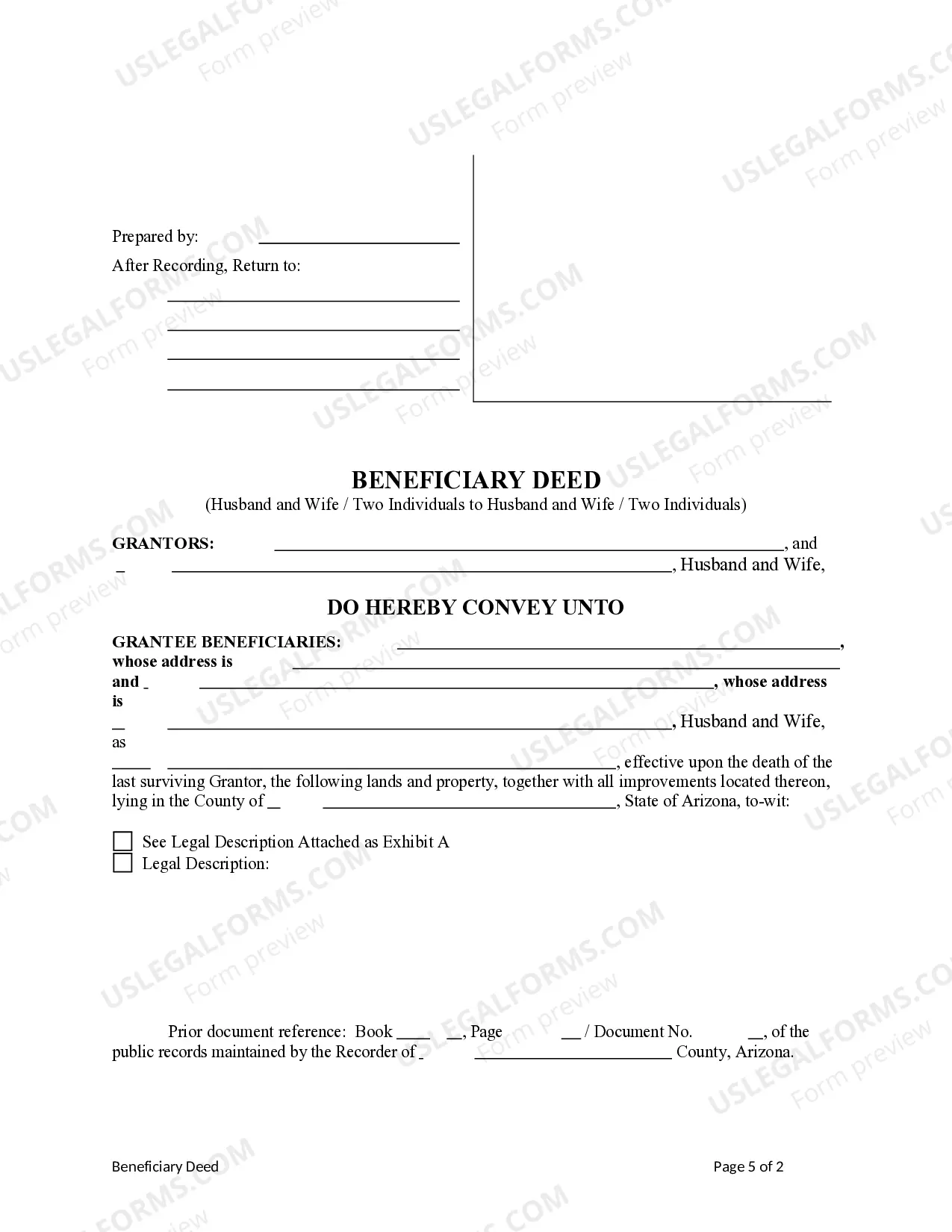

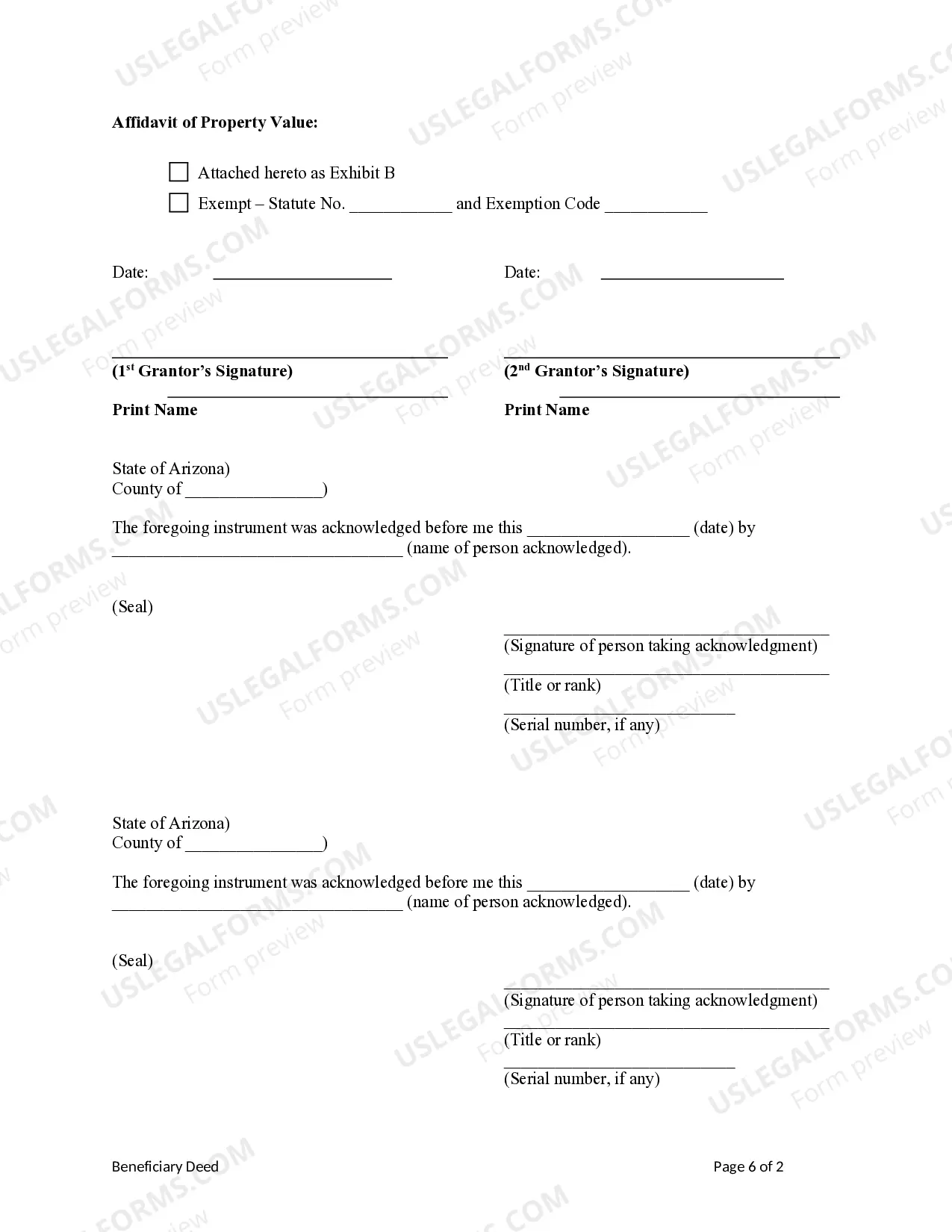

This form is a Transfer on Death Deed where the Grantors are husband and wife / two individuals and the Grantees are husband and wife / two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

Goes Dies Survivorship For The Death

Description

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

- Access your account by clicking here if you're a returning user. Make sure your subscription is active to download forms.

