Real Estate - Tradução

Description

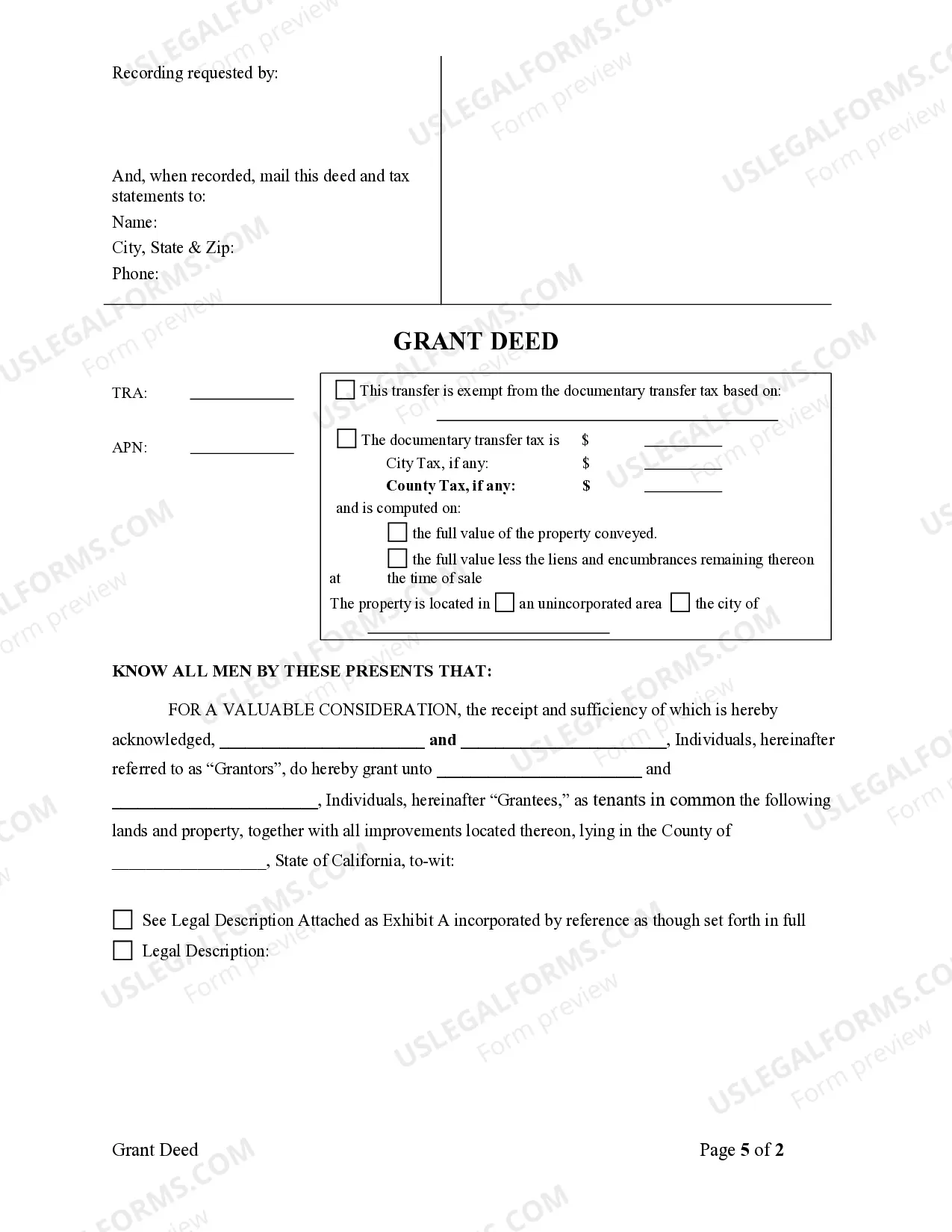

How to fill out California Grant Deed - Two Individuals To Two Individuals?

- Log in to your account if you’ve used US Legal Forms before. Ensure your subscription is active; renew it if necessary.

- Review the form in Preview mode to confirm it fits your requirements and adheres to local jurisdiction laws.

- If adjustments are needed, use the Search tab to find alternate templates that are suitable.

- Purchase the selected document by clicking 'Buy Now' and choose your preferred subscription plan. You'll need to create an account for full access.

- Complete your transaction by entering your credit card details or selecting your PayPal account.

- Download the completed form to your device for easy access through the 'My Forms' section anytime you need it.

US Legal Forms stands out with a robust library of over 85,000 legal forms, allowing you to find comprehensive templates at a competitive price. Their platform empowers you to obtain legally sound documents efficiently while having the support of premium experts.

Start simplifying your legal processes today. Visit US Legal Forms to get started!

Form popularity

FAQ

Yes, you can write your own real estate contract, but ensure it includes all necessary legal elements. Clarity and comprehensiveness are key to avoiding disputes later. While it's possible to draft your own, consulting legal resources or templates can simplify the process and ensure compliance. Look into options like US Legal Forms to access professionally crafted contracts that relate to real estate - tradução.

The five essential elements of a real estate contract are offer, acceptance, consideration, legality, and capacity. Each element must be present for the contract to be enforceable. An offer outlines the terms, acceptance signifies agreement, consideration indicates the value exchanged, legality pertains to lawful purpose, and capacity means that all parties can enter a contract. Grasping these elements is crucial for navigating real estate - tradução effectively.

To write a real estate addendum, begin by clearly stating the original contract's details and referencing it. Specify the changes or additions you wish to make, using clear, concise language. Ensure that all parties involved sign and date the addendum for its validity. For templates that cater to real estate - tradução, you can utilize resources like US Legal Forms.

A residential buyer tenant representation agreement is a contract between a buyer and a real estate agent. This agreement grants the agent the authority to represent the buyer's interests during a property transaction. It typically outlines the agent's responsibilities and the duration of the agreement, ensuring both parties understand their roles. Knowledge of real estate - tradução can enhance your understanding of these agreements.

Filling out a contract agreement involves several essential steps. Start by providing all necessary details such as names, addresses, and the subject matter of the agreement. Clearly define the terms, including obligations and timelines. For a streamlined process, consider using US Legal Forms for templates and guidance on real estate - tradução.

You report proceeds from real estate transactions on Schedule D of your tax return. This form helps you calculate any capital gains or losses from the sale. Accurate reporting is crucial, as it informs the IRS of the financial details surrounding your real estate transactions.

Real estate agents typically file taxes as self-employed individuals, meaning they report their income using Schedule C on their tax returns. They can also deduct business-related expenses, such as marketing or brokerage fees. Maintaining thorough records of income and expenses ensures proper tax preparation and maximizes allowable deductions.

Selling a house can count as taxable income, especially if you make a profit from the sale. However, you may exclude specific amounts if you meet certain conditions, including having lived in the house for at least two of the last five years. Understanding these factors ensures you comply with tax laws while maximizing potential savings.

Yes, real estate transactions typically get reported to the IRS through various forms and documents. For instance, title companies and real estate agents often provide the IRS with Form 1099-S, which details the proceeds from the sale. This reporting ensures transparency and compliance with tax regulations.

Yes, when you sell real estate, you generally must report the sale to the IRS. The IRS requires taxpayers to report gains and losses on their tax returns, especially for real estate transactions involving significant amounts. Failure to report can lead to penalties, so it is essential to maintain good records regarding the sale.