Limited Partnership Explained

Description

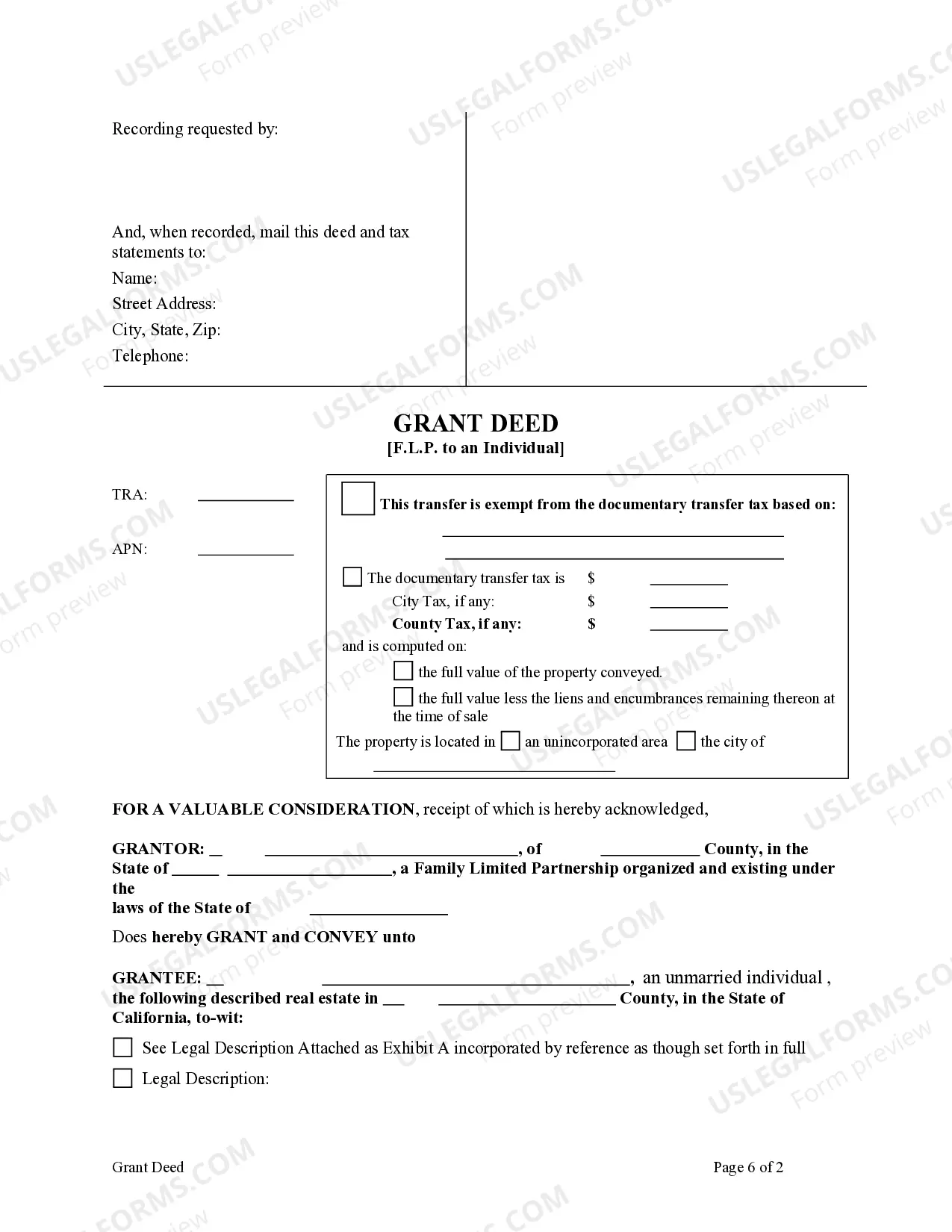

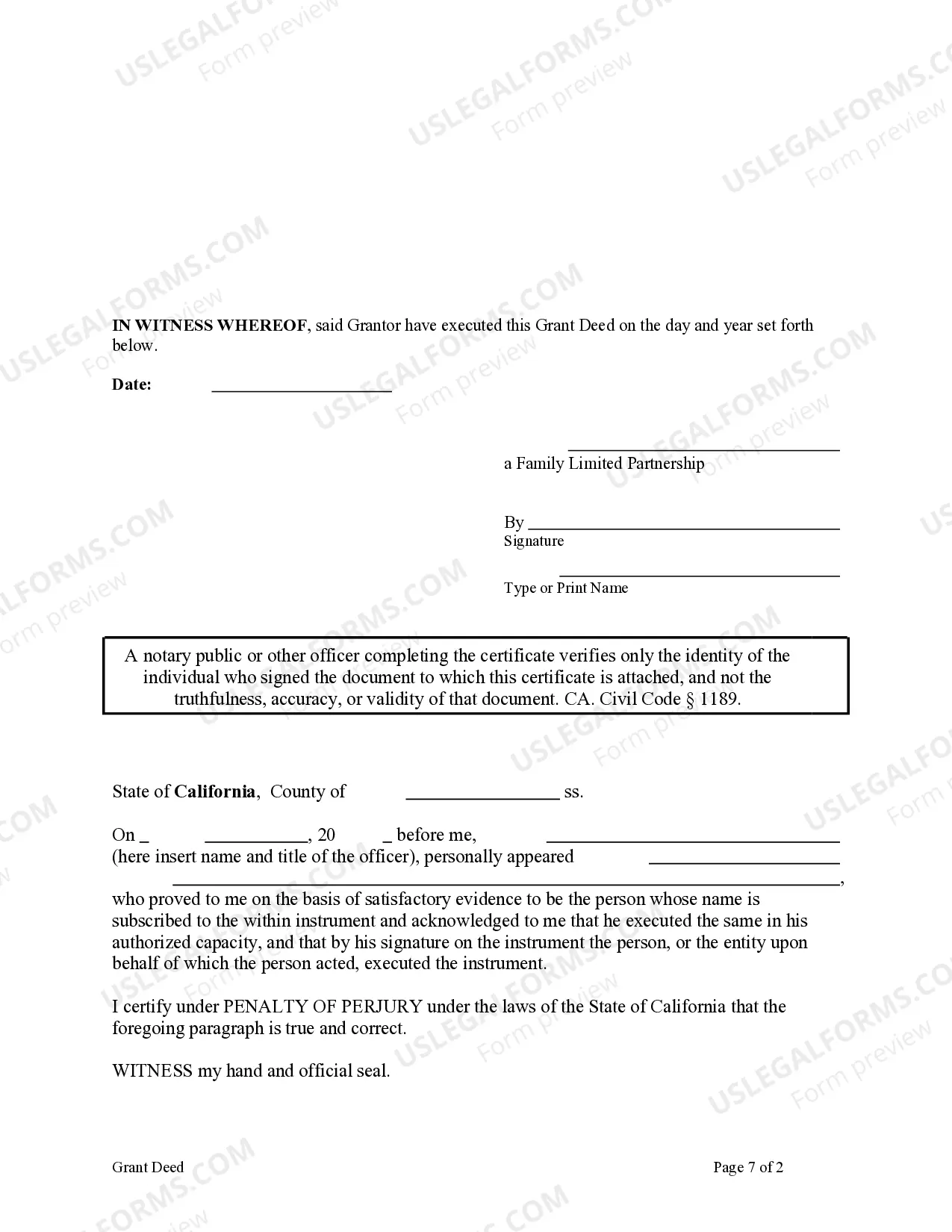

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

- If you're already a US Legal Forms user, log in to your account and locate the required form template. Ensure your subscription is active, and renew if necessary according to your chosen plan.

