Request Waiver Order With A Credit Card

Description

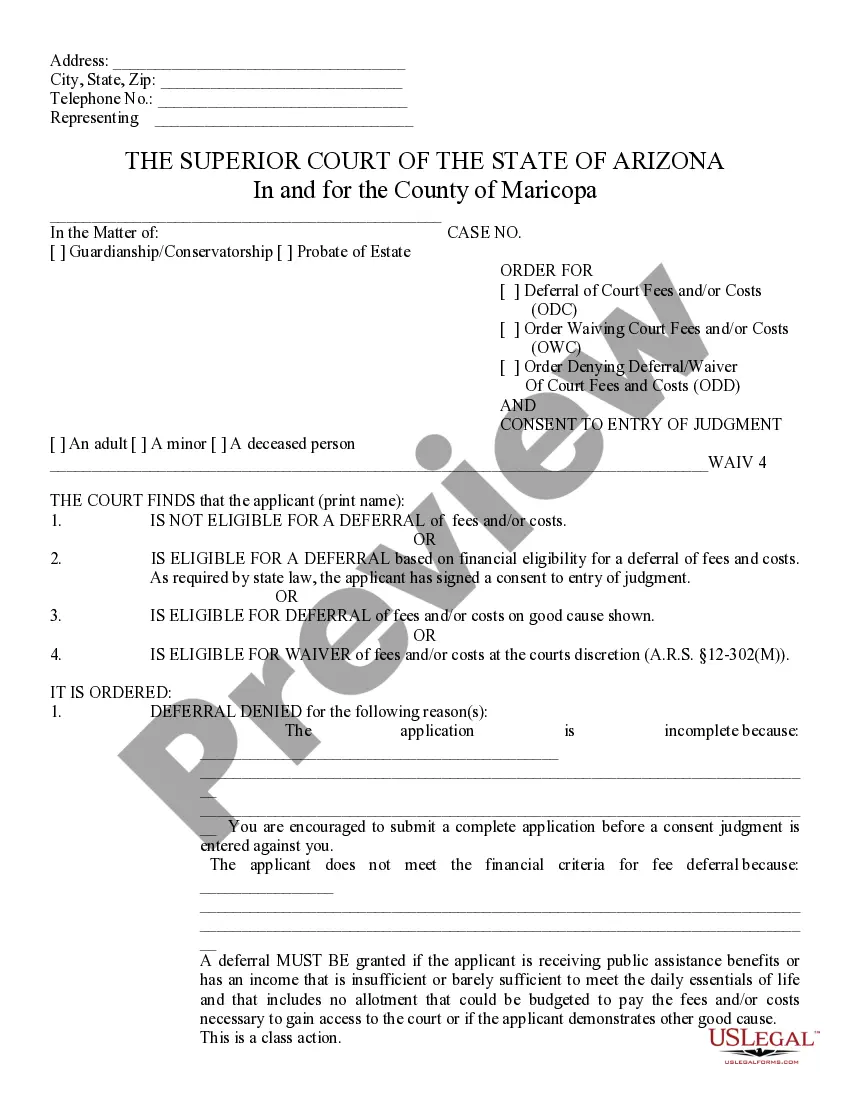

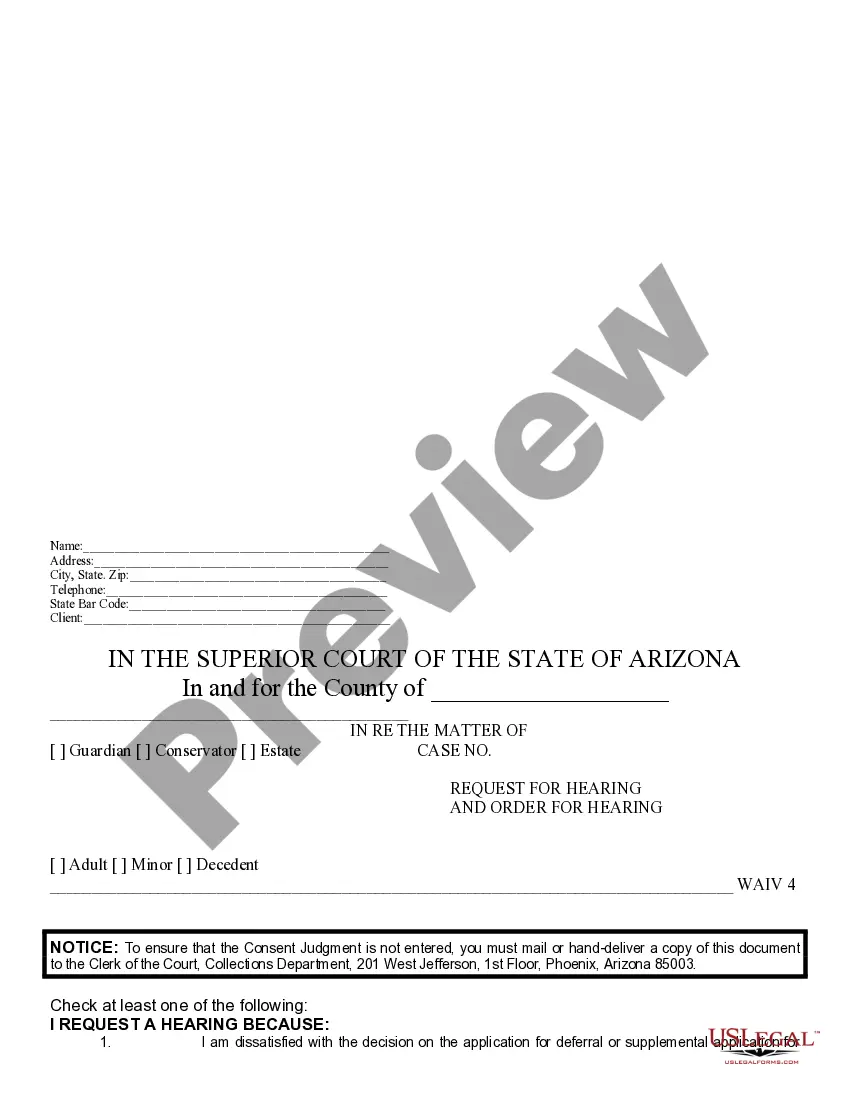

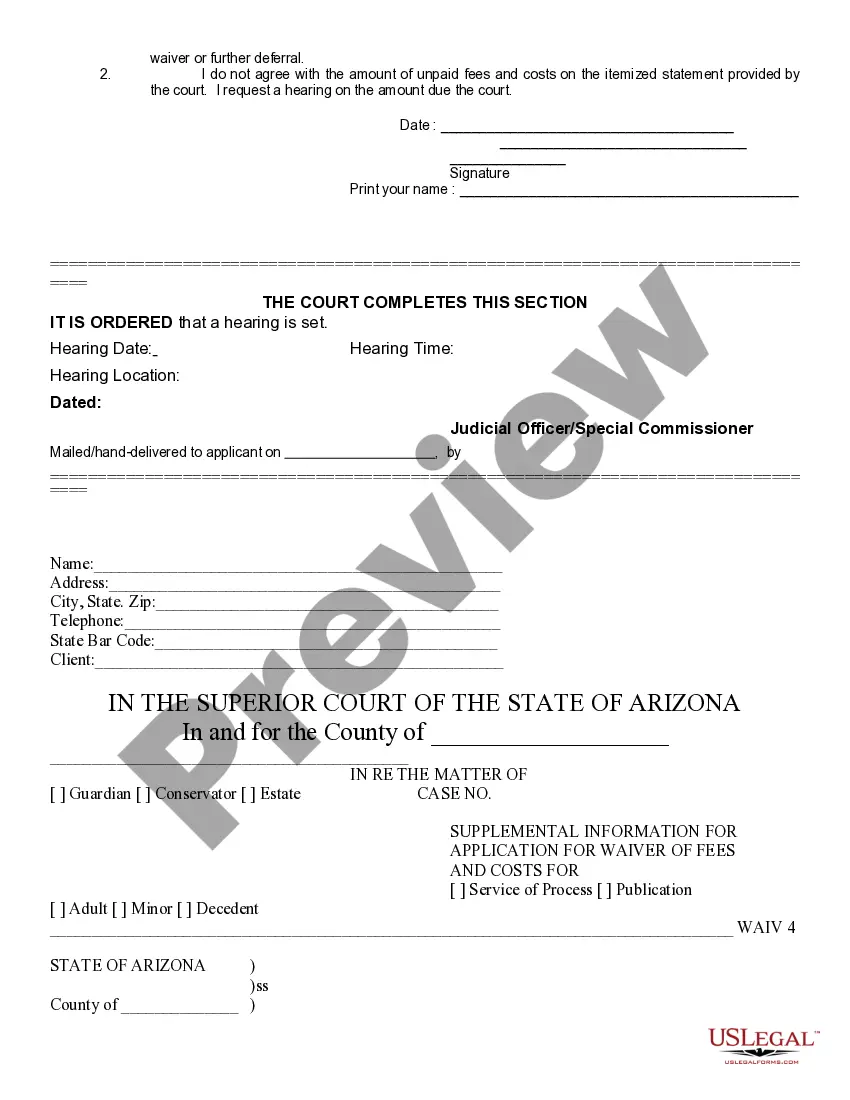

How to fill out Arizona PB Request To Waive Filing Fees And Order?

- Log in to your account if you are a returning user, ensuring your subscription is active. If not, renew according to your payment plan.

- For first-time users, begin by reviewing the preview mode and description of the desired legal form to ensure it fits your needs and local requirements.

- If adjustments are needed, utilize the search function to find an alternative template that better suits your circumstances.

- Purchase your chosen document by clicking on the 'Buy Now' button and selecting a subscription plan that works for you. An account registration will be required for full access.

- Complete your purchase using your credit card details or PayPal to secure your subscription plan.

- Download the completed form to your device and store it under the 'My documents' section for easy access whenever required.

Once you've completed these steps, you’ll have the necessary legal forms at your fingertips, ready for use. US Legal Forms streamlines the documentation process, making it quicker and more efficient for every user.

Don't wait any longer; start your journey towards hassle-free legal documentation today!

Form popularity

FAQ

