Quitclaim Deed With Power Of Attorney

Description

How to fill out Arizona Quit Claim Royalty Deed?

Maneuvering through the red tape of official documents and templates can be challenging, particularly when one does not engage in such tasks professionally.

Even locating the correct template to obtain a Quitclaim Deed With Power Of Attorney can be labor-intensive, as it must be valid and precise down to the last detail.

Nevertheless, you will significantly reduce the time spent obtaining an appropriate template if it originates from a trustworthy source.

Acquiring the appropriate form can be accomplished in a few straightforward steps: Enter the name of the document in the search box. Select the correct Quitclaim Deed With Power Of Attorney from the results list. Review the description of the sample or view its preview. If the template meets your requirements, click Buy Now. Continue by selecting your subscription plan. Use your email and create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal as your payment method. Download the template file onto your device in your preferred format. US Legal Forms can save you time and effort in verifying if the form you found online satisfies your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of finding the right forms online.

- US Legal Forms is the sole destination you need to acquire the most recent samples of forms, verify their use, and download these samples for completion.

- This collection consists of over 85,000 forms applicable in various sectors.

- When searching for a Quitclaim Deed With Power Of Attorney, you need not question its reliability since all forms are authenticated.

- Having an account with US Legal Forms guarantees that all necessary samples are readily available to you.

- You can store them in your history or include them in the My documents collection.

- Your saved forms can be accessed from any device by clicking Log In on the library site.

- If you do not yet possess an account, you can still search for the template you require.

