Limited Partner

Description

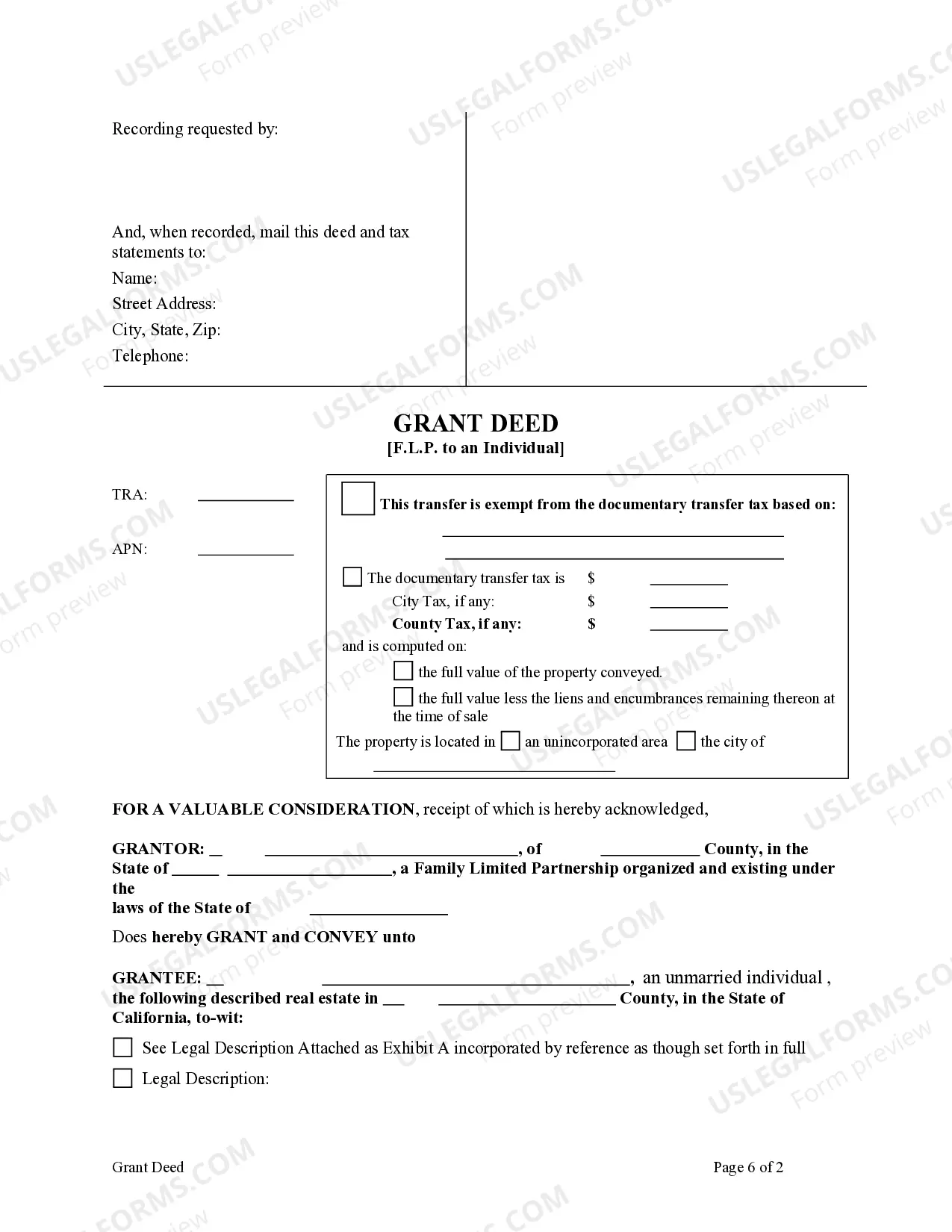

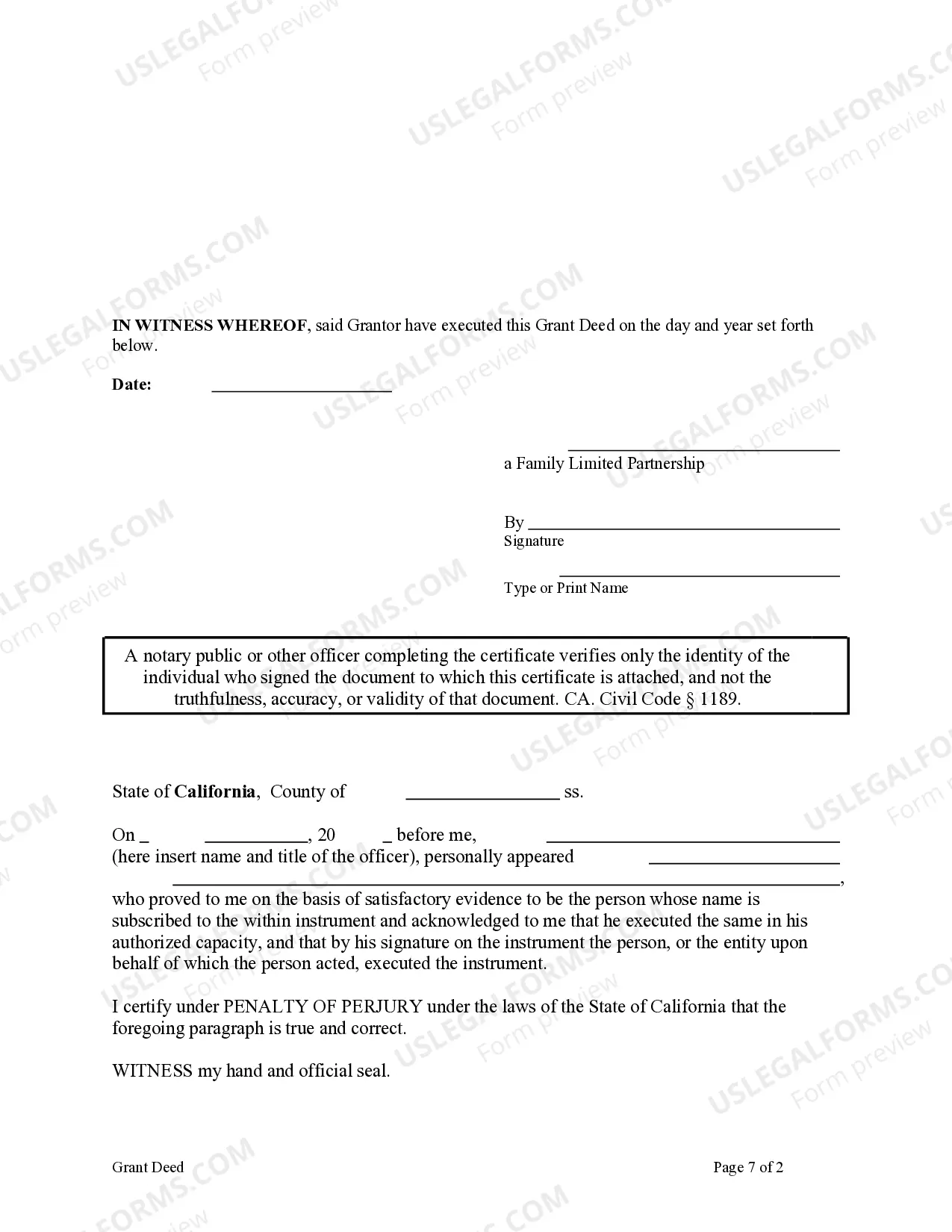

How to fill out California Grant Deed From Family Limited Partnership To An Individual.?

- If you have a US Legal Forms account, log in to download your preferred form template. Ensure that your subscription is current; renew if necessary.

- For first-time users, begin by examining the Preview mode along with the form description. Verify that you have selected the correct form that meets your specific jurisdictional requirements.

- If the required document isn't available, utilize the Search tab to find an alternative that fits your criteria. Once located, proceed to the next step.

- Purchase the document you need by clicking the Buy Now button. Select a subscription plan that best suits your needs and create an account to access the full library.

- Complete your purchase with your credit card information or PayPal account to finalize your subscription.

- Download your chosen form to your device. It will also be accessible anytime through the My Forms section of your profile.

In conclusion, US Legal Forms significantly benefits limited partners by providing an extensive library of over 85,000 user-friendly legal forms. With access to premium support for document completion, achieving accuracy and compliance has never been simpler.

Start your journey today and experience the convenience of using US Legal Forms for all your legal document needs!

Form popularity

FAQ

To establish a limited partnership, first choose a suitable name that complies with your state’s regulations. Then, draft a formal partnership agreement detailing the roles, contributions, and expectations for both general and limited partners. Afterward, file the required paperwork with your state and obtain any necessary licenses. Utilizing services from uslegalforms can help streamline this process with easy-to-use templates for your legal documents.

Obtaining a limited partnership requires drafting a partnership agreement that complies with state laws. You’ll need to identify a general partner who will manage daily operations and outline the roles of limited partners within the agreement. Resources like uslegalforms can provide templates to simplify this process and ensure that all legal aspects are covered. Once the agreement is finalized, you can register your partnership according to your state’s requirements.

To attract limited partners, create a compelling business plan that highlights the potential for returns and outlines your operational strategies. Build your credibility by showcasing your track record, team expertise, and market analysis. Additionally, consider using platforms like uslegalforms to create transparent legal documents that clearly communicate the terms of partnership. Transparency and trust are key factors in gaining the confidence of potential limited partners.

