Negotiable Promissory Note Withdrawal

Description

How to fill out Arizona Negotiable Promissory Note?

Whether you frequently handle documents or need to occasionally submit a legal report, it's crucial to have access to a resource that includes all relevant and current samples.

One essential step when dealing with a Negotiable Promissory Note Withdrawal is to ensure you have the most recent version, as this determines its eligibility for submission.

If you wish to simplify your search for the most up-to-date document samples, consider looking for them on US Legal Forms.

To acquire a form without creating an account, follow these steps: Use the search menu to locate the form you need. Review the preview and description of the Negotiable Promissory Note Withdrawal to confirm it's the correct one you seek. After verifying the form, simply click Buy Now. Select a subscription plan that suits you, then register for an account or Log In to your existing one. Input your credit card information or PayPal account to complete the purchase. Choose the desired file format for download and confirm your choice. Say goodbye to the confusion associated with legal documents. With a US Legal Forms account, all your templates will be systematically arranged and validated.

- US Legal Forms is a comprehensive library of legal documents that contains nearly any document sample you might need.

- Search for the templates you need, assess their relevance immediately, and learn more about their intended use.

- With US Legal Forms, you gain access to over 85,000 form templates across various fields.

- Retrieve the Negotiable Promissory Note Withdrawal samples with just a few clicks and store them in your account whenever necessary.

- Having a US Legal Forms account enhances your experience by giving you swift and convenient access to all required samples.

- All you need to do is click Log In on the website header and navigate to the My documents section where all your needed forms will be readily available.

- This way, you won't waste time searching for the perfect template or verifying its accuracy.

Form popularity

FAQ

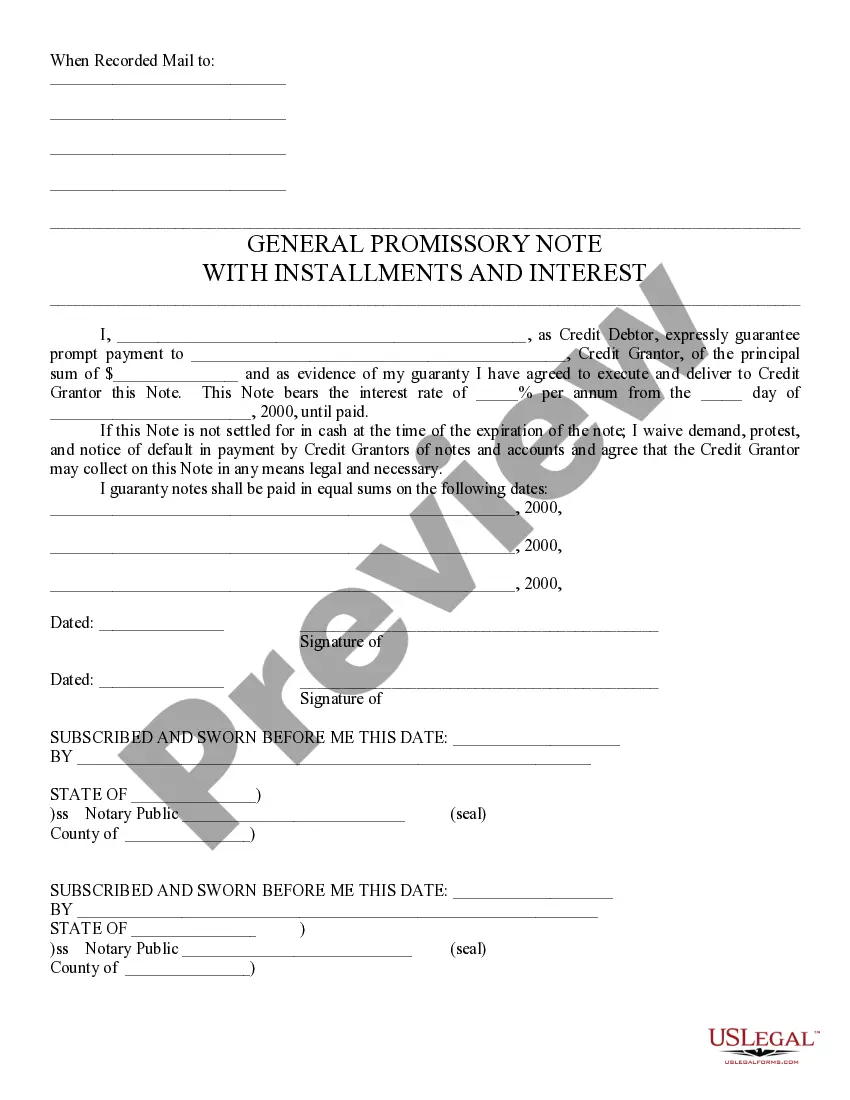

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A negotiable promissory note is unconditional promise made in writing by one person to another to pay on demand to the payee, or at fixed or ascertainable future time, sum certain in money, to order or to bearer. These notes are governed by the Uniform Commercial Code.

Cash equivalents include all undeposited negotiable instruments (such as checks), bank drafts, money orders and certain certificates of deposit. IOUs and notes receivable are not included in cash.

The Negotiable Instruments (Amendment) Bill, 2017 The bill defines the promissory note, bill of exchange, and cheques. The bill also specifies the penalties for dishonor of cheques and various other violations related to negotiable instruments.

Types of Negotiable InstrumentsPersonal checks. Personal checks are signed and authorized by someone who deposited money with the bank and specify the amount required to be paid, as well as the name of the bearer of the check (the recipient).Traveler's checks.Money order.Promissory notes.Certificate of Deposit (CD)