Grantor Corporation Forever With Us

Description

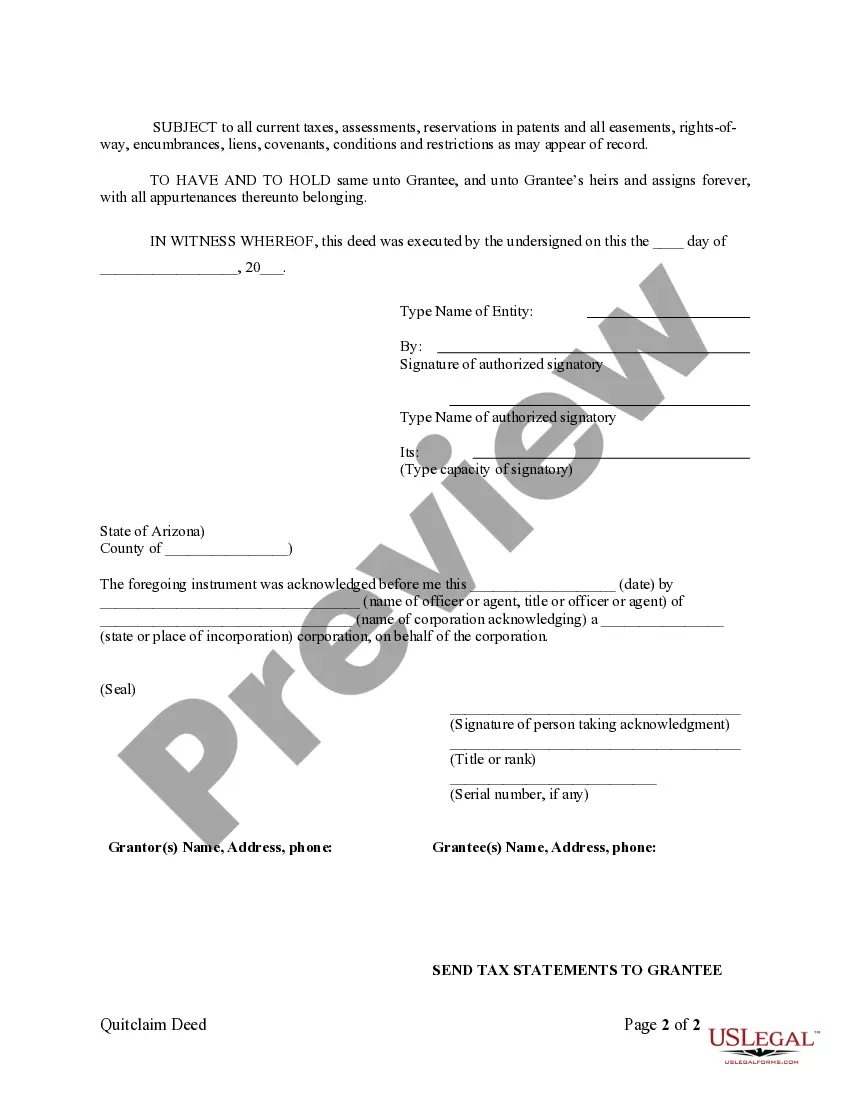

How to fill out Arizona Quitclaim Deed From Corporation To Corporation?

- If you are a returning user, log in to your account and click the Download button on your desired form template. Ensure your subscription remains active; renew if necessary.

- For first-time users, start by checking the Preview mode alongside the form description to confirm it meets your specific requirements and local jurisdiction.

- If you require a different template after viewing your chosen option, utilize the Search tab above to locate an alternative that fits.

- Once you find the right document, click on 'Buy Now' to select your preferred subscription plan. You will need to create an account to access the full library.

- Provide your payment information, either through credit card or PayPal, to finalize your subscription.

- Finally, download your form to your device. You can access it anytime via the My Forms section of your profile.

With an extensive online library of over 85,000 forms and packages, US Legal Forms is the ideal solution for your legal needs. The platform not only simplifies the document process but also ensures accuracy and compliance through expert assistance.

Start leveraging our comprehensive resources today and experience a hassle-free legal documentation process with US Legal Forms. Get started now!

Form popularity

FAQ

Yes, a grantor trust can indeed be irrevocable once the grantor dies or when specific provisions are triggered. While it is revocable during the grantor's life, the transition makes it impossible to amend afterward. This feature can be beneficial for estate planning, offering asset protection and ensuring that your wishes are met. Rely on the resources from the 'Grantor corporation forever with us' to navigate these complexities.

Generally, a grantor trust will need a new Employer Identification Number (EIN) after the grantor's death. This is because the trust's tax status changes, and it is now treated as a separate entity. Making these adjustments promptly helps keep your finances organized and compliant. Utilizing the 'Grantor corporation forever with us' feature will provide you with the assistance needed in this area.

Upon the grantor's death, the role of grantor often ceases, as the trust becomes irrevocable. A successor trustee typically steps in to administer the trust according to its terms. This process allows for a smooth transition, ensuring beneficiaries continue to receive benefits without delays. With the 'Grantor corporation forever with us', you can ensure all aspects of this transition are handled properly.

When the grantor dies, a grantor trust transitions to an irrevocable trust, as previously mentioned. The assets within the trust continue to be managed under the terms set forth in the trust document. Beneficiaries can receive distributions without being subject to estate taxes up to a certain limit. It's crucial to work with legal resources such as uslegalforms to ensure this transition is seamless.

To trigger grantor trust status, you must ensure that the trust grants you the power to control the income or the assets. This can be through various mechanisms, such as retaining the right to amend terms or keep certain benefits. By structuring your trust correctly, you can enjoy tax benefits. Explore the 'Grantor corporation forever with us' feature to facilitate the setup process.

Yes, a grantor trust generally receives a step up in basis upon the death of the grantor. This adjustment allows beneficiaries to inherit assets at their current market value, minimizing capital gains taxes. This aspect aligns with the goal of estate planning, enhancing the value families receive from their inherited assets. The 'Grantor corporation forever with us' ensures your estate planning strategies are effective.

A grantor trust typically remains revocable during the grantor's lifetime. However, upon the grantor's death, it often changes to an irrevocable trust. This change occurs because the grantor can no longer alter the trust terms or assets. Understanding this transition helps you manage your estate effectively, ensuring your wishes are honored.

Yes, a Grantor Retained Annuity Trust (GRAT) typically needs to file a tax return. However, like a grantor corporation forever with us, the income from a GRAT usually passes through to the grantor's personal return. Understanding these nuances can help ensure accurate reporting and compliance with IRS rules.

To terminate a corporation with the IRS, you need to file a final tax return for the year your corporation ceases operations. Include all required information and notify the IRS that this return is your last for the grantor corporation forever with us. After filing, consider certifying that all payroll and sales taxes have been settled to complete the termination process.

To notify the IRS that your business is closed, you should send a final tax return, indicating that it is the last return for your grantor corporation forever with us. Additionally, you can provide a letter explaining the closure directly to the IRS. Make sure to also check if there are any specific forms required, as keeping the IRS informed helps maintain accurate records.