Tenancy Property Agreement With Right Of Survivorship

Description

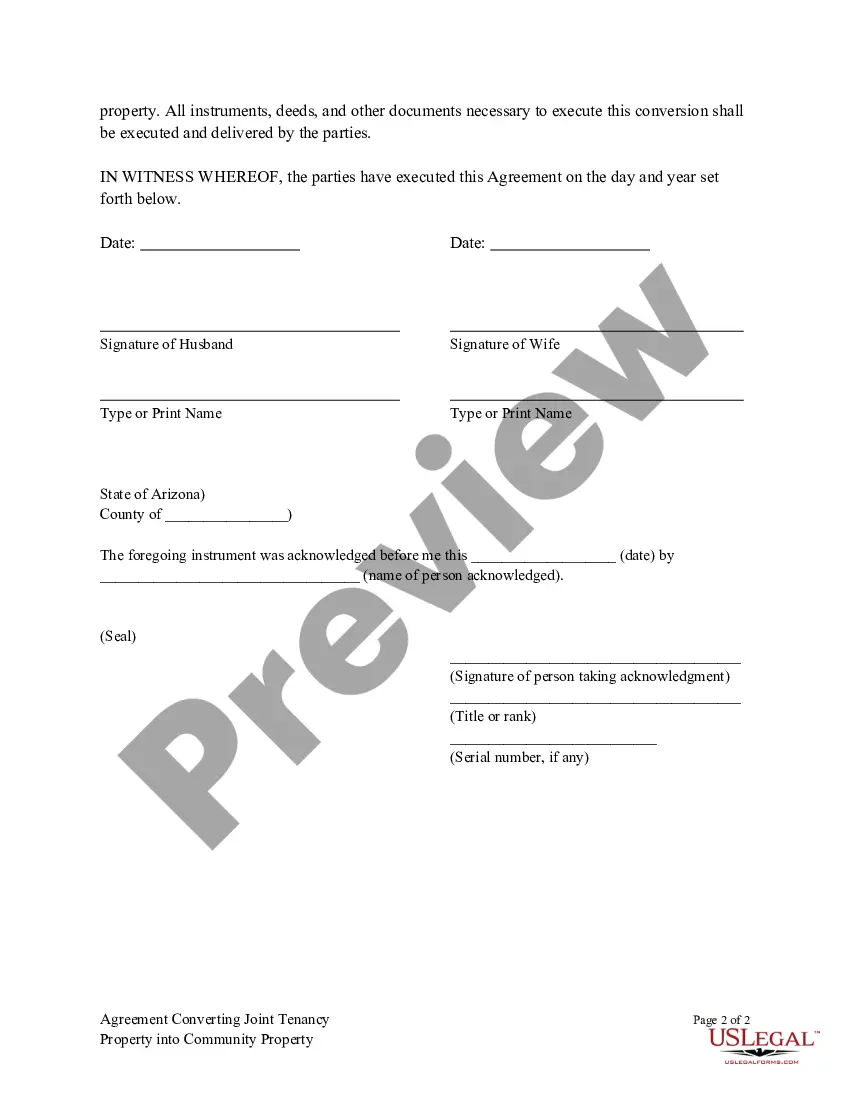

How to fill out Arizona Agreement Converting Joint Tenancy Property Into Community Property - Deed?

- Log in to your US Legal Forms account if you're an existing user and ensure your subscription is active. Download the required form by selecting the 'Download' button.

- If you are a first-time user, start by previewing the form and checking the description to confirm it's suitable for your needs and aligns with local jurisdiction requirements.

- If necessary, use the search bar to find any other relevant templates that may fit your requirements better.

- Once you find the right document, click on 'Buy Now' and select a subscription plan that works best for you.

- Proceed to make your payment using your credit card or PayPal account to complete the purchase.

- Finally, download the form to your device, allowing you to fill it out as needed. Access it anytime in your account under 'My Forms'.

By utilizing US Legal Forms, you can quickly and efficiently complete your tenancy property agreement with right of survivorship, ensuring peace of mind for you and your co-owner.

Start today by visiting US Legal Forms and empowering yourself with the right legal tools for a seamless property agreement process!

Form popularity

FAQ

The right of survivorship in New York allows co-owners to inherit each other's share of a property upon death. This concept is central to a tenancy property agreement with right of survivorship. It eliminates the need for probate, providing a seamless transfer of ownership. Understanding this right is crucial for effective estate planning.

No, the right of survivorship is not automatic in New York. It requires explicit designation in the tenancy property agreement. Without this designation, assets may go through probate upon one owner's death. Consult with a legal expert to clarify your ownership structure and ensure your intentions are documented.

In New York, husband and wife are not automatically joint tenants unless stated in the tenancy property agreement. You must explicitly indicate this form of ownership in your legal documents. Joint tenancy with right of survivorship offers specific benefits, such as bypassing probate. Always ensure your agreement reflects your ownership intentions.

To determine if you have the right of survivorship, review your tenancy property agreement. This agreement will typically specify the type of ownership shared between parties. If your document states that you are joint tenants, you usually have the right of survivorship. Always consider consulting with a legal professional if you're unsure.

Yes, the right of survivorship does override a will in the context of a tenancy property agreement with right of survivorship. When one tenant dies, their share automatically transfers to the surviving tenant, despite any contrary wishes expressed in a will. This automatic transfer can create complications in estate distribution, leading to misunderstandings among heirs. Therefore, utilizing a platform like USLegalForms can help you navigate these complexities and clarify your intentions.

One significant disadvantage of the right of survivorship within a tenancy property agreement is the potential for unintended inheritance. If an owner passes away, their share automatically goes to the surviving co-owner, bypassing their will or estate plans. This outcome can result in property distribution that does not align with the deceased's wishes. Thus, it's important to carefully consider how the right of survivorship impacts your estate planning.

The disadvantage of the right of survivorship in a tenancy property agreement with right of survivorship is that it can limit your control over your share of the property. If one owner passes away, the surviving owner automatically receives their interest without regard to any estate plans or claims from heirs. This can lead to unexpected outcomes, particularly if the deceased owner wanted their share to go to someone else. Therefore, it's essential to consider these implications before entering into such an agreement.

Setting up joint tenancy with right of survivorship requires careful consideration of the legal paperwork. First, you will need to create a tenancy property agreement with right of survivorship, clearly outlining that all parties are equal owners with rights of survivorship. You can utilize resources like USLegalForms to help you draft this agreement correctly, ensuring that it meets all legal requirements. It's important to file the agreement with your local land records office to make it official.

The step-up basis for a joint tenancy right of survivorship occurs when one owner of the property dies. In this case, the surviving owner receives an increase in the property’s tax basis to its fair market value at the time of death. This adjustment can help minimize capital gains taxes if the surviving owner decides to sell the property later. Understanding this can be an important aspect of your tenure, so consider including it in your tenancy property agreement with right of survivorship.

To create a joint tenancy with rights of survivorship, you must draft a tenancy property agreement with right of survivorship. This document should clearly state that you and your co-owners share equal ownership in the property, and it should specify the right of survivorship. By doing this, you ensure that if one owner passes away, their share automatically transfers to the surviving owner. It's advisable to consult a legal professional to ensure all necessary details are properly included.