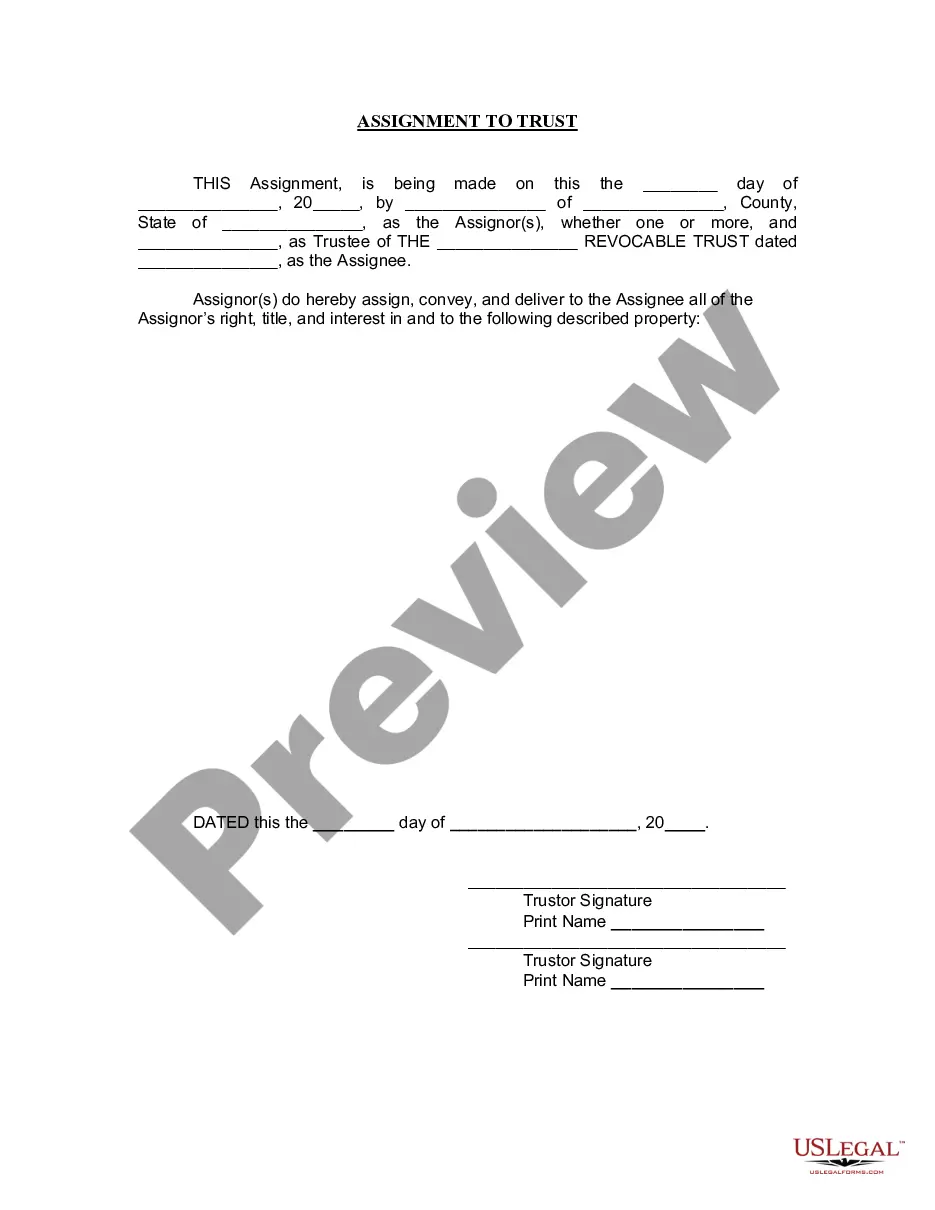

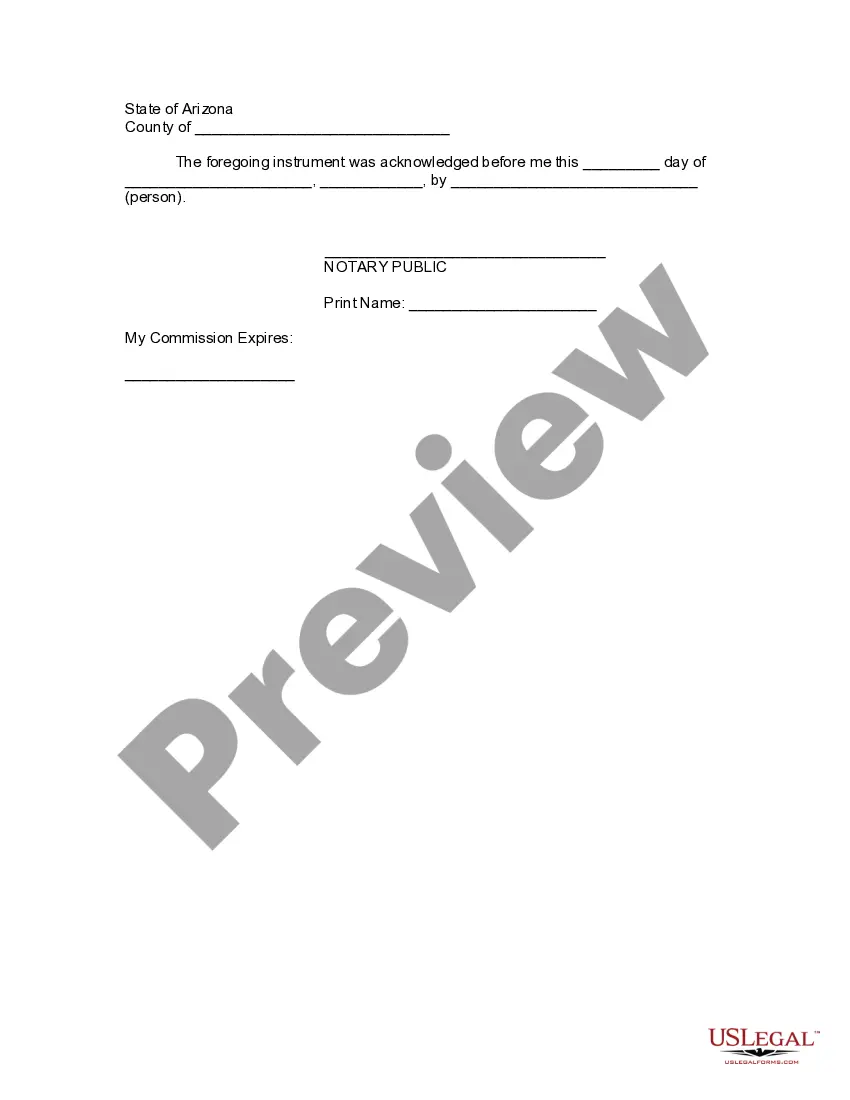

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Assignment Of Living Trust Form

Description

Form popularity

FAQ

The best way to create a living trust is to follow a structured approach: first, gather your assets, then complete the Assignment of living trust form, and finally, fund your trust by transferring assets into it. Each step is crucial to ensuring that your wishes are accurately carried out. You can also seek guidance from legal professionals or utilize tools from US Legal Forms, which provides resources to streamline the creation of your living trust efficiently. This way, you can feel confident that you are setting up your living trust correctly.

To establish a living trust, you typically need the Assignment of living trust form, a trust declaration, a property transfer deed, and an inventory list of assets. These documents help outline your intentions and ensure your assets are managed as you wish. Using the Assignment of living trust form simplifies the process and clearly defines how your assets will be distributed. If you're unsure about the forms needed, consider using US Legal Forms for step-by-step guidance and reliable templates.

While living trusts offer benefits like avoiding probate, they come with some downsides. Setting up a living trust can involve upfront legal costs and time to manage asset transfers. Additionally, your assets may not have protections against creditors unless structured properly. By understanding these aspects, you can confidently engage with the Assignment of living trust form and ensure that it aligns with your overall estate planning strategy.

Filling out a living trust requires thoughtful and precise documentation. First, gather all necessary information about your assets and their values. When you complete the Assignment of living trust form, ensure that you accurately list beneficiaries and specify how assets will be distributed after your passing. This clarity will help prevent confusion or disputes among survivors, streamlining the distribution process.