Form popularity

FAQ

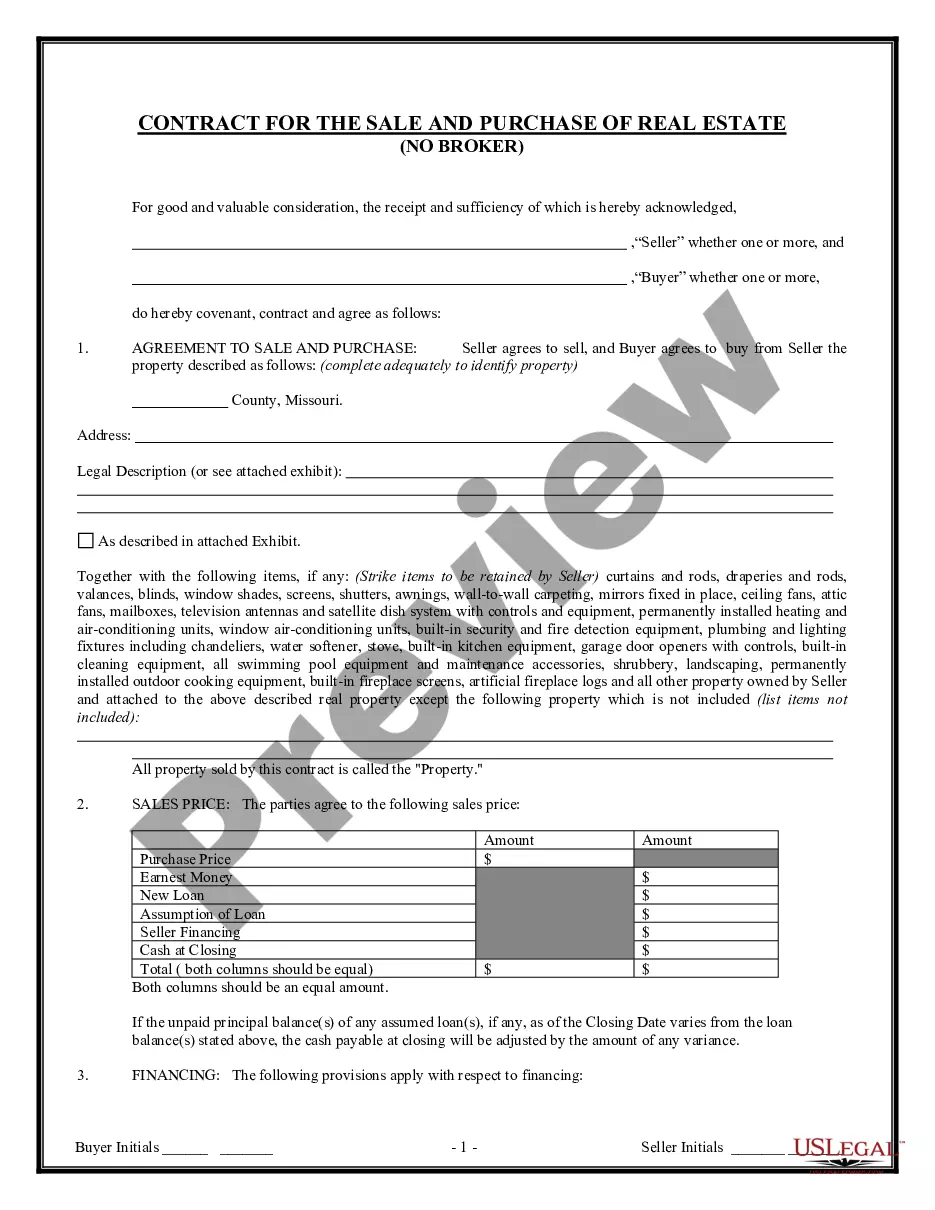

Complete the Quitclaim DeedIdentify the property on the quitclaim form by providing the APN along with other property details, including the city, county and legal property description. Copy the description provided on the current deed if available. The quitclaim deed lists the legal name of the grantor on the form.

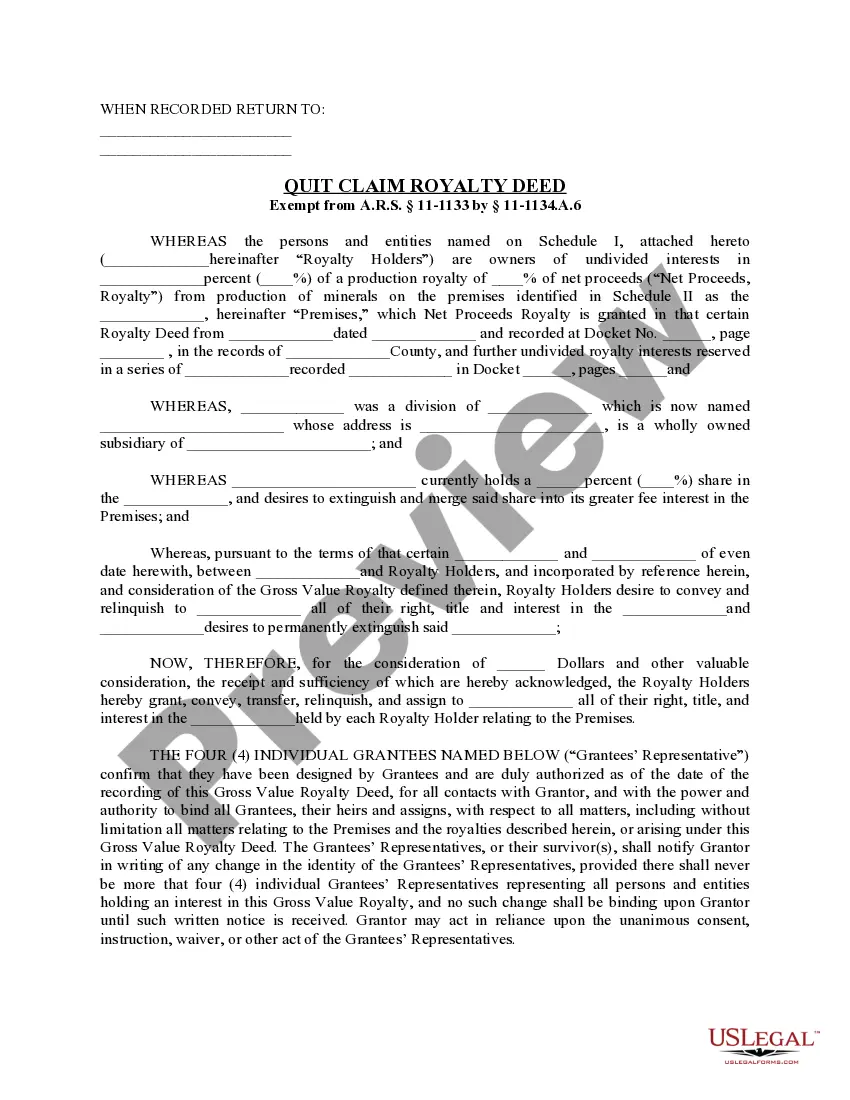

A power of attorney can only be given by deed and the following formalities must be satisfied: the deed must be in writing; it must be made clear that it is intended to be a deed (this can be done by using wording such as by way of deed2026 at the start of the instrument and executed as a deed at the end);

Yes, a power of attorney can certainly legally inherit assets from the person they have the power over.

29 Powers of attorney are deeds (1) A power of attorney that complies with this Act is, for all purposes, taken to be a deed, even though it is not expressed to be a deed or to be sealed.

Do I need to register the Enduring Power of Attorney document? In the ACT an Enduring Power of Attorney does not need to be registered unless it is being used on your behalf in respect of the transfer of, or other dealing with, land.