Ca Deed With A Mortgage

Description

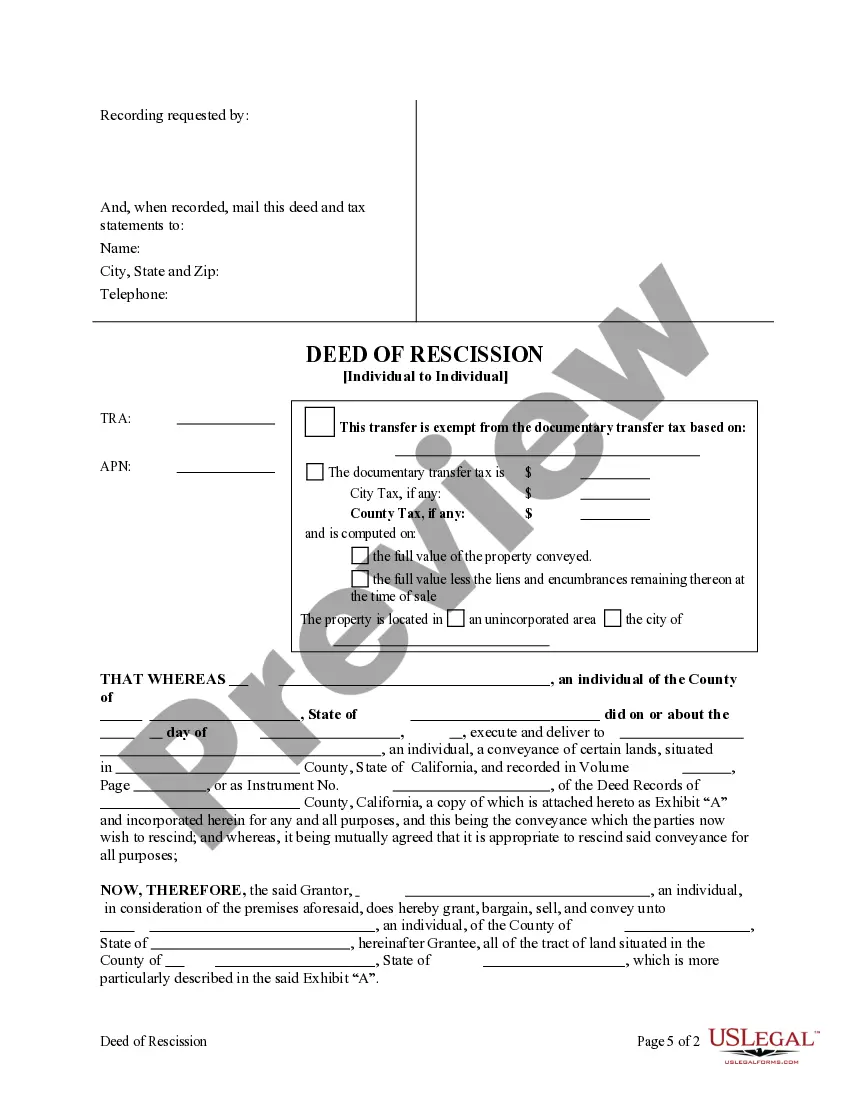

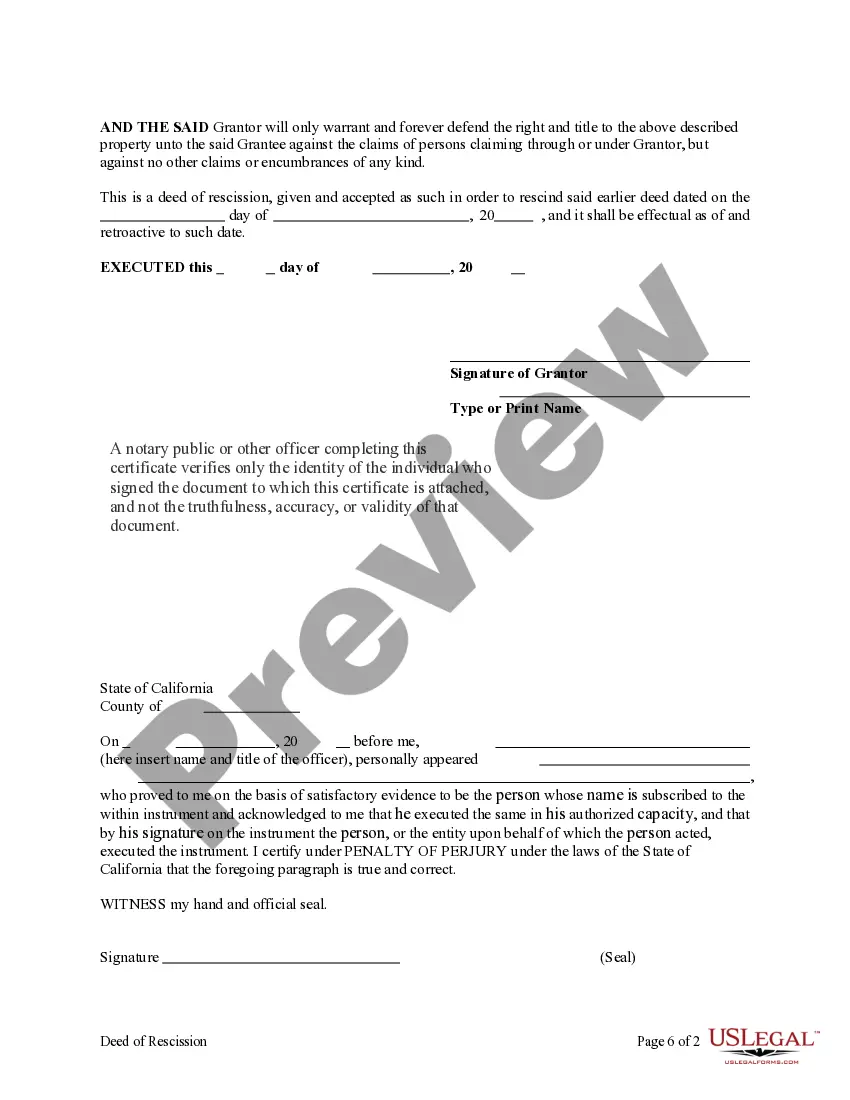

How to fill out California Deed Of Rescission - Individual To Individual?

It’s clear that you cannot instantly become a legal expert, nor can you quickly learn how to prepare a Ca Deed With A Mortgage without specialized knowledge.

Drafting legal documents is a lengthy endeavor that necessitates specific training and expertise. So why not entrust the preparation of the Ca Deed With A Mortgage to the experts.

With US Legal Forms, one of the most comprehensive libraries of legal templates, you can find everything from court documents to templates for internal business correspondence.

If you need a different template, initiate your search again.

Create a complimentary account and select a subscription plan to acquire the template. Click Buy now. Once the payment is completed, you can download the Ca Deed With A Mortgage, fill it in, print it, and deliver it or send it by mail to the appropriate individuals or organizations.

- We understand the importance of compliance with federal and state statutes and regulations.

- That’s why all forms on our site are location-specific and current.

- Begin by using our platform and obtain the form you require in just minutes.

- Find the document you need using the search function located at the top of the page.

- Review it (if the preview option is available) and examine the supporting description to see if the Ca Deed With A Mortgage matches your needs.

Form popularity

FAQ

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

Write the contract in six steps Start with a contract template. ... Open with the basic information. ... Describe in detail what you have agreed to. ... Include a description of how the contract will be ended. ... Write into the contract which laws apply and how disputes will be resolved. ... Include space for signatures.

How to Write a Contractor Agreement Outline Services Provided. The contractor agreement should list all services the contractor will provide. ... Document Duration of the Work. Specify the duration of the working relationship. ... Outline Payment Terms. ... Outline Confidentiality Agreement. ... Consult with a Lawyer.

PA requires that an independent contractor provide services that are not unique to the employer's business, sets his or her own work hours, offers his or her services to the public at large, and is employed under a contract.

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place ...

Anyone who is a sole proprietor, business owner or is self-employed has to pay Pennsylvania self employment tax, which is actually a Social Security and Medicare tax. The Pennsylvania self employment tax provides 12.4% to Social Security and 2.9% to Medicare, for a total of 15.3%.

Once you determine that you meet the minimum requirements, you can apply for a city license . All contractors need a license and must register with the Pennsylvania State Attorney General's Office if you're earning or expect to earn over $5,000 from your work.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.