Quitclaim Deed Trustees With Executors

Description

How to fill out California Quitclaim Deed - Trust (Two Trustees) To An Individual?

- Log in to your US Legal Forms account if you're a returning user. Click the Download button for your required template while ensuring your subscription is valid.

- For first-time users, browse the extensive library. Use the Preview mode to check the form description and verify it meets your local requirements.

- If necessary, utilize the Search tab to find another template that better fits your needs before proceeding.

- Select the document by clicking the Buy Now button. Choose your preferred subscription plan and create an account to access the full library.

- Complete your purchase by entering your payment information through credit card or PayPal.

- Once the transaction is complete, download your form and save it on your device. Access it anytime from the My Forms menu in your profile.

US Legal Forms empowers you to execute legal documents quickly and efficiently. With a vast collection of over 85,000 fillable forms, you can find just what you need at a competitive cost.

Start simplifying your legal paperwork today. Explore the benefits of US Legal Forms and ensure your documents are accurate and compliant!

Form popularity

FAQ

While you might not be required to hire a lawyer to file a quitclaim deed in Illinois, having legal assistance can ease the process. Quitclaim deed trustees with executors often find that legal guidance helps in ensuring accuracy and compliance with state laws. You can use the US Legal Forms platform to access templates and resources that simplify the filing process, making it a straightforward task.

A quitclaim deed typically does not go through probate. This is because ownership transfers immediately upon the signing of the deed. For quitclaim deed trustees with executors, the transfer allows for a smooth transition of property without the lengthy probate process. However, it's essential to ensure that all legal requirements are met to avoid complications.

The individuals who benefit most from a quitclaim deed are often family members or close friends who wish to transfer property quickly and without formalities. This simple method of conveyance helps avoid lengthy legal procedures. Quitclaim deed trustees with executors provide a clear and efficient way to handle these transfers, benefiting everyone involved.

Yes, trustees can execute quitclaim deeds, provided they have the authority to do so. This is often used in probate situations, where a trustee facilitates the transfer of property as part of an estate settlement. Engaging with quitclaim deed trustees with executors ensures that these processes are legally binding and organized appropriately.

A quitclaim deed can be problematic due to its limited protections for the buyer. Since this type of deed does not assure clear title, buyers might face unexpected legal challenges later on. When utilizing quitclaim deed trustees with executors, it’s crucial to assess the property’s history fully to avoid future disputes.

A significant disadvantage for buyers receiving a quitclaim deed is the lack of warranty regarding the property’s title. This means buyers could inherit hidden issues like unpaid taxes or liens. Understanding the role of quitclaim deed trustees with executors can help in navigating these potential pitfalls and securing additional safeguards.

People often use quitclaim deeds as a simple way to transfer property ownership without the complexities of traditional sales. This method is especially useful among family members or friends, where trust is a key factor. Quitclaim deed trustees with executors can facilitate these transfers, ensuring a smooth process for all parties involved.

