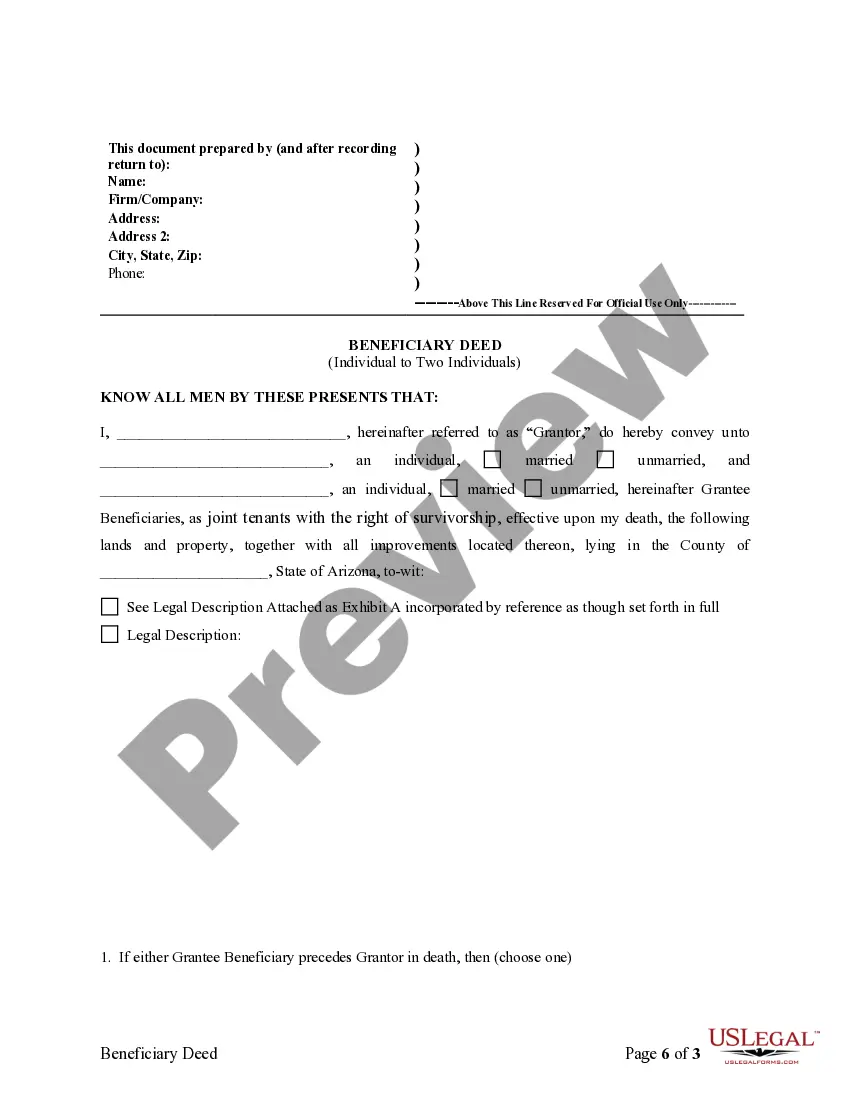

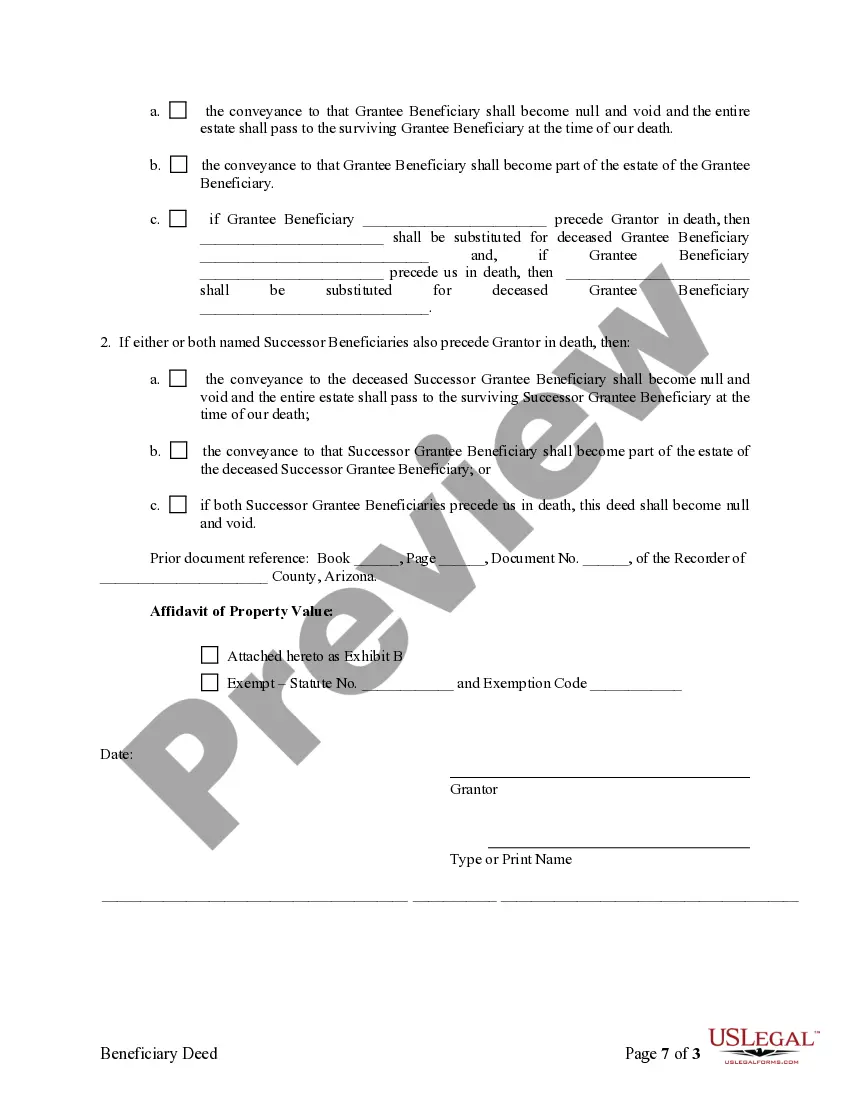

This form is a Transfer on Death Deed where the Grantor Owner is an individual and the Grantee Beneficiaries are two individuals. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Arizona Death Deed Beneficiary Withholding

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a simpler and more affordable way of creating Arizona Death Deed Beneficiary Withholding or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual collection of more than 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant templates diligently prepared for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Arizona Death Deed Beneficiary Withholding. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and navigate the library. But before jumping directly to downloading Arizona Death Deed Beneficiary Withholding, follow these tips:

- Review the form preview and descriptions to ensure that you have found the form you are looking for.

- Make sure the form you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Arizona Death Deed Beneficiary Withholding.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and transform document execution into something simple and streamlined!

Form popularity

FAQ

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.

In the event that your mother recorded the beneficiary deed, the home likely became yours immediately upon her death, and it should not be subject to the terms of her will.

The Arizona Beneficiary Deed Law allows you to avoid the possibly lengthy probate process. It allows you to sign and record a deed, during your lifetime, that transfers real property to one or more people upon your death.

In Arizona, establishing a TOD provision often involves filling out a form provided by the financial institution that holds your assets. For real estate, a Beneficiary Deed must be filled out and recorded with the county recorder's office.