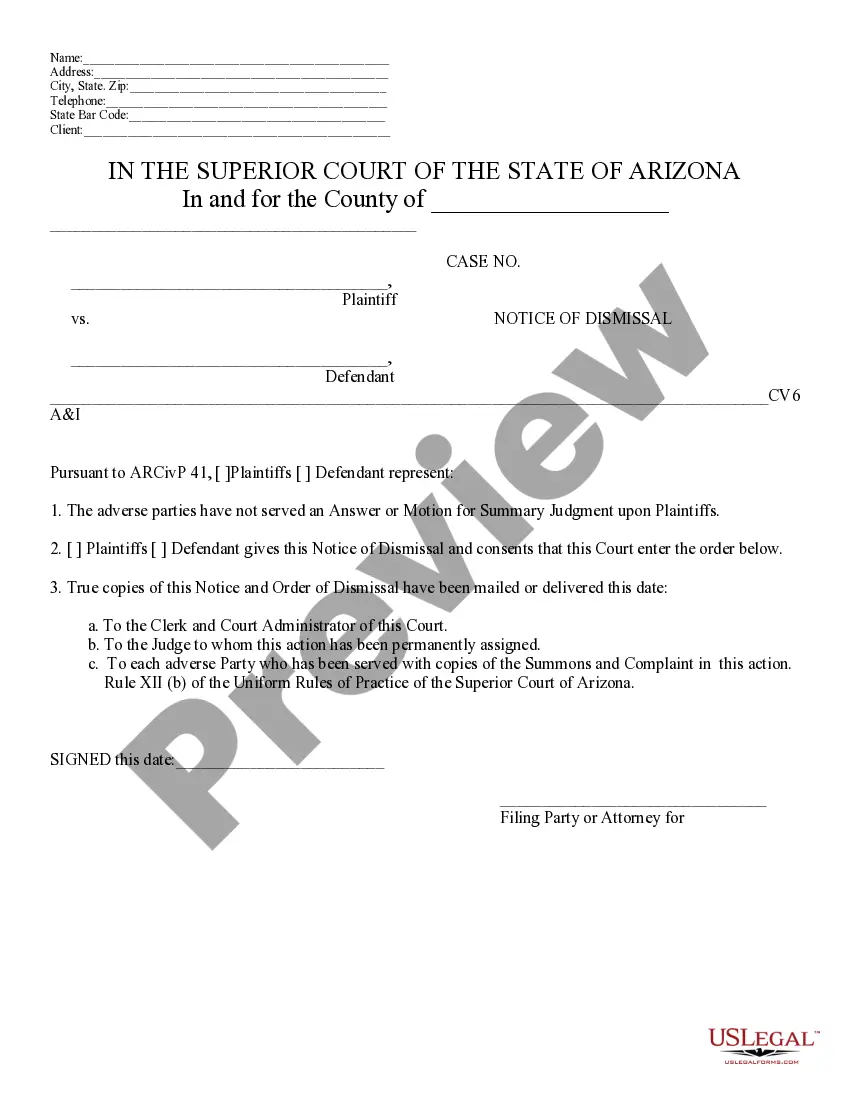

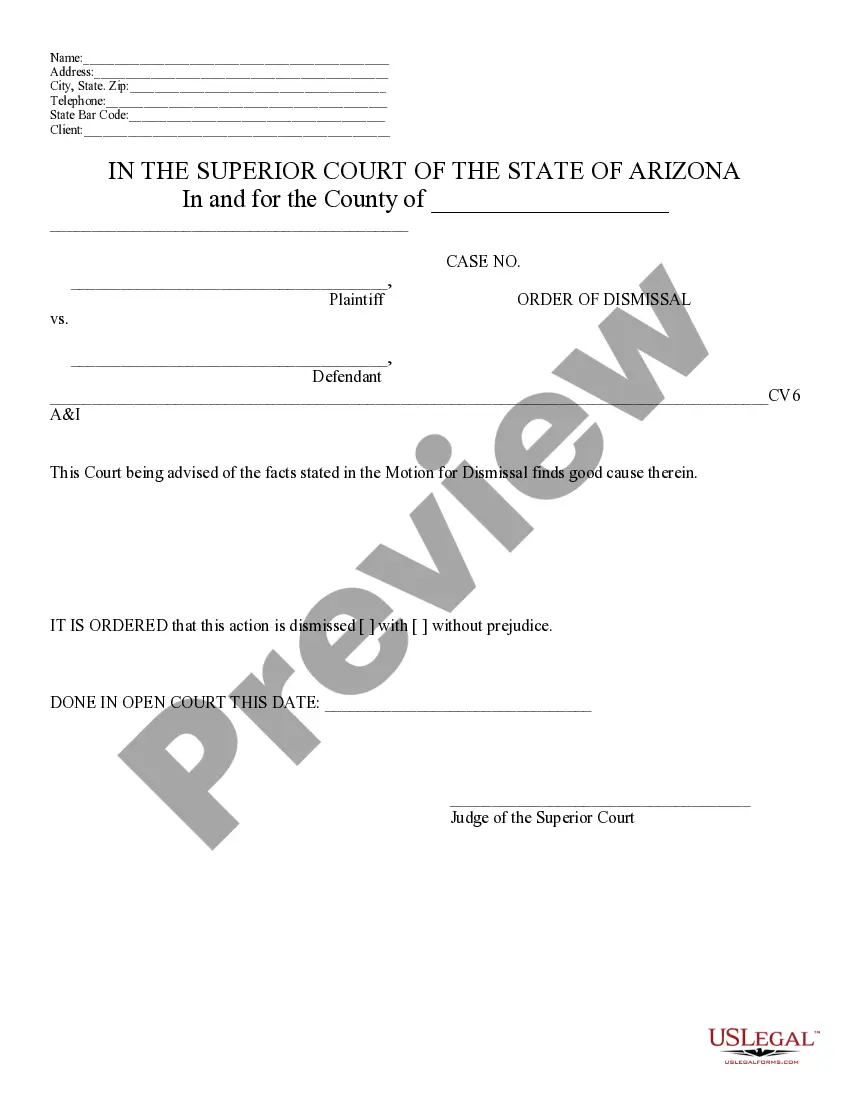

Motion for Dismissal: This is a motion which asks the court to dismiss a particular cause of action. The document must include the reasoning behind wanting the dismissal, as well be signed in front of a Notary Public. Also included, is a sample Order Granting Dismissal. This would be signed by the Judge and filed with the clerk's office. This form is available in both Word and Rich Text formats.

Arizona Dismissal Purchase Withholding

Description

How to fill out Arizona Motion For Dismissal?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of dealing with bureaucracy. Finding the right legal documents calls for precision and attention to detail, which explains why it is vital to take samples of Arizona Dismissal Purchase Withholding only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the details about the document’s use and relevance for your situation and in your state or county.

Consider the following steps to complete your Arizona Dismissal Purchase Withholding:

- Utilize the library navigation or search field to locate your sample.

- Open the form’s description to check if it suits the requirements of your state and region.

- Open the form preview, if available, to make sure the template is definitely the one you are searching for.

- Go back to the search and look for the appropriate document if the Arizona Dismissal Purchase Withholding does not match your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Select the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by selecting a payment method (bank card or PayPal).

- Select the file format for downloading Arizona Dismissal Purchase Withholding.

- When you have the form on your gadget, you may alter it using the editor or print it and complete it manually.

Get rid of the inconvenience that accompanies your legal paperwork. Explore the extensive US Legal Forms catalog to find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Beginning in 2023, Arizona is doing away with a progressive tax system and instead applying a flat tax rate of 2.5% on taxable income. This tax rate will apply to income earned throughout 2023 that is reported on returns filed in 2024.

Enter your annual gross taxable wages, the number of paychecks you receive each year, your annual withholding goal, the amount already withheld for this year, the number of paychecks remaining in this year, and select the largest percentage on line 10 that is less than line 9.

The Arizona Department of Revenue has announced that a revised Form A-4 applies effective January 31, 2023, to take into account the new flat tax of 2.5% effective January 1, 2023 under SB 1828. (See EY Tax Alert 2022-1645.)

The employer should select 2.0% on behalf of the employee. The new default Arizona withholding rate is 2.0%.

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.