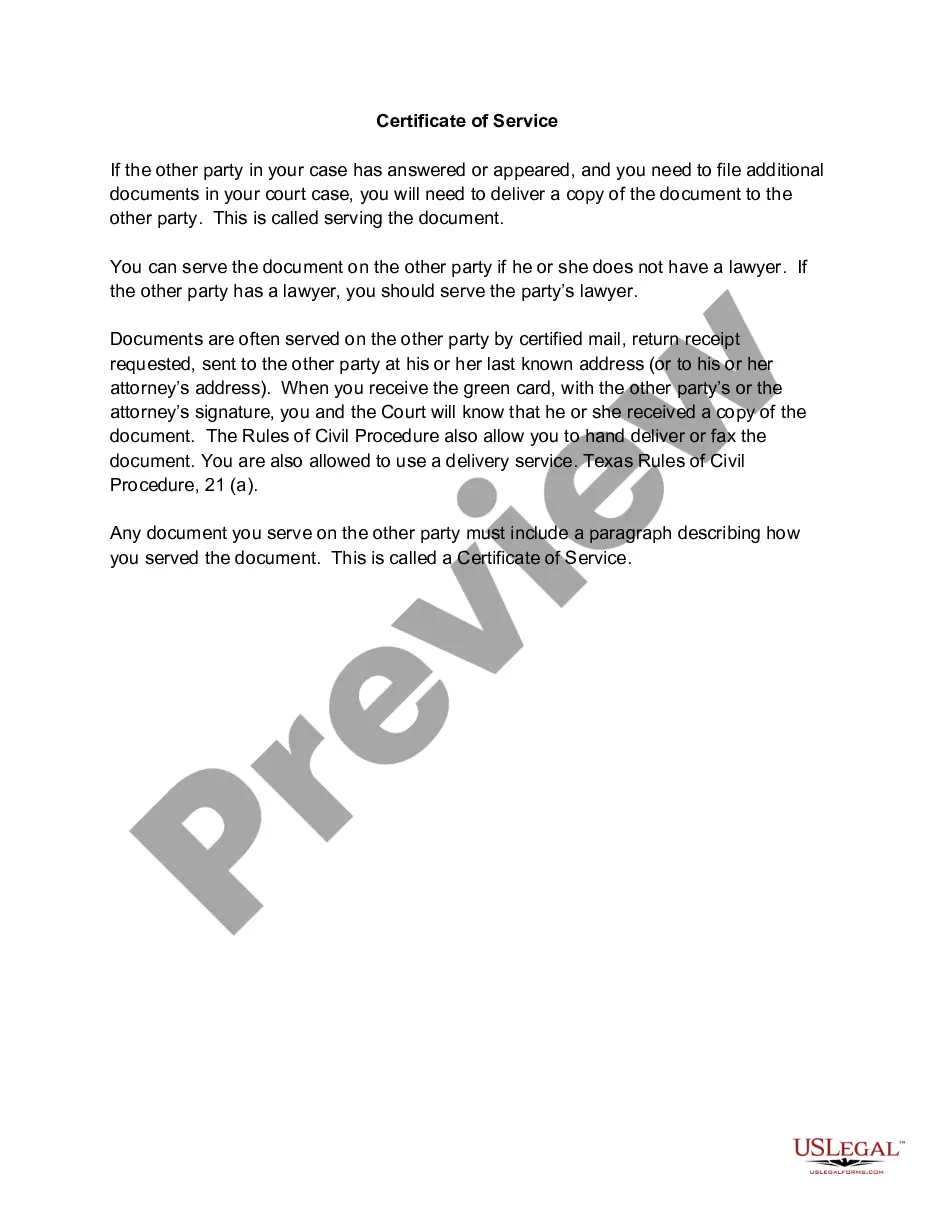

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your requirements. If it does not, make use of the search option to find the appropriate one. Click Buy Now once you have located the template you need.

- Sign up and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Pick the format you want for your 30 Day Cancellation Notice On Certificate Of Insurance (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Utilize the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

In the insurance world, a notice of cancellation provision obligates insurers to provide advance written notice to the Certificate Holder if an insurance policy is cancelled or not renewed. The most common required cancellation notice period is 30 days, though, in some cases, up to 60 days may be required.

A cancellation notice (also referred to as a notice of contract termination, contract termination letter, or notice of cancellation of contract) is a written notice of the forthcoming cancellation of a contract.

Common Reasons for Car Insurance Cancellation. Car insurance can be canceled for a variety of reasons, often dictated by state laws. The most common acceptable reason for cancellation is that you didn't pay the premium on time.

I regret to inform you that I, Penelope Mason, have decided to terminate my life insurance coverage effective immediately. The reason for my decision is based on losing my job and being unable to pay premiums. Please send me a written confirmation of the cancellation for my records at your earliest convenience.

Your letter should include: Date of notice. Insurance company name and address. Appropriate department name and contact person. Insured's name (found in the declarations page of the policy) Insured's mailing address. Insured's phone number. Policy number. Coverage period (on declarations page)