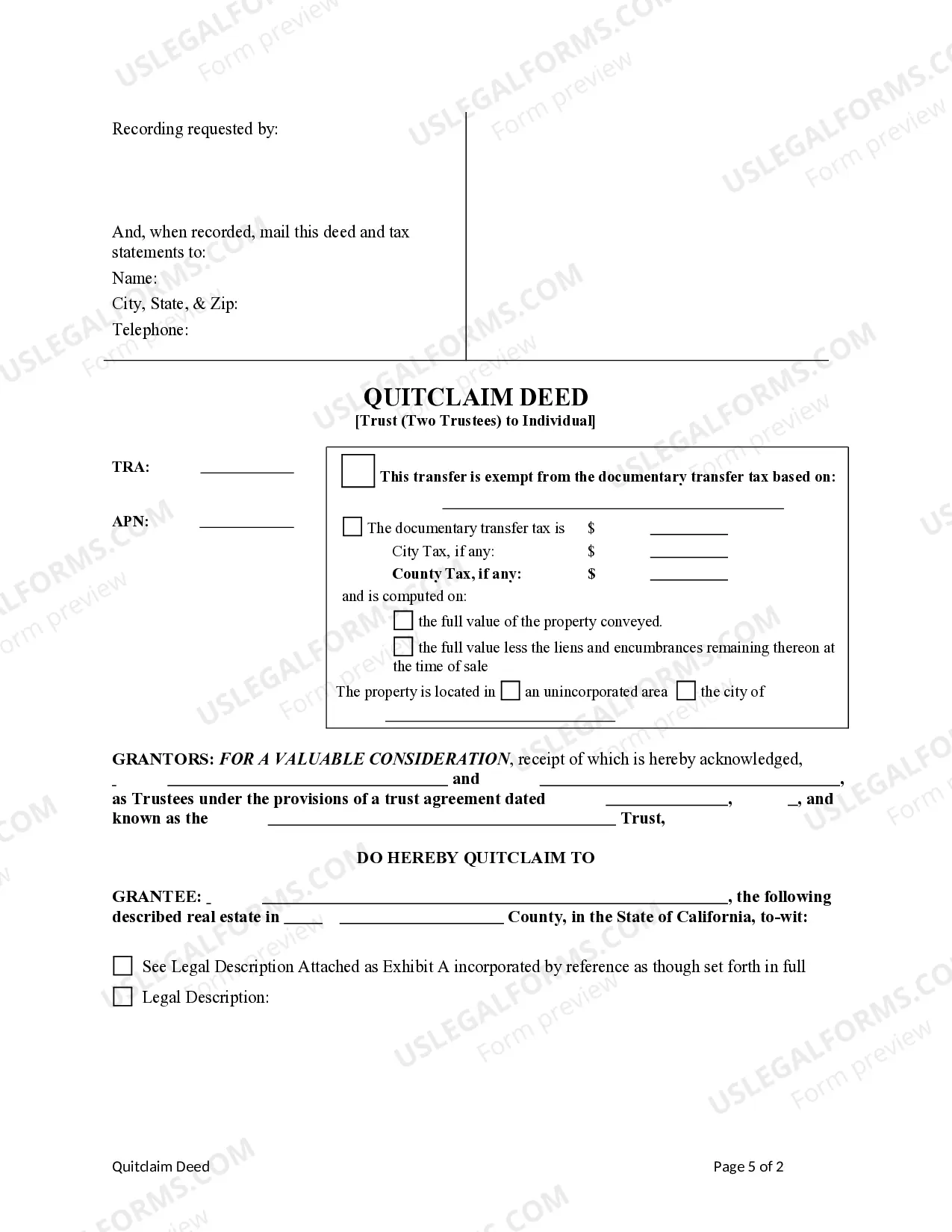

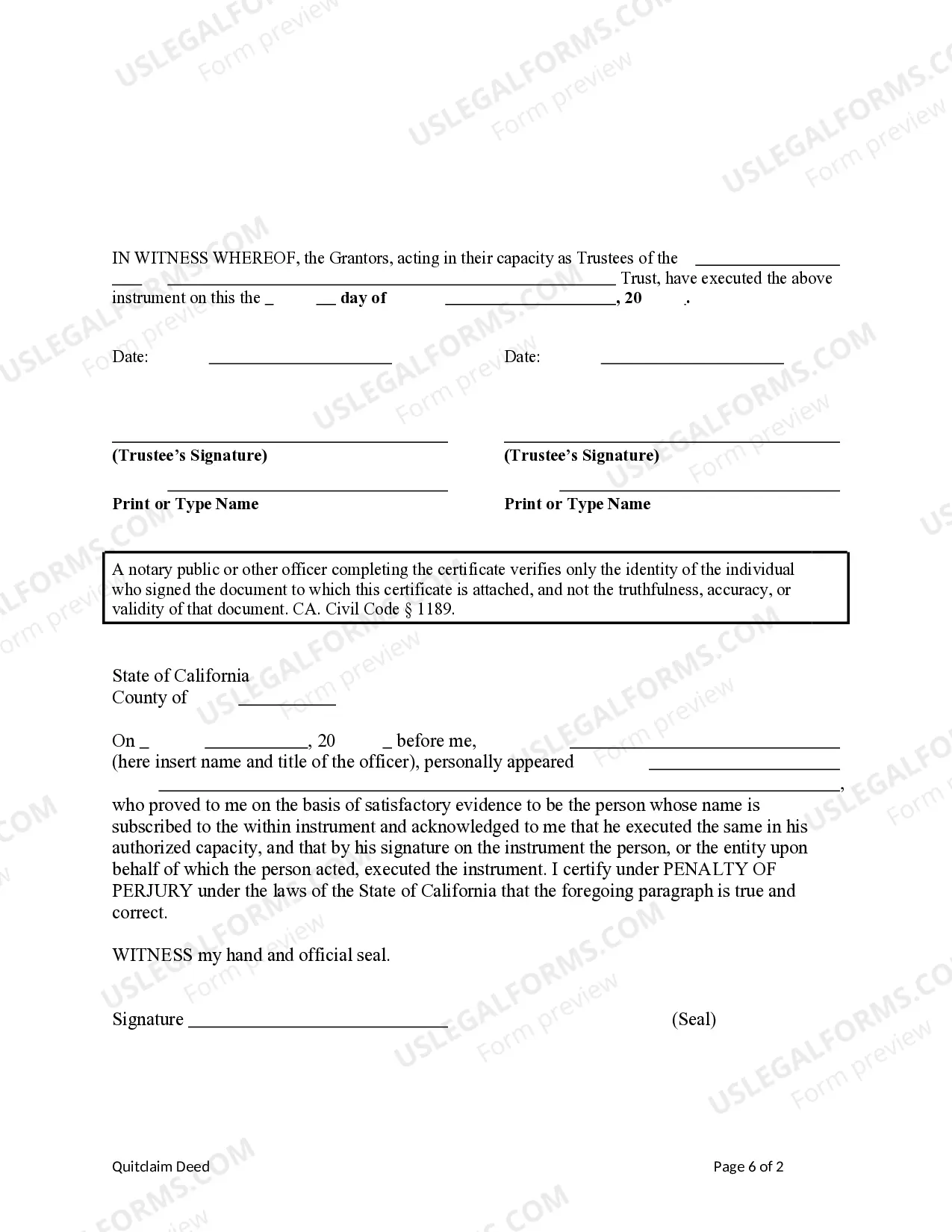

To fill out a quitclaim deed form, start by downloading the correct template from uslegalforms. Input the names of the grantor and grantee clearly, alongside the property description that identifies the boundaries. After completing the form, both parties must sign it in the presence of a notary, as this adds validity. This process is vital, especially for quitclaim deed trustees with executors managing property transitions.

Yes, a quitclaim deed remains valid after death, but its effectiveness may depend on specific circumstances. If the grantor had signed and recorded the deed prior to their death, the transfer of property ownership takes place. However, it is essential to consult with quitclaim deed trustees with executors to understand how estate laws apply in your situation. This ensures smooth transitions in property ownership.

When filling out a quitclaim deed, first ensure you have the correct forms. Identify the grantor, the grantee, and the property details accurately. Include any required legal descriptions to avoid future disputes. Using resources from uslegalforms can guide you through this process seamlessly, especially when dealing with quitclaim deed trustees with executors.