Az Inheritance Laws

Description

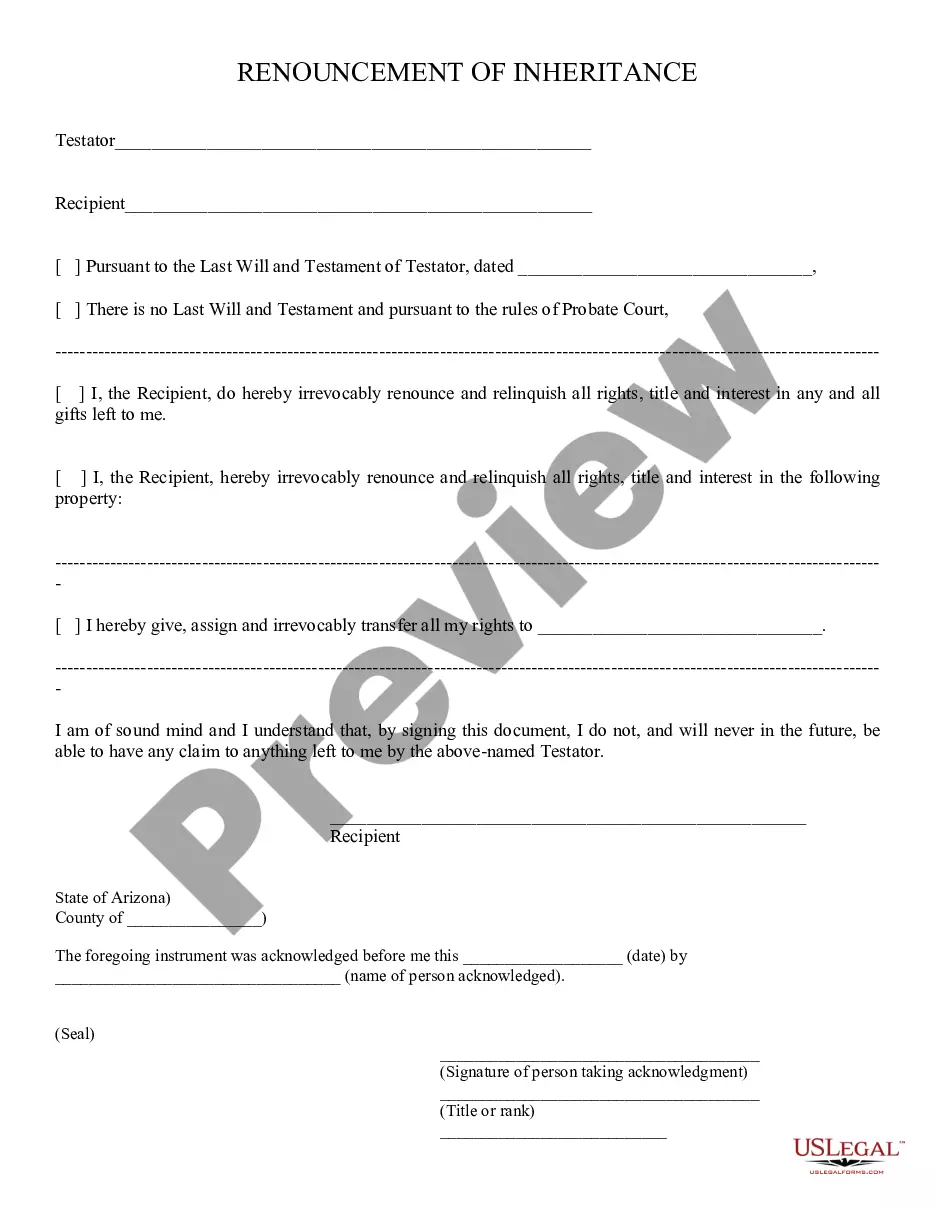

How to fill out Arizona Renouncement Of Inheritance?

Legal document management can be overwhelming, even for experienced specialists. When you are searching for a Az Inheritance Laws and do not get the time to spend searching for the appropriate and updated version, the procedures might be stressful. A robust online form catalogue can be a gamechanger for anyone who wants to deal with these situations successfully. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any requirements you might have, from individual to enterprise documents, in one location.

- Use innovative resources to accomplish and deal with your Az Inheritance Laws

- Gain access to a resource base of articles, guides and handbooks and resources highly relevant to your situation and requirements

Save effort and time searching for the documents you need, and employ US Legal Forms’ advanced search and Review tool to find Az Inheritance Laws and get it. For those who have a membership, log in to the US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the documents you previously downloaded as well as to deal with your folders as you see fit.

Should it be your first time with US Legal Forms, make a free account and obtain unrestricted access to all advantages of the library. Here are the steps to consider after accessing the form you want:

- Confirm this is the right form by previewing it and reading its description.

- Ensure that the sample is accepted in your state or county.

- Pick Buy Now when you are all set.

- Select a subscription plan.

- Find the file format you want, and Download, complete, eSign, print and deliver your document.

Enjoy the US Legal Forms online catalogue, supported with 25 years of experience and stability. Enhance your day-to-day document management in a smooth and intuitive process right now.

Form popularity

FAQ

Who Gets What in Arizona? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no descendantsspouse inherits everythinga spouse and descendants from you and that spousespouse inherits everything3 more rows

Spouses in Arizona Inheritance Laws In nearly all scenarios, Arizona will allow the spouse of the deceased to inherit his or her full intestate estate. More specifically, this applies either to a marriage where neither partner had children or where all the children in the picture they had together.

Arizona's intestate succession laws dictate the distribution of a person's estate assets if they die without a valid will. The intestacy laws state that the decedent's spouse and other heirs, as determined by state law, are entitled to inherit any portion of the estate not covered by the decedent's will.

In Arizona, intestate succession laws give preference to the decedent's spouse and children. If the decedent does not have a spouse or children, the decedent's parents, siblings, and extended family may be entitled to portions of the estate.

There is no inheritance tax in Arizona. If you have a loved one who lives in another state, however, you should check the local laws. Pennsylvania, for instance, as an inheritance tax that can apply to out-of-state heirs. Arizona also has no gift tax.