Arizona Death Deed Beneficiary Without Will

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Dealing with legal paperwork and procedures can be a lengthy addition to your schedule.

Arizona Death Deed Beneficiary Without Will and similar forms typically require you to search for them and comprehend how to fill them out correctly.

Therefore, whether you are handling financial, legal, or personal affairs, having a comprehensive and user-friendly online repository of forms at your fingertips will significantly help.

US Legal Forms is the leading online platform for legal documents, boasting over 85,000 state-specific forms and various tools to assist you in completing your paperwork effortlessly.

Is it your first time using US Legal Forms? Sign up and create an account in just a few minutes, and you’ll gain access to the form library and Arizona Death Deed Beneficiary Without Will. Then, follow the steps below to fill out your form: Ensure you have located the correct form by utilizing the Preview feature and reviewing the form description. Choose Buy Now when you are ready, and select the monthly subscription plan that suits you best. Click Download, then complete, sign, and print the form. US Legal Forms has 25 years of experience assisting users with their legal documents. Obtain the form you need today and simplify any process effortlessly.

- Browse the library of relevant documents accessible to you with a simple click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Protect your document management processes with high-quality support that enables you to prepare any form within minutes without any additional or hidden fees.

- Simply Log In to your account, find Arizona Death Deed Beneficiary Without Will, and obtain it immediately through the My documents tab.

- You can also retrieve forms you have downloaded previously.

Form popularity

FAQ

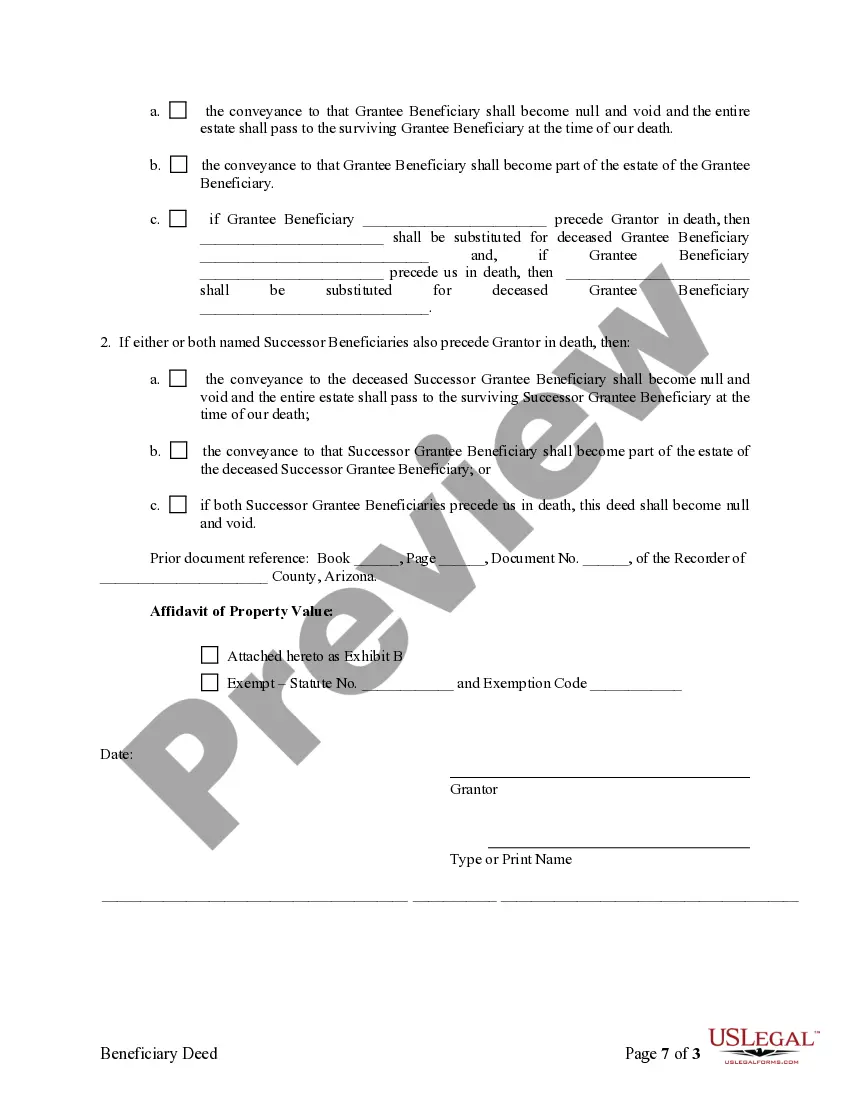

A deed can remain in a deceased person's name until the property is transferred to the designated beneficiaries. If there is no will and a beneficiary deed is in place, the transfer occurs automatically upon death without going through probate. However, if there is no beneficiary named, the property may require probate processes to transfer to heirs as defined by Arizona law.

While an Arizona death deed beneficiary without will simplifies property transfer, it has drawbacks. One significant disadvantage is that a beneficiary deed does not provide complete estate planning, as it only addresses real property. Additionally, if the designated beneficiary passes away before the property owner, the deed may become ineffective, potentially complicating transfers.

Getting a beneficiary deed in Arizona involves filling out the required form and ensuring it complies with state law. Using services like US Legal Forms can streamline this process, offering clear instructions and legal assistance. After filling out the deed, have it notarized and file it with the local county recorder to finalize the arrangement.

To obtain a beneficiary deed in Arizona, you must complete a deed form that meets state requirements. You can find templates online, including on platforms like US Legal Forms, which provide accessible resources tailored to your needs. Once completed, the deed should be signed in front of a notary and recorded with the county recorder’s office to ensure your designation is legally binding.

In Arizona, the statute for beneficiary deeds is outlined in Arizona Revised Statutes § 33-405. This statute allows property owners to designate one or more beneficiaries to receive real estate upon their death, simplifying the transfer process. With a properly executed Arizona death deed beneficiary without will, the property bypasses probate, making it more convenient for the beneficiaries.

To file a beneficiary deed in Arizona, you need to visit the County Recorder's Office in the county where your property is located. Make sure to have the completed and notarized deed in hand. The filing process ensures your intentions regarding the Arizona death deed beneficiary without a will are officially recognized. After filing, keep a copy for your records, as it serves as proof of your designated beneficiary.

Yes, you can create your own beneficiary deed in Arizona; however, it is essential to follow specific legal requirements. It’s advisable to use a template or a reliable platform like USLegalForms to ensure that the document meets all necessary legal standards. This can help you avoid mistakes that could lead to complications. Understanding the Arizona death deed beneficiary without a will can empower you to manage your property effectively.

When an owner dies without a will in Arizona, the property typically goes through probate, which can be a lengthy process. The state’s intestacy laws will determine how the property is distributed among the heirs. If a beneficiary deed is in place, the property will transfer directly to the designated beneficiary without going through probate. Thus, knowing about the Arizona death deed beneficiary without a will can simplify property transfer.

Filling out a beneficiary deed in Arizona involves providing key information about the property and the designated beneficiary. You will need to include the legal description of the property, the names of the current owner, and the beneficiary. Carefully review the document for accuracy before signing and having it notarized. This deed serves as an essential step in outlining your intentions regarding the Arizona death deed beneficiary without a will.

To file a beneficiary deed in Arizona, begin by creating the document that designates the beneficiary. You must then sign the deed in front of a notary public. After that, you will file the deed with the County Recorder's Office in the county where the property is located. This process allows you to designate an Arizona death deed beneficiary without a will efficiently.