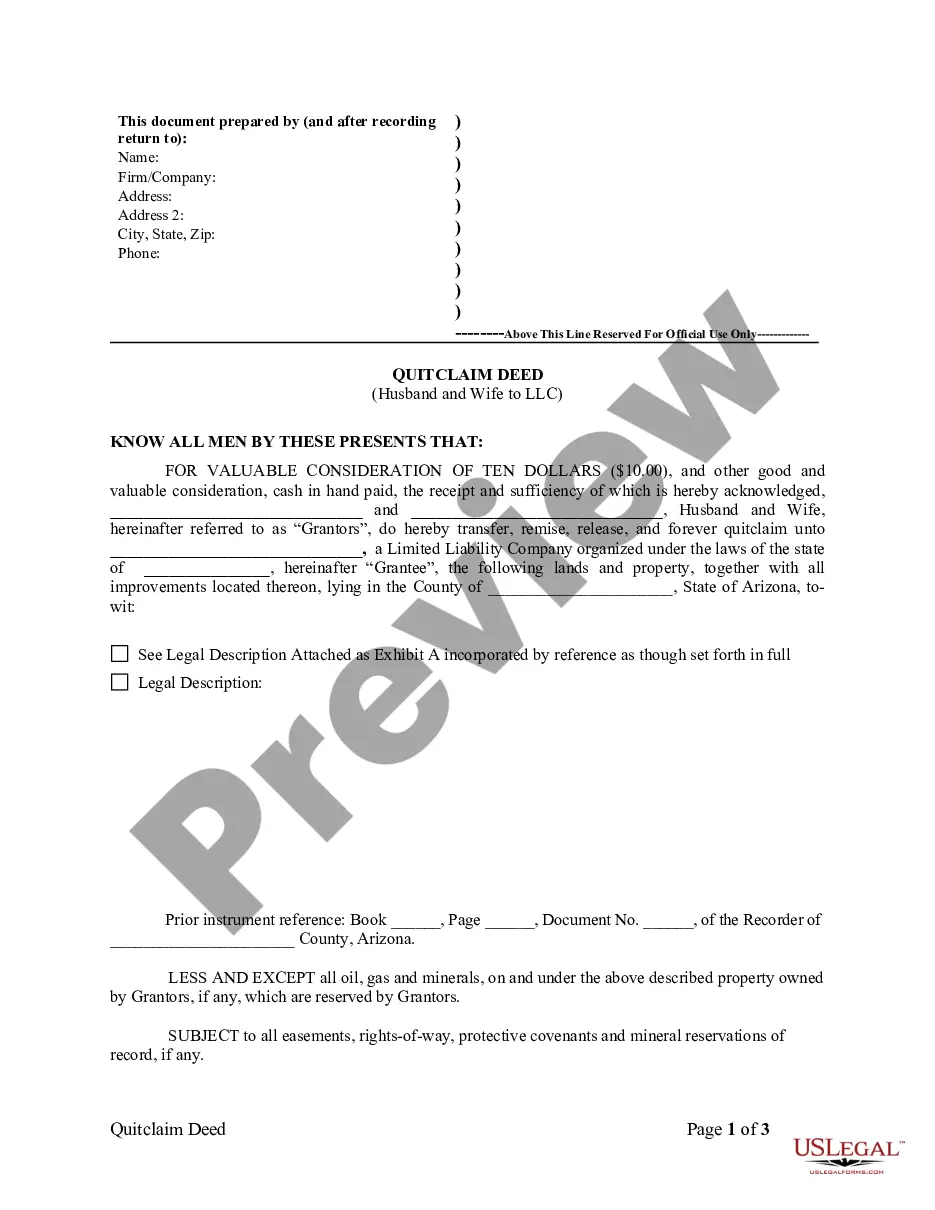

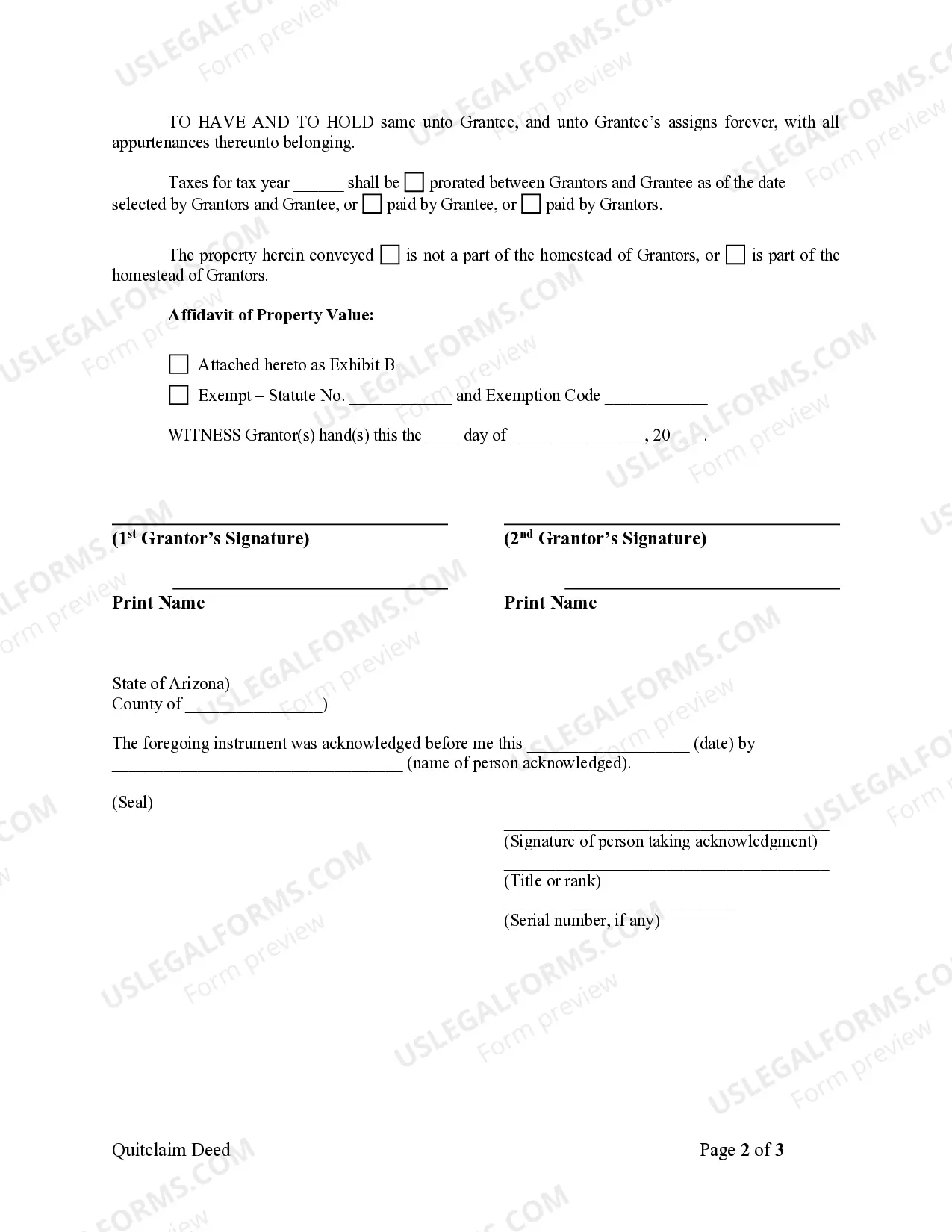

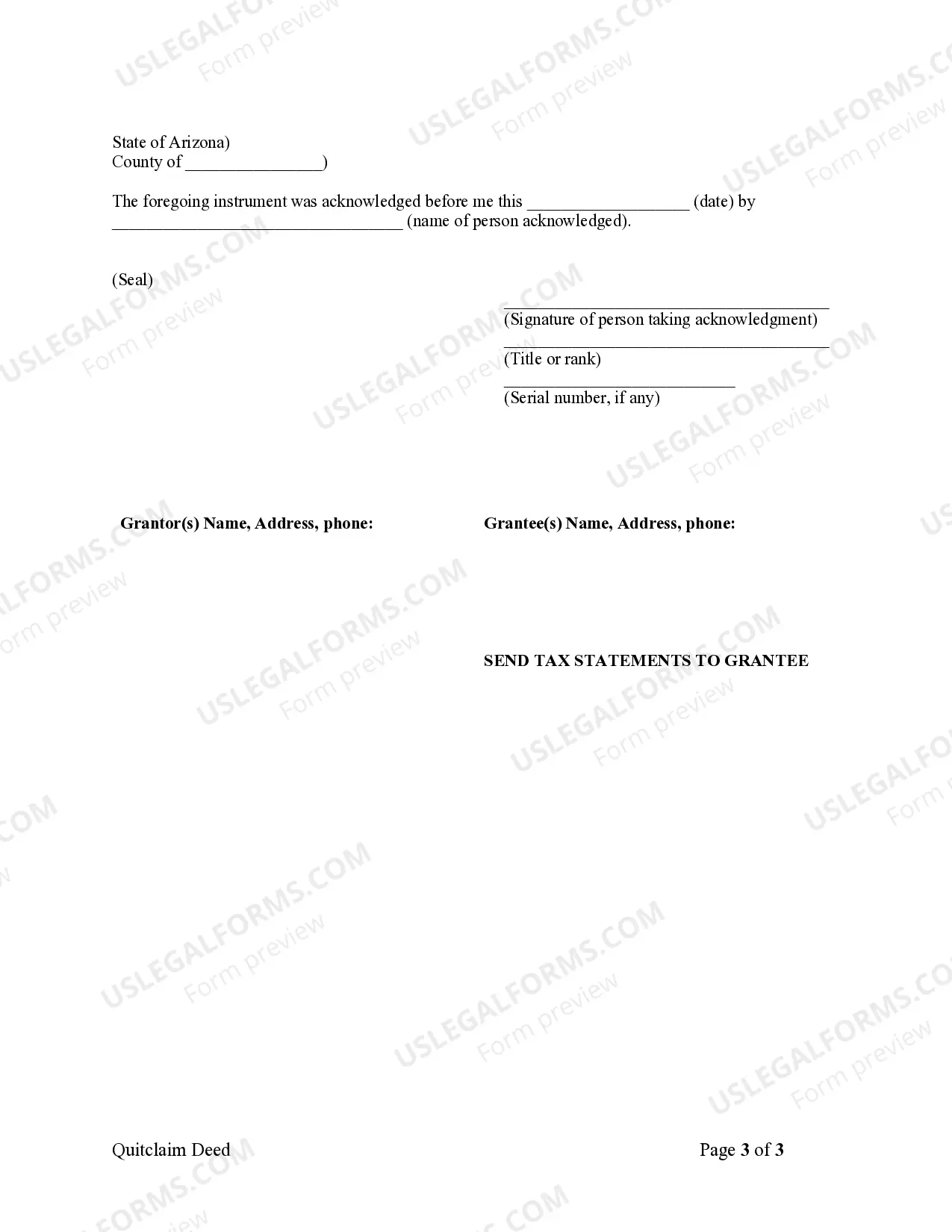

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Limited Liability Company For Dummies

