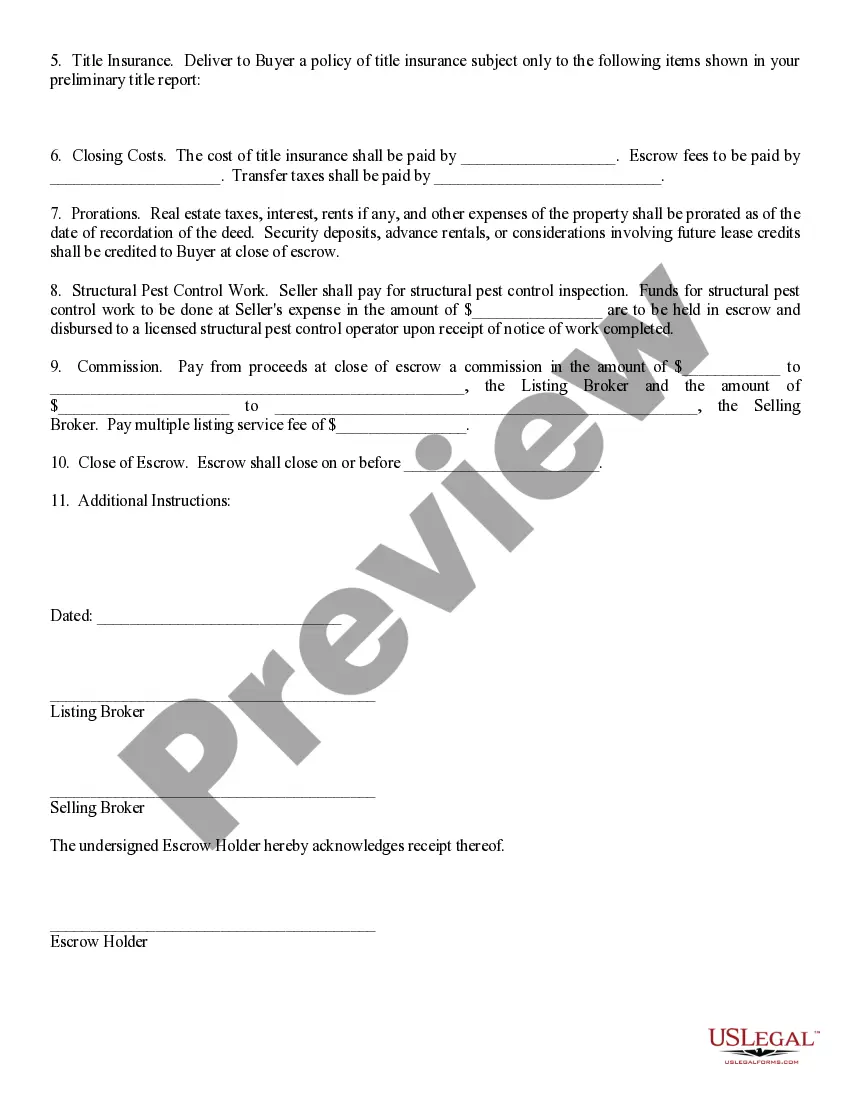

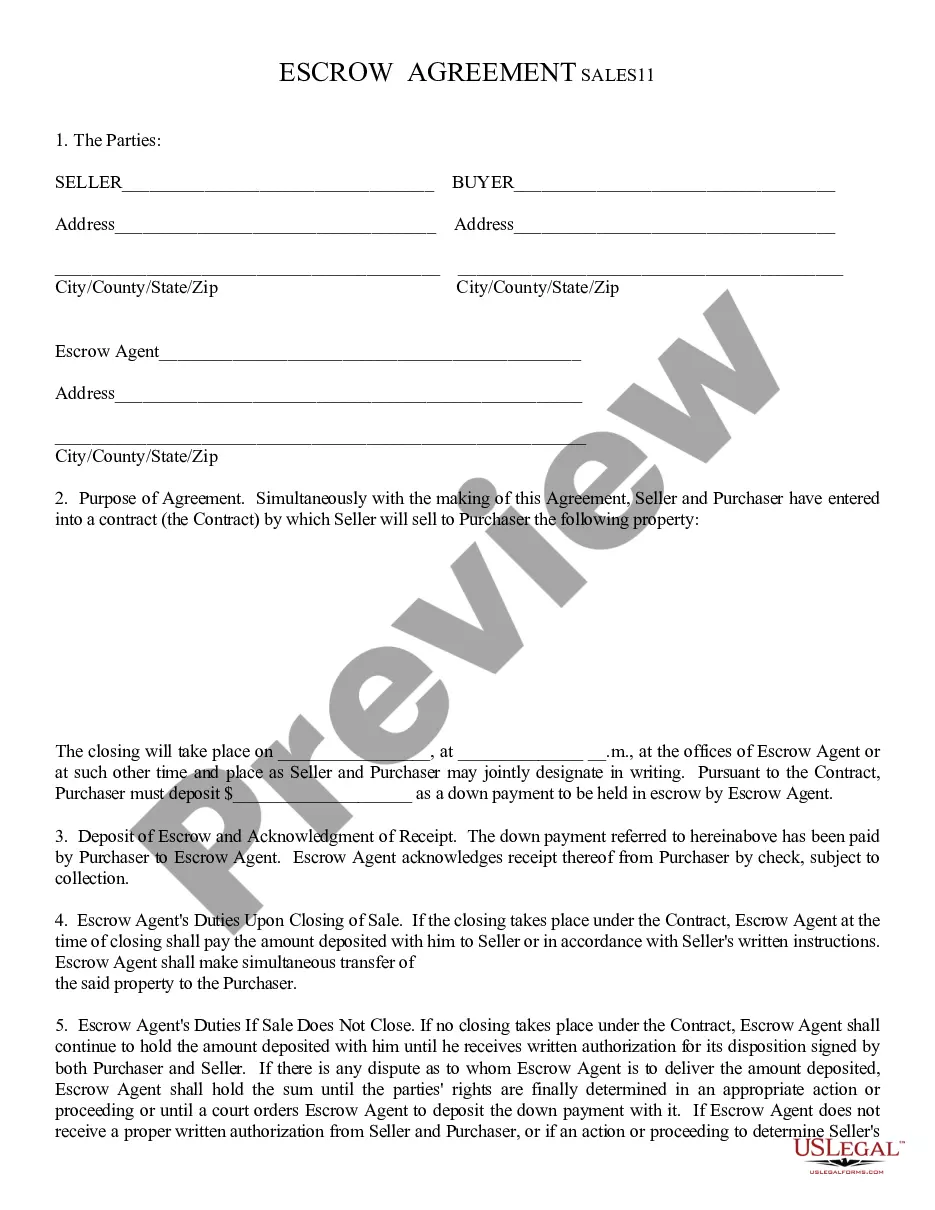

Escrow Instructions - Short Form: This document is a list of intructions when dealing with the escrow account, attached to the buying/selling of property. This form outlines the duties to be performed by the Buyer, Seller and Escrow Agent in conjunction with the buying and selling of the land or home. It is available for download in both Word and Rich Text formats.

Escrow Process

Description

How to fill out Arizona Escrow Instructions In Short Form?

- Log in to your US Legal Forms account if you've used it before, ensuring your subscription is active.

- If you're a new user, explore the comprehensive library of over 85,000 legal templates. Use the preview mode to view details of the form you need.

- Use the search feature to find any additional documents that may be relevant to your escrow agreement.

- Once you've found the right form, select the 'Buy Now' button and choose a suitable subscription plan.

- Complete your payment using a credit card or PayPal to access your legal documents.

- Download the form to your device, and you can always find it later in the 'My Forms' section.

The US Legal Forms service is designed to empower users, ensuring that legal documentation is quick and straightforward. With access to premium experts, you can also receive guidance on completing forms accurately.

Ready to take control of your escrow process? Visit US Legal Forms today and unlock the legal resources you need!

Form popularity

FAQ

To get your escrow, you need to contact the escrow company managing your account and request a full settlement statement. This document outlines the balance and any transactions that have occurred. If you believe there are discrepancies or have questions related to the escrow process, don't hesitate to communicate directly with them. Platforms like uslegalforms provide resources to help you understand rights and obligations within your escrow.

To become an escrow processor, you typically need to gain experience in real estate transactions and complete relevant training. Many find it helpful to start in a supporting role, such as an administrative assistant, and then progress to the escrow processing position. Certification programs and courses on the escrow process can further enhance your skills and knowledge. Additionally, networking in the real estate industry can open doors to opportunities.

Yes, you can set up your own escrow account, but it's crucial to follow legal guidelines. Many choose to work with an escrow service to ensure that funds are handled correctly according to the escrow process. If you opt to manage it yourself, be prepared to manage the responsibilities associated with tracking payments and documentation. Always ensure compliance with state regulations to protect all parties involved.