The primary disadvantage of being a limited partner is the lack of control over day-to-day management. Limited partners are typically passive investors, which means their influence on business decisions is restricted. Additionally, limited partners may face risks if the general partner mismanages funds or undertakes strategies that do not align with their investment goals. Understanding these dynamics is crucial for a successful partnership.

Connecting with limited partners involves leveraging various networking strategies and platforms. Attend industry events, seminars, and workshops focused on investment opportunities. Utilize online platforms, such as uslegalforms, to find resources that can help you draft partnership agreements and reach potential investors. Engaging with private equity firms and venture capital networks can also lead to valuable connections.

Using a limited partner structure can provide unique advantages for certain investors and businesses. Limited partners enjoy the benefit of limited liability, meaning they are not personally responsible for the partnership’s debts beyond their investment. In contrast, an LLC requires more active participation from all members. This makes a limited partner an appealing option for passive investors seeking to contribute capital without managerial obligations.

Reporting income from a limited partnership involves completing specific tax forms, typically IRS Form 1065 for the partnership and Schedule K-1 for each limited partner. Each partner must report their share of income, deductions, and credits on their individual tax returns. Utilizing services like US Legal Forms can help you navigate the complexities of tax reporting for limited partners.

Typical limited partners include individuals, institutional investors, or family offices looking to invest in business ventures with reduced risk. They seek opportunities that align with their investment goals but prefer not to engage in management. Identifying potential limited partners can enhance your business's funding potential.

A typical limited partnership could involve a startup business where one or more general partners manage operations while limited partners provide the necessary capital. This structure allows the limited partners to share in profits without being liable for business debts. Recognizing successful models like this can inspire your partnership strategy.

An example of a limited partner could be an investor who contributes capital to a real estate venture but does not participate in the management of the properties. This type of arrangement allows the limited partner to benefit from potential profits without facing the same exposure as general partners. Such examples highlight the financial advantages of being a limited partner.