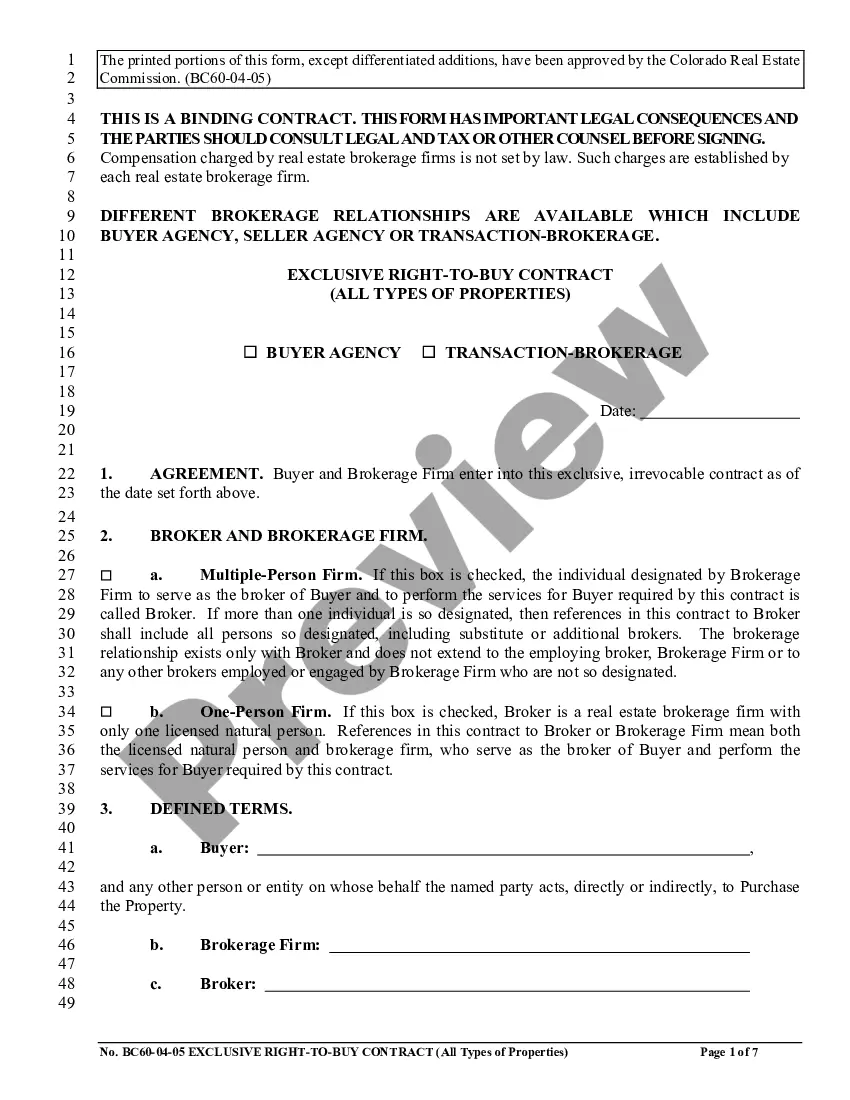

Description

How to fill out Arizona Quitclaim Deed From Husband And Wife To LLC?

- If you're a returning user, log in to your account and access the template by clicking the Download button. Ensure your subscription is active or renew it as needed.

- For first-time users, start by reviewing the Preview mode and form description. This helps confirm you’ve selected the correct document for your local regulations.

- If the template isn't suitable, utilize the Search tab to find an alternative that aligns with your requirements.

- Once you find the right document, click on the Buy Now button to select your preferred subscription plan. Registration is necessary to access the entire library.

- Proceed with your purchase by entering your payment information via credit card or PayPal.

- Finally, download the template to your device for completion, which you can also retrieve later via the My Forms section of your account.

Utilizing US Legal Forms not only makes the LLC establishment process simpler but also ensures that your documents are legally sound. With over 85,000 forms available, it is a reliable resource.

Start your journey towards establishing your LLC today by visiting US Legal Forms and take advantage of their expert assistance!

Form popularity

FAQ

Writing an LLC example involves straightforward steps. Begin by selecting a business name, such as 'Effective Marketing LLC', and clearly place 'LLC' at the end. This clear format signifies your business type and structure. For further guidance on the legal requirements, you can rely on USLegalForms to navigate through the documentation process effectively.

To write an LLC example, simply take a business name you like and add 'LLC' at the end. For example, 'Creative Solutions LLC' serves as a straightforward illustration. This practice helps ensure that your intended name reflects your business structure accurately. It's practical to consult USLegalForms if you need assistance with name availability checks.

An example of an LLC name could be 'Best Gadgets LLC'. This clearly indicates a business offer alongside the LLC designation. Remember that the name should be unique and not already in use by another registered entity in your state. Finding the right name can be made easier by checking resources like USLegalForms, which provide helpful tools.

