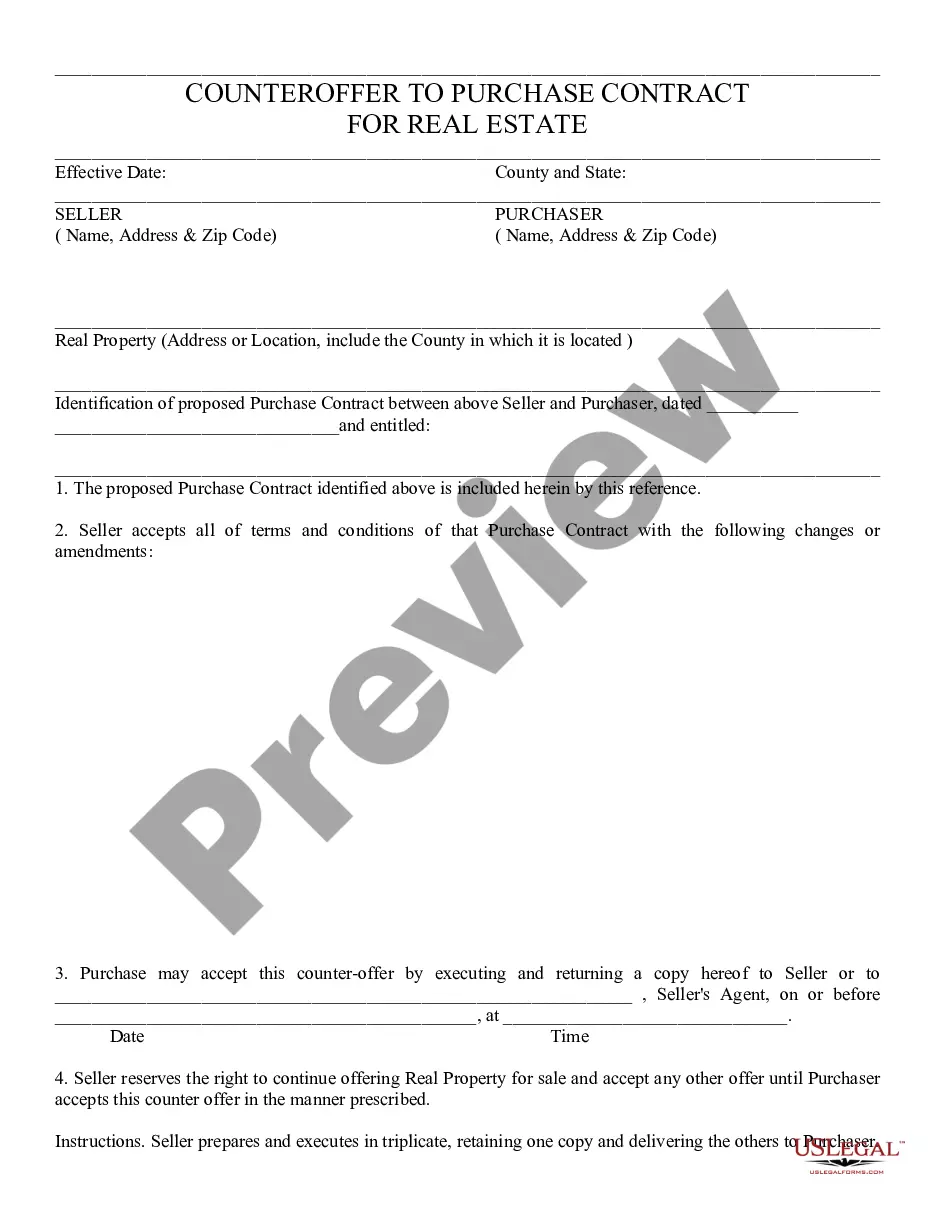

Counter Offer to Purchase 3 - Residential: A Counter Offer is used when the Purchaser and Seller are attempting to reach an acceptable price to both parties. The Purchaser offers an amount for the property in question; the Seller then gives this counter offer which states that he/she accepts the Purchaser's offer with an exception. If the Purchaser agrees to the exception, or counter offer, then he/she must sign the document in front of a Notary Public to accept. This form is available in both Word and Rich Text formats.

Purchase Real Estate With Ira

Description

How to fill out Arizona Counter Offer To Purchase 3 - Residential?

- Start by logging into your US Legal Forms account. If this is your first visit, you'll need to create an account to access the resources.

- Browse through the extensive form collection. Use the Preview mode to view details and ensure you select the correct document that fits your requirements and jurisdiction.

- If needed, leverage the Search feature to find alternative templates. Ensure you choose a form that fulfills your unique investment needs.

- Once you've identified the correct document, click the Buy Now button. Choose a subscription plan that suits your budget and needs.

- Complete your purchase using your credit card or PayPal account. Confirmation of your payment will be required to finalize the transaction.

- After the purchase, your document will be available in the My Forms section of your profile. Download it to your device, ready for use.

In conclusion, US Legal Forms not only simplifies the legal document process but also empowers you to confidently invest in real estate using your IRA. With a vast library and expert assistance, you can create legally sound documents tailored to your needs.

Get started today and streamline your real estate purchasing process with US Legal Forms!

Form popularity

FAQ

To borrow from your IRA without penalty, you need to consider specific scenarios like 60-day rollovers or certain hardship withdrawals. If you take a distribution and return the funds within 60 days, you avoid taxes and penalties. Alternatively, explore a self-directed IRA, which may allow for loans under specific conditions. Overall, it is essential to understand the rules surrounding IRAs to ensure you can utilize your funds effectively while adhering to IRS regulations.

When an individual passes away, their IRA becomes part of their estate, which means it must go through probate. The designated beneficiaries will inherit the IRA and will need to follow specific rules to manage the account. Depending on the type of IRA, beneficiaries may also have to make decisions about distributions. Planning ahead with tools like USLegalForms can simplify the inheritance process and provide clarity on the next steps.

To get real estate out of an IRA, you typically need to initiate a distribution. This process often involves liquidating the asset or transferring it to a different type of account. It's important to understand the tax implications, as distributions from an IRA can incur taxes and penalties. Using the right guidance can help you navigate this process smoothly and ensure compliance with IRS regulations.

To get real estate out of your IRA, you typically need to execute a process known as a distribution. This involves completing the necessary paperwork while ensuring compliance with IRS regulations. It’s crucial to understand the tax implications and potential penalties associated with this action. By using platforms like US Legal Forms, you can simplify the process of purchasing real estate with IRA funds, making your investment journey smoother.

You cannot buy a primary residence directly with your IRA for personal use. However, you can use your IRA to invest in real estate properties that may generate rental income. For a comprehensive understanding of how to maximize your retirement strategy, think about utilizing our platform, US Legal Forms, to find relevant resources and documentation.

It is against IRS rules to live in a house owned by your IRA. The property must remain an investment, and using it personally could lead to penalties. If you want to explore real estate investment further, consult experts who can guide you on how to leverage your IRA effectively.

Holding real estate in an IRA has several drawbacks. First, you cannot directly manage the property or use it personally, as it must remain an investment. Additionally, any income generated by the property could be subject to unrelated business income tax (UBIT), which may reduce the overall return on investment.