A credit card waiver is a legal document that allows you to bypass certain fees or requirements related to your credit card. When you request a waiver order with a credit card, you essentially ask for a temporary exemption from these responsibilities. This process can be beneficial, especially if you face unexpected financial challenges. For a streamlined experience in managing such requests, you can consider using the US Legal Forms platform.

To waive your credit card payment, you need to inquire about your credit card issuer's waiver policies. Typically, this involves making a formal request that outlines your reasons for needing a waiver. Documentation may be required to support your case. By aiming to request a waiver order with a credit card, you may find relief in your financial situation.

A waiver in a credit card context is an official approval that allows you to bypass some fees or payments for a specified period. This helps users manage their financial obligations during tough times. If you find yourself struggling, knowing that you can request a waiver order with a credit card gives you peace of mind. It's best to familiarize yourself with your lender's specific waiver process.

Getting a waiver for a credit card involves reaching out to your credit card issuer and formally asking for a waiver. Start by explaining your circumstances, such as financial hardship or unforeseen emergencies. It’s essential to provide supporting information, which can help your case. Ultimately, you can successfully request a waiver order with a credit card by being clear and polite in your communication.

To waive off a credit card bill, you typically need to request a waiver from your credit card provider. You can do this by contacting their customer service team and explaining your situation. They may ask for documentation or a valid reason for the request. By following the proper procedures, you can smoothly request a waiver order with a credit card.

Yes, USCIS accepts credit card payments for certain fees, making it convenient for individuals to manage their payments. This includes payments for various forms and applications, including the process for requesting a waiver order with a credit card. Utilizing a platform like US Legal Forms can guide you through the payment options and ensure your submission is processed smoothly and securely.

USCIS does not routinely check your credit when you apply for immigration benefits. Instead, they focus on your eligibility based on immigration laws and your personal circumstances. However, it's essential to be prepared to prove your financial stability if required. Using services like US Legal Forms can help you understand what documentation you might need to support your request waiver order with a credit card.

Yes, you can file Form I-601A online with the help of platforms like US Legal Forms. This service simplifies the process for you, making it easier to request a waiver order with a credit card. By using their online tools, you can ensure that your application is filled out correctly and submitted efficiently. Moreover, online filing provides you with instant access to your documents and a streamlined experience.