Real Estate Residence

Description

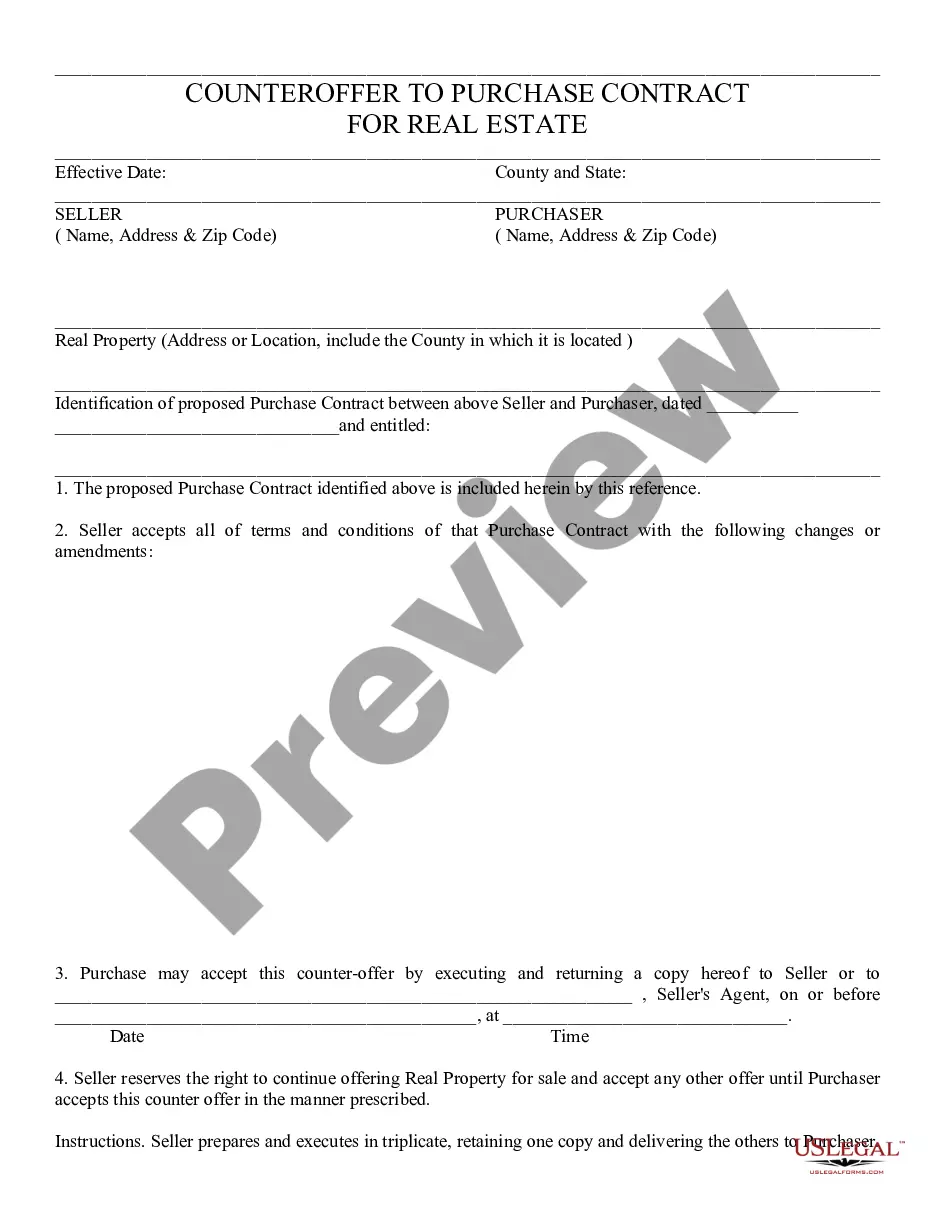

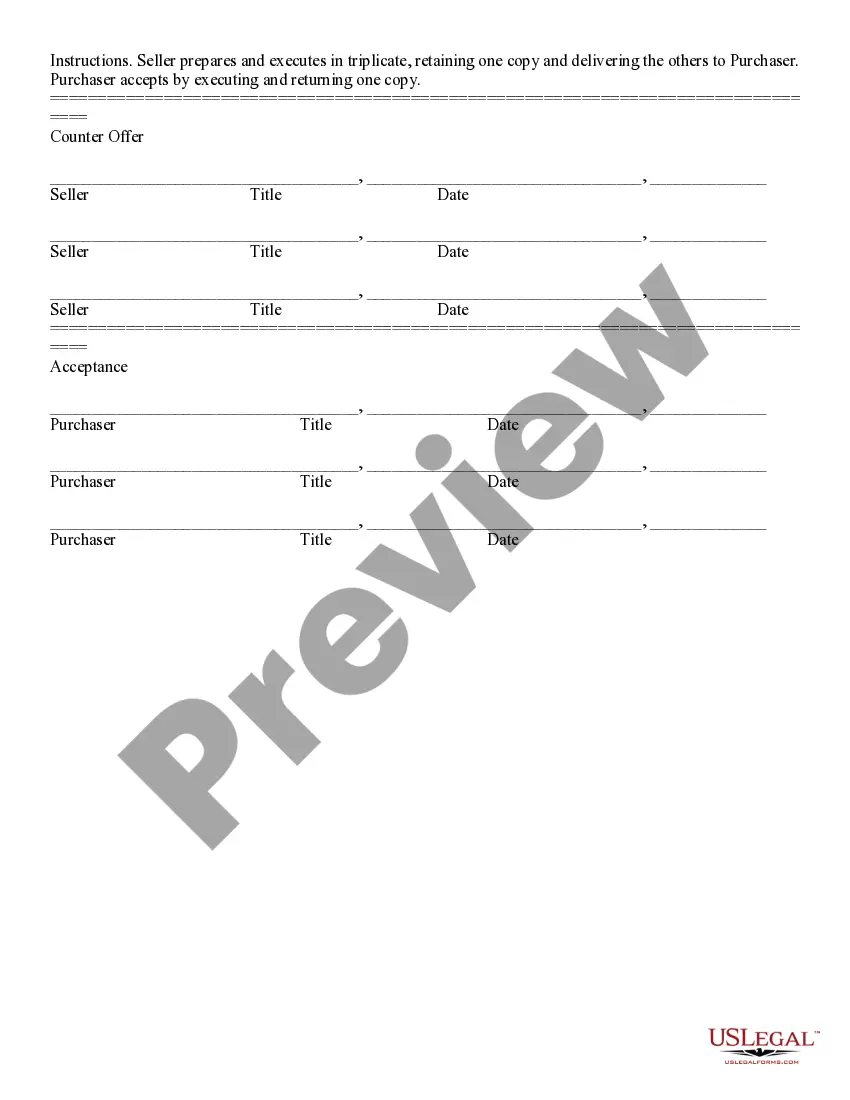

How to fill out Arizona Counter Offer To Purchase 3 - Residential?

- Log in to your US Legal Forms account. If you are a new user, create an account to get started.

- Browse through the extensive form library and use the Preview mode to understand the template. Ensure it fits your needs and complies with your state's regulations.

- If the current form doesn't suit your needs, use the search feature to find the specific document that meets your requirements.

- Select the document you wish to purchase by clicking the Buy Now button and choose the appropriate subscription plan.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Once the transaction is confirmed, download your form. You can access it anytime from the My Forms section in your account.

In conclusion, US Legal Forms streamlines your access to essential legal documents, empowering both individuals and attorneys to create precise and legally sound documents with ease. Take advantage of this powerful resource and simplify your real estate residence documentation today!

Start your journey with US Legal Forms now!

Form popularity

FAQ

Residence real estate refers to properties specifically designated for living purposes, including single-family homes, apartments, and townhouses. These spaces are designed to provide comfortable living environments and cater to a range of lifestyles. Understanding residence real estate gives you insight into your buying options and investment strategies.

Investing in residential real estate can often be a valuable decision due to the potential for property appreciation and rental income. Many people find that owning a residence creates stability and offers a sense of community. Evaluating your financial goals can help you determine if investing in a real estate residence aligns with your long-term plans.

The term 'residential' in real estate designates properties built for homeowners or tenants. It encompasses various types of dwellings, including single-family homes and multi-family units. Grasping what residential means helps you connect with the real estate residence that best fits your lifestyle and budget.