To place your assets in a living trust, start by identifying all the assets you wish to include. Next, you will create or draft your living trust document and explicitly transfer ownership of your assets, such as real estate and bank accounts, into the trust. Ensuring that the Assignment of living trust form is completed correctly is crucial during this process to ensure all assets are effectively retitled to the trust. Doing so can help you manage your estate efficiently.

The 5 year rule often pertains to Medicaid eligibility and involves look-back periods for when assets were transferred to trusts. If you establish a trust, any assets placed within it may affect your eligibility for benefits if transferred within five years of applying. This rule underscores the importance of careful planning and timing with your estate, particularly when preparing the Assignment of living trust form. Consulting with experts can help you navigate these regulations.

While many assets can be placed in a trust, certain assets require special handling. For instance, retirement accounts and life insurance policies generally should not be placed directly in a trust due to tax implications. It is essential to keep these assets outside the trust and designate the trust as a beneficiary instead. Understanding the nuances of asset placement can simplify your estate planning when you utilize the Assignment of living trust form.

Assigning assets to a trust involves transferring ownership through the assignment of living trust form. This form clearly establishes which assets belong to the trust, ensuring they are managed under its terms. It’s essential that your parents review their assets and make the necessary assignments accurately to avoid complications.

A family trust can have downsides, including the potential for family conflict over asset distribution. If not structured properly, using the assignment of living trust form may lead to disagreements among family members. Regular communication and clear instructions can help mitigate these issues.

Setting up a trust can have pitfalls, such as incurring unnecessary costs and taxes if not managed wisely. Furthermore, there’s the risk of incomplete documentation with the assignment of living trust form, which can create confusion later. It's important to approach trust setup with thorough research and, if needed, professional assistance.