Beneficiary Transfer On Death

Description

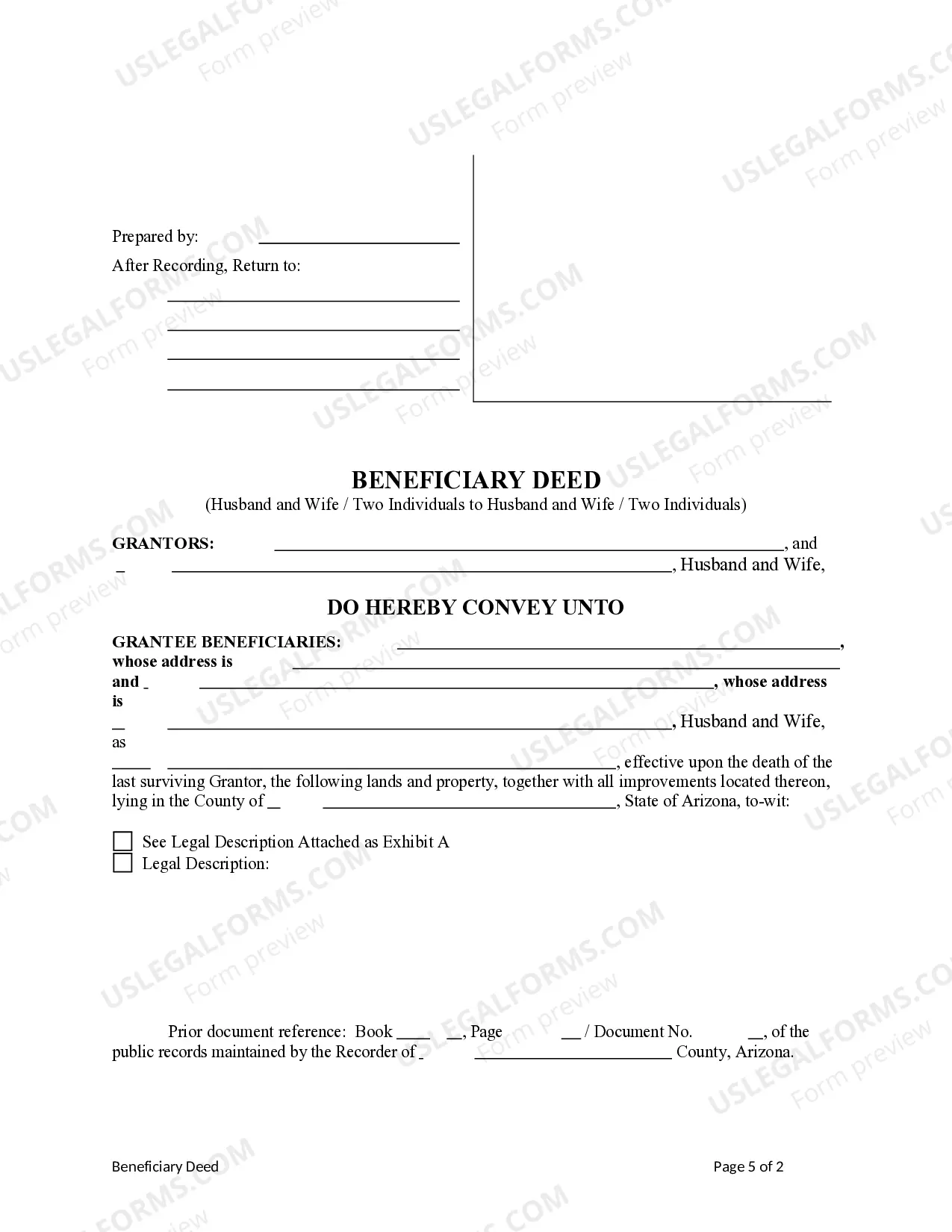

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

- If you're a returning user, simply log into your account. Ensure your subscription is active and click the Download button to save your form.

- For first-time users, start by previewing the available forms. Check the description to confirm that the form meets your specific requirements and complies with local jurisdiction laws.

