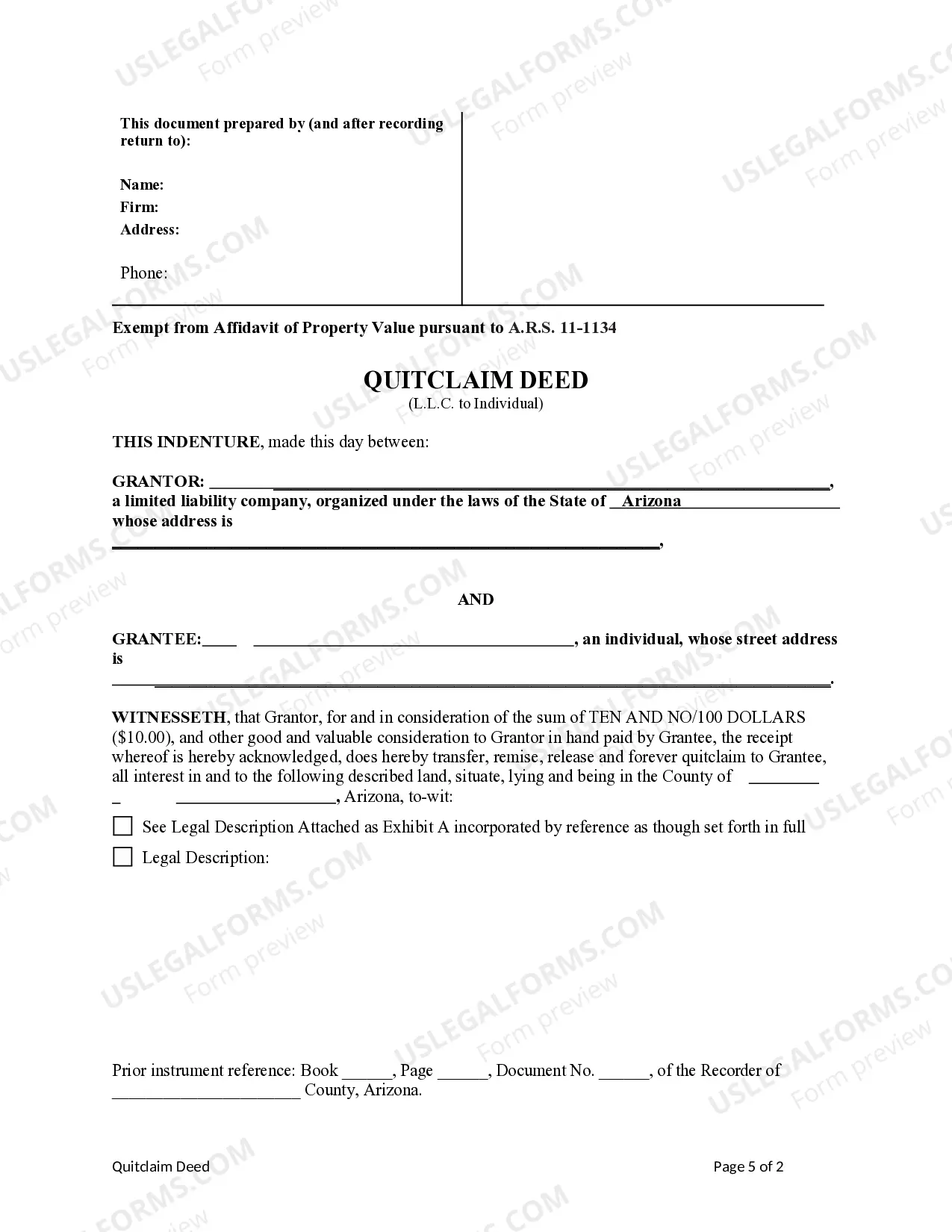

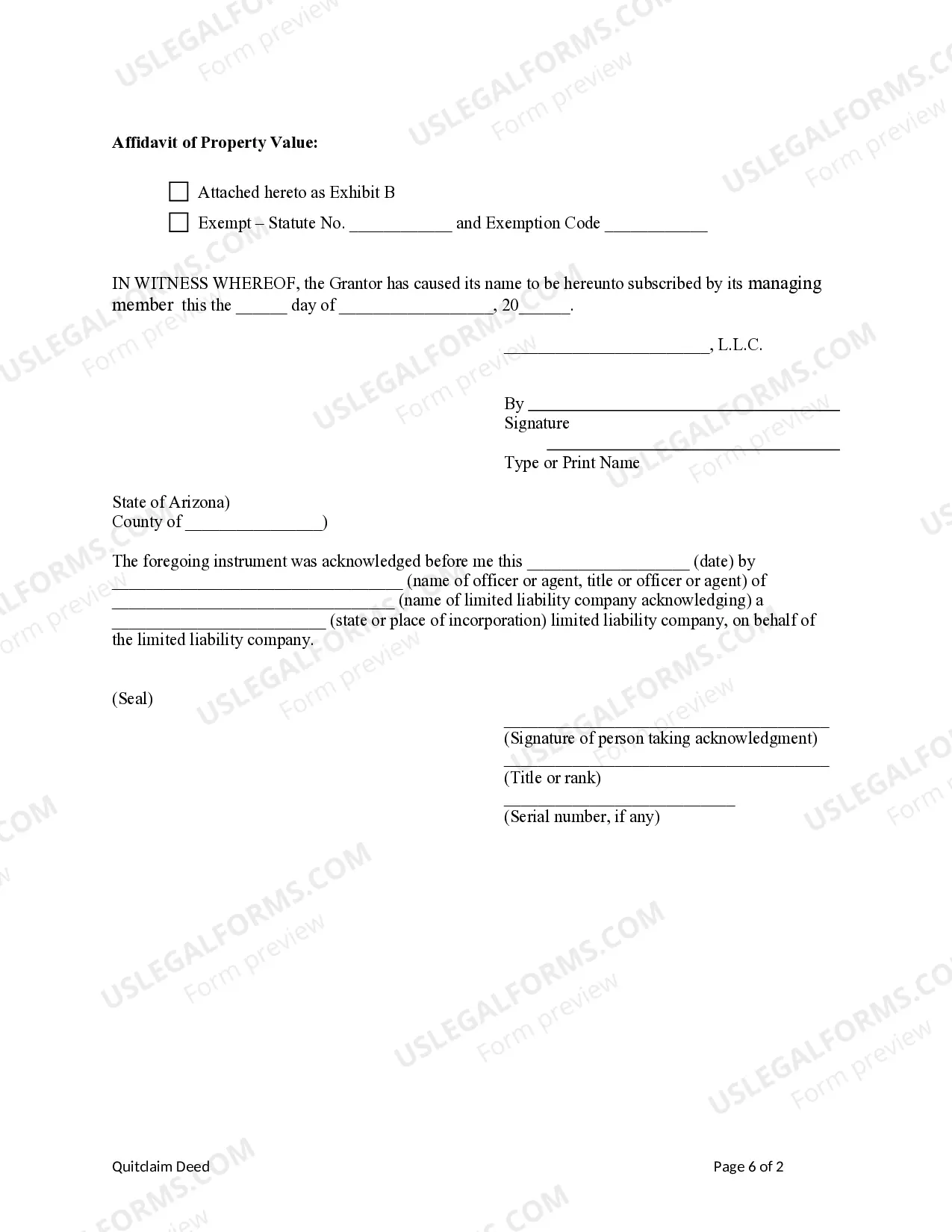

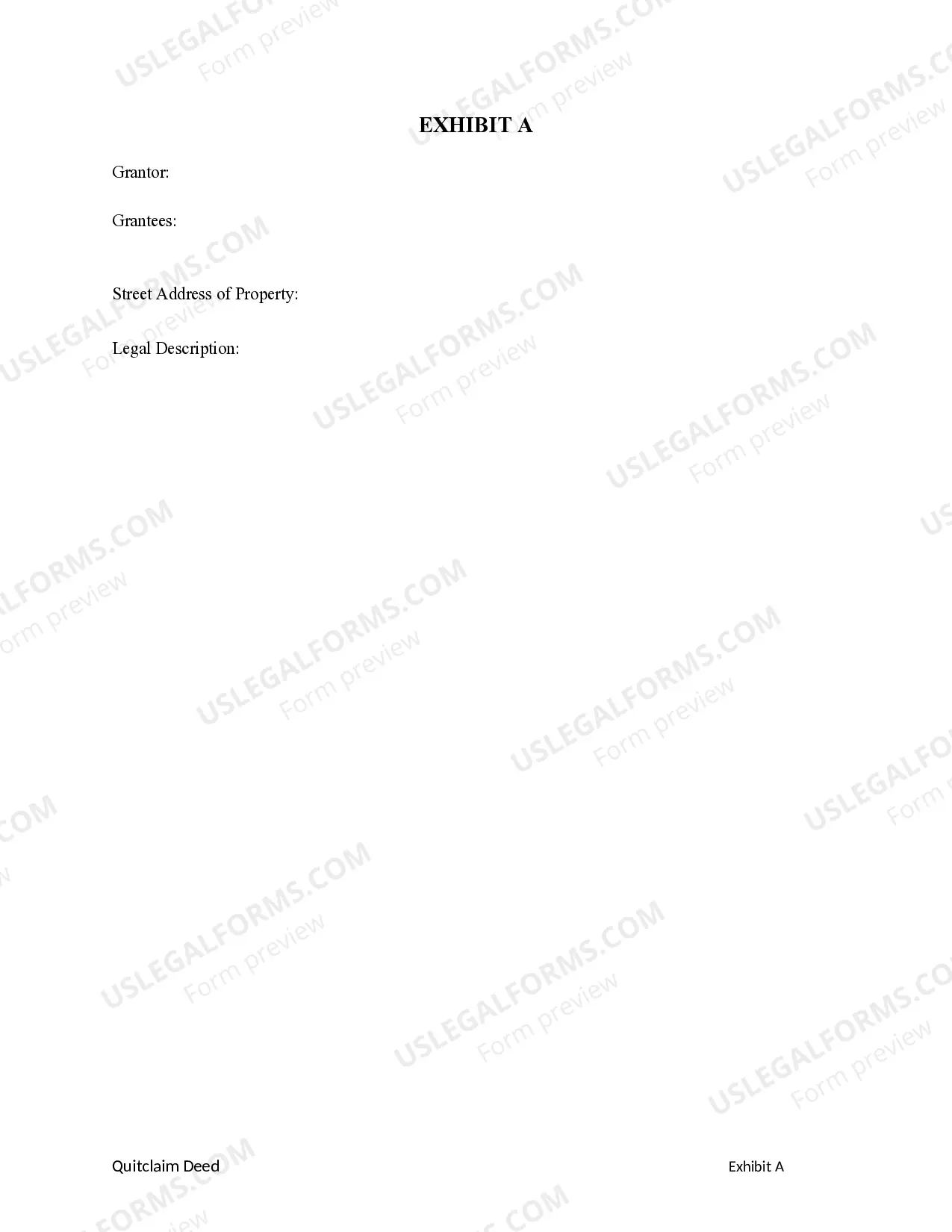

This form is a Quitclaim Deed where the Grantor is a LLC and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Limited Liability Company With The Ability To Establish Series

Description

How to fill out Arizona Quitclaim Deed From A Limited Liability Company To An Individual?

- Visit the US Legal Forms website and log into your existing account. Ensure your subscription is active to access form templates.

- If this is your first visit, browse the extensive library of over 85,000 legal forms. Utilize the Preview mode to double-check the template you select fits your specific needs.

- Should you need a different template, use the Search tab to find the accurate document that complies with local jurisdiction requirements.

- Proceed to purchase the document by clicking 'Buy Now'. Choose a subscription plan that best fits your requirements, and register your account to gain access.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Finally, download the form and save it on your device. You can find it later under 'My documents' in your profile for easy access.

By following these steps, you can efficiently secure the legal documents necessary for your limited liability company with the ability to establish series. The process is designed to be user-friendly, leveraging US Legal Forms' extensive collection to streamline your experience.

Start your journey today and enhance your business foundation with confidence. Visit US Legal Forms to get started!

Form popularity

FAQ

