Real Estate With A Rebate

Instant download

Description

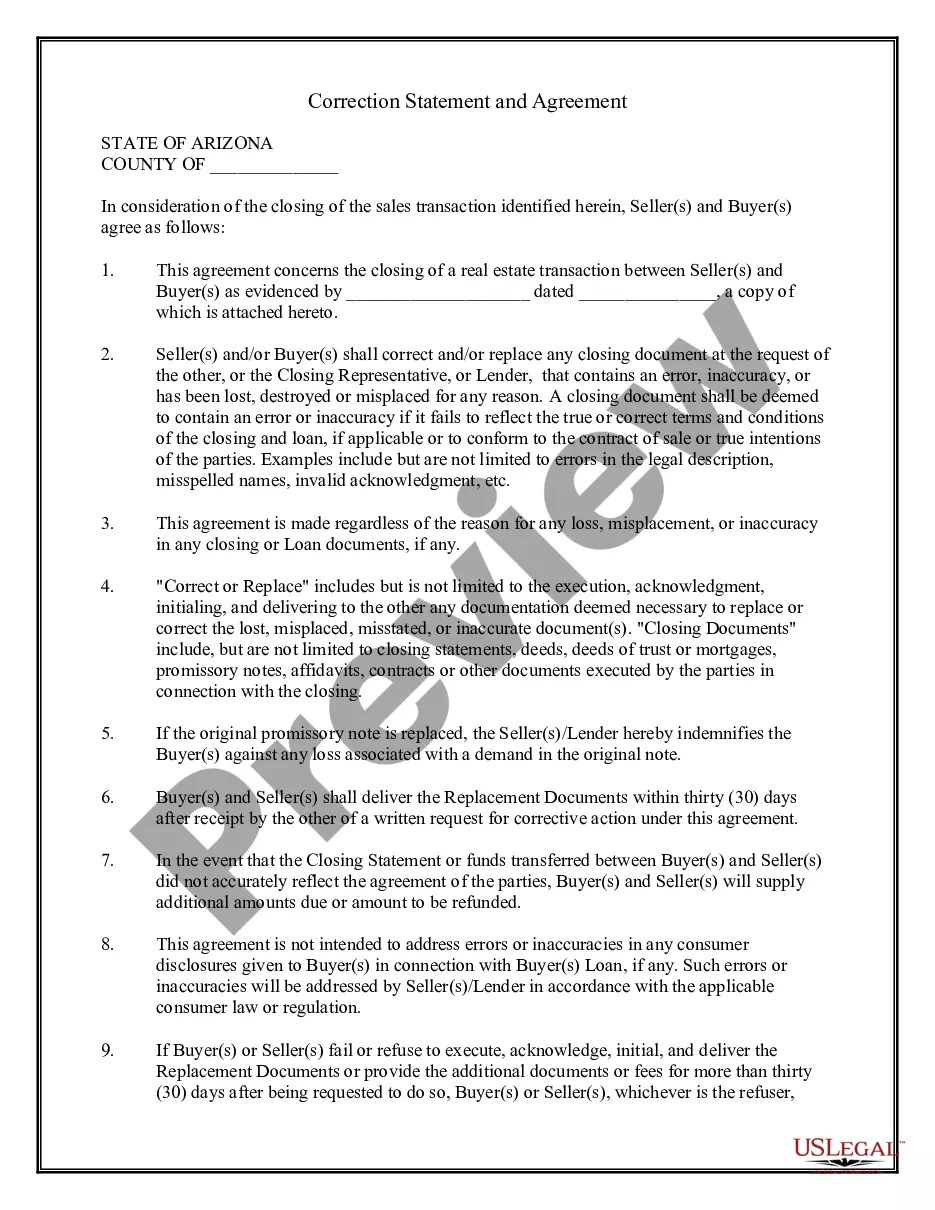

The Correction Statement and Agreement form is a critical document in real estate transactions that provides a structured process for correcting errors or inaccuracies in closing documents. This form is tailored for parties involved in a real estate transaction, specifically emphasizing the mutual obligations of sellers and buyers in recognizing and addressing discrepancies. Key features include the obligation to correct or replace closing documents within thirty days of a written request and the definition of what constitutes an error, such as misspelled names or incorrect legal descriptions. The form ensures that all parties are indemnified against losses linked to the original promissory note under specific circumstances. Utility for the target audience includes enhancing organizational efficiency, minimizing disputes, and ensuring compliance with legal requirements. Attorneys can utilize this form to safeguard client interests and streamline the correction process, while paralegals and legal assistants may find it essential for maintaining accurate records. Partners and owners benefit from a clear understanding of their liabilities, and associates can leverage the form to facilitate smoother transactions, overall strengthening the real estate process.

Free preview

Form popularity

FAQ

A rebate in real estate is a specific return of a part of the real estate agent’s commission to the buyer. This practice helps reduce closing costs and makes homes more accessible to buyers. Real estate with a rebate enables you to invest your savings in other areas like renovation or moving expenses. It’s a practical approach for those looking to maximize their investments.

Yes, commission rebates can be considered taxable income in Canada. This means that if you receive a rebate on your real estate transaction, you may need to report it on your tax return. To navigate this process, you can consult resources or platforms like US Legal Forms to clarify tax implications related to real estate with a rebate.