Deed Lieu To Withholding

Description

How to fill out California Deed In Lieu Of Foreclosure - Individual To A Trust?

Working with legal paperwork and procedures can be a time-consuming addition to the day. Deed Lieu To Withholding and forms like it often require that you look for them and understand how you can complete them effectively. For that reason, if you are taking care of economic, legal, or individual matters, having a thorough and convenient web catalogue of forms close at hand will help a lot.

US Legal Forms is the best web platform of legal templates, featuring more than 85,000 state-specific forms and numerous resources to assist you to complete your paperwork quickly. Discover the catalogue of relevant papers accessible to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any time for downloading. Safeguard your papers administration procedures having a top-notch services that allows you to make any form in minutes without any extra or hidden fees. Just log in to the account, find Deed Lieu To Withholding and acquire it right away from the My Forms tab. You can also access previously saved forms.

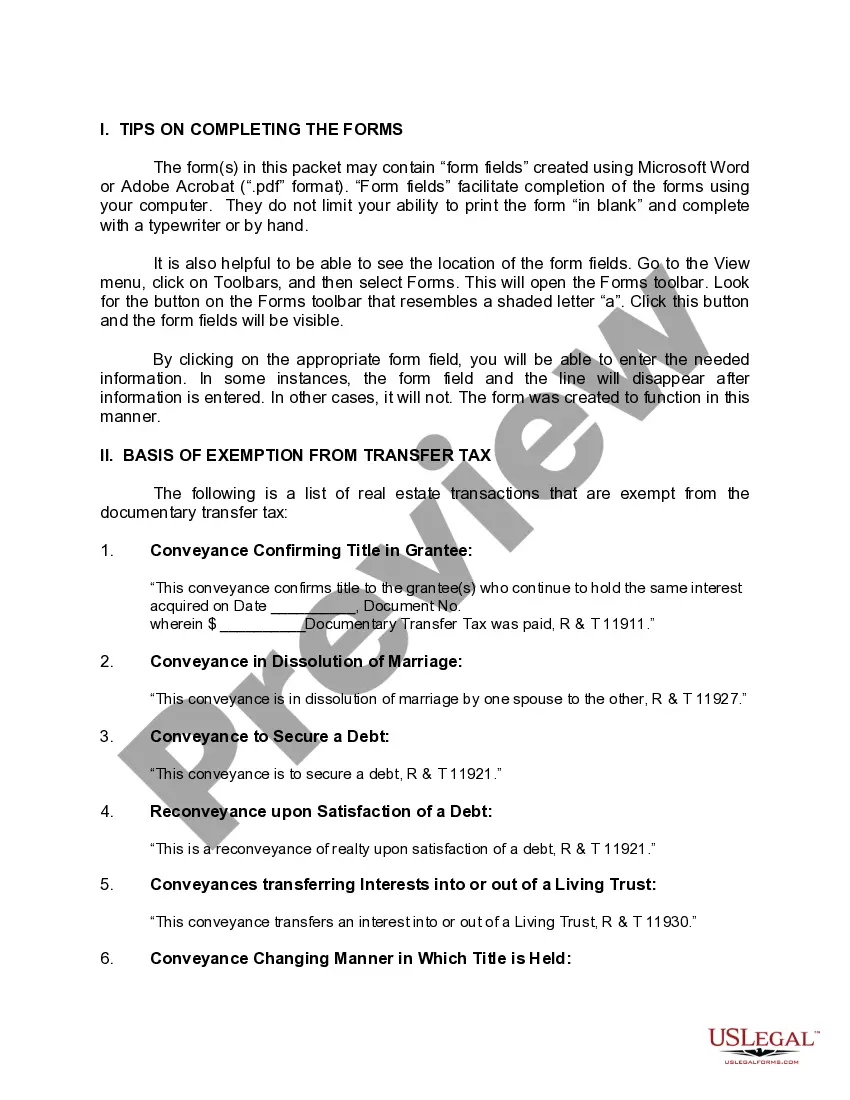

Would it be the first time making use of US Legal Forms? Register and set up up an account in a few minutes and you will gain access to the form catalogue and Deed Lieu To Withholding. Then, adhere to the steps listed below to complete your form:

- Be sure you have the correct form by using the Preview option and reading the form description.