Absolutely, an LLC can establish a series under the right legal framework. A Limited liability company with the ability to establish series can create multiple series, each with its own assets, liabilities, and operations. This structure allows for greater flexibility and allows owners to segregate different business ventures within the same overarching LLC.

A Limited liability company with the ability to establish series needs to file taxes regardless of income level. For federal tax purposes, LLCs must file if they have income, deductions, or credit to report. Therefore, it's important to keep detailed records from the start to ensure compliance when the LLC's earnings kick in.

One disadvantage of a Limited liability company with the ability to establish series is the potential complexity in maintaining compliance for each series. If a series fails to adhere to state regulations, the liability protections can be compromised. Additionally, not all states recognize series LLCs, which may limit your business flexibility.

Yes, you can change your Limited liability company with the ability to establish series to operate as a series LLC, provided your state allows it. This process often requires amending your operating agreement and filing necessary documents with the state. Consulting a legal professional can ensure you undertake this transition correctly.

Typically, a Limited liability company with the ability to establish series does not file its taxes with personal taxes. The LLC's income is passed through to members, who report it on their personal tax returns. This separation helps maintain liability protection and can simplify individual tax filings.

Filing taxes for a Limited liability company with the ability to establish series can vary by state. Generally, each series can file its own tax return if it is treated as a separate entity. However, it's crucial to consult with a tax professional to ensure compliance with federal and state tax laws, as requirements may differ.

In a Limited liability company with the ability to establish series, multiple members typically file taxes using Form 1065, which is the partnership return. Each member reports their share of income, deductions, and credits on their individual tax returns using Schedule K-1. It's essential to maintain accurate records for each member's contributions and distributions to ensure smooth tax reporting.

Absolutely, you can change your LLC to a Limited liability company with the ability to establish series. This transition typically requires state-specific filings and updating your operating agreement. US Legal Forms provides resources that can help guide you through the necessary steps and documentation required for this change.

Making your LLC a Limited liability company with the ability to establish series requires specific steps that can differ by state. Generally, you will need to amend your operating agreement and file a resolution with your state. Working with a service like US Legal Forms can streamline this process and ensure that you are following the correct procedures.

To get an EIN for your Limited liability company with the ability to establish series, you will need to complete the IRS Form SS-4. This form can be filled out online, by mail, or by fax. The EIN serves as your business's social security number, which is necessary for tax purposes and to open a business bank account.