- For first-time users, start by previewing the form and reading its description carefully. Confirm that it aligns with your specific requirements and local jurisdiction.

- If you need a different template, utilize the Search tab to find the exact match. Ensure it fits your needs before proceeding.

- Purchase the document by clicking the Buy Now button. Select your subscription plan and register for an account to gain full access.

- Complete your purchase by entering your credit card details or using your PayPal account for convenience.

- Finally, download your form. Save it to your device and access it anytime via the My Forms menu in your profile.

US Legal Forms provides a convenient and comprehensive platform to efficiently navigate legal paperwork, featuring a robust collection of over 85,000 forms. Users can benefit from premium expert assistance for precise document completion.

Don't hesitate to empower your legal journey with US Legal Forms. Start today and experience the ease of obtaining your forms.

Form popularity

FAQ

Limited partnerships offer distinct advantages. They provide a way for investors to participate in businesses while restricting their liability to their investment amount. Additionally, they foster collaboration, as general partners manage the operations while bringing in funds from limited partners. Grasping how a limited partnership works opens up various investment opportunities, as detailed in the limited partnership explained.

To obtain a limited partnership, you must first identify partners and agree on the partnership’s structure and operations. As a next step, file the required paperwork, like the certificate of limited partnership, with your state's Secretary of State. Following this, you can create a partnership agreement to outline the roles and responsibilities of each partner. Understanding the process makes the limited partnership explained much clearer.

Becoming a limited partner allows individuals to invest in a business without taking on full liability. This setup appeals to those who wish to support businesses, like startups or real estate projects, while shielding their personal assets from potential losses. Many choose this route to diversify their investment portfolio and tap into business opportunities without active management responsibilities. Thus, the limited partnership explained offers a safer investment option.

To establish a limited partnership, you typically need at least one general partner and one limited partner. The general partner must take on unlimited liability, while the limited partner’s liability is confined to their investment. Additionally, compliance with state laws and filing necessary paperwork is essential for a successful setup. Knowing the requirements can help you navigate the limited partnership explained.

A common real-world example of a limited partnership is a venture capital firm. In this scenario, the general partners manage the fund and make investment decisions, while the limited partners provide capital but do not engage in daily operations. This structure allows limited partners to invest in high-risk opportunities while limiting their personal liability. This example clearly illustrates the concept of limited partnership explained.

To create a limited partnership, you need to file a certificate of limited partnership with your state's Secretary of State. This document typically includes details such as the partnership's name, the names of general and limited partners, and the partnership’s principal address. It's crucial to follow your state's specific requirements for documentation and fees. Understanding how a limited partnership works can simplify the process.

Partners do not necessarily have to share profits equally in a partnership; that decision is governed by the partnership agreement. Some partnerships opt for equal distribution, while others might base the share on the level of investment or individual contributions. Having a clear agreement helps ensure that all partners understand how profits will be shared. Therefore, limited partnership explained includes the flexibility partners have regarding profit-sharing arrangements.

In a limited partnership, the split of profits is generally outlined in the partnership agreement. Limited partners typically receive profits in proportion to their investment, while general partners may take a larger share due to their management role. This clear structure promotes fairness and helps prevent conflicts regarding profit distribution. Hence, understanding how profits are split in a limited partnership is key to a successful business relationship.

Splitting profits in a partnership depends on the agreement the partners have established. Common methods include splitting profits equally, distributing based on investment amounts, or considering the amount of work each partner contributes. It’s crucial to have a written agreement that details the profit-splitting method to ensure transparency and fairness. Understanding how to split profit in a partnership allows for smooth collaboration and satisfaction among partners.

In a limited partnership, profits are typically shared according to the terms set out in the partnership agreement. While general partners usually receive a greater share due to their active role in managing the business, limited partners often receive a share in proportion to their investment. This arrangement allows for a clear understanding of profit distribution and prevents confusion. Therefore, knowing how profits are shared in a limited partnership is vital for all involved.