In simple terms, an LLC, or Limited Liability Company, is a type of business structure that protects personal assets. This means that if the business incurs debt or faces lawsuits, your personal property usually cannot be affected. Think of it as a shield that separates your personal finances from your business dealings. For those looking to learn more, the 'Limited liability company for dummies' approach offers valuable insights.

An LLC is properly written by placing 'LLC' directly after the company's name, without any additional punctuation or abbreviations. For example, 'Your Business Name LLC' is correct and plainly indicates your business structure. Following this format is crucial for legal documentation and public recognition. Remember, using USLegalForms can assist you in adhering to proper writing guidelines.

When writing LLC correctly, remember to use 'LLC' after your business name. For instance, if your business name is 'Sample Business', it should appear as 'Sample Business LLC'. It’s important to follow your state's specific guidelines regarding the use of this designation. This clarity ensures your business operates within legal parameters.

Filing taxes for an LLC can be straightforward with the right guidance. Essentially, the limited liability company for dummies must determine how it will be taxed—whether as a sole proprietorship, partnership, or corporation. Understanding these classifications allows owners to file appropriate tax forms. Leveraging services like US Legal Forms can provide the necessary resources to simplify filing taxes for your LLC.

Yes, you can file your LLC on your own. The limited liability company for dummies can be formed without professional help, but it is crucial to understand the requirements of your state. This includes naming the LLC, selecting a registered agent, and filing the Articles of Organization. To simplify this process, you might consider using US Legal Forms.

The best way to file for an LLC often involves online submission. Using a service designed for forming limited liability companies helps streamline the process, making it easier for those new to the concept. The limited liability company for dummies can be established efficiently by gathering necessary documents and using platforms that specialize in this area. US Legal Forms offers comprehensive resources to guide you through the process.

Failing to file taxes for your LLC can lead to penalties and interest from the IRS. It is important to address this to maintain your limited liability company for dummies in a good legal standing. The tax liabilities can accumulate quickly, potentially damaging your credit and personal finances. Seeking guidance from professionals or resources like US Legal Forms can help you navigate these obligations.