The primary difference lies in the type of properties they focus on. A commercial real estate agent deals with properties intended for business purposes, while a residential real estate agent works with homes where people live. Understanding this distinction is important as it can affect your interactions and expectations when navigating the real estate residence market.

In real estate, 'residential' refers to property designed primarily for people to live in. This includes homes, apartments, and condominiums. By understanding this definition, you can better navigate your options within the real estate market and find a real estate residence that suits your needs.

To make $100,000 your first year in real estate, focus on building a strong network and understanding your local market. Utilize social media, attend events, and connect with potential clients and other professionals. Consider leveraging tools from US Legal Forms, which can help you navigate contracts and legal documents effectively, allowing you to focus on closing deals for real estate residences.

The IRS rule for primary residence states that a home must be the primary living space for the taxpayer and their family. This status allows you to benefit from exclusions on capital gains taxes under certain conditions. To qualify, you usually need to live in the home for at least two out of the last five years. Familiarizing yourself with these rules can help you effectively manage your real estate residence.

Your primary residence is determined by where you live most of the time. The IRS evaluates factors such as the address on your tax returns, the location of your family, and where you register to vote. Understanding these criteria can help clarify your real estate residence status. Keeping accurate records will support your position should the IRS require documentation.

Yes, you must report the sale of your home to the IRS. If you sell your real estate residence and make a profit, it could potentially be subject to capital gains tax. However, there are exclusions available for primary residences. Engaging with platforms like uslegalforms can help you understand the reporting process and any available tax benefits.

The IRS considers several factors to determine your primary residence. These include where your family lives, where you spend most of your time, and the address you use for tax documents. The IRS collects information from various sources to validate your claims regarding your real estate residence. Staying organized with the correct paperwork can strengthen your position.