Yes, you can add escrow to your mortgage later on. This process typically involves reaching out to your lender and discussing the possibility of including escrow for property taxes and insurance payments. It's a great way to manage your expenses more predictably over time. Always consult with your lender to ensure you fully understand the escrow process and any potential changes to your mortgage agreement.

The close of escrow process finalizes all terms of the real estate transaction. During this phase, the escrow agent ensures that all financial obligations are satisfied, the signed documents are secured, and the escrow instructions are followed. Once completed, the deed is recorded in public records, officially transferring property ownership. Familiarizing yourself with this process can improve your overall transaction experience.

The closing process usually starts with the title search and ends with the signing of documents. Initially, the escrow agent will confirm that all conditions are met. Next, funds are transferred, and the seller provides the deed. Finally, the buyer receives possession of the property, and the escrow closes, marking a successful end to the escrow process.

The processes of escrow include opening the account, funding it, reviewing conditions, and verifying necessary documents. Throughout this time, the escrow agent facilitates communication between the buyer and seller, ensuring all requirements are met. Once all obligations are satisfied, the agent will move forward with the closing. This structured approach helps maintain a clear path to a successful transaction.

Closing escrow involves several key steps to finalize the transaction. First, the escrow agent gathers all necessary documents, including title insurance and closing statements. Next, funds are distributed to the seller, and the buyer receives the property title. Finally, the documents are recorded with the county, officially transferring ownership.

The escrow process typically consists of several key steps. First, the buyer and seller agree to terms and open an escrow account. Next, they submit required documents to the escrow agent, who verifies everything. The agent then disburses funds and records documents as agreed in the contract, completing the transaction. This systematic approach provides a clear pathway to success.

To simplify the escrow process, clear communication between the buyer, seller, and escrow agent is essential. Use technology, such as online platforms like uslegalforms, to ensure that all necessary documents are completed and submitted efficiently. Additionally, maintaining organization with deadlines and checklists can help prevent delays. A straightforward approach enhances the experience for everyone involved.