Who Is Liable For The Withholding On The Sale Of A Property Owned By A Foreigner

Description

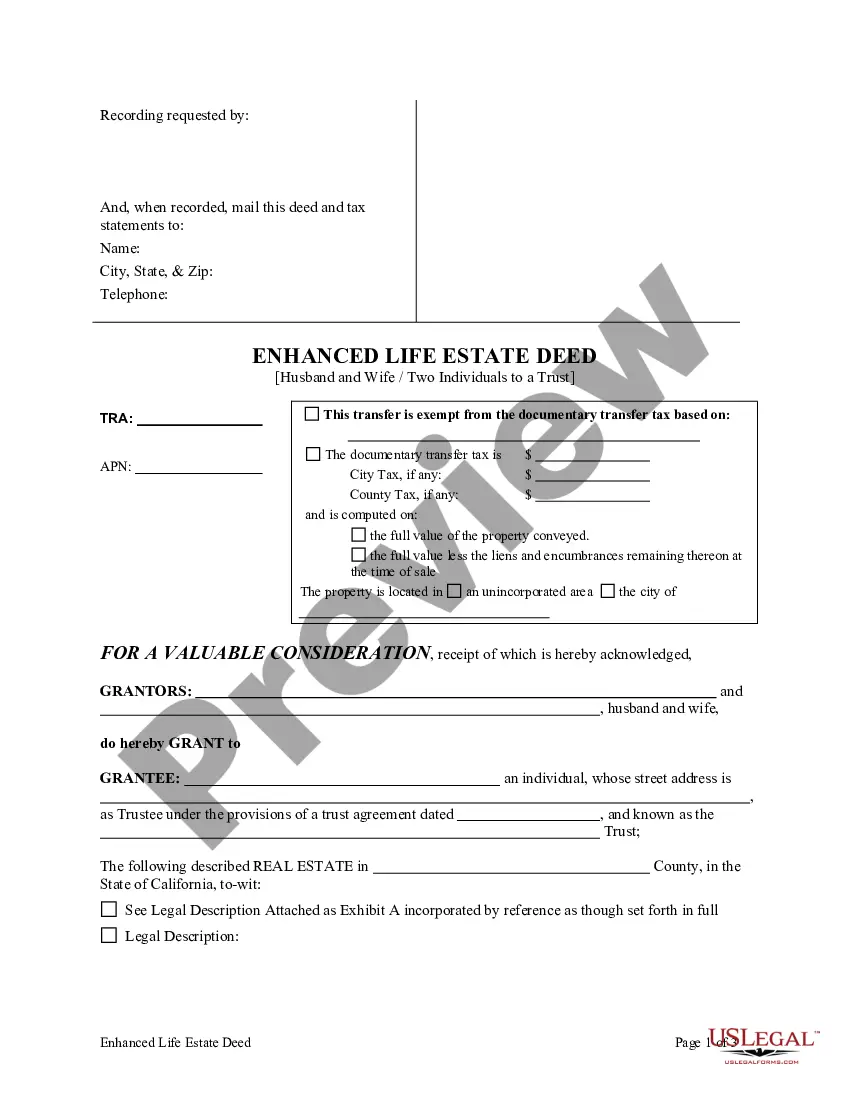

How to fill out California Enhanced Life Estate Deed From Husband And Wife, Or Two Individuals, To A Trust.?

- Log in to your US Legal Forms account. If you're a returning user, ensure your subscription is active to access your documents.

- In the form library, utilize the Preview mode to find the correct template suited to your needs and jurisdiction.

- If necessary, explore other templates using the Search tab to ensure you have the right document.

- Proceed to purchase by clicking the Buy Now button and selecting your preferred subscription plan.

- Complete your payment using a credit card or PayPal to finalize your subscription.

- Once purchased, download your chosen form and save it on your device for easy access within the My Forms menu.

By utilizing US Legal Forms, you gain access to a robust library of over 85,000 editable legal documents. This platform not only provides a greater selection than many competitors but also connects you with premium experts to assist with your form completion.

In conclusion, ensuring you have the correct legal documents when dealing with property transactions involving foreign sellers is vital. Take advantage of US Legal Forms to streamline your process and facilitate compliance. Start using the platform today!

Form popularity

FAQ

The responsibility for tax withholding usually lies with the entity making the payment. In real estate transactions involving foreigners, that often means the buyer of the property must withhold taxes. Educating yourself on withholding obligations is crucial, as it informs you about who is liable for the withholding on the sale of a property owned by a foreigner.

Liability for withholding taxes refers to the legal responsibility of a party to withhold taxes from payments made to another party. This obligation typically arises in scenarios involving payments to foreign entities or individuals. Failing to fulfill this obligation can lead to penalties or additional taxes owed. Understanding your liability can save you from complications, especially in transactions involving foreign property owners.

The employer is primarily responsible for determining how much to withhold from your paycheck, based on the information you provide on your tax forms. However, it is important for you to review your withholding status regularly to ensure it is accurate. If discrepancies arise, you should communicate with your employer to address them promptly. Understanding the role of withholding can help you grasp who is liable for the withholding on the sale of a property owned by a foreigner.

Liability for withholding generally lies with the party making the payment to the foreign entity. In most cases, this is the buyer in a real estate transaction. If the necessary withholding does not occur, the buyer could face penalties from the IRS. Knowing who is liable for the withholding on the sale of a property owned by a foreigner is vital for compliance.

The responsibility for withholding on payments to a foreign person typically falls on the buyer or the party making the payment. This means that if you are involved in a transaction where a foreigner receives payment, you must ensure that the required taxes are withheld. Failure to comply can lead to significant penalties. Therefore, it’s essential to understand who is liable for the withholding on the sale of a property owned by a foreigner.

The buyer typically assumes the responsibility for withholding taxes under FIRPTA when buying property from a foreign seller. The buyer must ensure that the correct amount is withheld during the transaction. Understanding who is liable for the withholding on the sale of a property owned by a foreigner can help buyers meet their legal obligations. Utilizing resources like USLegalForms can simplify this process and provide additional guidance.

Yes, a foreigner can sell a house in the USA. The process does not differ significantly from that of a U.S. citizen. However, it is essential for the seller to understand the tax implications involved. Knowing who is liable for the withholding on the sale of a property owned by a foreigner can help prevent costly mistakes.