- Choose Buy Now once all set, and select the monthly subscription plan that meets your needs.

- Press Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience supporting consumers control their legal paperwork. Obtain the form you need right now and improve any process without breaking a sweat.

Form popularity

FAQ

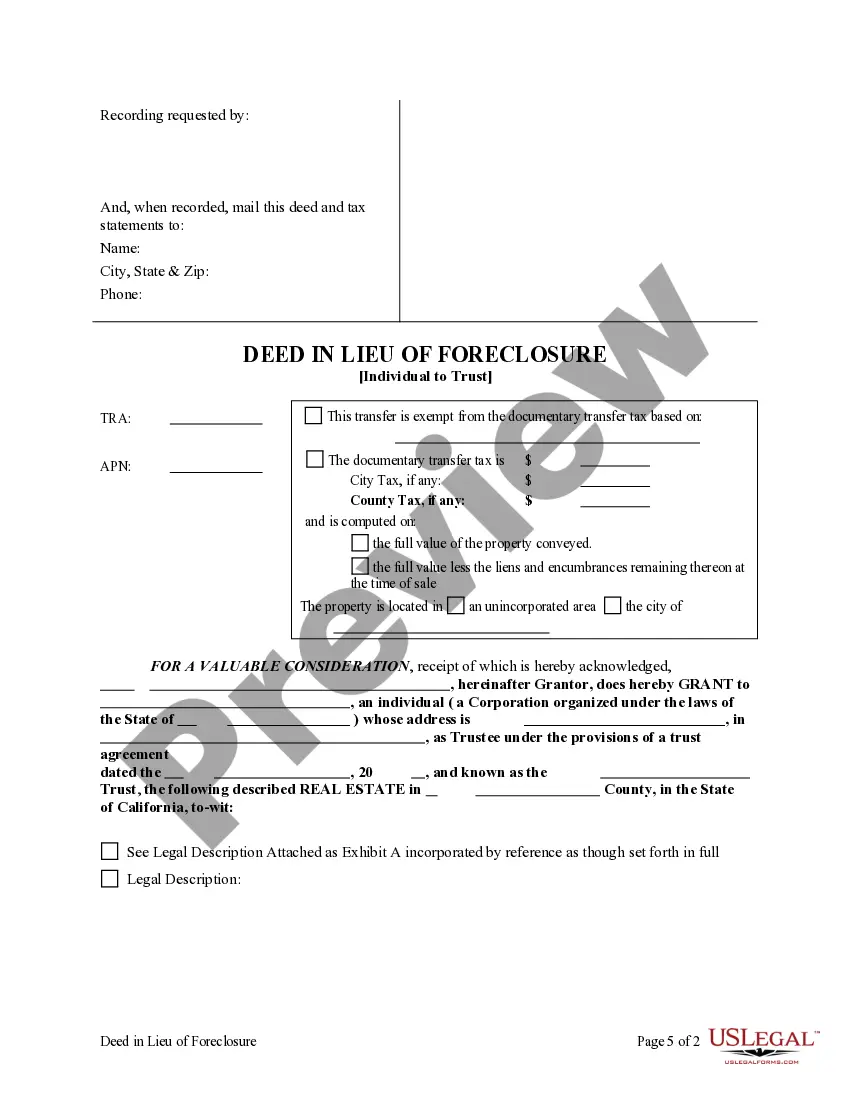

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt. Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

Less damage to your credit: A deed in lieu agreement stays on your credit report for 4 years while a foreclosure sticks around for 7 years. Taking a deed in lieu agreement can allow you to buy a new home sooner than if you go through a foreclosure.

Pros and cons of a deed in lieu of foreclosure ProsYou may receive up to $3,000 in relocation assistanceConsYour credit score may drop by up to 125 points

Disadvantages of a deed in lieu of foreclosure You will have to surrender your home sooner. You may not pursue alternative mortgage relief options, like a loan modification, that could be a better option. You'll likely lose any equity in the property you might have.