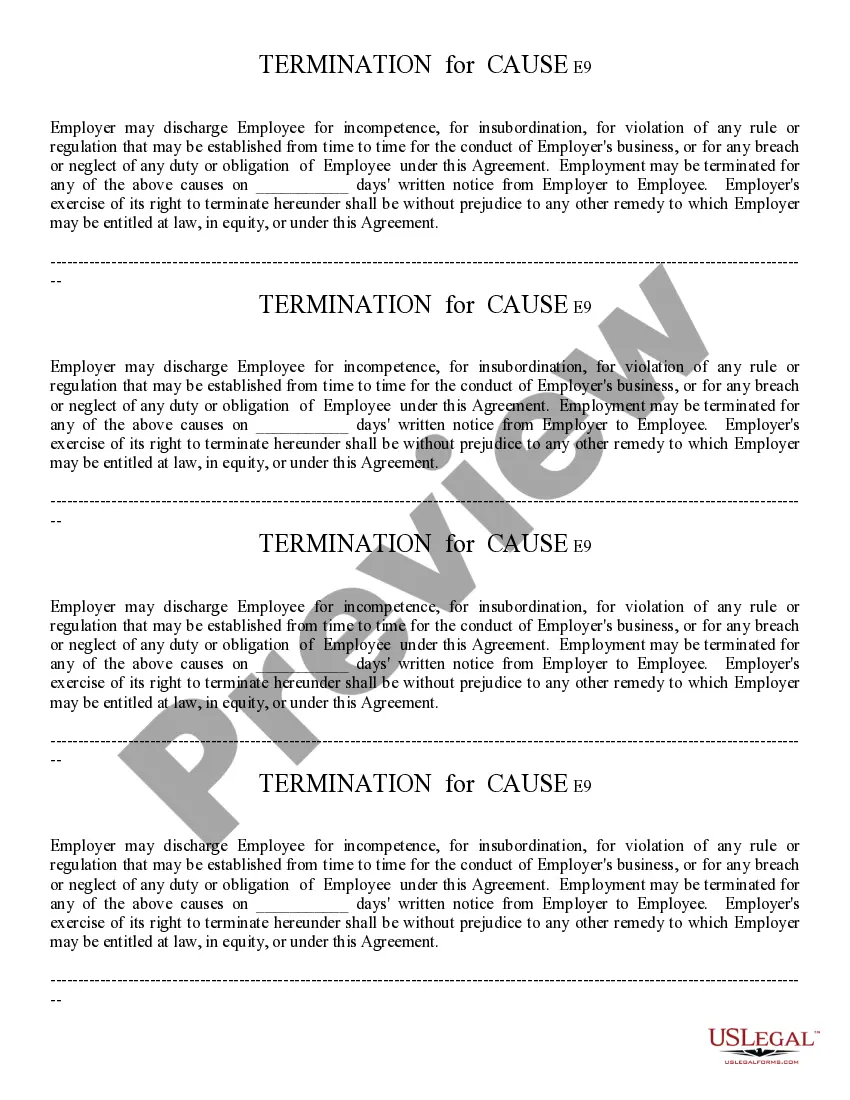

Termination Of Employee Example

Description

How to fill out Arizona Termination By Employer At Will?

It’s clear that you cannot instantly become a legal expert, nor can you swiftly learn how to create a Termination Of Employee Example without possessing a distinct set of abilities. Assembling legal documents is a lengthy process that necessitates particular training and expertise. So why not entrust the construction of the Termination Of Employee Example to the professionals.

With US Legal Forms, one of the most extensive legal document libraries, you can access everything from court documents to templates for internal communication. We understand how important compliance and adherence to federal and state laws and requirements are. That’s why, on our platform, all documents are location-specific and current.

Here’s how to get started on our website and acquire the document you need in just a few minutes.

- Find the form you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if Termination Of Employee Example is what you seek.

- Begin your search anew if you’re after a different template.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the purchase is finalized, you can obtain the Termination Of Employee Example, complete it, print it, and send it or mail it to the necessary individuals or entities.

Form popularity

FAQ

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

One way to do this is to check online by visiting ilsos.gov. You will need your driver's license and the date of issuance. There is a cost of $12 (plus a payment processor fee) to get your records online.

What is a Notice of Proposed Tax Due? The Notice of Proposed Tax Due (ITR-61-G and ITR-61-S) is the first notification issued regarding an examination of a tax return. This notice is issued if the information we have available indicates there is a potential tax due and includes information on when and how to respond.

From issuing driver's licenses and registering vehicles, to promoting organ/tissue donation awareness, overseeing the Illinois State Library and administering the state's literacy efforts, the Secretary of State's office directly touches the lives of nearly everyone in Illinois.

The Secretary of State's office mails a renewal letter to State ID Card holders 60 to 90 days prior to the expiration of your State ID card. The renewal letter is mailed to the address our office has on file for the State ID Card. The letter contains the information needed to renew your State ID Card online.