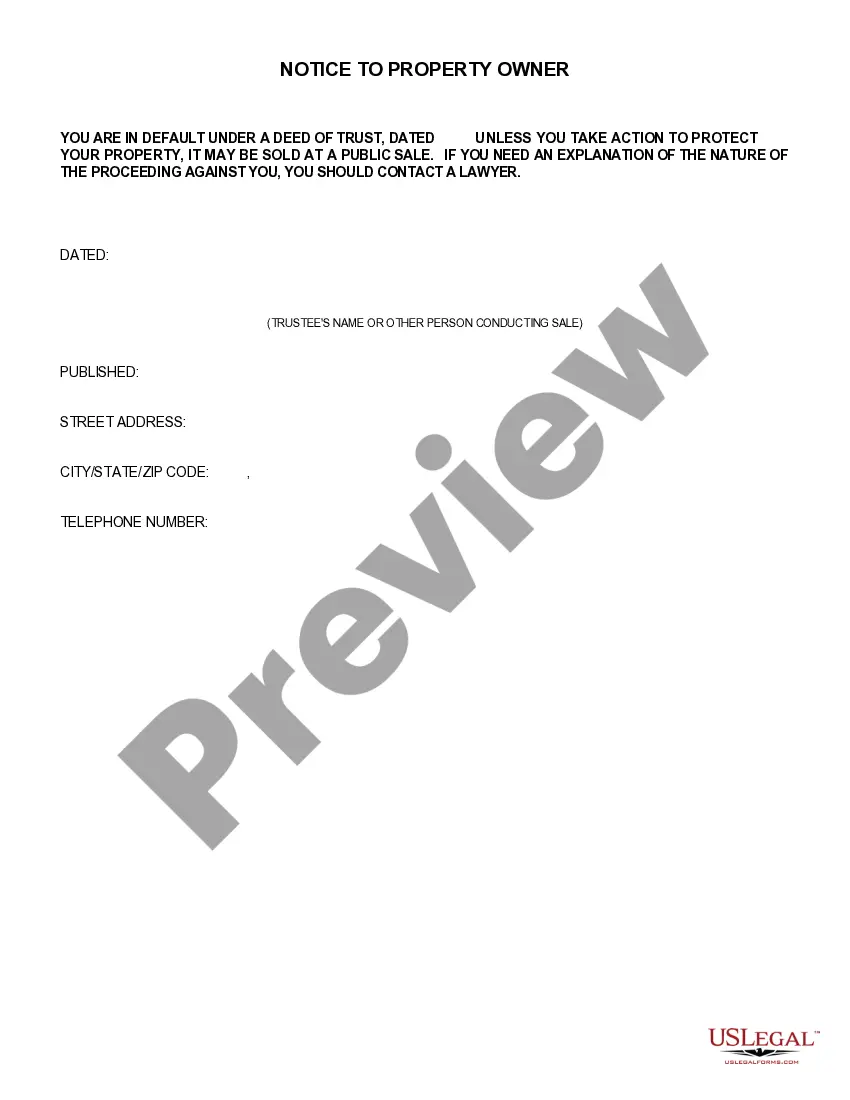

Notice Trustees Sale Foreclosure Proceeding

Description

How to fill out California Notice Of Trustee's Sale?

Engaging with legal documents and processes can be a lengthy addition to your schedule. Observe that the Notice Trustees Sale Foreclosure Proceeding and similar forms typically necessitate that you search for them and grasp how to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal affairs, having a comprehensive and functional online repository of forms readily available will be immensely beneficial.

US Legal Forms is the premier online source of legal templates, featuring over 85,000 state-specific forms and an array of resources to help you complete your documents with ease.

Explore the collection of relevant documents accessible to you with just one click.

Then, follow the steps below to complete your form: Ensure you have located the correct form using the Preview option and reviewing the form description. Select Buy Now when ready and choose the monthly subscription plan that suits your needs. Click Download, then fill out, eSign, and print the form. US Legal Forms has 25 years of experience helping clients manage their legal documents. Obtain the form you require now and simplify any process effortlessly.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management processes with a reliable service that enables you to prepare any form in minutes without any extra or hidden fees.

- Simply sign in to your account, locate Notice Trustees Sale Foreclosure Proceeding, and obtain it instantly from the My documents section.

- You can also access previously saved forms.

- Is this your first time using US Legal Forms? Register and set up your account in just a few minutes, and you will gain entry to the form library and Notice Trustees Sale Foreclosure Proceeding.

Form popularity

FAQ

Consider Bankruptcy: Filing for bankruptcy can stop a foreclosure auction. However, bankruptcy should only be considered as a last resort. Sell Your Home: Selling your home may be the best option if you're unable to keep up with your mortgage payments.

Foreclosure Can Take Months or Years Notice of default: The lender typically issues a notice of default, indicating its intention to foreclose, when the loan becomes 90 days past due. Typically, the notice indicates legal foreclosure will begin in 90 days unless the borrower brings their payments up to date.

Foreclosure Timeline First missed payment. The first step is a missed payment. ... Default. If you continue to miss mortgage payments, you're considered in default. ... Foreclosure lawsuit or notice of default. ... Pre-foreclosure. ... Notice of sale. ... Leave residence.

Under a judicial foreclosure proceeding, the lender files suit with the court to initiate foreclosure?typically after the borrower misses their third consecutive mortgage payment (also known as going 90 days past due on their loan).

A suit to obtain 2[a decree] that a mortgagor shall be absolutely debarred of his right to redeem the mortgaged property is called a suit for foreclosure.