Ca Deed Of Trust

Description

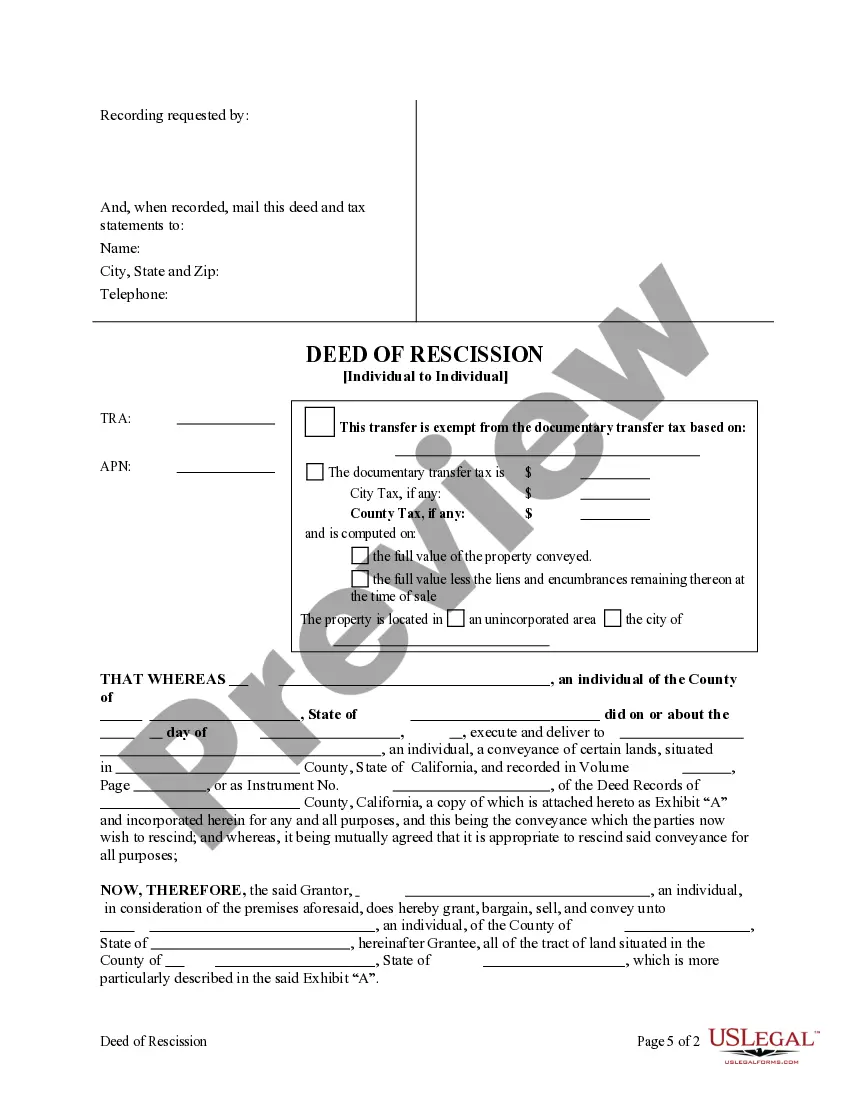

How to fill out California Deed Of Rescission - Individual To Individual?

Securing a preferred source to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents necessitates accuracy and meticulousness, which is why it is essential to source Ca Deed Of Trust samples only from trustworthy providers, such as US Legal Forms.

After obtaining the form on your device, you can modify it using the editor or print it for manual completion. Simplify the challenges associated with your legal paperwork. Explore the vast collection of US Legal Forms where you can locate legal templates, assess their applicability to your case, and download them immediately.

- Utilize the library navigation or search feature to find your template.

- Review the form’s description to determine if it meets the criteria of your state and locality.