- For first-time users, begin by exploring the Preview mode to confirm that the template matches your specific requirements and jurisdiction.

- If the initial form isn't suitable, utilize the Search tab to locate another template that fulfills your needs.

- Once you find the appropriate document, select the Buy Now option and choose the subscription plan that fits you best, creating an account in the process.

- Complete your transaction by entering your payment information or using PayPal.

- Finally, download the form to your device and access it anytime through the My Forms menu.

With US Legal Forms, not only do you have access to an extensive library of over 85,000 editable legal documents, but you also gain the ability to consult with premium experts for extra assistance, ensuring accuracy and compliance with legal standards.

In conclusion, obtaining legal documents related to goes dies survivorship for the death is simplified with US Legal Forms. Start now, streamline your legal processes, and ensure peace of mind with just a few clicks!

Form popularity

FAQ

The IRS offers specific benefits for surviving spouses, including the possibility to file jointly for the tax year of the deceased. This can result in lower tax rates and eligibility for certain credits. Additionally, a surviving spouse can inherit the deceased's unused exemptions on gifts and estate taxes. To understand these rules in detail, US Legal Forms offers valuable resources and guidance.

Yes, a death must be reported to the IRS, particularly when it comes to tax returns and any income that needs to be documented. The IRS requires the filing of any necessary final returns for the deceased, even if the estate had no income. This transparency helps fulfill any final tax obligations. You'll find tools and templates related to this process on US Legal Forms.

To serve as a personal representative for a deceased individual, you often need to be nominated in the will or appointed by a court. This role involves managing the deceased's estate, including settling debts and distributing assets to beneficiaries. It requires an understanding of legal and financial responsibilities. Resources from US Legal Forms can assist you through this process to ensure proper handling of the estate.

A decedent's final return typically includes all income earned up until the date of death, as well as any deductions applicable to that income. This may involve wages, Social Security benefits, and any dividends or interest accrued. Additionally, you should account for any tax credits the deceased could claim. With US Legal Forms, you can find guidance on accurately compiling these details.

The IRS recommends retaining tax records for at least three years after a person's death, specifically if you filed a return. However, if the final return is audited or if there are any discrepancies, it's wise to keep records longer. Some experts suggest holding onto documents for up to seven years to be safe. Using US Legal Forms can help you maintain organized records.

Filing a final tax return for a deceased individual involves specific steps to ensure compliance with IRS requirements. You can use Form 1040, and note 'deceased' along with the date of death on the top of the return. It is essential to gather all relevant documents, such as income statements and deductions, to accurately report finances for the year. For a streamlined experience, consider using US Legal Forms for assistance.

When a loved one passes away, understanding the requirements of tax filings can be confusing. Even if there is no income, you may still need to file a final Form 1041, especially if the estate earned income during the tax year. The IRS often requires transparency in these situations to help determine the decedent's financial responsibilities. Utilizing resources from US Legal Forms can simplify this process.

Yes, a wife is generally entitled to a share of her husband’s inheritance if he dies without a will. State laws typically ensure that surviving spouses receive a portion of the deceased's estate. However, the exact share depends on the state law and whether there are other living relatives. Understanding goes dies survivorship for the death can clarify her rights and help in effective estate planning.

While Transfer on Death (TOD) accounts allow for easy transfer of assets, they can create complications. If other heirs contest the transfer, this could lead to legal battles. Moreover, TOD does not account for debts, which means creditors could still claim assets before distribution. Familiarizing yourself with goes dies survivorship for the death can help you weigh these factors more effectively.

After a person dies without a will, the estate will be subject to intestacy laws. This means that assets will be distributed according to state guidelines, rather than the deceased's personal wishes. The process can lead to lengthy court proceedings and possible family disputes. Being informed about goes dies survivorship for the death can offer alternative solutions to this situation.