Arizona Deed Trust Form For California

Description

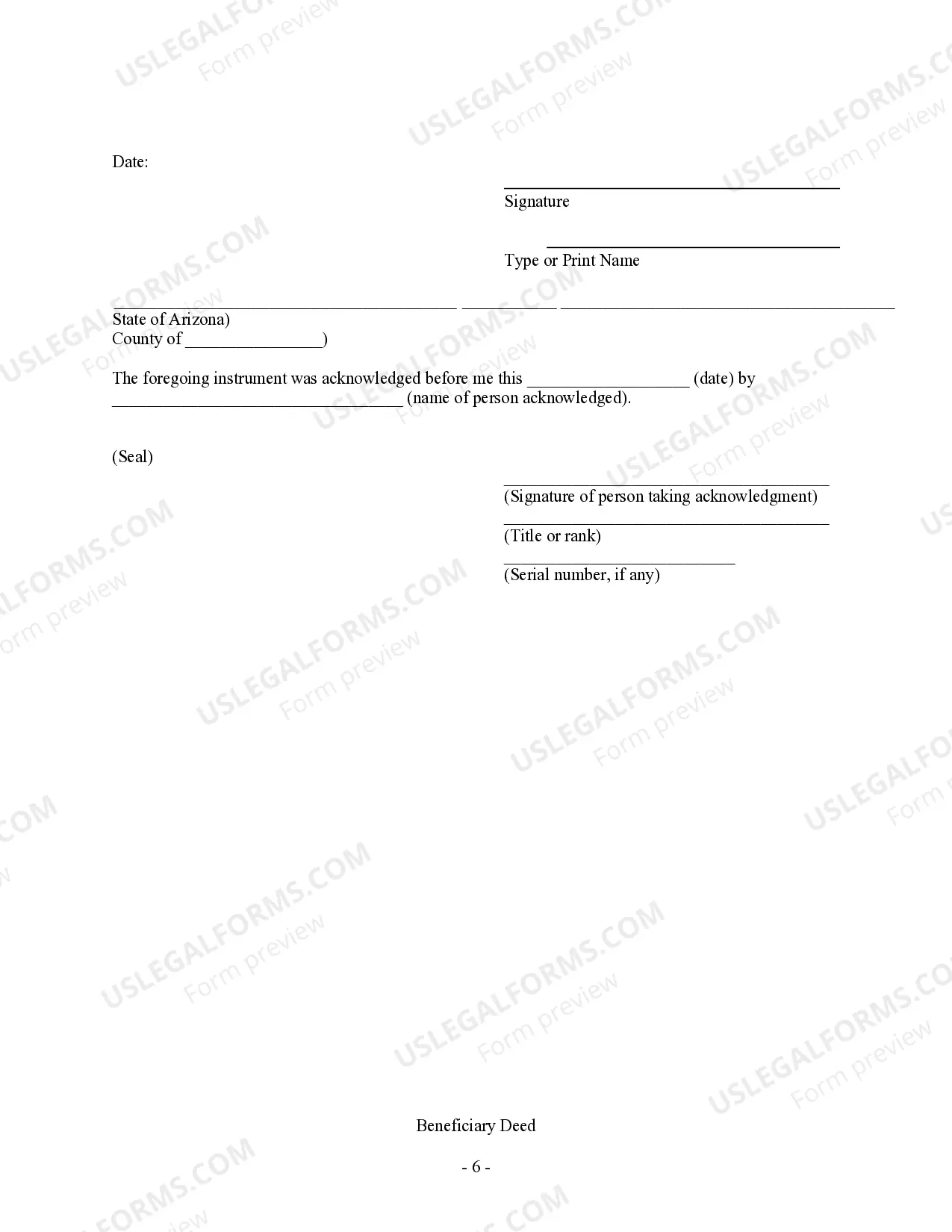

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Trust?

Whether for business purposes or for personal affairs, everyone has to manage legal situations at some point in their life. Completing legal paperwork requires careful attention, starting with picking the correct form template. For instance, if you choose a wrong edition of a Arizona Deed Trust Form For California, it will be rejected when you send it. It is therefore important to get a dependable source of legal papers like US Legal Forms.

If you need to get a Arizona Deed Trust Form For California template, follow these easy steps:

- Find the sample you need using the search field or catalog navigation.

- Check out the form’s description to make sure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search function to find the Arizona Deed Trust Form For California sample you require.

- Get the template if it meets your needs.

- If you have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you want and download the Arizona Deed Trust Form For California.

- After it is saved, you can fill out the form with the help of editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never need to spend time searching for the appropriate sample across the web. Utilize the library’s straightforward navigation to find the right form for any situation.

Form popularity

FAQ

A deed of trust is a commonly used mortgage document in California. Essentially, a deed of trust provides a lender with security for the repayment of the loan and effectively functions similarly to a mortgage.

A deed of trust in Arizona has three parties involved, instead of just the borrower and the lender on a mortgage. The deed of trust contains a borrower, a lender and a trustee, which is generally an attorney or escrow company.

How to create a living trust in California Take stock of your assets. ... Choose a trustee. ... Choose your beneficiaries. ... Draw up your Declaration of Trust. ... Consider signing your trust document in front of a notary public. ... Transfer your property to the trust.

What Are the Advantages & Disadvantages of Putting a House in a Trust? Protection Against Future Incapacity. ... It May Save Money on Estate Taxes. ... It Can Avoid Probate. ... Asset Protection. ... Trusts Can Cost More to Maintain. ... Your Other Assets Are Still Subject to Probate. ... Trusts Are Complex.

Therefore, a deed of trust needs to be signed by the trustor. Lastly, a deed of trust is not required to be recorded; however, in order to be valid, a deed of trust must be delivered to the beneficiary. (Hahn v. Hahn (1954) 123 Cal.