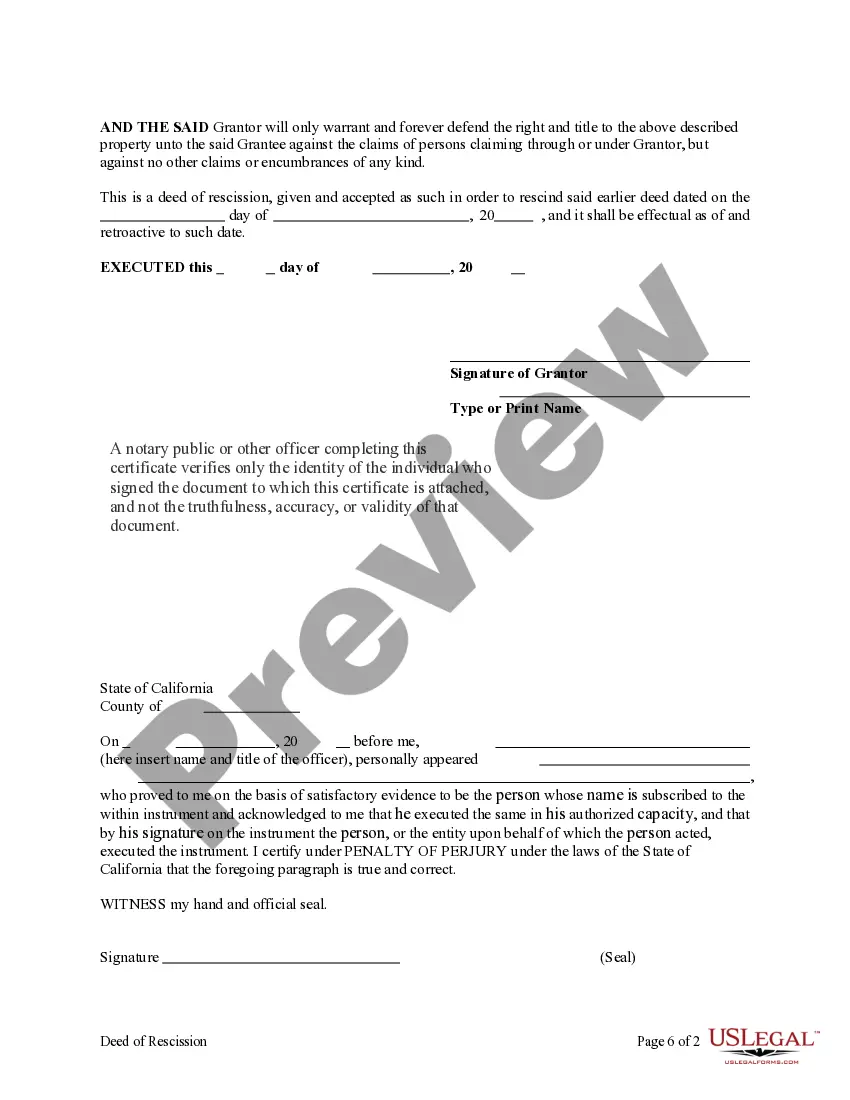

- Check the form preview, if available, to make sure the form is indeed what you need.

- If the Ca Deed Of Trust does not fulfill your needs, continue searching until you find the right template.

- Once you are confident about the form’s suitability, download it.

- If you are an authorized user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Select the pricing option that aligns with your requirements.

- Continue with the registration to complete your order.

- Finalize your transaction by picking a payment method (credit card or PayPal).

- Choose the file format for downloading the Ca Deed Of Trust.

Form popularity

FAQ

Filling out a grant deed in California involves several steps. You need to include detailed information about the property, the parties involved, and any necessary legal descriptions. Clearly state the intent to transfer ownership and have the grant deed signed before a notary. For easy access to forms and instructions, uslegalforms provides valuable resources to assist you.

A recent federal law ends the continuous coverage requirement on April 1, 2023. Starting April 1, 2023, Pennsylvania and other states will have to start completing disenrollments if households are ineligible for MA at the time of their renewal or do not complete their renewal.

Definitions. Parents of Dependent Children: Eligibility levels for parents are presented as a percentage of the 2023 FPL for a family of three, which is $24,860. Other Adults: Eligibility limits for other adults are presented as a percentage of the 2023 FPL for an individual, which is $14,580.

Income & Asset Limits for Eligibility 2023 Pennsylvania Medicaid Long-Term Care Eligibility for SeniorsType of MedicaidSingleIncome LimitAsset LimitInstitutional / Nursing Home Medicaid$2,742 / month*$2,000?Medicaid Waivers / Home and Community Based Services$2,742 / month?$2,000?1 more row ?

As of April 1, 2023, Pennsylvania must follow pre-COVID Medicaid eligibility rules. This means Medicaid coverage can end for those who are no longer eligible or who do not complete their yearly Medicaid renewal. Renewals will happen throughout the year.

In Pennsylvania, you must be seizure free for six months before you will be permitted to drive. Your physician will be required to complete a medical report stating that your seizures are controlled and send that report to the Pennsylvania Department of Transportation.

Arizona, Arkansas, Florida, Idaho, Iowa, New Hampshire, Ohio, Oklahoma and West Virginia are among the states that will begin removing ineligible Medicaid recipients as early as April. Other states will start taking that step in May, June or July. Not everyone will be removed from the program all at once.

$2,742 is the income threshold amount for 2023. This number is expected to be revised upwards by a few dollars on January 1, 2024.

?Online Forms To that end, most of our forms, publications, and maps are available in a digital PDF format on our Forms, Publications, and Maps page. Select forms are available as online, fillable forms that can be submitted completely via the internet.