- If the form doesn't suit your needs, use the Search tab at the top of the page to find an alternative template.

- Once you've identified the correct document, select the Buy Now option and choose a subscription plan that fits your needs. Registration is necessary to gain access to our extensive library.

- Complete your purchase by entering your payment details or using your PayPal account. Once the transaction is confirmed, you are set to download.

- After payment, download the form to your device. You can also access it anytime from the My Forms section in your profile.

With US Legal Forms, you can access a comprehensive library featuring over 85,000 legal templates, ensuring you always find what you need. Our service allows for quick document preparation, and support is available from premium experts, so you never have to feel lost in the process.

In conclusion, streamlining your beneficiary transfer on death process is just a few steps away. Start today with US Legal Forms and experience the ease of legal document management. Ready to get started? Visit our website!

Form popularity

FAQ

You do not necessarily need a lawyer to create a transfer on death deed, as many people successfully complete this process on their own. However, consulting with a legal professional can help ensure that all details are handled correctly. A beneficiary transfer on death can be documented using resources like US Legal Forms, making the process straightforward and accessible. When in doubt, consider seeking legal advice for peace of mind.

Yes, New York State allows transfer on death (TOD) deeds. This law permits property owners to designate beneficiaries who will inherit real estate without the complications of probate. By using a beneficiary transfer on death in NYS, you can provide clarity and ease for your heirs. For your convenience, you can access the right forms through US Legal Forms.

A transfer on death works by allowing you to name a beneficiary who will receive your property upon your death. When you pass away, the property automatically transfers to the beneficiary without entering probate. This arrangement helps to avoid delays and ensures a smooth transition of assets. You can easily find the necessary forms on the US Legal Forms platform.

Yes, New Jersey does allow transfer on death (TOD) deeds. This option enables property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the probate process. Utilizing a beneficiary transfer on death in New Jersey can save time and reduce stress on your loved ones. If you need assistance, US Legal Forms provides the required forms for this process.

The best way to leave property after your death is typically through a beneficiary transfer on death. This method allows you to designate a beneficiary who automatically receives the property without going through probate. By using a transfer on death, you simplify the process and can ensure your assets go directly to your chosen individual. Consider using US Legal Forms to create the necessary documentation.

Despite the advantages, there are some disadvantages to consider with a transfer on death (TOD) arrangement. If you fail to update the beneficiary information over time, it could lead to unintended heirs receiving your assets. Furthermore, if your estate experiences complications or disputes, the TOD designation may not provide sufficient coverage. Thus, managing your beneficiary transfer on death designation is essential for ensuring your wishes are honored.

While both a transfer on death and a will can facilitate asset distribution after your passing, a transfer on death can often be more straightforward. The transfer on death option allows assets to avoid probate, which can save time and costs related to estate management. Conversely, a will might require a longer legal process to settle estate matters. Therefore, if simplicity and directness are priorities for you, a beneficiary transfer on death may be the better choice.

Choosing between transfer on death (TOD) and payable on death (POD) depends on your specific needs and circumstances. Both mechanisms serve the purpose of facilitating the transfer of assets directly to your beneficiaries, yet their applications differ slightly. Transfer on death often applies to real estate and investment accounts, while payable on death accounts typically relate to bank accounts. Evaluating the nuances can help you determine the best option for your beneficiary transfer on death strategy.

The key difference lies in the context of their use. A beneficiary is an individual or entity that receives assets upon your death, while transfer-on-death is the legal method that designates how these assets are transferred. By utilizing a transfer on death provision, you can clearly outline who inherits your property, ensuring your wishes are fulfilled without probate complications. This approach reinforces the importance of understanding the beneficiary transfer on death option.

Payable on death (POD) accounts offer benefits, but they come with some disadvantages as well. For instance, they may limit how you can manage your assets while you are alive. Additionally, if you do not properly designate a beneficiary or if your beneficiary predeceases you, your assets may end up going through probate. Thus, understanding these aspects is crucial to making informed decisions about your beneficiary transfer on death.